Portfolio Insight | 4th Quarter 2025

Following returns of over 25% in 2023 and 2024, the S&P 500 delivered another robust gain in 2025, rising 17.9%. This gain was quite remarkable considering the “tariff tantrum” in April that nearly led to a bear market, as well as fourth quarter concerns over Federal Reserve policy, the longest government shutdown in history, and worries over prospective bubbles in private credit and AI. However, the market overcame these concerns with strong earnings growth, two interest rate cuts, sustained consumer spending, and a positive 2026 economic outlook.

For the third year in a row, mega-cap growth stocks led the market. Their continued superior earnings growth defied the familiar concerns of historic market concentration and valuation. Sector leadership remained narrow with only three out of eleven sectors – Communication Services, Information Technology, and Industrials – outperforming the index in 2025. The biggest laggards were Real Estate, Consumer Staples, and Consumer Discretionary.

Market breadth improved somewhat in 4Q due to sector rotation, Fed rate cuts, and concerns regarding the AI trade. The strongest sectors in the quarter were Health Care, Communication Services, and Financials, while Real Estate, Utilities, and Consumer Staples trailed the most.

Macroeconomic & Government Concerns

During the fourth quarter, investors faced several concerns that led to significantly higher volatility than in the summer. Concerns over inflation, the job market, and Federal Reserve policies persisted. However, other issues popped up including a prolonged government shutdown.

The federal government shutdown that began on October 1st amid a dispute over spending, particularly the extension of Affordable Care Act premium subsidies, would eventually last 43 days and become the longest on record. The shutdown likely softened consumer spending but it didn’t derail the economy’s solid pre-shutdown momentum, and the recent 3Q GDP growth print of 4.3% was the best in two years. The absence of government economic data releases did, however, allow financial media to fill airtime with seemingly nonstop, sensational coverage of other concerns.

Private Credit Worries

One buzzworthy topic in 4Q was the health of the booming private credit market, including the defaults of auto-lender Tricolor and auto parts supplier First Brands, which owed money to both private credit lenders as well as big banks. These defaults appear to have been isolated instances of fraud rather than indicators of a systemic problem, and concerns have since faded a bit as economic fundamentals appear to remain healthy.

More AI Anxiety

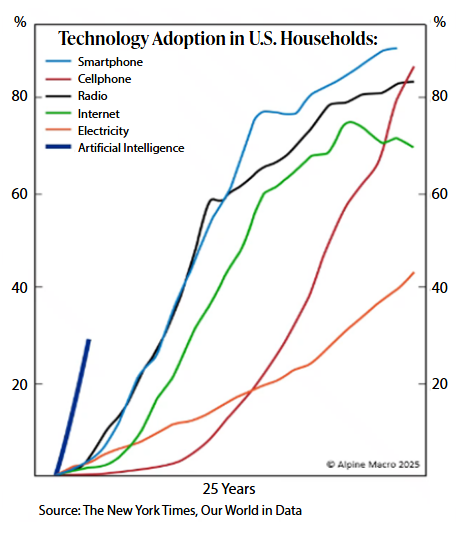

A more persistent worry was the durability of the AI trade, as big players announced huge capex plans through at least the end of the decade, and investors voiced concerns about debt financing and circular deals. Our conclusion, based on the statements of major companies and industry thought leaders rather than pundits and investors with an agenda, continues to be that concerns over an imminent AI bubble bursting are premature. The aggressive AI buildout is necessitated by the fact that households are adopting AI far more rapidly than any prior major technology (see chart on next page). Companies continue to report strong earnings growth and see growing evidence of material returns on investments in data centers and related infrastructure.

The strongest players are healthy enough to fund investment in power generation, chips, servers, and networking equipment, etc., and would only be doing so if they anticipated healthy returns. There will be winners and losers, but the demand is real, the cycle is young, and major “picks and shovels” providers are likely to see many years of significant earnings growth and correspondingly strong stock price performance.

Domestic Equity Outlook

Stocks closed 2025 near all-time highs, and optimism abounds. But as the labor market weakens and leading indicators show softening inflation ahead, a key question for 2026 is whether the Fed will be sufficiently aggressive with rate cuts, which would support struggling areas like housing and bring relief to consumers.

Despite 2025 being the third year in a row of strong gains, the market appears poised for another move higher in 2026. The economy is growing strongly, supported by the massive capex buildout for AI, strong consumer spending, and an easing Federal Reserve. Earnings momentum is solid, and further economic tailwinds from deregulation and tax refunds await. Our baseline projection of 7-9% gains in 2026 assumes modest valuation contraction and accelerating earnings growth.

Fixed Income Outlook

The Bloomberg US Aggregate Bond Index, a mix of government and corporate bonds, edged 1.1% higher in the fourth quarter, bringing its total gain in a year of steady growth to 7.3%. The decline in interest rates across the yield curve was a tailwind, with 10-year Treasury yields falling from 4.58% at the beginning of the year to 4.18% by year-end, and yields for 2-year Treasuries, which are more influenced by Federal Reserve policy, dropping from 4.25% to 3.47%. The Fed continued its rate cutting program by reducing short-term rates 0.25% in both October and December, bringing the Federal Funds rate down to 3.50% – 3.75%. Since 3Q24, the Federal Reserve has reduced short-term interest rates by 1.75%, and consensus market expectations call for 2 additional cuts in 2026.

Future Fed policy decisions are far from certain and subject to intense debate, including among those on the voting committee. On one hand, some question the need for cuts when the recent 3Q GDP print of 4.3%, along with solid retail sales and industrial production data, suggest that the aggregate economy is robust. On the other hand, current employment statistics paint a far less rosy picture. The unemployment rate, while not near levels seen during the COVID-era, has steadily risen to a multi-year high of 4.6%. Other areas of the economy, such as housing, remain in recession territory due to elevated interest rates. In addition, the overall rate of inflation continues to tick down toward the Fed’s 2% target. The picture is further complicated by the high likelihood that Fed Chairman Jerome Powell will be replaced in May. President Trump, who is expected to name a new Fed Chairman in the coming weeks, has been a vocal advocate for rate cuts. Kevin Hassett, the director of the National Economic Council and current favorite to land the role, has been consistent in his support for lower interest rates, but some investors view his close relationship with President Trump as a risk to the Fed’s future independence.

Even though interest rates have moved lower, we still believe that bonds remain an attractive asset class for those clients looking for income and portfolio stability. The majority of bonds we are buying today, with maturities of 1-6 years, currently yield between 3.75% and 4.25%. As always, bonds purchased for most client accounts are investment-grade quality and are bought with the intention of being held until maturity.

Global Markets Outlook

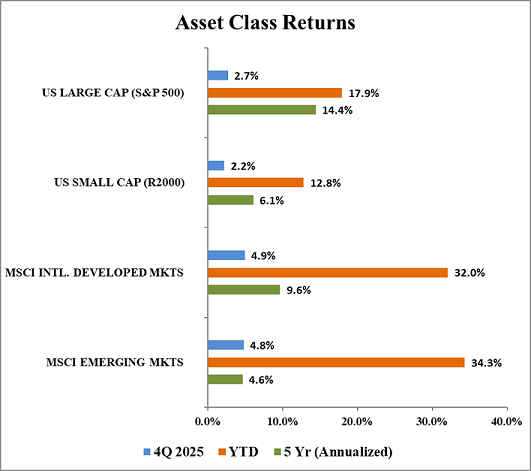

Global equity markets closed a strong 2025 with a solid fourth quarter. For the year, international developed markets returned 32.0% and emerging markets advanced 34.3%, while US large caps gained 17.9% and US small caps rose 12.8%. A weaker US dollar accounted for most of the non-US return advantage, and the dispersion was much less pronounced on a currency-adjusted basis.

Source: Bloomberg, Chilton Capital Management

The US Dollar Index (DXY) fell 9.4% in 2025 as interest rate differentials narrowed and investors reassessed the relative attractiveness of dollar assets. Trade-policy uncertainty, fiscal and debt headlines, and improving international sentiment also contributed to the dollar’s decline. Looking ahead, the dollar is less likely to have such an impact in 2026. Differentials are narrower than a year ago, and tariffs are no longer a shock factor. In fact, several non-US countries are either considering or already implementing anti-dumping penalties and tariffs on China. The EU and China are currently in an escalating trade war, and Mexico plans to significantly increase tariffs on China and other Asian countries in 2026. Finally, while US debt concerns were a hot topic in 2025, yields on longer-dated non-US debt have remained stubbornly high, largely due to fiscal expansion.

2025 was a solid year for international developed markets as increased defense spending and supportive monetary and fiscal policies offset lower tech exposure in Europe. European banks also re-rated on strong earnings and higher shareholder returns, while in Japan, strong performance was supported by improving corporate governance, abating deflation, a boost to corporate earnings from AI, and increased exports due to a weaker yen. Emerging markets topped the charts in 2025, led by South Korea, China, and Taiwan, all of which have significant exposure to AI. Latin America had robust returns as financials benefited and several commodities rose substantially, helped by a weaker dollar. Valuations also re-rated after years of underwhelming performance.

It could be difficult for international and emerging markets to outperform so significantly in 2026, after 2025’s re-rating and dollar weakness. Returns may prove more earnings-driven, with continued attention on how AI capex translates to durable productivity and earnings growth. Trade policy and geopolitical tensions in the Middle East, Ukraine/Russia, and Taiwan/China are the known risks, with additional macro, policy, and market-specific risks likely to emerge. In this environment, maintaining diversification across global markets remains a prudent way to manage uncertainty.

REIT Commentary

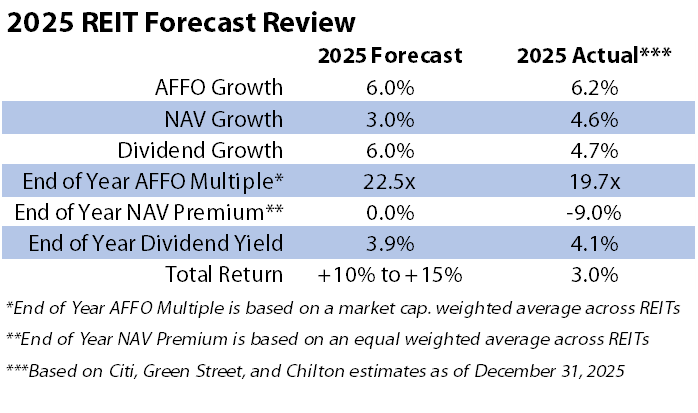

In the fourth quarter of 2025, the MSCI US REIT Index (RMZ) produced a total return of -1.7%, which brought calendar year 2025 total return to +3.0%. This compares to our original forecast of +10-15% for the year. While such short-term forecasts can be a fool’s errand, the fundamentals upon which the forecast was predicated were essentially correct, as shown below. Furthermore, we had projected the 10-year Treasury yield to remain flat at 4.58%, which compares to the actual year end yield of 4.18% as of December 31, 2025. Had we known that the yield would decline, we would’ve been even more bullish in our forecast. As such, the decline in AFFO multiple and increase in REIT dividend yield are head scratchers.

Across the REIT universe, dispersion within property types was remarkably wide in 2025. Healthcare (+36%), industrial (+18%), and regional malls (+11%) outperformed, driven by structural tailwinds and resilient fundamentals. Meanwhile, office (-22%), data centers (-14%), and self-storage (-10%) struggled amid weaker demand signals, higher sensitivity to growth narratives, and a difficult macro environment.

2026 Forecast

Given elevated earnings growth (~6% vs the long-term average of 3-4%) and a depressed AFFO multiple (19.7x vs. the long-term average 1-2 turns higher), our analysis suggests a total return of 10% as our base case including the 4% dividend yield. But, more importantly, we believe there is a strong case for multiple expansion in the coming years as income investors eventually rotate back to this asset class due to the accelerating economy, the contraction in new supply, and the expectation of above average rent growth due in part to higher replacement costs for virtually all property types.

2026-2028 Forecast

Based on our 2026-2028 projections, we see an AFFO CAGR of 6%, which in our view justifies a return to the historical AFFO multiple of 21.5x. Assuming a starting dividend yield of 4% and dividend growth in line with AFFO growth, this scenario produces an annualized total return of 14%. Adjusting for different ending AFFO multiples, we believe a reasonable range for the next 3 years would be an annualized total return between ~13-15%.

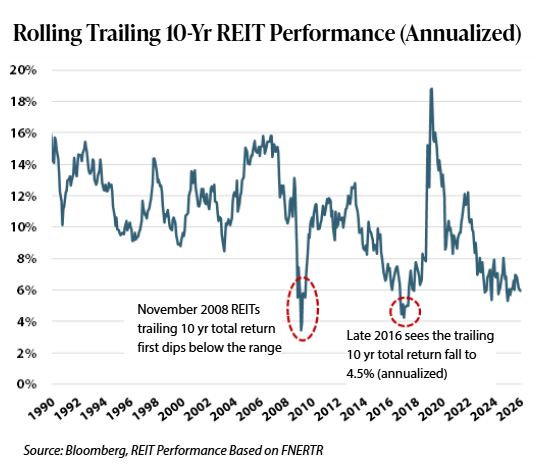

We believe this is reasonable given the magnitude of recent underperformance versus historical averages. We have stated normal REIT returns should be ~6-8% annually through a cycle, split roughly in half between income and appreciation. Looking back, REITs have actually outperformed this range, with an annualized total return of nearly +10% going back to 1990 (based on the FNERTR). This total return included sustained periods meaningfully above and below the long-term average. Highlighted below, REITs have seen 10-year periods reach as high as 19% (annualized) and as low as 4%. As of year-end, REITs once again dipped below 6% on the trailing 10-year return, which has historically preceded periods of strong REIT outperformance. For example, November 2008 and late 2016 were followed by numerous years of meaningful outperformance (5-year forward returns were 20.4% and 11.1%, respectively).

In summary, we are grateful for all of our clients that have had the conviction to stay invested in REITs and believe that 2026 possesses many of the catalysts that we look for in a dramatic turn in performance. We are optimistic in the one year, and particularly the three-year outlook for publicly traded REITs, and remain steadfast in our belief that public REITs should be held in most portfolios.

Bradley J. Eixmann, CFA

Brandon J. Frank

Robert J. Greenberg, CFA

Matthew R. Werner, CFA