Portfolio Insight | 1st Quarter 2023

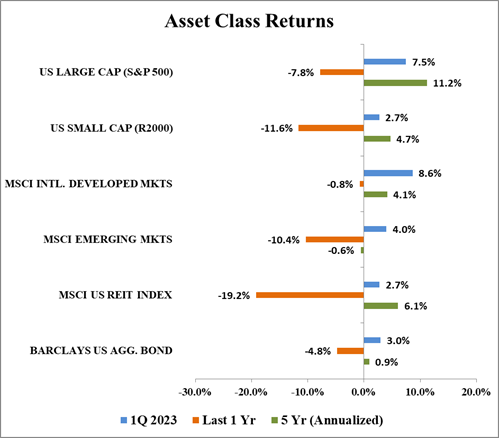

The S&P 500 continued to climb a wall of worry in the first quarter of 2023, breaking out with a strong January, dropping in February and the first half of March, and then rallying to post a +7.5% return for the quarter. Evidence is mounting that Federal Reserve rate hikes are having the desired effect of slowing inflation growth. Lower interest rates and a resilient economy were enough to offset banking industry turmoil and fears of a potentially deep recession, propelling stocks to a second consecutive quarter of gains.

The top performing sectors in the first quarter were Information Technology, Communication Services, and Consumer Discretionary, while those that underperformed the most were Energy, Health Care, and Financials. Large cap growth names staged a dramatic turnaround from their dismal 2022 performance, with gains of +9.5% in the period, compared to +5.1% for large cap value. The spread of growth outperformance relative to value was even wider at smaller market caps.

A Decent Start

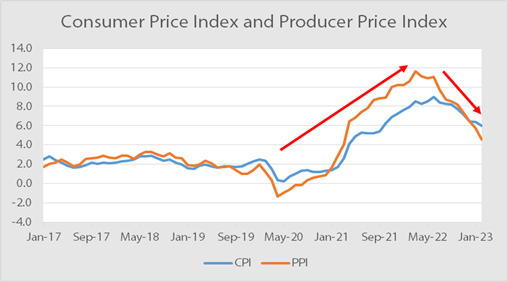

The Fed’s aggressive measures to tame inflation appear to be working. Inflation growth continues to slow from last year’s peak levels, and recent data on the wholesale/producer side suggests that the slowdown in consumer inflation (CPI) is likely to continue. The producer price index rose 4.6% on a 12-month basis in February, continuing its downward drift from double-digit levels last year.

Though still well above the Fed’s target of 2%, slowing inflation is a welcome sight. Both companies and consumers are benefitting from easing cost pressures.

Breakdowns in Banking

Market forecasters often say that the Fed tends to raise interest rates until they “break something.” The sudden closure of three regional banks within a span of five days in March would seem to be another example. Silicon Valley Bank and Signature Bank (NY) are the second and third largest bank failures in US history, trailing only Washington Mutual in 2008. However, these failures were mostly caused by terrible balance sheet management and huge exposure to tech/venture capital and cryptocurrency. Depositors in these two banks had been methodically pulling out cash as funding dried up. Those withdrawals began to accelerate once the depositors became concerned over the health of the banks’ balance sheets in a rising interest rate environment. This eventually sparked a bank run that necessitated government intervention. Meanwhile, European giant Credit Suisse, which had been plagued by scandals and mismanagement for many years, suffered several setbacks that accelerated its demise and compulsory takeover by Swiss rival UBS.

Given fears of systemic banking issues and major additional failures, the US government acted quickly and decisively to calm markets. The Fed created the Bank Term Funding Program (BTFP), a loan system that allows banks to pledge their Treasury bonds, agency debt, and mortgage backed securities (MBS) to the Fed as collateral for 1-year loans. In return, the Fed will loan banks the value of the securities at par to meet depositor requests. It also set aside $25 billion to cover any losses (unlikely given the type of collateral) and eased conditions at its discount window. Depositors at Silicon Valley and Signature were made whole, and Treasury Secretary Janet Yellen stated that the government is willing to take further action to guarantee bank deposits are safe.

A Resilient Economy

It is widely believed that tighter financial conditions as well as a pullback in bank lending will slow GDP growth. Ironically, the banking crisis is likely to aid in the Fed’s efforts to curtail economic growth to drive inflation closer to its 2% target (CPI is currently 6%). Cooling employment should lead to less inflation. Some economists estimate that more conservative lending will prove to be the equivalent of up to 1.5% of interest rate hikes.

The good news is that despite the Fed’s aggressive rate hikes, the US economy remains relatively strong, with low unemployment and continued consumer spending. Inflation, supply chain, and currency headwinds from last year are dissipating. Much of corporate America seems to be adapting well to the softer macroeconomic environment and is even reversing some of the excesses that it indulged in during times of “easy money.” Many such examples can be found in the information technology sector, where companies such as Salesforce and Microsoft are implementing aggressive “self-help” transformation plans, which unfortunately involve material layoffs but will also boost earnings and, therefore, stock upside. Others such as semiconductor giant Nvidia are seeing an end to deteriorating results and an acceleration of demand for products in exciting areas such as Artificial Intelligence (AI), which could be a meaningful secular business driver.

Domestic Equity Outlook

With inflation and interest rates appearing to have peaked, the Federal Reserve is possibly nearing the end of its current rate hiking cycle. The economy remains resilient, and conditions remain in place for the market to finish the year with a gain. Key remaining risks include the potential for the Fed to hike rates too much and plunge the economy into a deep recession, the possibility of other looming material bank failures, or additional potential shocks on the horizon such as Congress failing to raise the US debt ceiling.

Earnings will ultimately drive the market, and though expectations for this year and next have been declining, earnings estimates have recently stabilized. The current environment is providing plenty of attractive opportunities for consistent active managers with a disciplined investment process. Growth stocks in particular are showing promise as interest rates fall, economic growth slows, and valuations appear more attractive following a poor 2022.

Fixed Income Outlook

Like stocks, bonds remained volatile during the quarter, and rebounded after a historically poor 2022. The Bloomberg US Aggregate Bond Index, a mix of government and corporate bonds, rallied for a total return of +3.0%, with declining interest rates as the key tailwind. 10-year Treasury yields moved from 3.88% at the beginning of the year to 3.48% by quarter-end. This decline was driven by a lower level of expected future Federal Reserve rate hikes, a continued slowdown in inflation data, and a mid-quarter “flight to quality” as the banking sector panic pushed investors away from riskier stocks and into safe haven US Treasuries (pushing bond prices up and yields down).

The Federal Reserve has rapidly increased short-term rates since early 2022 with the hopes of lowering demand and ultimately cooling inflation. The Fed Funds Rate currently sits in the range of 4.75% – 5.00%, up from effectively zero. Some of the Fed’s “heavy-lifting” has been accomplished as a result of the recent banking turbulence. With such heightened uncertainty in the financial system, banks are more likely to be cautious with lending. As a result, this slowdown in lending/tightening of credit conditions should dent demand and have a similar impact as Fed rate increases. The financial markets are currently split on whether or not the Fed will raise rates again in the near-term before possibly cutting rates later in the year. Potentially, with inflation rolling over, the Fed could begin to cut rates to accelerate growth (improve housing affordability, etc.). Or, the possibility of a recession could compel the Fed to cut rates to stimulate the economy. Either way, this is a large shift in sentiment. As recently as just a couple of months ago, Fed Funds were expected to rise at least a percent higher than the current level.

While remaining stubbornly high in many areas, the aggregate inflation measures continue to move lower, albeit at a pace slower than most (the Fed in particular) had hoped. The current environment can be described as disinflationary (inflation growing less quickly), rather than outright deflationary (inflation moving lower). Energy prices will remain a key wildcard as lower oil/natural gas prices have been a recent tailwind for slowing inflation.

We continue to buy high-quality corporate and US Treasury bonds for those clients with fixed income allocations. These bonds have yields of 4.0% – 5.0% with maturities of 1 – 4 years. After several years of near-zero interest rates, and considering the potential for lower rates in the future, we feel that the near-term outlook for buy-and-hold bond investors remains favorable.

Global Markets Outlook

Despite fears of a worldwide recession, global markets sustained their upward momentum in the first quarter of 2023. International developed markets led the way, returning +8.6%, followed by US large cap stocks (S&P 500) returning +7.5%, and emerging markets returning +4.0%.

Several factors are contributing to this bounce, including a downward trend in inflation in both the US and the Eurozone. In the Eurozone, inflation has decreased for five consecutive months, though it remained high at 6.9% through March. Energy prices are helping, with West Texas Intermediate (WTI) oil down 5.7% and natural gas prices down by 50.5% in the first quarter due, in part, to a warmer than expected winter. Also helpful was the weaker US dollar, down 1.0% as represented by the US Dollar Index (DXY), and the beginning of China’s recovery after years of COVID-19 lockdowns.

The factors that are currently driving the market rebound are also the ones to watch going forward. The rate of inflation remains unsettling. Eurozone core (ex-food and energy) inflation is at an all-time high of 5.6% due to a significant rise in services prices. Accordingly, the European Central Bank (ECB) has raised rates by 1.00% this year, while the Bank of England has raised rates by 0.75% and the US Federal Reserve has raised rates by 0.50%. Tighter financial conditions, caused by the recent banking turmoil, will further challenge global growth. Finally, trade tensions between the US and China have been escalating with the US imposing controls on semiconductor exports to China and considering a ban on TikTok.

From a valuation standpoint, international stocks are currently trading at a significant discount to US stocks. Even though international developed markets have outperformed recently, they have substantially underperformed over the last decade, leaving room for a sustained run. International markets are likely to outperform if value beats growth, and if the US dollar depreciates against other currencies. Additionally, international stocks offer a higher dividend yield than US stocks, though fixed income investments now offer a more substantial yield than both, and are higher up in the capital structure. While there is no guarantee that international markets will outperform in the near term, diversifying within a portfolio may make sense.

REIT Commentary

In the first quarter of 2023, the MSCI US REIT Index (Bloomberg: RMZ) produced a total return of +2.7%. The quarter was marked by volatility, both to the upside and the downside. Most relevant to REITs, the collapse of several banks in March seemed to bring closer the end of the Fed rate hiking cycle, which has brought the 10-year Treasury yield from a peak of 4.08% on March 2 down to 3.48% as of March 31. This caused a rebound in REIT prices, which had been under pressure for the previous 40+ days.

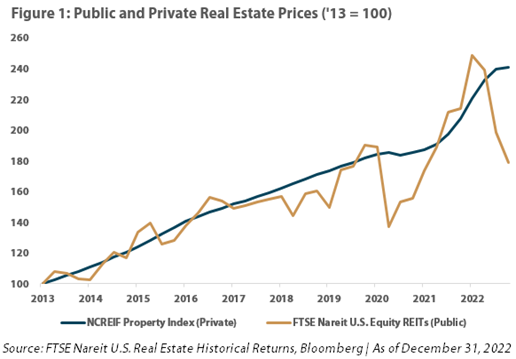

In spite of the rebound in public REIT prices, the private real estate market has yet to budge off its peak, as shown in Figure 1. As a result, there likely will be negative news about private real estate, particularly that which is financed with too much debt, over the next 12 months. Though this carries headline risk for public REITs, we believe the risk to public REITs is minimal. In fact, we see many similarities to 2008-2009 when public REITs began their rebound in March 2009 while private real estate was forced to muddle along for years.

As was the case in 2008-2009, private real estate is the victim of its own success. The high returns it was able to achieve in the period of 2011-2021 fueled a fundraising and deal-making frenzy at peak prices. To achieve the lofty returns promised to investors, fund sponsors and managers were forced to use higher leverage and floating rate debt, setting up the house of cards perfectly for the bottom to fall out. The Fed’s determination to quell inflation through the most rapid rate hiking cycle we’ve seen in 40 years should be all it will take to wipe out a significant portion of cash flow and equity from such projects.

In contrast to their private peers, public REITs were extremely disciplined in 2021 and 2022. Many REIT management teams accepted “take-private” offers from private equity, bringing about the most significant privatization wave since 2006-2007 – Blackstone alone took four public REITs private in 2022! As such, public REITs were net sellers at peak prices.

Furthermore, public REITs used the Fed’s accommodative interest rate policy in 2020-2021 to lock in long term fixed rate debt at all-time low rates. As a result, public REITs entered 2022 with the lowest debt in history, longest weighted average debt maturity in history, and extremely low amounts of floating rate debt. In contrast to debt to gross assets ratios of 50% – 70% for private players, the weighted average public REIT debt to gross assets ratio was 28% as of December 31.

In a lesson learned from 2008-2009, public REITs also entered 2022 with the lowest dividend payout ratio in history. While interest rate increases have severely cut cash flow for many private owners, public REITs have been increasing dividends at breakneck pace. Even so, public REITs have ample room for further dividend increases as the payout ratio remains at a record low of 64% as of December 31. We estimate the Chilton REIT portfolio will have a weighted average dividend increase of at least 12% in 2023.

With the interest rate increases as a catalyst, the discrepancy in pricing between private and public real estate will have to close in the next 12 months. We are confident that public REITs will outperform over this period, while employing less risk.

Bradley J. Eixmann, CFA

Brandon J. Frank

Robert J. Greenberg, CFA

Matthew R. Werner, CFA

DISTRIBUTION LIST REQUEST