Portfolio Insight | 3rd Quarter 2023

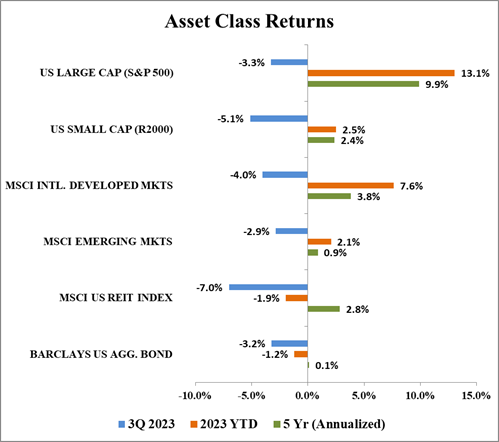

The S&P 500 hit a new 2023 high in late July before giving back some of its gains in the last few weeks of September. For the quarter, the index finished down 3.3%, its first quarterly drop this year. Inflation growth continued to slow, but continued Fed hikes, advancing commodity prices, and a re-accelerating economy led to higher interest rates, which paused further market gains. The S&P was up 13.1% through the third quarter.

The top performing sectors for the period were Energy, Communication Services, and Financials, while Utilities, Real Estate, and Consumer Staples underperformed the most. Growth stocks performed similarly to value stocks in the quarter, unlike the first half of the year when growth stocks solidly outperformed value stocks.

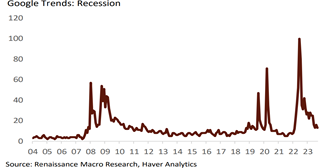

Fading Recession Fears

In his July press conference, Federal Reserve Chairman Jerome Powell revealed that the central bank foresees less likelihood of a US recession in the near-term. Likewise, there was a notable decline in recessionary concerns among market participants and individuals during the quarter. For many, recession is no longer top-of-mind like it was in 2022.

The very resilient economy has actually picked up steam, with GDP accelerating to a 2.4% annual growth rate in 2Q from 2.0% in 1Q, and expectations for growth are even higher for the soon to be reported 3Q. Steadily falling inflation growth, higher pay, and job security are driving continued consumer spending. Additionally, increasingly confident businesses and governments are investing for the future.

Possible Immaculate Disinflation

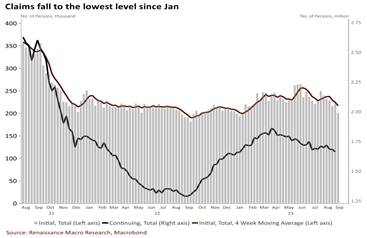

With the odds of a near-term recession falling and a continued tight labor market, some economists have begun using the term “immaculate disinflation” to describe the potential for the Fed to meet its goal of reducing inflation towards its 2% target without causing major damage to growth or employment. Historically, this has been a difficult balance to achieve as interest rate hikes are by nature intended to slow the economy. There are many prior examples of the Fed going too far and “breaking” something. However, the current situation, which has surprised the Fed and most economists, is precisely one of continued economic growth and strong employment. Recently, initial and continuing jobless claims have even started to fall.

Source: Renaissance Macro Research, Macrobond

Though it remains to be seen whether or not the Fed will achieve its goal, odds are improving and economists are beginning to postulate why the current business cycle may be very different from those in the past. One possible explanation is that the COVID pandemic upended the normal cycle by driving temporary inflation bursts instead of an elongated boom and bust cycle. Locked-down consumers ordered goods in the face of supply chain snarls and then, when lockdowns were lifted, engaged in aggressive “revenge spending” on services such as dining out, travel, and concerts. Further, household balance sheets have been healthy relative to the past due to higher consumer savings levels and significant fiscal stimulus, such as the direct cash payments, during the pandemic.

So far, the economy has demonstrated much less sensitivity to aggressive rate hikes than it has in the past. Much of this seems due to the fact that individuals and businesses have already locked in low long-term interest rates on debt.

Inflation is falling as supply chains and the overall economy normalize from the pandemic period and as pressure from Fed rate hikes begins to have an impact. Additionally, on the employment front, businesses that remain optimistic about current and future conditions could be hoarding labor.

Capital Markets Improvement

As inflation growth slows and the economy continues to show resilience in the face of higher interest rates, capital markets activity is beginning to improve. Leaders at major players Goldman Sachs and Morgan Stanley have seen an uptick in interest regarding M&A and public offerings, and they expect continued improvement into 2024.

Softbank-controlled chip design/ company Arm Holdings (ARM) went public on September 14th, and grocery delivery firm Instacart (CART), a COVID beneficiary, became the first major venture capital backed initial public offering (IPO) since December 2021 when it began trading on September 19th. Numerous other companies, including sandal maker Birkenstock and car-sharing platform Turo, have filed for initial public offerings.

Domestic Equity Outlook

Overall conditions continue to be favorable for stock price appreciation, as the resilient economy absorbs significant interest rate hikes from the Federal Reserve and unemployment remains low. Higher rates are having less impact than they have had in the past, but some headwinds to earnings have recently emerged in the form of higher commodity prices and a stronger US dollar. A government shutdown, union strikes, and the Fed “overdoing it” are near-term risks to sentiment.

If interest rates continue to move higher unabated, discount rates will need to be increased, meaning the outlook for a fair value stock market multiple will need to be reduced. However, with recession probabilities fading, the overall earnings outlook remains positive for the next few years. Seasonality often improves this time of year, and optimism about the end of the rate hiking cycle and the possibility of “immaculate disinflation” could move the market higher into year-end, leaving investors with solid gains for 2023 following a dismal 2022.

Fixed Income Outlook

The 10-year Treasury yield continued its upward momentum, rising from 3.81% at the beginning of the quarter to 4.61% at quarter-end, its highest level in over 16 years. As a result, the Bloomberg US Aggregate Bond Index, a combination of government and corporate bonds, fell 3.2% during the quarter and is now down 1.2% year-to-date. Fortunately, the majority of our fixed income positions have shown positive year-to-date total returns due to a shorter maturity profile.

Stronger than expected US growth, and the Federal Reserve’s continued efforts to combat inflation with short-term interest rate hikes, drove rates higher during the quarter. Previously, many investors had assumed that the Federal Reserve would begin cutting rates substantially in 2024 as inflation drifted closer to its 2% target. Now however, most believe that the Fed may only cut rates modestly next year, if at all. In other words, interest rates may stay higher for longer.

In a higher-for-longer environment, some investors might feel inclined to simply park cash in a money market fund earning 5.0% – 5.5%, instead of buying bonds. While buying a money market fund could make sense, one must be aware that money market yields are variable in nature. If/when interest rates eventually move lower, the yields on money market funds will move in lockstep. In fact, looking at the shape of the yield curve, investors are assuming that interest rates will drop at least 1% over the next several years. On the other hand, by buying bonds today and holding to maturity (which is always our plan), those securities have a fixed yield. The good news for investors is that the yields on high quality corporate bonds and US Treasuries continue to look better and better. For high quality corporate bonds maturing in the next 1-5 years, yields in the 5.5% – 6.0% range are common.

Our view is that the Fed is likely at or near the end of this rate hiking cycle. Similarly, we feel that interest rates are unlikely to move much higher than current levels. As such, locking in attractive yields in fixed income for multiple years makes sense for client bond allocations. In the event we are incorrect in our assessment that rates may have peaked, our use of a laddered bond strategy, with bond maturities spread out over a number of years, would allow us to reinvest the proceeds from maturing bonds at higher yields to maturity. Regardless, the outlook for fixed income has not looked this attractive in over a decade.

Global Markets Outlook

Global markets pulled back during the third quarter of 2023 following a robust start to the year. Emerging markets outperformed on a relative basis for the quarter, decreasing 2.9%. US large cap stocks (S&P 500) followed losing 3.3%, and international developed markets underperformed, falling 4.0%. Year-to-date, US large cap stocks continue to lead the pack gaining 13.1%, followed by international developed markets advancing 7.6%, and emerging markets with a modest increase of 2.1%.

Source: Bloomberg

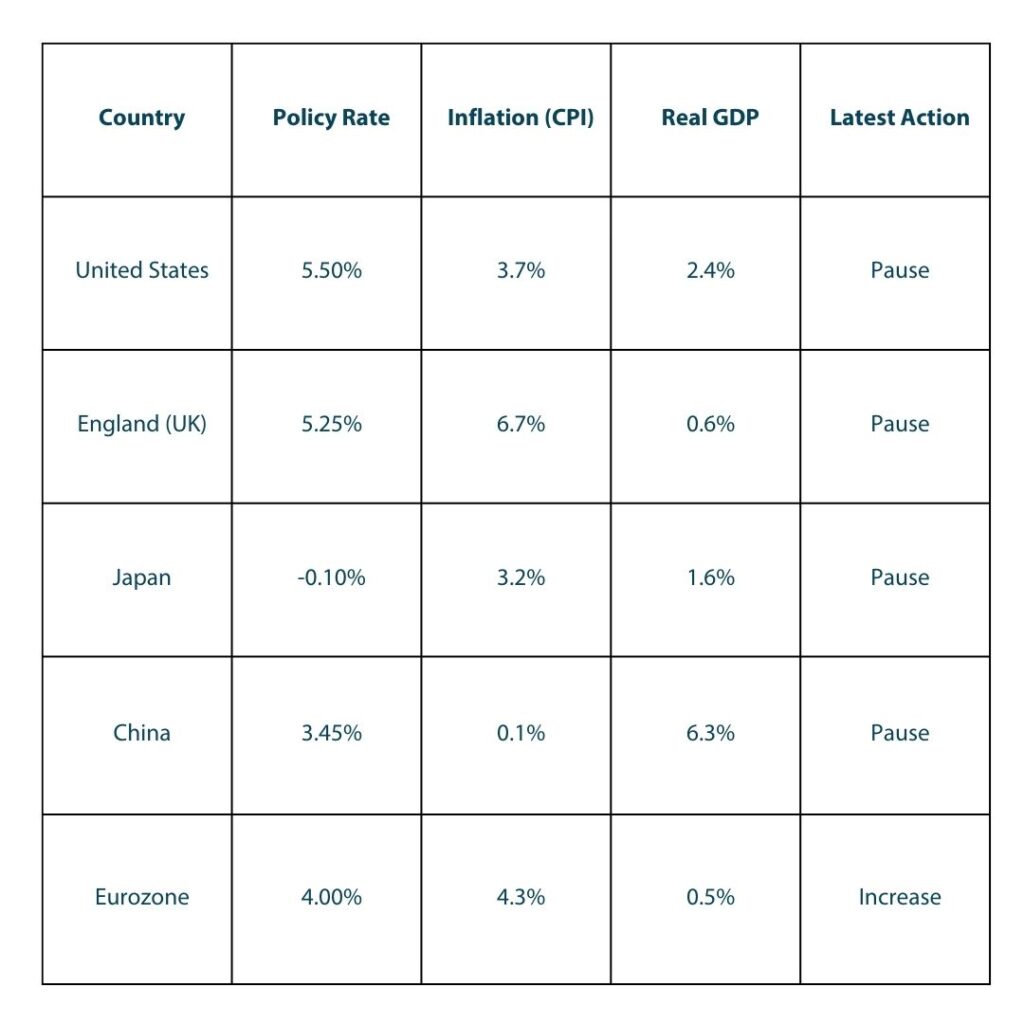

The disparity in returns this quarter highlights several effects of portfolio diversification. We live in a global economy that is connected, yet each country’s central banking policy is unique. In the United States, the Federal Reserve most recently maintained its policy rate as inflation trends lower and GDP growth remains resilient. In England, the central bank decided to pause rates after 14 consecutive hikes despite 6.7% inflation in August. The Bank of Japan also held rates steady. However its policy is markedly different from the rest of the world with its benchmark rate remaining negative. The European Central Bank hiked rates in response to elevated inflation but signaled a pause due to a shaky economic outlook. Conversely, the People’s Bank of China maintained its policy rate in September after cutting rates in August in an effort to stabilize its economy amid ongoing challenges in the property market.

Source: Bloomberg, Chilton Capital Management

Since investments made overseas are denominated in other currencies, diversification provides exposure to multiple currencies. Any strengthening of the foreign currency relative to the dollar will increase the value of the holding when translated back to US dollars. International currencies strengthened versus the dollar earlier this year, however the US Dollar Index (DXY) is now breaking out to a new high in 2023, which is a headwind for US investors.

Diversification also gives access to different industries. US indices have a much greater technology exposure compared to the rest of the world, whereas several non-US countries are more exposed to the energy and financial sectors. Technology stocks thoroughly outperformed in the first half of this year. However, the tide has recently turned and energy stocks are rising as crude oil races higher.

During the quarter, the MSCI US REIT Index produced a total return of -7.0%. The correlation with bond yields continues to be high, pushing REIT dividend yields higher and prices lower. While the end of the rate hike cycle appears to be close, it appears some investors had hoped for rate cuts sooner than what the data may suggest. Our conviction in the downside risk to REIT prices remains strong, but we still believe it will take some stability in the 10-year Treasury yield before investors can look more closely at the strong risk-adjusted returns offered by public REITs today.

While cycles are different, they usually rhyme. There are reasons to dust off the playbook from 2008-2009, as this period resulted in severely depressed real estate values, and therefore public REIT performance.

Similar to 2008-2009, real estate values, as measured by Green Street Advisors’ Commercial Property Price Index, are down 16.5% as of August 31st from the high in April 2022. This compares to a 32.3% drop from peak-to-trough in 2008-2009, which ultimately led to the FTSE NAREIT All Equity REITs Index producing a peak-to-trough total return of -67.5% from 2008-2009. In comparison, as of September 30th the peak-to-trough total return has been -29.2%, which could imply that the selloff is justified, or even that it could continue. However, the public REIT landscape is completely different today than it was in the prior periods.

Importantly, leverage of REITs is about half of what it was in 2008 going into the Global Financial Crisis. Leverage is a powerful tool that can magnify returns, both in a positive and negative manner. Specifically, a debt ratio of 50% (close to the REIT average in 2008) and a gross real estate decline of 25% would produce a negative 50% revaluation of the equity. In contrast, a debt ratio of 25% (near today’s level) and a 25% decline in real estate prices would result in only a 33% decline in the equity.

Second, each of the prior declines in real estate values coincided with a sharp recession, leading to massive job losses, the main source of real estate demand. Today, we are still adding jobs every month, and the unemployment rate is near a 50 year low. As a result, most REITs are pushing rental rates and enjoying above average occupancy. While interest expense costs are rising, the top line net operating income growth should prove enough to offset this expense, resulting in dividend increases. In contrast, dividend cuts were the norm in 2008-2009.

Third, there was a significant oversupply going into 2008. The loose lending standards from the banks contributed to speculative construction, leading to higher vacancy at a time when demand was also falling off of a cliff. However, as of June 30th, new construction was below the long term average. As such, we believe that REITs can sustain some amount of job losses and still maintain rent growth merely because there is nowhere else to go.

To be sure, there are going to be bankruptcies and problems at banks that made loans at high loan to value ratios in 2021-2022, but this will have little to no effect on public REITs. Going forward, the supply picture should look even better as we believe construction starts will continue to fall. While demand is a question mark, the current pricing of REITs implies that they will not be able to grow dividends or that the 10-year Treasury yield will continue to rise to 5% or higher. We believe REIT dividend increases will surprise casual investors to the upside, and that a leveling off of the 10-year Treasury yield will be a catalyst for investor flows to resume to this income and growth asset class.

Bradley J. Eixmann, CFA

Brandon J. Frank

Robert J. Greenberg, CFA

Matthew R. Werner, CFA