Portfolio Insight | 1st Quarter 2025

2025 started off in promising fashion, with the S&P 500 gaining 4.6% to a fresh all-time high of 6,147 on February 19th. The index then dropped over 10.0% into correction territory, rebounded, and finally rolled over again to end the quarter -4.3%, at 5,611. This volatility has extended into 2Q. Many investors worry that the Trump administration’s aggressive early policy moves, many of which have not been communicated or implemented in a calming manner, could negatively impact the economy and increase inflation pressures.

In the first quarter, the strongest sectors were Energy, Health Care, and Consumer Staples while Consumer Discretionary, Information Technology, and Communication Services were the weakest. The first quarter saw a dramatic reversal of leadership, with mega-cap growth stocks like the Mag 7 fading while value stocks gained. The question of whether this trend is sustainable should be at least partially resolved with the upcoming earnings season.

A Rocky Start

Optimism permeated the financial markets at the beginning of the quarter. One of the most contentious US presidential elections ever was in the rear-view mirror, and two years of major market gains had created a distinct wealth effect. In the back half of the quarter, however, evidence of a slowing economy as well as stubborn inflation emerged. Then, a series of surprisingly quick and impactful policy decisions from the new administration caused enough angst to roll the market over.

Aggressive tariff implementation, dramatically altered immigration policy, major layoffs of government workers by the Department of Government Efficiency (DOGE), and anxieties about the US potentially intervening in the Ukraine/Russia war, annexing Greenland, and even renaming the Gulf of Mexico have given investors pause. It appears that the administration is willing to tolerate some “short-term pain” to achieve its long-term goals of on-shoring manufacturing, reducing the federal deficit, keeping taxes low, deregulating, lowering interest rates, lowering gas prices, and driving sustainable economic growth that benefits everyone. It remains to be seen whether perhaps the most impactful of these changes, substantial tariffs on trading partners around the world (including relatively friendly ones Canada and Mexico), will slow growth, increase inflation, and offset the likely stimulative growth policies of the future.

High Policy Uncertainty

Amidst the chaotic early months of President Trump’s second term, the Federal Reserve held interest rates steady, closely watching economic and policy developments before acting further on interest rates and monetary policy. Following the most aggressive rate hiking cycle in 40+ years, the Fed does have room to cut rates and add liquidity to the economy, especially if rate-sensitive areas like housing or industrials need a stimulative boost.

Eventually, companies will need clarity to confidently invest, hire, and engage in capital markets activity. Somewhat counterintuitively, market returns are typically strong after periods of elevated policy uncertainty, once the policies are enacted and business investment resumes.

Pullbacks Are Normal

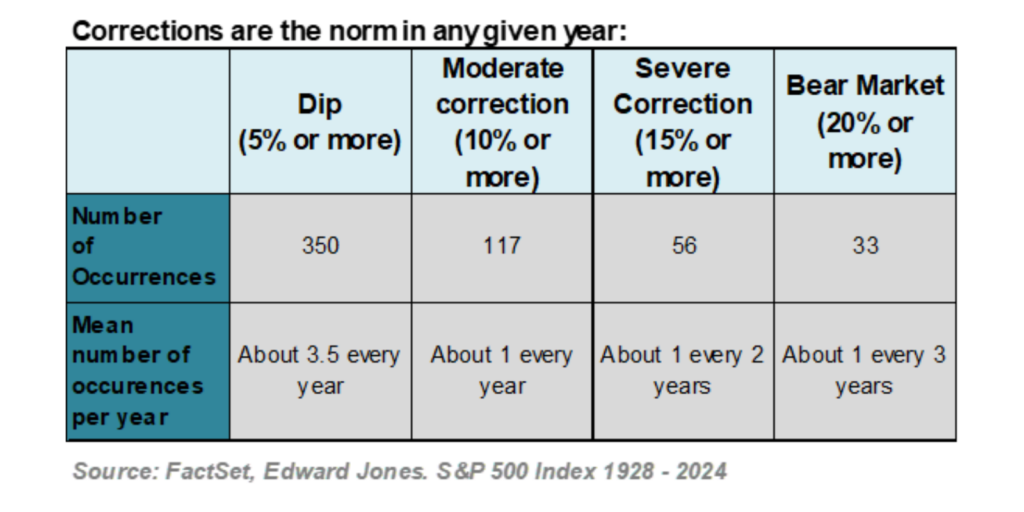

Following the long period of low volatility and relentlessly rising markets in 2023 and 2024, the market correction (10%) in March rattled many investors who had gotten used to a calm ride. However, it is worth remembering that pullbacks are frequent and normal.

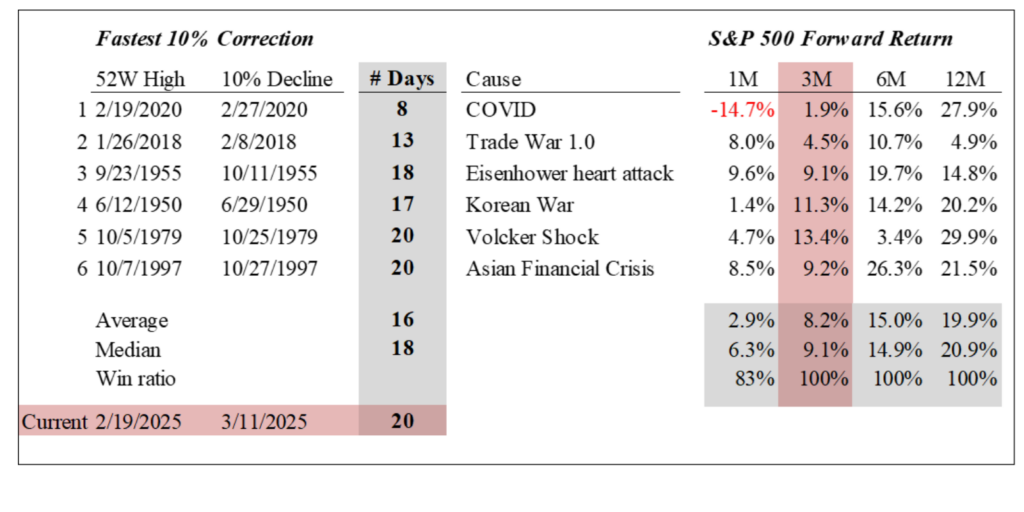

The rapid pace of the market drop during the quarter was notable in that it represented the 5th fastest correction in history. The good news is that, after every other similarly fast correction, the S&P 500 was higher 3 months, 6 months, and 12 months later.

Domestic Equity Outlook

Stocks have pulled back dramatically at the start of 2025. Such action often occurs when a new administration comes into power, especially when control flips to a new party that enacts major policy changes. The Trump administration’s aggressive rollout of tariffs has increased the risk of a recession. It remains to be seen if this approach is part of a larger negotiation. However, potentially meaningful and growth-boosting deregulation and tax-cut extension measures are likely to come in the second half of the year, and the Federal Reserve has the means to stimulate the economy if necessary.

From current levels, we see a generally favorable backdrop for equities, but with the expectation of higher volatility and downside risk. While investor and consumer sentiment have taken a hit, clarity on policy going forward and/or reassurance that the economy can avoid a recession could cause a dramatic turnaround in the market. Our portfolios are well positioned for a rebound, and there are numerous attractive stock opportunities in a wide variety of sectors, especially after the pullback. Should policy uncertainty persist and/or evidence of a recession emerge, our diversity of holdings and ongoing active research efforts would enable us to rapidly pivot portfolio exposures.

Fixed Income Outlook

Unlike the S&P 500, the Bloomberg US Aggregate Bond Index, comprised of both corporate and government bonds, rose 2.78% during the quarter. A “flight to safety” out of the equity markets and into bonds helped push down interest rates, and the yield on the 10-year Treasury fell from 4.58% to 4.23%.

The Federal Reserve remained on hold during the quarter, leaving the Federal Funds rate at a range of 4.25% – 4.50%. While these projections move regularly, the market currently expects the Fed to make four 0.25% rate cuts in 2025, plus one additional cut in 2026. As a reminder, while a lower Fed Funds rate does reduce interest paid on assets such as money market funds and CDs, the net effect is stimulative for the economy as rates for loans on items such as homes and automobiles become more affordable for consumers.

The Fed could be facing a major dilemma: weighing tariff-related inflation versus the possibility of a recession. Although the near-term inflationary impact of tariffs has not yet been felt, the Fed does not appear overly concerned that inflation will spike upward in a sustained fashion again. Members of the Federal Reserve, along with many outside economists, have noted that while prices for certain goods and services (such as insurance) continue to trend higher, prices for several other items (such as eggs and used cars) have recently trended lower. As a result, near-term inflation growth (pre-tariffs) could decelerate somewhat. Also, while several survey-based indicators would suggest future inflation expectations are moving higher, market-based indicators (such as the yields of Treasury Inflation Protection Bonds) have actually moved lower recently. At present, the Fed is more concerned with the potential deterioration in the labor markets. The unemployment rate continues to drift higher since bottoming in April 2023, and metrics such as job openings and quit rates have also worsened. While none of this employment data would suggest a recession is imminent, the Fed will be looking to stave off further worsening in these metrics by proactively cutting interest rates.

We still believe bonds remain an attractive asset class for those clients with fixed income allocations. While interest rates are modestly lower since year-end, most bonds we are buying today yield between 4.0% – 4.5%. As is typically the case, each bond purchased is investment-grade quality and is bought with the intent to hold until maturity.

Global Markets Outlook

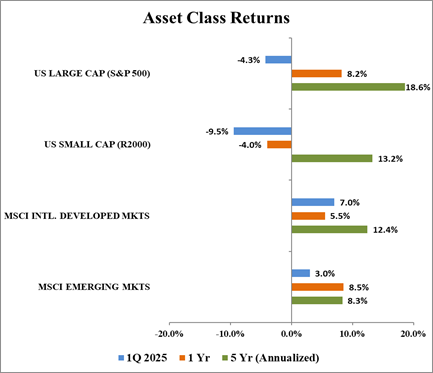

As the US was weighed down by trade uncertainty, tighter fiscal policy, persistent inflation concerns, and lower growth, international equities surged in the first quarter and sharply outperformed their US counterparts. International developed markets rose 7.0%, led by strong gains in Europe and Japan, while emerging markets advanced 3.0%, buoyed by a rebound in Chinese equities. In contrast, US large caps declined 4.3% and US small caps fell 9.5%.

Source: Bloomberg, Chilton Capital Management

A key driver of this divergence has been the contrasting fiscal landscape. In the US, a shift in focus toward deficit reduction has resulted in fear of government spending cuts, dampening growth expectations as the Federal Reserve maintains elevated interest rates. Meanwhile, European fiscal policy turned supportive. Germany, which has long pursued a policy of economic austerity, approved a €1 trillion spending package focused on defense and infrastructure. The European Commission also proposed the “ReArm Europe” initiative, targeting up to €800 billion in defense-related spending. These measures reflect a coordinated effort to stimulate growth amid geopolitical instability. The European Central Bank, Bank of England, and Bank of Canada all extended rate cuts, reinforcing an accommodative policy stance.

China also expanded fiscal support, announcing a record 3 trillion yuan ($411 billion) in special treasury bond issuance aimed at boosting consumption, upgrading industrial capacity, and supporting strategic sectors such as electric vehicles and semiconductors. Additional stimulus measures under consideration include subsidies for the services sector and further monetary easing. These initiatives, along with exciting AI developments, have contributed to a strong rebound in Chinese equities, which significantly lifted emerging market returns.

US equities were also challenged by ongoing trade policy uncertainty. The Trump administration’s announcement of new tariffs raised concerns about inflation, retaliatory measures, and supply chain disruptions that could hurt growth. While the long-term impact remains unclear, the immediate effect was heightened market volatility and a rotation away from US risk assets.

After strengthening significantly in late 2024, the US dollar moderated in Q1, providing a tailwind for international equities. Sector composition was another driver. The S&P 500’s heavy concentration in growth-oriented technology and consumer discretionary stocks proved a headwind during the risk-off trade. The Russell 1000 Growth Index fell 10.0%, while its value counterpart rose 2.1%. International markets, with greater exposure to financials, industrials, and energy, benefited from a global shift toward value and cyclicals. Looking ahead, the outlook for US and international equities appears balanced. US companies continue to lead in innovation and profitability, and if inflation moderates and the Federal Reserve lowers rates, domestic equities (especially growth-oriented sectors) could regain leadership. However, headwinds such as still higher valuations, policy uncertainty, fiscal tightening, and trade tensions may limit near-term upside.

International markets, by contrast, may benefit from a continued combination of lower valuations, improving economic conditions, and increased fiscal and monetary support. Still, challenges remain, including entrenched bureaucracy in Europe and political risk in emerging markets. Relative performance in the months ahead will likely depend on the path of interest rates, inflation, trade policy, fiscal priorities, currency dynamics, and investor risk appetite.

REIT Commentary

In the first quarter of 2025, the MSCI US REIT Index (RMZ) produced a total return of +1.1%, though it was once again marked with high volatility as February was +3.7% and March was -3.5%. The 10-year US Treasury yield was similarly volatile, as the market digested conflicting opinions on the effects of tariffs and inflation reports. After finishing 2024 at 4.58%, the 10-year Treasury yield surged up to 4.79% within the first few weeks of 2025, only to move back down to 4.23% by the end of March. While the first quarter has not made much progress toward our forecasted +10-15% total return for REITs in calendar 2025, the decline in the 10-year Treasury yield gives us confidence that the market is looking for safer investments with yield.

The volatility in the market also highlights the importance of active management. In the first quarter, the Chilton REIT Strategy Composite produced a total return of +3.9%, resulting in 280 bps of alpha, which is more than the Composite’s annual average alpha since inception in 2005. It is periods such as these when the core principles that guide our process are especially evident. Called “The Ten Commandments of REIT Investing”, we have constructed this set of principles for REIT management teams, bankers, boards of directors, and investors to ensure long-term success, premium valuation, and steady dividend growth.

Today, public REITs are facing stiff competition for investor’s money from private equity alternatives. It is safe to assume that few, if any, follow the Ten Commandments of REIT Investing. Investors in these private alternatives have demonstrated short term memory loss as to what happened in the Global Financial Crisis for such investments. Those that bought from 2010-2020 have likely enjoyed excellent returns, goosed by declining interest rates, high leverage, and falling cap rates. However, we believe public REITs will be on a more level playing field with their private counterparts going forward, and many will have a clear advantage. Even recently, from March 31st, 2023 to December 31st, 2024, the RMZ produced a total return of +20.4% while the NCREIF National Property Index (NCREIF NPI), an index that tracks values of private real estate, produced a total return of -5.8%. An index that tracks the daily NAVs of non-traded REITs (NCREIF Daily Priced Index, or DPI) produced a total return of -9.4%.

With strong balance sheets, we believe public REITs are in the perfect position to illustrate competitive total returns going forward as well. Though some private participants have proactively marked down their portfolios (and some forced to do so due to debt maturities), there is still a reckoning to come from investments made in the peak years of 2021 and 2022. Lenders have been willing to work with these borrowers, but it has certainly dampened their flexibility. In contrast, public REITs are sporting a record low net debt/EBITDA, and have options for borrowing secured or unsecured – usually at lower rates. As such, we believe public REITs’ access to capital will be a differentiator in this higher interest rate environment.

Bradley J. Eixmann, CFA

Brandon J. Frank

Robert J. Greenberg, CFA

Matthew R. Werner, CFA