REIT Commentary | Fourth Quarter 2024

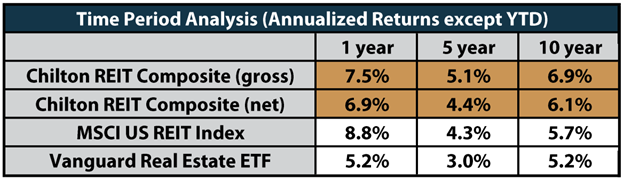

In the fourth quarter, the Chilton REIT Composite has underperformed the RMZ by producing a total return of -7.5% gross of fees and -7.7% net of fees, which compares to the RMZ’s total return of -6.1%. For full year 2024, the Chilton REIT Composite underperformed the RMZ by producing a total return of +7.5% gross of fees and +6.9% net of fees, which compares to the RMZ’s total return of +8.8%; however, the Chilton REIT Composite outperformed the Vanguard Real Estate Index (VNQ), our secondary benchmark, that produced a total return of +5.2%. See the table on page 2 for historical numbers.

–

Quarterly Attribution

Positive contributors to relative performance for the fourth quarter of 2024 included stock selection within the healthcare sector, and underweight allocations to the triple net and specialty sectors. Conversely, an overweight to the cell towers sector, an underweight to the regional malls sector, and an underweight to the lodging sector detracted from relative performance.

–

Full Year Attribution

Positive contributors to relative performance for the full year of 2024 included stock selection within the healthcare and office sectors, and an underweight allocation to the triple net sector. Conversely, an overweight allocation to the cell tower sector and underweight allocations to the regional mall and specialty sectors detracted from relative performance.

–

2024 Contributors Summary

- Stock selection within the healthcare sector contributed to relative performance. The Composite has held a meaningful overweight to senior housing focused REITs, which have outperformed the broader sector. This exposure was further bolstered when the Composite added American Healthcare REIT (NYSE: AHR) after its February IPO.

–

- Stock selection within the office sector also contributed to relative performance. Most notably, the Composite has held a meaningful overweight in Highwoods Properties (NYSE: HIW), which has outperformed the broader office sector materially.

–

- An underweight allocation to the triple net sector contributed to relative performance. During periods of rising interest rates, the sector’s long lease structure presents a headwind to increasing rents at the same pace as other property types. Additionally, external growth appears more challenging due to lower spreads to the cost of capital.

–

2024 Detractors Summary

- An overweight allocation to the cell tower sector detracted from the Composite’s relative performance. Given the long lease terms typical in cell towers, the group has again been impacted from the specter of rising rates this quarter and continued slowdown in leasing from the major carriers. Looking past near-term headwinds, we believe the non-cyclical nature of the group should drive higher earnings growth over the long term.

–

- An underweight allocation in the specialty sector also detracted from relative performance. In particular, Iron Mountain (NYSE: IRM) has outperformed in 2024 due to its data center division, weighing on Composite relative performance.

–

- An underweight allocation in the regional malls sector also detracted from relative performance. While our Composite has exposure shopping center REITs, we currently have no exposure to regional malls. The group outperformed in 2024 led by Simon Property Group (NYSE: SPG).

–

Market Commentary

2025 Chilton REIT Forecast | January 2025

Property Type Round-Up from REITWorld 2024 | December 2024

MOBs: Office but No Need for Life Support | November 2024

–

–

Additional Disclosures

Past performance is not indicative of future results. Investment returns and principal value will fluctuate so that an investor account, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. MSCI US REIT Index and Vanguard Real Estate ETF performance is presented as a benchmark for reference only and does not imply any portfolio will achieve similar returns, volatility or any characteristics similar to any actual portfolio. The composition of a benchmark index may not reflect the manner in which any is constructed in relation to expected or achieved returns, investment holdings, sectors, correlations, concentrations or tracking error targets, all of which are subject to change over time.

The information contained herein should be considered to be current only as of the date indicated, and we do not undertake any obligation to update the information contained herein in light of later circumstances or events. This publication may contain forward looking statements and projections that are based on the current beliefs and assumptions of Chilton Capital Management and on information currently available that we believe to be reasonable, however, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. This communication is provided for informational purposes only and does not constitute an offer or a solicitation to buy, hold, or sell an interest in any Chilton Capital Management investment or any other security.

Leave a Reply Cancel reply

We are trusted partners on your journey to financial prosperity.

Experience the Chilton advantage

what we do

who we are

resources

contact us

Wealth Management

Financial Planning

Trust Company

Institutional Investment Strategies

Our People

Our Performance

Our Process

Portfolio Insights

Chilton Investment Outlook

REIT Outlook

REIT Commentary

Media & Press

Contact Us

Client / E-Path Login