Mortgage Rates – What’s Going On?

Many of you are probably wondering the same thing – what’s been going on with mortgage rates and where are they headed? With inflation intensifying, the average rate on a 30-year mortgage has jumped from 2.78% in July 2021 to the more recent 5.54% as of July 21, 2022, according to Freddie Mac. To grasp how impactful this rate spike is – for a $400,000 home with a 20% down payment, inclusive of taxes & fees and using the 2.78% and 5.54% 30-year mortgage loan rates previously discussed, a monthly mortgage payment has gone from ~$1,640 to ~$2,153 per month, respectively, a drastic increase of ~31.3% only one year later. Note that is this exercise is not even incorporating the fact that the median existing-home sales price is up 13.4% year-over-year to $416,000 in June 2022.

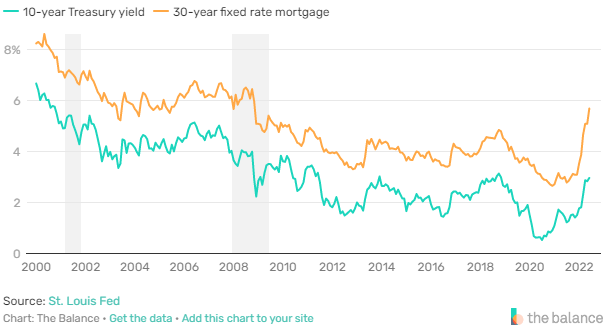

In an attempt to alleviate rampant inflation, the Federal Reserve (the “Fed”) recently raised the federal funds rate by another 75 basis points (0.75%) in July 2022, following a 75 bps rate hike in June, a 50 bps rate hike in May, and a 25 bps rate hike in April. The federal funds rate is the interest rate at which banks must pay to borrow funds from their reserves kept at the Fed on an overnight basis. It is the principle tool that the Fed has to heat up or slow down the economy by attempting to cause a chain reaction where changing short term interest rates eventually flow through to long term interest rates, which then affect economic activity, asset pricing, and risk appetite. Historically, mortgage rates have followed the 10-year Treasury yield, as shown in the following graphic, meaning that the Fed does indeed have an indirect control over mortgage rates.

Since the pandemic began in March 2020, the 10-year Treasury yield has been bouncing all over the place, reaching an all-time low of 0.53% in July 2020, rising to 3.48% in mid-June 2022, and currently residing at 2.70% as of July 28, 2022. While the recent rise in the 10-year Treasury yield and corresponding 30-year fixed mortgage has been swift, it is important to note that since April 1971 the 10-year Treasury yield and 30-year mortgage rate have averaged 6.03% and 7.79%, respectively, according to Freddie Mac.

With regards to where mortgage rates might be headed – despite inflation soaring at its fastest pace since November 1981 with the CPI (consumer price index) up 9.1% year-over-year for June 2022 and the expectation for the Fed to raise rates another 75 basis points at the end of July, the general consensus among industry leaders is overall uncertainty with a slight tilt towards increased rates. Due to concerns over an impending recession, the longer term interest rates could fall even as the federal funds rate rises, which explains the recent drop in the 10-year Treasury yield from 3.48% to 2.70%, as of July 28, 2022.

As for the implications – people who want to buy a home are simply being priced out. The housing-affordability index fell to 102.5 in May 2022, the lowest level since July 2006, according to the National Association of Realtors. With housing-affordability at historical lows and more people choosing to rent instead, we feel that this could prove to be beneficial for a number of apartment REITs and single family rental REITs with established portfolios and notably high occupancy. For example, the average rent increase for a new unit in the portfolio of AvalonBay Communities (NYSE: AVB), a coastal apartment REIT, was 12.7% in the second quarter. Single family rental REIT Invitation Homes (NYSE: INVH) was able to raise rent on new tenants by 16.7% in the same period.

In conclusion, mortgage rates have notably increased over the past year and could continue to rise in the near-future given the Fed’s forthcoming and expected rate hikes in an attempt to slow-down 40-year high inflation while simultaneously trying to avoid an economic recession. No one knows exactly where these rates will go, but it unfortunately looks as if the low-rate train has left the station, taking housing-affordability, rent pricing power, and rate refinancing with it – with no plans to return anytime soon. While home price increases should slow, we do not believe prices will actually decrease. Historically, residential real estate, including single family, apartments, and single family rentals, have performed well during periods of inflation, and we believe that this time will be no different, albeit with some volatility along the way.

These materials may contain forward looking statements and projections that are based on the current beliefs and assumptions of Chilton Capital Management LLC (“Chilton”) and on information currently available that Chilton believes to be reasonable, however, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. These materials are provided for informational purposes only and do not constitute an offer or a solicitation to buy, hold, or sell an interest in any investment or any other security, including any investment with Chilton or any of its affiliates or any other related investment advisory services. The information contained herein is current as of the date hereof, but may become outdated or subsequently may change. Chilton does not undertake any obligation to update the information contained herein in light of later circumstances or events. Chilton does not represent the information herein is accurate, true or complete, makes no warranty, express or implied, regarding the information herein and shall not be liable for any losses, damages, costs or expenses relating to its adequacy, accuracy, truth, completeness or use. These materials are subject to a more complete description and do not contain all of the information necessary to make any investment decision, including, but not limited to, the risks, fees and investment strategies of an investment.