Portfolio Insight | 1st Quarter 2021

In Loving Memory of R. Randall Grace, Jr. (1971-2021)

The Chilton Investment team is shocked and deeply saddened by the sudden passing of our friend and colleague, Randall Grace. Randall was an incredibly talented and hard-working teammate who contributed immensely to the success of the G&I team and Chilton as a whole. We will miss him greatly and wish his wife, his children, and all of his many other family members and friends all the best during this difficult time.

Randall always put Chilton’s clients first and had tremendous trust in his team and our investment process. We want to assure clients that though we are moving forward with heavy hearts, we will not lose focus on continuing to do the absolute best job investing that we can every day for you. If you have any questions, please do not hesitate to contact your wealth advisor or G&I team members directly. Thank you.

______________________________________________________________________________________________

The market continued its year-long ascent to new record highs in the first quarter, with the S&P 500 producing a 6.2% total return. Fueled by an aggressive global COVID-19 vaccine rollout that enabled further economic reopening and by fresh government stimulus, stocks made steady gains with only a few bouts of weakness during the period.

The top performing sectors in the first quarter were some of the biggest laggards in 2020, including Energy and Financials, as well as Industrials. A big 2020 sector winner, Information Technology, was a top three underperformer along with the Consumer Staples and Utilities sectors. There was a significant rotation out of recent multi-year-leading growth stocks into cyclical value stocks this quarter. Similarly, small and mid-cap stocks, which tend to have more cyclical characteristics, took over leadership from large cap stocks as investors became more comfortable adding risk.

What A Difference A Year Makes

It is hard to believe that a year has passed since the onset of the COVID-19 pandemic, which has caused millions of deaths and permanently harmed individuals, businesses, and entire economies around the world. March 23rd marked the one-year anniversary of the shocking 2020 market low, when, at the height of fear and uncertainty about the future, the S&P 500 closed at 2,237. Since that day the index has rallied an equally shocking 77%+ on the back of aggressive monetary and fiscal stimulus as well as the unprecedented development and distribution of effective and safe COVID-19 vaccines, which have allowed previously shut-down economies to reopen. Though the pandemic is not yet over, it appears that there is progress toward an eventual return to normalcy. Broad economic data as well as corporate earnings are rapidly improving as the second quarter begins.

Pockets of Speculative Fervor

Over the long run, we seek to exploit market inefficiencies with a consistent and disciplined process to generate outperformance. Late January gave us a prime example of how markets can be irrational and inefficient at times, despite academic teachings to the contrary.

In this instance, the stock of Gamestop, a mostly failing bricks-and-mortar video game retailer, caught the attention of millions of highly speculative retail traders on a Reddit page called Wall Street Bets. In an impressive show of force, individuals pushed the heavily-shorted stock higher, forcing a waterfall of short covering (forced buying of the stock) by large hedge funds including Melvin Capital. Despite no obvious fundamental justification, the stock ripped higher from near $19 at the end of 2020 to a peak of nearly $483 on January 28th. It has bounced around violently ever since, and currently trades around the $185 level.

Other “meme” stocks like AMC Entertainment Holdings and BlackBerry Limited similarly went viral and also blasted upward, causing large losses for many hedge funds. Concerns that short sellers would cover their losses by dumping more widely held stocks even pressured the overall market for a short period. Long-term investors are wise to ignore such short term, emotional, non-fundamental action since there is no reasonable basis for it, and deep losses are possible. There is evidence of some speculative fervor in parts of the market, but in the long run, fundamental attributes like actual earnings results drive stock prices.

Similarly, the prices of bitcoin and related cryptocurrencies, non-fungible tokens (NFTs), and even doge-coin, of which there is a limitless supply and which started as a joke, have moved sharply higher as investors seek non-traditional assets for various reasons. The block chain technology underpinning these vehicles has some redeeming long term qualities, but without associated cash flows, and with possible hacking and copying risk, these “assets” can be difficult to fundamentally value. Nonetheless, some large banks and investment funds are now allowing limited client access to cryptocurrencies.

More Stimulus And Higher Taxes

New President Joe Biden and his government have made their mark quickly in 2021, reversing numerous Trump policies, passing more stimulus, and promising significant infrastructure spending. Many have compared the current pandemic to a war that governments must win at any cost, resulting in massive debts that could cause problems in the long run.

In the short run, significant spending is boosting economic prospects and optimism, including the top line growth of corporate America. Such spending could ultimately lead to an overheated economy and inflation, forcing the Fed to raise interest rates to slow things down. A proposed increase in both corporate and individual taxes for the wealthy could crimp investment spending and profit growth. Offsetting this, however, still relatively low interest rates have prompted a wave of refinancing that is easing the financing cost for companies and individuals.

Domestic Equity Outlook

Though the cyclical value trade seemed to get ahead of itself at times in the first quarter, we generally believe that the current acceleration of global economies supports a continuation of the trend for the rest of the year. In equity portfolios, we have added a few fresh names that are directly tied to reopening and expect to carefully continue to do so as 2021 progresses, barring some unforeseen setback. Our active management process seeking fresh business improvement is pointing us towards such names.

Significant further market gains in the near-term seem unlikely though the positive earnings trajectory for corporate America continues to justify new market highs. Major risks to monitor are potential setbacks in the fight against COVID-19, inflation, and the impact of forthcoming higher tax rates on corporations and many individuals.

Fixed Income Outlook

The impact of rising interest rates has hurt most bond prices thus far in 2021, something fixed income investors have rarely had to deal with over the past 30+ years. The Bloomberg Barclays Aggregate Index, a mix of government and corporate bonds (mostly government), fell 3.4% in Q1 after rising 7.5% in 2020. 10-year Treasuries, which yielded just 0.93% at year-end, rose to 1.74% by quarter end. Fortunately, most of our corporate bond holdings carry shorter maturities, and have shown slightly positive total returns year-to-date (short-term bonds are less interest rate sensitive than their long-term counterparts).

The rise in interest rates has been primarily driven by growing optimism about US economic growth prospects and longer-term concerns about inflation. While the recent increase has seemed dramatic, it is important to note that today’s 10-year Treasury yield still remains historically low. In fact, it is still below the year-end 2019 level of 1.92%. Shorter-term Treasury yields remain extremely low, with yields of less than 0.20% for maturities of 2 years or less.

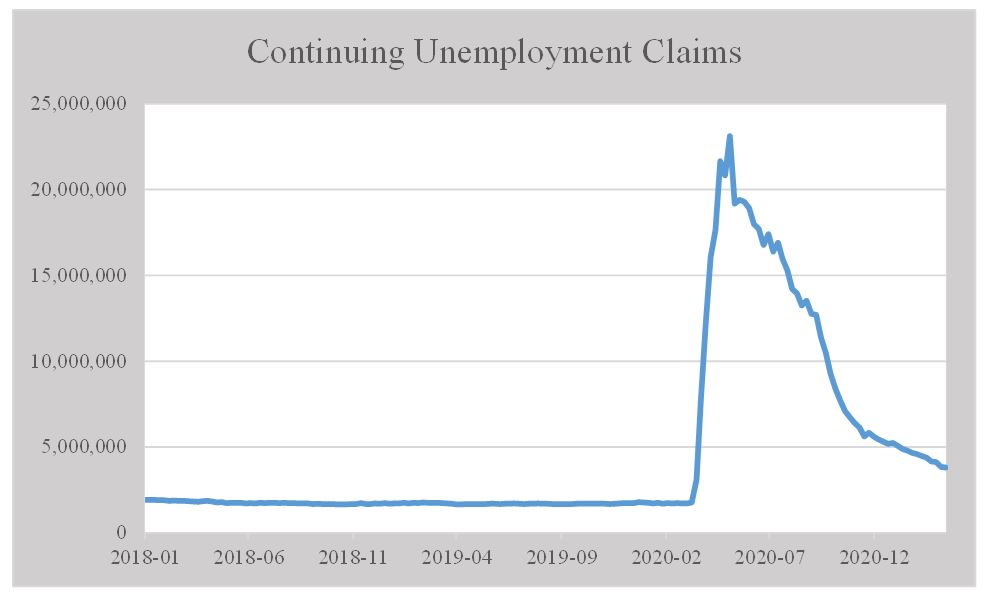

The Federal Reserve continues to suggest that short-term interest rates are likely to remain near zero through 2023. While major progress has been made in getting the US economy back to pre-pandemic levels, many areas of the economy still have a long way to go, especially the labor market. As a result, the Fed wants to keep short-term rates low to continue stimulating the economy with lower borrowing costs for individuals and businesses. In fact, we’ve had a number of corporate bonds called away early as companies aggressively refinance older, higher interest debt with new bonds at lower rates. The Fed has consistently indicated that it will keep rates low until unemployment reaches pre-pandemic levels and core inflation moderately exceeds 2% for some time.

Despite a small pullback in bond prices, we generally remain on the sidelines when it comes to purchasing new corporate bonds. Especially in the case of shorter-term corporate bonds, prices remain elevated (and thus, yields remain exceptionally low). The vast majority of investment-grade bonds with a maturity of 3 years or less currently yield less than 0.50%. Our plan is to use any significant volatility-related price dislocations to deploy excess cash from client fixed income allocations.

The majority of our fixed income portfolios remain comprised of short dated investment-grade corporate bonds that we intend to hold until maturity. While the total return potential is limited for most investment-grade bonds today, fixed income continues to play an important role in the asset allocation process by providing both income and relative stability within a diversified portfolio.

Global Markets Outlook

Global equity markets resumed their rally in Q1 as world economies continued to recover amidst the broad-based rollout of COVID-19 vaccines. US small cap stocks led the way with a 12.7% return, followed by US large cap stocks increasing 6.2%. Emerging markets and international developed markets had outperformed for the majority of the quarter, until a resurgence of COVID-19 case counts and further lockdowns across certain countries led to the realization that the vaccine rollout was not going smoothly in many parts of the world. International developed markets finished the quarter with a 3.6% return while emerging markets increased by 2.2%.

Global central banks remain highly accommodative, keeping interest rates low to help facilitate further economic recovery. It is our view that central banks will continue this dovishness for a number of years, given the uneven recovery seen throughout the world. This is one of the reasons we continue to favor equities over fixed income. Lower interest rates are supportive of higher levels of equity valuation, while global fixed income yields remain at generational lows (and in some cases, are in negative territory).

The Case for International Diversification

There is no question that US equities have substantially and consistently outperformed their international counterparts in recent years. In addition, correlations between the two have increased, meaning that stock market declines felt in the United States are also felt in similar magnitude in international markets. However, this international underperformance and high correlation may not always be the case moving forward. Like most asset classes, the relative performance of US and non-US indices tends to move in cycles.

The outperformance of US equities can be traced to a number of factors, but two in particular stand out: 1) realized and projected earnings growth, and 2) the relatively high technology-related composition of the US indices. These factors are related. Helped in part by the extraordinary growth of a select number of extremely large US technology-oriented companies (such as Facebook, Amazon, Apple, Netflix, and Google/Alphabet – the “FAANGs”) in recent years, US markets have seen rapid earnings growth, which has led to significant valuation expansion. While further solid earnings growth is likely over the next several years in the US, a material increase in valuation metrics is less of a certainty.

On the other hand, international and emerging markets tend to have a higher concentrations of cyclical and value stocks, which could benefit disproportionately as global economies continue to recover. In the event that mega-capitalization FAANG stocks underperform for a sustained period of time, there is a decent chance that US markets could underperform. It should also be noted that non-US markets trade at lower multiples, and carry higher dividend yields, than US markets. While there is no guarantee international markets will outperform in the near term, the case for diversification within a larger portfolio could make sense.

REIT Commentary

In Q1, the MSCI US REIT Index (Bloomberg: RMZ) produced a total return of +8.8%. While the continued rebound in REIT performance has been overdue, the rotation from the “COVID” REITs (i.e. cell towers, data centers, industrial) to the “Vaccine” REITs (i.e., regional malls, shopping centers, coastal apartments, lodging, coastal office) after the November 9th Pfizer announcement has been nothing short of extraordinary. While the increase in price over the past five months for some Vaccine REITs pricing in a “return to normal” made sense, others have soared past pre-COVID valuations, while still others have been left behind. Improbably, some COVID REITs with attractive long term growth are now below pre-COVID values despite a positive change to long term fundamentals.

For an active manager like us, bifurcation of performance between REITs is the “straw that stirs the drink,” as it creates temporary buying opportunities for REITs we do not already own. However, when it occurs for REITs that are already in the portfolio, our short term performance can lag the benchmark if we are overweight. Therein lies a challenge of portfolio managers across all industries.

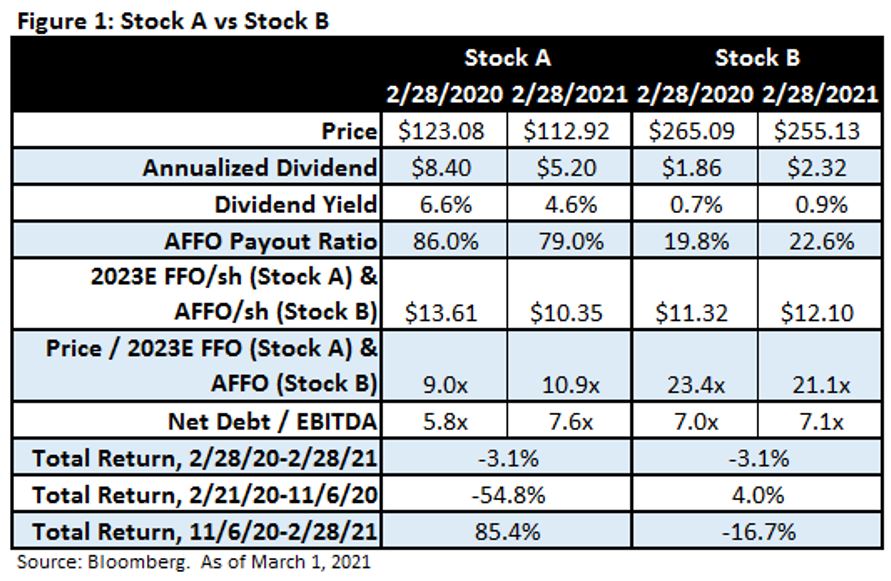

Let’s look at a few examples. Stock A and Stock B represent two different investments. In Figure 1 below, one can see the earnings estimate from a year ago for 2023 and the current estimate for 2023, as well as the prices, multiples, dividend yields, and payout ratios. After looking at the two, which would you buy? Are you surprised by the historical performance?

From February 28th, 2020 to February 28th, 2021, Stock A and Stock B produced the same total return of -3.1%, though they took very different paths. Stock A is Simon Property Group (NYSE: SPG), and Stock B is SBA Communications (NYSE: SBAC). SPG is a mall REIT, which has seen occupancy and tenant sales fall significantly due to COVID, while e-commerce has taken significant market share. SBAC is a cell tower REIT, which has a clear path for earnings growth due to the increased importance of mobile data and the 5G upgrade cycle to come.

While SPG was down 54.8% from February 21st, 2020 to November 6th, 2020, SBAC was up 4.0% over the same period. The change in earnings estimates justified at least some of the move upward in SBAC. In contrast, the move downward for SPG may have been overdone, but has the long term trajectory for malls improved in the past year? In response to the vaccine announcement, SPG has generated a total return of +85.4% from November 6th, 2020 to February 28th, 2021, while SBAC produced a total return of -16.7% over the same period.

While the gap closed somewhat in March, investors still have the ability to purchase high quality growing REITs at “discounted” valuations, thus creating an extremely attractive risk-reward scenario. Note that SBAC has a lower payout ratio and lower leverage than SPG, as measured by net debt/EBITDA (or earnings before interest, taxes, depreciation, and amortization). Furthermore, we would argue that its earnings stream is of higher quality as well, given the strength of its underlying tenants (Verizon, AT&T, T-Mobile, and Dish Network) in comparison to SPG (brick and mortar retailers).

The biggest opportunities we see today are in cell towers, single family rental homes, self-storage, manufactured homes, industrial, and data centers. We see some opportunities in Vaccine REITs such as healthcare, student housing, high quality retail/mixed use, and Sunbelt office and apartments. We believe our current mix of COVID and Vaccine REITs has an optimal potential risk-adjusted return.

Bradley J. Eixmann, CFA, beixmann@chiltoncapital.com, (713) 243-3215

Brandon J. Frank, bfrank@chiltoncapital.com, (713) 243-3271

Matthew R. Werner, CFA, mwerner@chiltoncapital.com, (713) 243-3234