Portfolio Insight | 4th Quarter 2020

A resilient, forward looking market rounded out 2020 with a third consecutive quarter of impressive gains. The S&P 500 index added 12.1% in the quarter, closing at an all-time high of 3,756 on December 31st, and registering a surprisingly strong 18.4% total return for the year.

Top performing sectors in 2020 were Information Technology, Consumer Discretionary, and Communication Services, while stocks underperformed the most in the Energy, Real Estate, and Financials sectors. For the fourth quarter, Energy, Financials, and Industrials actually led, with Real Estate, Consumer Staples, and Utilities lagging the most. Following the 34% collapse from the early 2020 February 19th peak to the March 23rd low, the market staged a dizzying 68% rally into year-end as economies reopened and investors realized that the pandemic, as devastating as it has been, will not last forever.

A Remarkable Recovery

Following global lockdowns, the reopening of economies around the world contributed to a whopping 33.1% annual real US GDP growth rate in the third quarter, the fastest quarterly pace since World War II. Fourth quarter GDP is also likely to be up, probably in the high-single-digit range. Employment has generally been recovering since the spring, but recently rising COVID-19 cases and implementation of fresh restrictions have slowed and added risk to the recovery. Millions of Americans are still suffering financially and/or mentally from job loss, social distancing, and isolation. The continuation of the pandemic was the impetus for the recently passed $900 billion coronavirus relief/stimulus and government funding bills, signed by President Trump on December 27th. Despite the headwinds and somewhat uneven recovery, the trajectory of major corporate earnings, and therefore, the market, continues to be upward.

Vaccine Optimism

The unprecedented amount of funding and brainpower dedicated to vaccine development seems to have paid off with approval of multiple effective and safe vaccines in record time. Vaccines from Pfizer/BioNTech, Moderna, and AstraZeneca/Oxford have all won emergency use authorizations, and aggressive global inoculations are underway. Hopes for a return to normalcy sparked an impressive market rally and some asset class rotation including a period of significant outperformance for small cap stocks vs. large caps into year end.

A Regime Change

The highly contentious 2020 presidential election cycle presented another obstacle for financial markets to overcome and is thankfully in the rear-view mirror. Though President Trump has filed lawsuits and questioned the integrity of the results, Joe Biden is set to be sworn in as the 46th President on Wednesday, January 20th. The Democratic Party still holds a majority in the House of Representatives, though Republicans gained seats. In addition, Democratic candidates won both Senate runoff elections held in Georgia on January 5th, giving the party control over government. This increases the likelihood of significant legislation such as further stimulus, infrastructure spending, and higher taxes.

Early administration appointments by President-elect Biden have tended to be moderates, possibly upsetting some of the more progressive members of Congress but providing comfort to many investors. Examples include former Federal Reserve Chairwoman Janet Yellen as Secretary of the Treasury and Merrick Garland as Attorney General.

Domestic Equity Outlook

We believe the market will be less volatile in 2021 than in historic 2020, while continuing to test the nerve of investors and generating a mid-single-digit total return. This outcome assumes significant earnings growth off of a depressed 2020 base and some valuation contraction. Corporate operating results are likely to see a cyclical recovery, with lower interest expense somewhat offsetting higher tax expense. A near-term correction could occur due to current high levels of bullishness, stretched valuation, a new administration, and potential hiccups in the vaccine rollout. However, as long as the economic recovery generally remains intact, this would likely present a stock buying opportunity.

Assuming that the COVID-19 vaccines are effective, safe, and broadly administered, global economies can gradually return to normal. With an easy comparison to 2020, potential release of pent-up demand for travel and entertainment, and the rebound of cyclical companies as permanent reopening occurs, we believe the stage is set for a meaningful rebound in earnings that could carry over into 2022. Ample liquidity in the system and a Federal Reserve willing to be extremely supportive add fuel to the bullish thesis for stocks, especially when compared with other asset classes like bonds and cash. Of course, as 2020 showed, unforeseen risks can arise at any time, and it is important to have a plan and a well-tested, consistent, disciplined investment process in place to successfully navigate through turbulent periods.

Unless circumstances change, we would not expect to make major changes to portfolios other than upgrades when we find fresh and superior process fits. At the margin, we would generally expect new portfolio additions to be cyclicals that benefit from economies re-opening and fiscal stimulus, or reasonably valued secular growers with fresh catalysts. Active management and adherence to our time-tested, successful process will continue to drive our portfolio decision making.

Fixed Income Outlook

Corporate bonds finished on a high note in 2020 after experiencing considerable turbulence earlier in the year. Government bonds generally moved higher throughout the year. The Bloomberg Barclays Aggregate Index, a mix of government and corporate bonds (mostly government), rose 7.5% in 2020. Bond returns were propelled by the continued downward pressure on interest rates. 10-year Treasuries yielded a mere 0.93% at year-end, well below the 1.92% seen at the end of 2019. Shorter-term Treasury yields remain exceptionally low, with yields of less than 0.16% for maturities of 2 years or shorter.

Recent Federal Reserve commentary suggests that short-term interest rates are likely to remain near zero through at least 2023. The Fed is keeping rates down to reduce borrowing costs for individuals and businesses, which should ultimately help stimulate the US economy. Future rate increases will be contingent on sharply lower unemployment and considerably higher realized inflation. Both of these seem unlikely in the near-term. The Fed also remains committed to its program of buying Treasuries, corporate bonds, and mortgage bonds, which should help keep a lid on interest rates. Longer-term interest rates may drift higher as the global economy continues to heal following the rollout of the coronavirus vaccines, as Congress enacts additional stimulus, and/or when the Fed pulls back from its bond buying program. In fact, yields have already begun to move moderately higher as presumed incremental stimulus spending from a Democratic-controlled Congress have driven up inflation expectations (see chart below).

While we continue our research for new fixed income ideas, we remain on the sidelines when it comes to purchasing new corporate bonds. Prices remain elevated (and thus, yields remain exceptionally low). Our expectation is that eventual market volatility will present better risk/reward opportunities for future bond investments. As has been the case for the past several months, the vast majority of investment-grade bonds with a maturity of 3 years or less currently yield less than 0.50%. This lack of yield is forcing many investors to alter the risk profile of their portfolios dramatically. Some have decided to buy higher yielding, longer-dated bonds (which introduces interest rate risk), or to buy riskier junk-rated bonds (which introduces more credit risk), or even to reallocate to other asset classes (such as equities). The tradeoff, of course, in moving away from investment-grade bonds towards higher yielding assets is the likelihood of greater portfolio volatility.

The majority of our fixed income portfolios remain comprised of short dated investment-grade corporate bonds that we intend to hold until maturity. Looking ahead to 2021, we believe a reasonable estimate of fixed income total returns is in the 1-2% range. While the upside potential is limited for many investment-grade bonds today, fixed income continues to play an important role in the asset allocation process by providing both income and relative stability within a diversified portfolio.

Global Markets Outlook

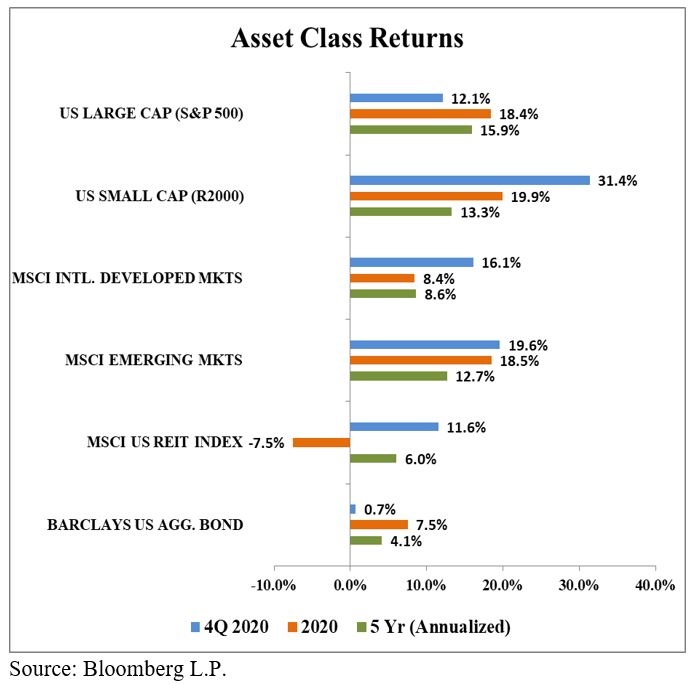

Global equity markets capped a tumultuous year with a powerful rally in the fourth quarter, driven by prospects of vaccines halting the spread of the virus and expectations of an accelerating economic recovery into 2021. US small cap stocks surged 31.4%, emerging markets rose 19.6%, international developed markets increased 16.1%, and US large cap stocks represented by the S&P 500 rose 12.1%. US dollar weakness accelerated, with the currency falling 4.8% in the quarter, providing a tailwind for US investors in international markets. For the full year 2020, US small cap stocks led the way with a 19.9% return, emerging markets increased 18.5%, US large cap stocks rose 18.4%, and international developed markets rose 8.4%.

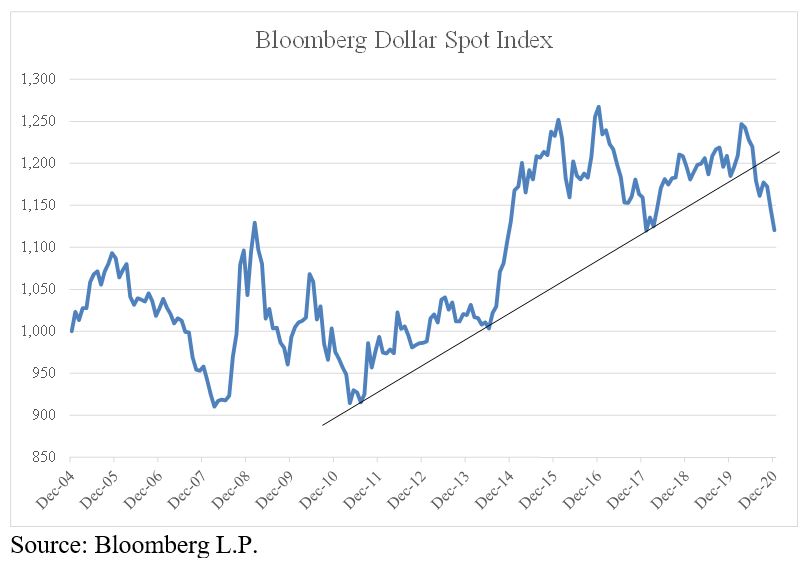

The US dollar fell 5.4% in 2020, a trend that is likely to continue over the next several years as the world economy heals and rising global growth attracts investors outside the relative safe haven of the US (see chart below).

Inoculation Recovery Underway

The COVID-19 pandemic shocked the globe with nearly 2 million deaths, hundreds of millions of lost jobs, and the broadest global recession in history. While the pandemic is far from over, widespread vaccine distribution is underway and the green shoots of the global recovery are strengthening. Substantial immunity appears possible by the end of 2021, allowing business and travel activity to move towards normalization over the next several quarters. A broad economic rebound, supported by accommodative fiscal and monetary policies, provides a constructive backdrop for global markets. While the virus continues to spread, and the pandemic still remains top of mind, markets are forward looking, expecting a swift 2021 recovery in corporate earnings.

Implications for Asset Allocations

As the world economy transitions from the reflation to the recovery stage of the business cycle, historical patterns begin to appear. The effect of loose monetary policies and an improving economic recovery drives a rotation from growth towards cyclical value. We have positioned portfolios to benefit from this cyclical recovery, while retaining a balanced posture with large cap growth companies. As we enter 2021 the stalwart principles of diversification hold true. Elevated US equity valuations and low interest rates likely portend below-trend US capital market returns over the next several years.

Broadening portfolio allocations, to diversify across asset classes, geographies, and currencies, may enhance returns to help clients achieve financial goals. For example, smaller companies, which typically exhibit the largest earnings declines in recessions, and sharper recoveries in economic rebounds, are outperforming large cap companies in this cyclical recovery. International markets appear attractive relative to the US for several reasons, including cheaper valuations, higher dividend yields, greater underlying cyclical exposure, the weakening US dollar, and diversification from domestic risk of higher taxes. We recognize that every client is different and suggest you work with your wealth adviser to ensure your asset allocation is appropriate to meet your goals.

REIT Commentary

In the fourth quarter, the MSCI US REIT Index (Bloomberg: RMZ) produced a total return of 11.5%. This resulted in a calendar year 2020 total return of -7.6%, which compared to our prediction for a total return between +8% and +12%. However, even producing a total return of -7.6% seemed inconceivable on March 23rd when the RMZ was down 40% year-to-date.

Impressively, the Fed’s quick action and commitment to buying bonds in the open market prevented any REITs from having to raise dilutive equity as many were forced to in 2009. Instead, the fixed income market was wide open, allowing REITs to borrow at record low interest rates, a trend we expect to continue into 2021.

In spite of the broad fiscal and monetary stimulus, the virus did create a massive bifurcation in performance among sectors and individual stocks. In general, owning cell towers, data centers, industrial, self-storage, and single family rentals proved to be the best decision for the period of February 21st through November 9th. In contrast, the office, shopping center, regional mall, lodging, healthcare, and coastal apartments were victims of the virus and underperformed the benchmark.

The announcement on November 9th by Pfizer of the over 90% efficacy of its COVID-19 vaccine began a reversal in performance of a magnitude we have never seen before. For the period of November 9th to December 31st, the previous “winners” became the “losers” and vice versa.

2021 REIT Forecast

2020 proved that the REIT space is anything but homogeneous. The divergence between REITs approached ten year highs in 2020 due to the uneven effects of the virus. We believe that this will continue into 2021, leading to further opportunities for active REIT managers. However, our annual forecast is based on the performance for the RMZ, which is the compilation of 14 different underlying sectors. Broadly speaking, we use several metrics to forecast RMZ performance. Namely, we estimate AFFO (adjusted funds from operations) growth, NAV (net asset value) growth, and dividend growth. All of these should be positive in 2021 due to the pullback in each of these metrics in 2020.

The combination of the three methods leads us to a projection of +14% to +19%, though we do expect volatility to continue as headlines on vaccinations, shutdowns, the economy, and stimulus issues could move the stocks below or above our targets throughout the year.

Long Term COVID-19 Effects

First, we believe that “work from anywhere” (WFA) will be a more impactful change to working than “work from home” (WFH). While we do assume some decline in demand for office space, the movement of people away from cities such as New York City and San Francisco to warmer, affordable cities such as Phoenix, Austin, Charlotte, and Nashville will have dramatic effects on the local residential, retail, and office markets.

Second, we believe that a large portion of e-commerce’s gain on brick and mortar retail in 2020 will be permanent. Many people that previously were not using e-commerce for certain items, namely food, staples, and even cars (!!) found the ease and speed for the first time, and will likely not go back to their previous routines.

Third, for the same reason that this will hurt brick and mortar retail, the move to e-commerce will only continue to drive rent growth and cap rate compression for industrial warehouses of all shapes and sizes.

In summary, while 2020 was not what we forecasted from an absolute return perspective, we were able to improve upon our long term track record of beating the benchmark, and believe the “reset” only helps set up the next cycle for further success. In particular, the further divergence in performance between REIT securities should create a healthy environment for active managers.

Bradley J. Eixmann, CFA, beixmann@chiltoncapital.com, (713) 243-3215

Brandon J. Frank, bfrank@chiltoncapital.com, (713) 243-3271

R. Randall Grace, Jr., CFA, CFP®, rgrace@chiltoncapital.com, (713) 243-3223

Matthew R. Werner, CFA, mwerner@chiltoncapital.com, (713) 243-3234