Property Type Round-Up from REITWorld 2025 | February 2026

This past December, we attended the annual REITWorld conference in Dallas, where we conducted 34 meetings with REIT CEOs and CFOs. We also participated in three organized dinners and five property tours, maximizing time spent with REIT executives during our visit.

–

Three key themes stood out: 1) a clear supply deceleration across several property types, expected to flow through to stronger fundamentals over the next 12-18 months; 2) continued discipline in capital allocation, reflected in selective acquisitions, higher development hurdles, balance sheet flexibility, and share buybacks when discounts become too wide to ignore; and 3) a persistent valuation disconnect that could generate incremental M&A in 2026. Already, several REITs are either subject to activists or have initiated the process of seeking strategic alternatives.

–

With this marking the Chilton REIT team’s 32nd consecutive appearance at the semi-annual NAREIT conference, we continue to find value in the depth of conversations with both management teams and industry peers. Once again, we walked away with several actionable ideas, which we present below alongside key takeaways from our meetings and general property-type updates that are driving our investment theses.

–

Multifamily

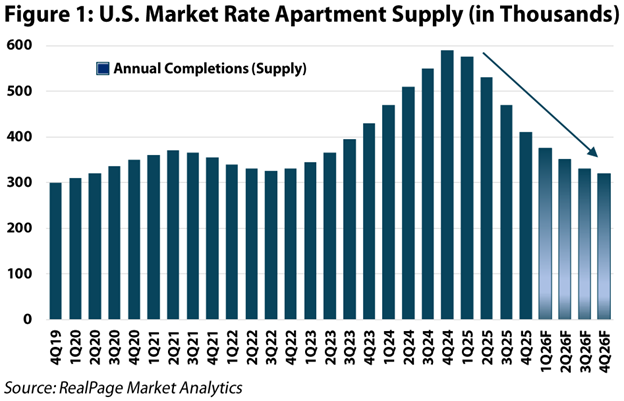

Our team met with AvalonBay Communities (NYSE: AVB), Independence Realty Trust (NYSE: IRT), UDR Inc. (NYSE: UDR), and attended a well-organized property tour with Mid-America Apartments (NYSE: MAA). Across these discussions, our view that 2026 is likely to remain a transition year was reinforced. With supply pressure fading (Figure 1), affordability favoring renting, and year-over-year comparisons easing, the slope of the rental recovery story continues to slowly improve.

–

–

Across these four meetings, three topics consistently dominated the conversation: capital allocation discipline, internal initiatives, and renter demand. Given apartment REITs’ relatively high cost of equity capital in relation to available yields, acquisitions have become less frequent, and REITs have smartly increased development hurdle rates to contend with higher blended capital costs. Additionally, share buybacks are an increasingly attractive use for free cash flow or proceeds from dispositions. For example, AVB and Camden Property Trust (NYSE: CPT) announced $488 million and $50 million of share repurchases in 2025, respectively, at an implied ~6% cap rate, reinforcing their reputations as prudent capital allocators versus acquiring assets at roughly ~5% cap rates.

–

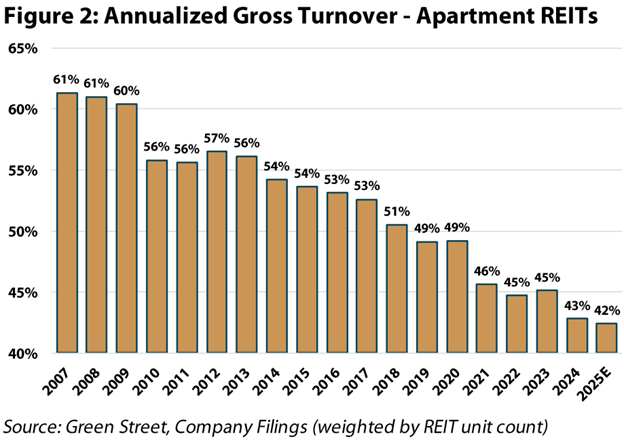

On internal initiatives, management teams emphasized centralized staffing models to drive efficiencies, value-add resident services to generate incremental income, and accelerating use of AI to automate key tasks. As for renter demand, the elevated cost to own has pushed apartment turnover near all-time lows (Figure 2), keeping occupancy high (~96%) and leading way to concessions, or apartments offering one to two months of free rent, finally tapering off.

–

–

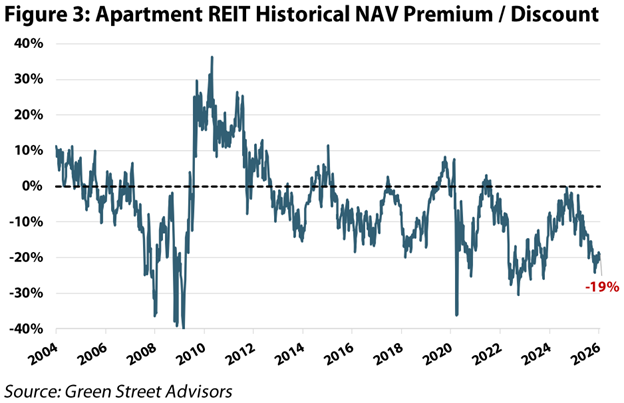

Overall, we remain equal-weight to the multifamily sector, balancing near-term supply headwinds and a slowdown in household formations against a steep valuation discount, with apartment REITs currently trading at a ~19% discount to net asset value (NAV) on a weighted basis (Figure 3). Whether the inflection point arrives in late 2026 or early 2027, the risk of missing the turn continues to be top of mind as fundamentals trend towards stabilization and eventual outperformance.

–

–

Single Family Rentals

We met with Invitation Homes (NYSE: INVH) and American Homes 4 Rent (NYSE: AMH), the second- and third-largest owners of single-family rentals (SFRs) in the U.S., with over ~145,000 homes combined. While the long-term demand backdrop remains intact, the SFR sector has experienced pressure on rental growth from significant new supply in the form of ‘build-to-rent’ (BTR) communities. Not helping are the headlines from President Trump’s Truth Social post and subsequent Executive Order aimed at limiting large institutional investors from purchasing single-family homes. Although the practical impact on INVH and AMH is still uncertain, the announcement has introduced a clear overhang on the group that is likely to stick through the election cycle. We believe the impact to earnings will be muted as acquisitions have not been a driver for growth since 2022. In fact, the Executive Order could potentially minimize competition from smaller platforms that need to acquire to gain scale.

–

With all of this in mind, on January 16, 2026, INVH announced its acquisition of ResiBuilt, a BTR developer in the Southeast for $89 million. This transaction enhances INVH’s development capabilities and reinforces the narrative that institutional SFR platforms that are building rather than buying homes are helping create housing supply rather than compete for existing homes. This dynamic is already evident at peer AMH. Excluding a portfolio acquisition in October 2024, AMH has acquired just 158 homes since the end of 2022, while simultaneously developing and delivering more than 5,300 homes over the same period.

–

Our overweight to single-family rental REITs relative to an equal-weight in multifamily is driven by expected higher rental growth rates, more predictable fundamentals including likely exemption from any political interference, and near-record discounted valuations, with AMH and INVH trading at ~30% discounts to their private market values.

–

Manufactured Housing / RVs

We met with Sun Communities (NYSE: SUI) and Equity Lifestyle Properties (NYSE: ELS). The core manufactured housing (MH) segment, representing ~60% of rental revenue for each REIT, continues to benefit from structural affordability tailwinds, high retention and occupancy levels, and de minimis new supply, supporting steady and durable internal growth.

–

By contrast, the RV segment that accounts for ~30% of revenues remains more mixed. ELS acknowledged that Canadian “snowbird” demand is down ~40% year-over-year, continuing to pressure transient RV results, while the annual RV segment offers a brighter outlook through improved retention and mid-single digit revenue growth potential. Both companies also emphasized a continued push to convert sites to annual usage, with SUI highlighting the completion of ~9,800 site conversions since 2020, expanding its annual site count by ~24%. These conversions are attractive as they shift revenue toward a more recurring cash flow stream with higher retention, lower volatility, and reduced operating complexity. Given MH’s position as the most durable residential sub-sector, we remain confident in our slight overweight allocation at this time.

–

Triple Net

We met with Realty Income (NYSE: O), Getty Realty (NYSE: GTY), NNN REIT (NYSE: NNN), Broadstone Net Lease (NYSE: BNL), and FrontView REIT (NYSE: FVR). As discussed in our November 2025 REIT Outlook, triple net (or net lease) REITs own properties that are leased under contracts where the tenant pays the property taxes, insurance, and maintenance capital expenditures (the three ‘nets’). These five REITs range from a market cap of over $55 billion for O to less than $400 million for FVR yet share many similarities such as high occupancy rates, strong rent coverage ratios, and high average lease terms making for predictable growth in earnings and dividends.

–

Tenant health and occupancy were consistently described as stable, with the primary debate centered on capital allocation and the math around external growth. While acquisition cap rates have stabilized following earlier-cycle volatility, most management teams remain constrained, or more accurately disciplined, by their cost of equity. That said, both GTY and NNN leaned into record acquisition activity in 2025, reflecting a willingness to stay active today in hopes that a lower cost of equity emerges.

–

FVR, a recent addition to our REIT composite, trades at a wide discount to its NAV, despite a top-tier management team and high-quality portfolio with sector-leading disclosures. In 2025, FVR experienced a sharp drawdown to ~$11 per share following its IPO in October 2024 at $19 per share driven by elevated bad debt and early operational noise, which weighed heavy on investor sentiment. Since mid-year however, management has materially de-risked that narrative by resolving the troubled assets, improving occupancy to ~98%, strengthening the executive team, enhancing investor outreach, creating unique financing solutions, and maintaining disciplined capital allocation with a clear focus on returning the share price, now at ~$16 per share, back toward the IPO price of $19. Our meeting with management reinforced our conviction in this deeply discounted triple net REIT.

–

Self-Storage

We met with Extra Space Storage (NYSE: EXR), Public Storage (NYSE: PSA), and SmartStop Self Storage (NYSE: SMA). Management teams were the most constructive we have seen in nearly three years. Fundamentals appear to be stabilizing, supply pressures are easing (consistent with trends across several other sectors), and move-in rents are beginning to improve sequentially, signaling the worst of the slowdown is in the rearview and momentum is finally turning more favorable. Operators are also increasingly deploying AI and data-driven tools to enhance decision-making across pricing, labor scheduling, and marketing to name a few. Notably, self-storage is one of the few REIT sectors where AI can directly support revenue growth through more dynamic pricing and customer acquisition, rather than other sectors limited to incremental cost savings.

–

One of our favorite meetings was with the newest storage REIT, SmartStop. Despite its smaller scale (187 properties versus PSA’s ~3,500), SMA expects to grow earnings at a double-digit rate in 2026, roughly six times that of peers in the 1-2% range. The recent acquisition of Argus (the sixth largest self-storage manager in the U.S.), provides opportunities for NOI margin expansion and new fee-generating management business. Other sources of growth come from its managed REIT platform and favorable refinancing capabilities giving SMA’s disciplined management team multiple levers to drive growth. We maintain a strategic overweight position in SMA following our participation in the REIT’s IPO early last year.

–

Data Centers

We met with Andy Power, CEO of Digital Realty Trust (NYSE: DLR). Despite the record leasing going on around the globe, DLR is not tempted to build hyperscale campuses in rural tertiary markets. The company is targeting measured growth in primary and secondary markets, shooting for ‘7 for 7’, meaning 7% FFO/sh growth for 7 years. While this may be less than what could be achieved by increasing speculative development, we agree with the steady growth strategy, which will maintain low leverage and minimize development risk. DLR also stated that the booking window has increased from 6-12 months to 18-24 months due to the mismatch between demand and supply. We believe that the lack of supply and continued demand will push rents for the foreseeable future for data centers space. DLR is in the best shape it has ever been in the history of the company, and has a clearly stated disciplined capital allocation strategy that is underappreciated in the market, in our opinion.

–

Shopping Centers

As we commented in September with the Chilton REIT Outlook, Shopping Center fundamentals continue to impress and, in our view, are underappreciated in the public markets. We heard a similar story during our tours and meetings with InvenTrust Properties (NYSE: IVT), Brixmor (NYSE: BRX), Federal Realty (NYSE: FRT), Regency Properties (NYSE: REG), Curbline Properties (NYSE: CURB), and Whitestone Realty (NYSE: WSR). Despite lamenting depressed equity prices, most management teams still see avenues for accretive external growth and various strategies to close discounts to private valuations. Punctuating this theme, Blackstone (NYSE: BX) announced all-cash takeout of Hawaii retail focused REIT Alexander and Baldwin (NSYE: ALEX) for a 40% premium during the conference (vs December 8th closing price).

–

This backdrop has been building for several years (minimal supply, ramping demand, etc.), however, short term disruptions (e.g. Bed Bath) impacted stock last year (-3.9% vs the index +3.0%). In our view, 2026 differs due to three reasons: 1) below normal tenant disruption and a small tenant watch list, 2) attractive starting valuation and, most importantly, 3) increasing private capital interest. As it is one of our favorite sectors, we have increased exposure to 9.9% versus 5.5% in the index (as of January 31st, 2026).

–

Healthcare

Healthcare was a notable bright spot in 2025, specifically the Seniors Housing (SH) subsector we wrote about in December, and based on conversations with management teams across the group we expect strength to continue into 2026. Specifically, within SH we met with Ventas (NYSE: VTR) and American Healthcare (NYSE: AHR) while we also had meetings with Omega Healthcare (NYSE: OHI) and Healthcare Realty (NYSE: HR), plus a virtual meeting with Sabra Healthcare (NASDAQ: SBRA) before the conference.

–

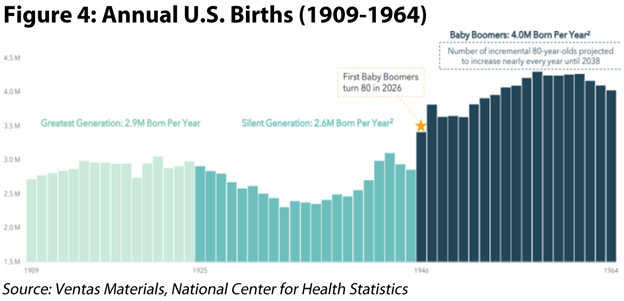

SH meeting attendance and interest was elevated, and, although queries prodded for potential cracks after such a strong year, organic growth remains robust as aging baby boomers drive record demand (Figure 4). For acquisitions, competition from private competitors has increased, but we are also seeing more assets coming to market (thanks to more stable interest rates) and the REITs’ first mover advantage continues to pay dividends. Despite 2025’s record setting year, we believe 2026’s transaction volume could increase further (the REITs should remain outsized beneficiaries).

–

–

Outside of SH, voracious private appetites for Medical Outpatient Buildings (MOB) impressed and we had a constructive first meeting with HR’s new CEO Peter Scott. Aside from an update to the successful non-core disposition program, we were encouraged to hear the broader strategic review includes leaning further into high return redevelopment projects. We continue to believe the market is underappreciating the robust and predictable growth profile in MOBs. WE view HR as a value play that balances with the high growth SH exposure within Healthcare.

–

Industrial

Our Industrial slate was light due to several REITs choosing not to attend due to the odd timing of the conference so close to the Holidays. We did have the opportunity to visit with First Industrial (NYSE: FR). Separately, Prologis (NYSE: PLD) was the first REIT to report 4Q earnings (on January 21st) and most of the group provided year end business updates in early January. Results are arriving better than expected as vacancy found a bottom in 3Q 2025 (at 7.6% according to JLL) and investors are warming to the growth outlook amid the prospect of seeing rent growth return. PLD even spoke to improvements in Southern California (still declining but looking to bottom in 2026), which supports our exposure to Rexford (NYSE; REXR). With that said, the re-emergence of tariff fears has acted as a governor to Industrial performance in 2026. Our current industrial exposure of 14.1% is in line with the index at 14.6%, but we have boosted positions during the current relative weakness.

–

Cold Storage

Our team covered this sector in entirety with Lineage’s (NYSE: LINE) investor event kicking off the conference followed by a small group meeting with Americold’s (NYSE: COLD) new CEO Robert Chambers. Operational pressures are still present – food volume is shaky given inflation’s impact on lower-end consumers and newly delivered competing supply is taking longer to work through than hoped. However, labor is a rare bright spot, and we are optimistic that a more ‘normal’ year in 2026 for seasonality can allow the REITs to operate with more certainty.

–

However, the fundamental situation was overshadowed by reports from activist Ancora pushing COLD to divest from non-core regions, which was announced during the conference. While COLD pushed back on some specifics (e.g., what regions make the most sense to prune), the new management team agreed with the need for action and indicated its intention to move decisively. In response, COLD added new board members and entered into a cooperation agreement with Ancora late in December. Additionally, further Bloomberg reports suggested a surprising level of private equity interest in Cold Storage, and we are hopeful strategic changes can deliver quickly.

–

We maintain 1.7% exposure to COLD as we believe the long-term necessity of this business and the potential for near term strategic prioritization are under appreciated by record low valuations (COLD’s implied cap rate according to Green Street was 9.4% as of January 31st, 2026, while we believe non-core divestitures could be in the 7-8% range).

–

Office

We met with management teams from Boston Properties (NYSE: BXP), Highwoods Properties (NYSE: HIW), Cousins Properties (NYSE: CUZ), and Piedmont Realty (NYSE: PDM), and toured Dallas assets of HIW, CUZ, and PDM. Office REITs have been lackluster performers for the past several years due to the aftermath of COVID and the reluctance of workers to return to the Office. However, as we reported last year, the extremely bifurcated nature of today’s office market is driving some impressive conditions in newest buildings located in the best submarkets. HIW highlighted Dallas’ Uptown submarket on a property tour, where its recently delivered 23Spring development is meaningfully exceeding underwriting (reports of triple digit gross rent levels would have been unfathomable for Dallas until very recently). Throughout the conference we heard similar examples of minimal vacancy causing pockets of increasing market rents. Notably, BXP spoke to the continued strength in Midtown Manhattan, and CUZ spoke to the tightest areas of Atlanta. Overall, we emerged more convinced that the best positioned Office REITs are still underappreciated.

–

We believe the rental growth story in Office is just getting started, and our confidence is underpinned by the current cost of land/construction and the rental rates needed to justify new development (in many cases still 20-30% above market rates). This emerging outlook allowed us to start discussing Office REITs shifting to offense mode, and we came away encouraged by the opportunity for accretive acquisitions this year and beyond. Ground up development is more challenging to pencil, but BXP’s 343 Madison project continues to impress (30% anchor tenant fully secured following the conference) and we wouldn’t be surprised to see more emerge in 2026.

–

Conclusion

The overarching message for REITs medium term outlook is one of decelerating supply driving robust growth against a valuation backdrop discounted to both historical average and the current private market. As a complement, years of capital discipline position REITs with near record low leverage levels and many property types benefit from accretive growth opportunities. Across meetings, the common thread was management teams positioning for offense when the math works – select development, targeted M&A, pruning non-core assets, or leaning into buybacks – setting up a year where patient capital and sector selectivity can drive outperformance. Heading into 2026, we’re increasingly constructive, with our preference skewing to property types with the most durable growth outlooks (Healthcare and Data Centers) as well as certain underappreciated property types (Shopping Centers, parts of Residential). Additionally, given wide divergence amongst REITs, our portfolio is positioned in several deeply discounted names that we believe can benefit from strategic alternatives (CSR, WSR, COLD, REXR). We see multiple ways for REITs to win and, as we commented in our January 2026 REIT Outlook, we are encouraged by above average growth driving flows to a deeply discounted group as others are setting new all-time highs.

–

Isaac A. Shrand, CFA

ishrand@chiltoncapital.com

(713) 243-3219

Thomas P. Murphy, CFA

tmurphy@chiltoncapital.com

(713) 243-3211

Matthew R. Werner, CFA

mwerner@chiltoncapital.com

(713) 243- 3234

Bruce G. Garrison, CFA

bgarrison@chiltoncapital.com

(713) 243-3233

–

RMS: 3,147 (1.31.2026) vs. 3,054 (12.31.2025) vs. 3,177 (12.31.2021) vs. 1,433 (3.23.2020)

–

An investment cannot be made directly in an index. The funds consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use.)

The information contained herein should be considered to be current only as of the date indicated, and we do not undertake any obligation to update the information contained herein in light of later circumstances or events. This publication may contain forward-looking statements and projections that are based on the current beliefs and assumptions of Chilton Capital Management and on information currently available that we believe to be reasonable, however, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. This communication is provided for informational purposes only and does not constitute an offer or a solicitation to buy, hold, or sell an interest in any Chilton investment or any other security. Past performance does not guarantee future results.

Information contained herein is derived from and based upon data licensed from one or more unaffiliated third parties, such as Bloomberg L.P. The data contained herein is not guaranteed as to its accuracy or completeness and no warranties are made with respect to results obtained from its use. While every effort is made to provide reports free from errors, they are derived from data received from one or more third parties and, as a result, complete accuracy cannot be guaranteed.

Index and ETF performances [MSCI and VNQ and FNER and LBUSTRUU] are presented as a benchmark for reference only and does not imply any portfolio will achieve similar returns, volatility or any characteristics similar to any actual portfolio. The composition of a benchmark index may not reflect the manner in which any is constructed in relation to expected or achieved returns, investment holdings, sectors, correlations, concentrations or tracking error targets, all of which are subject to change over time.