Essential Business Spotlight: Cold Storage | September 2024

Commercial real estate fills many roles in society and, arguably, none is more essential than feeding the population. The first thought might be grocery stores, but today’s report dives deeper into the extensive infrastructure and logistics existing between food producers and consumers. Not only are frozen food sales growing rapidly (estimated 5% compound annual growth rate over the coming decade), but roughly 75% of food products passes through the cold chain.

–

More jarring, approximately 13% of all food produced globally spoils annually due to subpar Cold Storage availability, translating to ~1.6 billion tons of food wasted each year. This speaks to the industry’s operational intensity that, in our view, provides high barriers of entry for sophisticated, well-established operators.

–

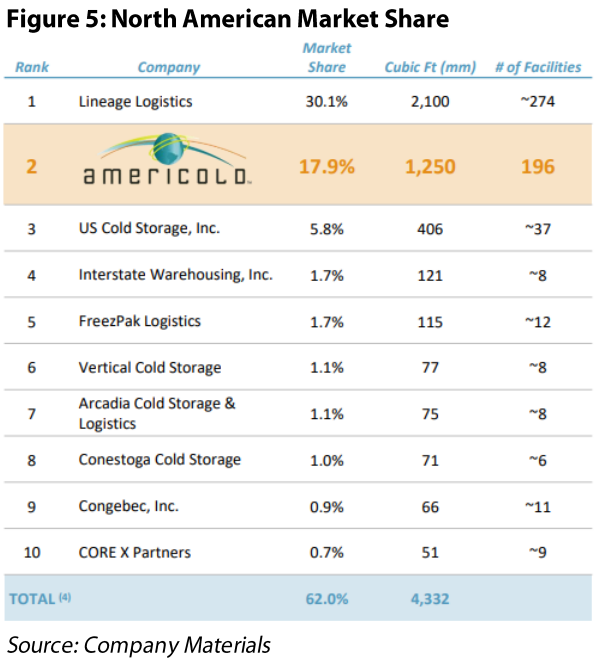

Currently, the two most established Cold Storage operators are also the only two publicly traded REITs – Americold Realty Trust (NYSE: COLD) and Lineage (NYSE: LINE) – with the latter making news as the largest IPO of 2024 (and largest REIT IPO in history). Together, they represent a market share of 17% globally (48% of North America) and operate nearly 700 facilities worldwide.

–

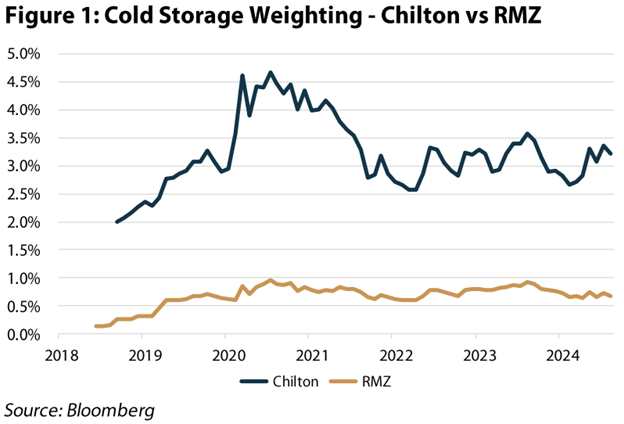

Over the medium term, we believe 1) continued online grocery adoption, 2) increased frozen food consumption, 3) recovering margins (labor & inflation), and 4) consolidation opportunities support one of the strongest 2–3-year AFFO growth outlooks amongst REITs. Additionally, over the long term, we expect both Cold Storage Equity REITs to strengthen their positions within this essential business. As such, and highlighted in Figure 1, we initiated an overweight Americold position in September 2018. Due to valuation differences discussed in today’s publication, we have not participated in LINE. As of 8/31/24 our COLD position was 3.2% relative to 0.7% in the MSCI US REIT Index (RMZ). Note LINE has not been added to the index yet, but based on the current market cap we anticipate LINE comprising 1.5% of the index, which means we are still 100 basis points overweight Cold Storage incorporating both REITs.

–

–

What is Cold Storage?

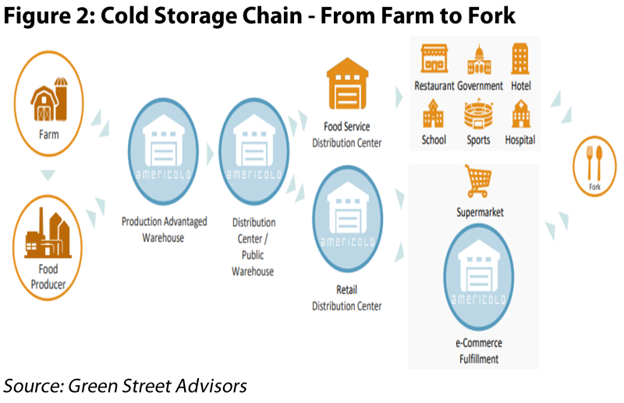

While Cold Storage is seeing pockets of demand from new industries such as pharmaceuticals, the cold chain today is entirely tied to food production and consumption. Highlighted in Figure 2, the cold chain occupies nodes ranging from ‘production-advantaged’ warehousing (e.g., at the farm) to last mile delivery fulfillment. All in, Cold Storage comprises the indispensable infrastructure that maintains food freshness along the pathway to consumption.

–

–

Not Traditional Industrial

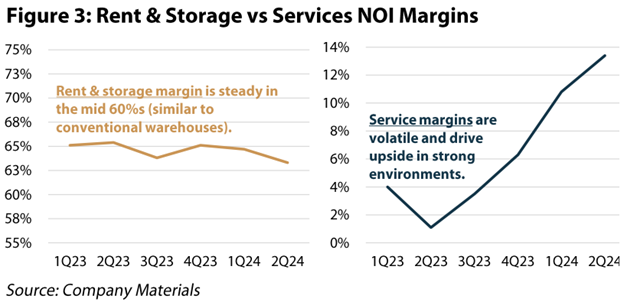

The two most important distinctions between Cold Storage and conventional warehouses are energy and labor intensity. Maintaining freezing temperatures in a large warehouse requires a substantial amount of energy, and it also requires a significant employee base compared to a simple industrial facility. These factors create a lower margin, but, more importantly, a substantially more operationally intense business than conventional warehousing. In Figure 3, we compare COLD’s rent and storage margins against services margins. While rent and storage produces a higher NOI (net operating income) margin, this segment is also meaningfully more stable (similar to conventional warehouse margins). On the other hand, service margins are more volatile but are important driver of upside. From 2Q23 to 2Q24, COLD’s same store services margin improved from 1.1% to 13.4%, which translated into NOI growing from $3 million in 2Q23 to $43 million in 2Q24.

–

–

Another important distinction is the level of service Cold Storage operators provide to tenants. In traditional industrial, the landlord essentially provides four walls, leaving the operations of the facility up to the tenant. In Cold Storage, the landlord is typically the operator who handles products for the tenant. In addition, Cold Storage operators provide myriad ancillary services such as loading/unloading, blast freezing, and in some cases even transportation. This is an important revenue enhancing source when times are good, but this operational leverage is also a detractor when fundamentals are challenged. In addition, some contracts are variable, which leaves the operator susceptible to seasonal fluctuations.

–

Demand Drivers

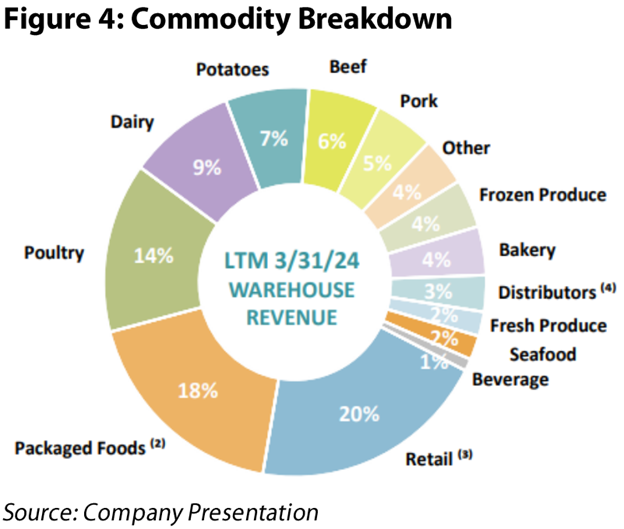

Similar to demand for traditional warehouse space, Cold Storage demand is a function of inventory levels, which is a function of production and consumption. In general consumers shifting to more packaged frozen meals and fresh meat increases relative storage needs, but, as we mentioned above, 75% of all food spends time in the cold chain so it boils down to population growth and migration. In Figure 4, we highlight the surprising level of commodity diversification within the cold chain.

–

–

Turning to migration, the increasing number of Americans moving to the Sunbelt (comprised of warmer states such as Arizona, Texas, and Florida) has a positive impact on Cold Storage demand. Consumer behavior can also impact storage needs for retailers. Recently, the rapid adoption of online grocery is increasing the need for ‘last mile’ distribution facilities that grocers rely on from third parties. We expect online grocery adoption to continue, which presents another tailwind to Cold Storage demand.

–

Aside from these traditional demand drivers, it is important to remember that most of the cold chain is still operated by less sophisticated mom and pop (e.g., only one facility), and 13% of food is lost to spoilage. Therefore, even if food consumption globally remained flat, we would expect LINE and COLD to continue taking market share from marginal operators. Additionally, this landscape provides an exceptional runway for LINE and COLD to roll up competitors while also providing an immense benefit to society at large. Estimate from the Rockefeller Foundation suggest eliminating food spoilage would feed another billion people, so this is truly a life-saving business.

–

Risks

Despite the rosy outlook discussed above, the past several years have not been an easy operating environment. For starters, Cold Storage was not immune to the transportation backlogs plaguing most industries during the pandemic, which drove destocking across the cold chain. Remember that Cold Storage generates significant upside from service revenues, and, although base rent was not impacted by destocking, service margins declined meaningfully. Additionally, the tight labor market drove expenses higher and led to unmanageable turnover that increased inefficiencies. Finally, inflation rapidly increased costs (i.e., power), and, given the typical contract structure, it took time to pass these increases along to tenants.

–

While the above risks are the ones our team spends the most time on, we commonly receive questions on Ozempic. Some sell side estimates assume 20 million Americans could adopt GLP-type drugs by 2027 and each would see a ~30% calorie reduction. This would imply that aggregate calories consumed decline by 1.8%. If this reduction flowed directly into cold storage volumes, we could see a mid-single digit impact to AFFO in 2027. However, this ignores variable cost reductions as well as the product mix. In reality, certain food groups could see declines, while others could be beneficiaries (e.g., less bags of chips but more fresh meat is a net increase to cold storage usage). Therefore, we do not think the demand impact would be as significant as some “bears” suggest.

–

Finally, new construction is always a risk we need to address in commercial real estate. Currently, speculative Cold Storage development stands at 2.5 million sqft, which is down from ~3.3 million sqft under development in 2022. While declining interest rates could spur new activity, even when we have seen speculative development in the past, these novice operators typically fail within the operationally intense business. Additionally, Cold Storage developments tend to have a much more pronounced “J curve” than traditional development. This means yields might remain negative a year or more after completion before a project reaches break even. For new entrants to the space, this growth curve presents another headwind (not too mention makes bank financing more difficult).

–

Industry Fragmentation = Growth Pipeline

As the table below highlights (Figure 5) COLD and LINE both maintain dominant market share positions in North America, with LINE at 30% and COLD at 18%. Two companies controlling ~50% of the North American market might not sound fragmented, but, after US Cold Storage (private) at number three, no other company even reaches 2% market share. Indeed, if we showed the same list from 2019, four of the top 10 companies wouldn’t exist anymore because they were acquired by LINE or COLD. As we’ve noted above, the vast majority of owners remain ‘mom and pop’ types who only own one facility. This built-in growth pipeline underpins our investment thesis in the space as we expect LINE and COLD to continue rolling up less efficient competitors. Given the size of the acquisition pipeline, neither company is opportunity-constrained and thus, can focus on only the best available acquisitions. For example, COLD’s recent acquisitions are expected to stabilize at 9-10% after initial yields in the high 8%’s.

–

–

Development Opportunity

Development is another integral piece of the growth story. Americold has two strategic partnerships that illustrate the cold chain’s immense value to the broader supply chain. The first agreement, with DP World, provides COLD the opportunity to construct facilities at ports around the world and has already broken ground on its first project in Dubai. The other agreement, with Canadian Pacific Kansas City (NYSE: CP), provides a similar opportunity at rail links and has also broken ground on one project. Importantly, the CP agreement enables the preclearance of frozen product traveling between Mexico and the US, which is a huge efficiency improvement. Overall, we expect COLD and LINE to continue dominating the development landscape given their respective reputations for operational excellence. Moreover, given the intense operational capabilities required to build and run these facilities, it is a risky endeavor to go with unproven developers. As a result, COLD expects yield of 10-12% on its in-process development projects.

–

Relative Valuation

Historically, Cold Storage assets have traded ~150-200 basis points higher than conventional industrial cap rates (according to JLL). While transaction data remains scarce, based on our conversations with industry participants, we believe cap rates have compressed from these levels. We should have a better sense as transaction activity picks up, but we would not be surprised to see more institutional interest in the future, as evidenced by the ~$5 billion raised in the LINE IPO.

–

Turning to earnings multiples, based on Green Street, COLD has traded at an average discount of 5.2x forward AFFO (adjusted funds from operations) relative to the broader industrial group. In our view, some discount is appropriate due to the margin profile differences of the two businesses, but we believe the current discount of ~9x is far too wide given the attractive growth outlook in Cold Storage. Specifically, COLD’s AFFO per share was effectively flat between 2020 and 2023, but is expected to grow by an average of ~15% over the next 3 years. For comparison, the average Industrial REIT is expected to grow AFFO by ~7% annually for the next 3 years. In our view, accounting for the exceptional growth outlook in Cold Storage today, we believe the group’s valuation is quite attractive and, as such, we have maintained an overweight position in COLD.

–

Shifting to valuation between the two public Cold Storage REITs, it is important to point out that the general consensus around LINE has been that it has a superior portfolio to COLD. We believe this is somewhat overblown. COLD has been impacted by cyber incidents and a challenging operating environment that LINE has not had to address in the public markets. On that point, COLD’s management has done a commendable job navigating this turbulent time, and, in our view, the business today stands on much surer footing. With that said, it is important to distinguish that LINE’s portfolio focuses more on last mile while COLD tends to have more exposure closer to the producer. Given that last mile facilities exist close to population centers and food producers tend to be in more rural locales, we agree that LINE should trade at a higher multiple. However, currently COLD is trading at 20x consensus 2024 AFFO while LINE stands at 26x as of 8/31/24. In our view, based on COLD’s exceptional growth outlook, this discount is far too wide.

–

Conclusion

Following the recent record-setting IPO from Lineage Logistics (NYSE: LINE) interest in Cold Storage REITs has grown materially. While we did not participate in the IPO, we welcomed the news given Cold Storage historically was lost within the traditional industrial sector. As investors come to a better understanding of the niche property type, we think the value proposition of this essential business will prove attractive to many. Namely, we believe 1) online grocery adoption, 2) growing frozen food consumption, 3) recovering margins, and 4) consolidation opportunities should drive one of the strongest earnings growth outlooks amongst REITs. As such we maintain our overweight position to the group as a whole.

–

Thomas P. Murphy, CFA

tmurphy@chiltoncapital.com

(713) 243-3211

–

Matthew R. Werner, CFA

mwerner@chiltoncapital.com

(713) 243- 3234

–

Bruce G. Garrison, CFA

bgarrison@chiltoncapital.com

(713) 243-3233

–

Isaac A. Shrand, CFA

ishrand@chiltoncapital.com

(713) 243-3219

–

RMS: 3,078 (8.31.2024) vs. 2,727 (12.31.2023) vs. 3,177 (12.31.2021) vs. 1,433 (3.23.2020)

–

An investment cannot be made directly in an index. The funds consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use.)

The information contained herein should be considered to be current only as of the date indicated, and we do not undertake any obligation to update the information contained herein in light of later circumstances or events. This publication may contain forward looking statements and projections that are based on the current beliefs and assumptions of Chilton Capital Management and on information currently available that we believe to be reasonable, however, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. This communication is provided for informational purposes only and does not constitute an offer or a solicitation to buy, hold, or sell an interest in any Chilton investment or any other security. Past performance does not guarantee future results.

Information contained herein is derived from and based upon data licensed from one or more unaffiliated third parties, such as Bloomberg L.P. The data contained herein is not guaranteed as to its accuracy or completeness and no warranties are made with respect to results obtained from its use. While every effort is made to provide reports free from errors, they are derived from data received from one or more third parties and, as a result, complete accuracy cannot be guaranteed.

Index and ETF performances [MSCI and VNQ and FNER and LBUSTRUU] are presented as a benchmark for reference only and does not imply any portfolio will achieve similar returns, volatility or any characteristics similar to any actual portfolio. The composition of a benchmark index may not reflect the manner in which any is constructed in relation to expected or achieved returns, investment holdings, sectors, correlations, concentrations or tracking error targets, all of which are subject to change over time.