Portfolio Insight | 3rd Quarter 2024

Despite a few brief unsettled periods in August and September, the S&P 500 moved 5.9% higher in the third quarter of 2024, closing at an all-time high of 5,762 and bringing its very solid year-to-date gain to 22.1%. While the job market softened somewhat, inflation growth continued to slow, positive GDP growth persisted, and the Federal Reserve began lowering interest rates with a 0.5% cut in September.

In the third quarter, the strongest sectors were Utilities, Real Estate, and Industrials while Energy, Information Technology, and Communication Services were the weakest. For the first nine months of 2024, the best sectors were Utilities, Information Technology, and Communication Services, while the worst sectors were Energy, Consumer Discretionary, and Materials. Market leadership shifted in July, but the sustainability of this change remains an open question.

Volatility Picks Up

After an extended period of calm with the volatility index (VIX) pinned down in the low teens (see the VIX chart below), the market underwent two short-lived but severe spikes of investor fear beginning on August 5th and September 3rd. Factors contributing to the August upset, which saw the largest VIX spike since the pandemic, included the Fed’s decision to hold interest rates near a 20-year high when many felt that a cut was warranted, a weaker-than-expected jobs report, and the unwinding of the yen carry trade following a surprise rate hike by the Bank of Japan.

Source: Bloomberg

These episodes of volatility proved to be buyable pullbacks. Despite some turbulence, the S&P 500 never officially reached correction status, dropping just 8.5% before ripping back to record highs by the end of the quarter. August and September tend to be seasonally weak, volatile months, and markets can be quite inefficient when investors become short-term focused and trade on emotions rather than fundamentals, which generally change more slowly.

The Mag 493?

As slower inflation growth and a gradually deteriorating employment picture gave market participants more confidence that the Federal Reserve would soon embark on a rate cutting cycle, a long-awaited broadening of market leadership began in mid-July. From July 16th through September 30th, the S&P 500 equal weight index (+5%) outperformed the cap-weighted S&P 500 (+2%) as well as the cap-weighted Magnificent 7 stocks, which were actually negative (-1%).

Collectively, the Mag 7 will average nearly 30% earnings growth in 2024. This will likely slow to around 20% in 2025 and possibly mid-teens in 2026, per Bloomberg. This compares to the overall S&P 500, which will likely see 5% growth in 2024 accelerating to mid-teens in 2025 and slowing back down to around 10% in 2026. The higher earnings growth of the Mag 7 largely explains their past outperformance and supports continued absolute upside despite higher valuation than the overall market. However, this group may cede sustained leadership relative to the other 493 names as the earnings growth spread narrows. Less reliance on these 7 companies, which currently make up over 31% of the index, would likely be a positive development for the overall market.

A New Cycle

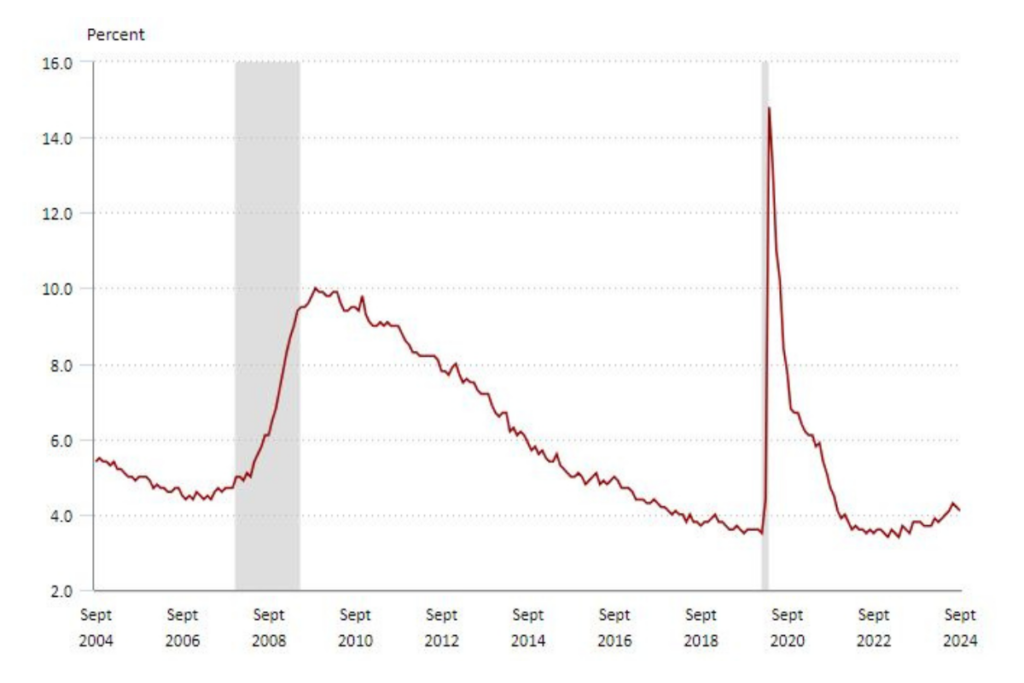

The Federal Reserve was probably late to address the worst inflation spike in over 40 years. However, the Fed has arguably made up for its slow start with an aggressive rate hiking cycle that appears to have cooled inflation without causing a recession—the so-called soft landing. With inflation growth now slowing steadily towards its 2% goal and the unemployment rate hooking modestly upward (see the unemployment rate chart below), the Fed has ample room to cut rates at a pace that can be adjusted based on incoming economic data.

Source: US Bureau of Labor Statistics

The good news now is that the economy is still growing and mass layoffs are not occurring. Unemployment was recently at historic lows and job openings had spiked after economies reopened in 2020. So, some softening following the significant monetary tightening was to be expected. For now, the Fed’s actions seem to be having the desired effects. Monetary loosening should be supportive of rate-sensitive industries like housing and positive for consumer spending and growth of risk assets.

Domestic Equity Outlook

Market volatility is likely to return in the coming months as market participants scrutinize the Fed’s rate cut path, economic (especially employment) data, and a closely-contested election. In times like these, patience and a focus on company fundamentals, specifically current and future earnings, are paramount.

Major secular themes like AI could continue to boost corporate growth and margins for years to come. These tailwinds, plus fading headwinds from high interest rates and inflation, can continue to drive earnings and the market higher into next year.

Fixed Income Outlook

With the “Powell Pivot” finally here, bonds staged a significant rally during the quarter. The Bloomberg US Aggregate Bond Index, a combination of government and corporate bonds, posted a total return of 5.2% in Q3, bringing its year-to-date gain to 4.4%. Yields fell across the board, with the 10-year Treasury yield declining from 4.36% to 3.81% during the quarter, while shorter-term yields fell even further. As has been the case for some time, bond returns in most client accounts have remained ahead of the Index.

On September 18th, Federal Reserve Chairman Jerome Powell announced a 0.5% interest rate cut, a “pivot” from the aggressive rate hikes of the post-COVID era. This reversal in policy also represents a pivot in focus toward the employment component of the Federal Reserve’s dual mandate. While the cumulative impact of inflation has been substantial for everyday Americans, the rate of growth has meaningfully slowed recently. At the same time, the outlook for employment has worsened somewhat. As a result, the Federal Reserve is now more concerned that higher rates could weaken the economy and ultimately, employment.

On the one hand, lower interest rates provide a stimulus to the economy. Households benefit from cheaper mortgages and automobile loans, which free up additional funds to spend elsewhere. Likewise, lower borrowing costs provide a boost to corporate America by increasing the incentive to expand their businesses via capital expenditures, acquisitions, etc., and by pushing down existing corporate interest expense.

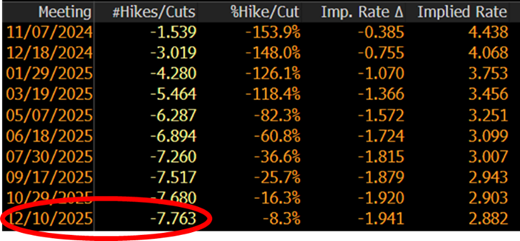

On the other hand, lower interest rates hurt savers as the yields on fixed income (including money market funds) decline. Money markets that yielded ~5.0% in mid-September now yield closer to 4.5%. To take this a step further, investors are now pricing in nearly 8 additional 0.25% interest rate cuts between now and the end of 2025. This implies that investors may see money market yields closer to 2.5% by the end of next year. On balance, the net effect of these interest rate cuts on the US economy is likely to be substantially stimulative.

Source: Bloomberg

We believe that bonds remain a relatively attractive asset class for clients with fixed income allocations. The majority of bonds we are buying today yield 3.5% – 4.5%, with maturities of 1-6 years. With rates likely to move lower over the next year, we feel locking-in these types of yields for several years makes sense. As is usually the case, each bond is investment grade quality and is bought with the intent to hold until maturity.

Global Markets Outlook

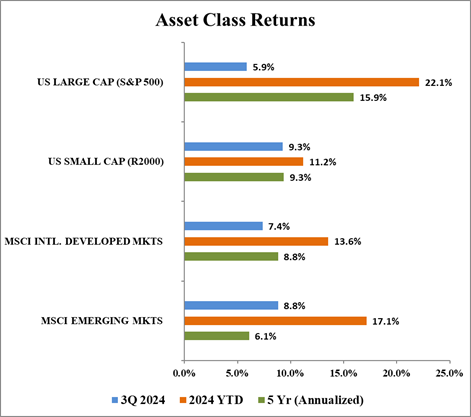

Global markets performed strongly in the third quarter of 2024 as economies remained stable amid interest rate cuts by major central banks worldwide. New leadership emerged with US small cap stocks returning 9.3% for the quarter. Emerging markets followed with an 8.8% gain, international developed markets added 7.4%, and US large caps finished up 5.9%. Year-to-date, US large cap stocks remain on top with a 22.1% return, followed by emerging markets at 17.1%, international developed markets at 13.6%, and US small caps at 11.2%.

Source: Bloomberg, Chilton Capital Management

Several significant shifts emerged in the third quarter. Notably, value outperformed growth after six consecutive quarters of underperformance, with the Russell 1000 Value Index returning 9.4% compared to 3.2% for the Russell 1000 Growth Index. The Federal Reserve also cut interest rates for the first time this cycle, and markets expect further cuts this year and next. Other prominent central banks, including the Bank of England, European Central Bank, Swiss National Bank, and Bank of Canada also implemented cuts, while the People’s Bank of China cut rates and introduced additional stimulus measures. A notable change in sector performance also emerged, as growth heavy sectors Communication Services and Information Technology —previous leaders—became the second and third worst performers of the quarter, ahead of only the energy sector. In contrast, traditionally value-weighted sectors like Utilities, Real Estate, and Financials, which had previously lagged, took the lead.

Historically, it is not unusual for value stocks to outperform growth, and for defensive sectors to outpace cyclicals in the early stages of a rate-cutting cycle. As the economy slows, investors tend to shift toward more defensive assets. However, growth stocks typically start to outperform value 12 months after the first rate cut, driven by the potential onset of economic expansion and lower interest rates, which reduce borrowing costs and enhance the present value of future earnings.

Of course, every cycle is unique. In the 12 months following the first rate cut in 2001, value outperformed growth by 10.9% as technology valuations got a reality check. However, in the 12 months after the first cut in late 2019, growth outperformed value by 35.8%, thanks to a pandemic/stimulus induced demand boom. While today’s environment is unlikely to produce such extreme results, investors with a strong conviction that growth will outperform over the next year may find U.S. large-cap stocks particularly attractive. On the other hand, those favoring value may look to international and small-cap stocks.

REIT Commentary

In the third quarter of 2024, the MSCI US REIT Index produced a total return of 16.1%, helped by a lower 10-year Treasury yield and solid earnings reports. While rate cuts were expected, the magnitude and duration of the rate cut regime has reversed the trend of capital flows to REIT ETFs and mutual funds, setting up a favorable cost of capital environment for public REITs. We believe this environment is ripe for accretive acquisitions, the “X” factor for future earnings growth that is yet to be factored into consensus estimates.

As shown below, public REITs have enjoyed multi-year periods of trading at NAV (net asset value) premiums for several periods in the past (1990’s, 2003-2007), giving them adequate time to raise capital and make accretive investments (acquisitions, mergers, development, redevelopment). Theoretically, the companies raising accretive capital to invest in projects garner a larger NAV premium, creating a positive feedback loop. However, since 2010, REITs have traded at an NAV premium for only 8 months at the longest, and a median duration of NAV premium of only 3.5 months. As such, they were forced to eschew an entire leg of the REIT value creation “stool”.

Source: Evercore ISI

While public REITs were largely forced to be on the sideline (or even be net sellers) from 2010-2024, private real estate was happy to take share using much higher leverage ratios to lower their cost of capital below public REITs. For example, since 2010 Blackstone (NYSE: BX) has grown its real estate platform from $33 billion to $337 billion as of December 31, 2023. In fact, the cost of capital had become so different between public and private that 21 public REITs went private for a total of $141 billion from 2017 to present day. Notably, BX was the buyer of 8 of these public REITs for a total of $58 billion.

We believe a changing of the guard is imminent. As of September 30, 2024, public REITs were trading at a 1% NAV premium, a trend that could lead to a return of the accretive acquisition “X” factor. In addition, public REITs boasted an average debt / gross assets ratio of 32%, net debt to EBITDA ratio of 4.5x, and retained cash flow of 26% of AFFO (adjusted funds from operations, or cash flow after maintenance capital expenditures) as of June 30, 2024. There has already been three REIT IPOs in 2024 including the largest ever, Lineage Logistics (NYSE: LINE), and select REITs have tapped the secondary equity markets to prepare for a period of external growth. In contrast, many private funds are dealing with high debt costs and elevated loan to value ratios due to purchases made at peak prices in 2021 and 2022.

As of September 30, 2024, estimates call for expected AFFO growth of 5%, and 6% in 2025 and 2026, respectively. However, if REITs were able to make acquisitions at a 150 basis points (bps) spread that equated to 5% of their total market cap annually, it would add 150 bps to annual AFFO growth, resulting in enhanced annual growth around 7%. We believe the conditions are ripe for a period that will more closely resemble 2003-2007, with sustained NAV premiums, growing NAVs, accretive acquisitions, and solid organic growth, once again demonstrating that public REITs are a superior vehicle for investing in commercial real estate.

Bradley J. Eixmann, CFA

Brandon J. Frank

Robert J. Greenberg, CFA