Portfolio Insight | 3rd Quarter 2025

The S&P 500 marched higher in the third quarter as continued improvement in the corporate earnings outlook, fading trade policy concerns, a robust AI-driven capex cycle, and the resumption of the Federal Reserve’s rate cutting cycle drove the index to its best quarter of 2025. Mega-cap growth stocks again led the market to new all-time highs, and with an impressive 8.1% gain in 3Q, the S&P has now returned 14.8% year-to-date.

In the third quarter, the strongest sectors were Information Technology, Communication Services, and Consumer Discretionary while Real Estate, Materials, and Financials lagged the most. Year-to-date, Communication Services, Information Technology, and Industrials stocks outperformed the most while Health Care, Consumer Staples, and Consumer Discretionary stocks lagged the most.

News Cycle Chaos

One impressive aspect of the 2025 stock market has been its ability to work through a seemingly nonstop flow of shocking, unpredictable headlines driven largely by the unconventional Trump administration. Direct personal attacks on Fed chairman Powell, an attempt to remove current governor Lisa Cook, a dizzying array of new tariff announcements, and surprise direct government investments in companies like Intel have kept market participants on their toes. Likewise, concerns about Ukraine-Russia and the Middle East, market concentration, a prospective AI “bubble,” and the implications of a US government shutdown have unnerved investors.

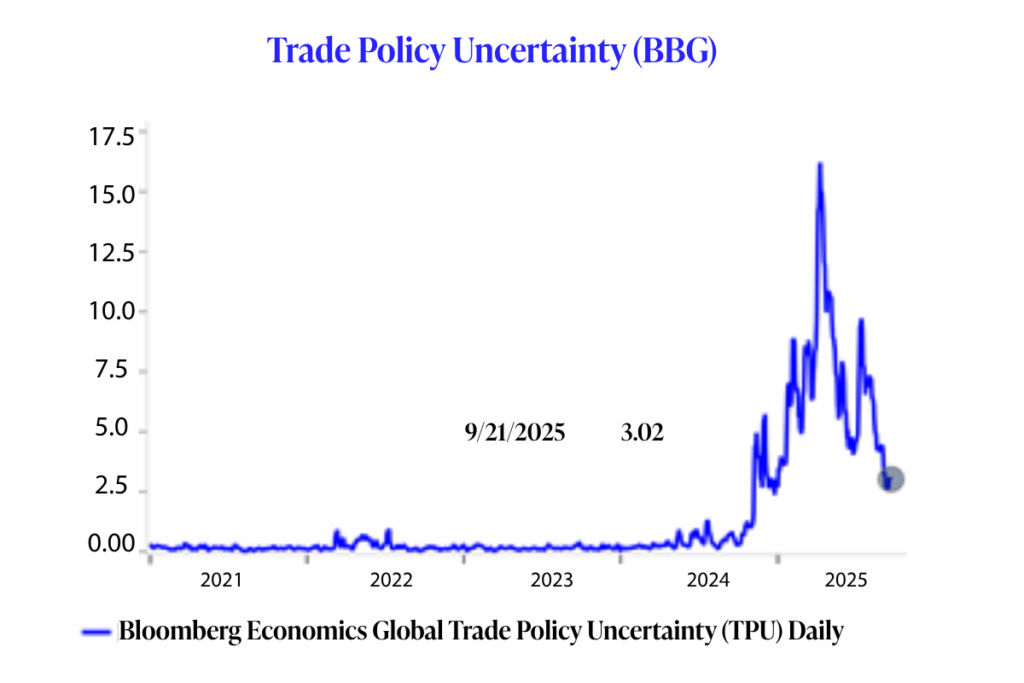

However, peering through the fog, a clear positive has been the fact that peak Trump trade policy uncertainty appears to be in the rear view mirror as measured by mentions in articles. The Supreme Court could strike tariffs down in 4Q. Meanwhile, the administration appears to be seeking different approaches, such as specific sector tariffs, to make them “stick.” This potential action presents a risk to steady market gains as companies and investors seem to have largely gotten comfortable with current trade deals.

Source: Strategas/Bloomberg/Macrobond

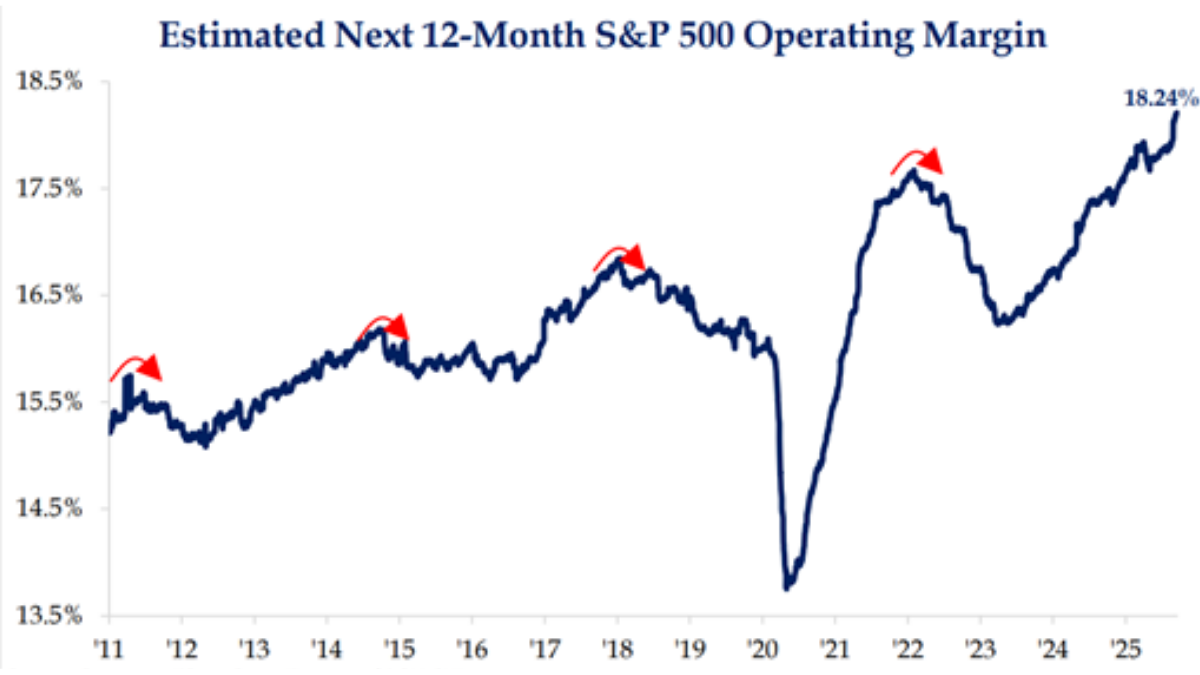

Margins Ratcheting Higher

The incredibly resilient and impressive earnings power of the largest domestic companies has continued to inflect higher. Despite macroeconomic uncertainty and perceived pressures from tariffs and inflation, the current 12-month forward outlook for operating margins is at an all-time high.

Source: Strategas, Bloomberg, Data as of 9/22/25

Companies are doing more with less, and it’s flowing through to the bottom line. Coupled with expectations for accelerating revenue growth across the market cap spectrum, investors can foresee increasing earnings and a bullish backdrop for stocks.

AI’s Massive Impact

Many investors are suspicious of market gains that continue to be driven mostly by mega-cap growth companies in the technology sector. However, this mega-cap leadership is currently justified as these companies continue to have superior earnings outlooks compared to the broader market. Moreover, while tech sector growth is highest, every sector except energy should see positive, accelerating year-over-year growth in the third quarter.

AI is a huge, possibly 15-20 year driver of productivity and growth for the global economy, and we are only in year three since the introduction of ChatGPT. Morgan Stanley estimates that S&P 500 companies could eventually reap annual net benefits of $920 billion from full AI adoption, mainly from cost reductions and additional revenue. 90% of occupations will likely be impacted by AI, not just through roles that are automated, but others that will see enhancement through AI augmentation. This will also include the creation of new roles which could collectively accelerate global GDP growth. NVIDIA’s visionary leader Jensen Huang echoes this sentiment, and the company as well as many others appear to still have many years of high growth ahead of them.

Domestic Equity Outlook

Following a volatile first half of the year, stocks spent 3Q in a narrow trading range, grinding higher with little interruption. In spite of all of the noise out there, these gains appear justified. The key drivers of stock gains are in place, most notably improving corporate earnings and a Fed interest rate cutting cycle.

Absent an aggressive layoff cycle or spike in inflation, both of which we consider unlikely, companies are likely to continue generating improved profits underpinned by accelerating revenue growth, record margins, and interest rate cuts. The benefits of deregulation, clarity on tariffs, and a tax and spending bill passed earlier this year should provide a tailwind and give management teams the confidence to hire and invest. We continue to believe that the market has likely seen most or all of its gains for the current calendar year, but that further gains in stocks are likely as we begin to set our sights on 2026-27. As active managers that do not buy the index, we continue to see numerous opportunities to buy stocks with upside potential that fit our fundamental process.

Fixed Income Outlook

Buoyed by lower interest rates during the quarter, the Bloomberg US Aggregate Bond Index, a mix of government and corporate bonds, rose 2.0% and is now up 6.1% year-to-date. The 10-Year Treasury yield fell modestly during the quarter, moving from 4.24% to 4.16%, having begun the year at 4.58%.

The Federal Reserve restarted its rate cutting program in mid-September, reducing short-term rates by 0.25%. This was the first cut since late 2024, bringing the Federal Funds rate down to the range of 4.00% – 4.25%. As a reminder, in response to the post-pandemic inflationary surge, the Fed had rapidly increased short-term interest rates from effectively zero to a cycle-high 5.25% – 5.50% range by mid-2023. The Fed then reversed course and began cutting rates in late 2024, only to pause for most of 2025. Consensus market expectations call for two additional 0.25% rate cuts during 2025 and two more in 2026.

If the US economy is growing, the employment picture appears relatively healthy, and inflation is running above target, why is the Fed cutting rates at all? The Fed is cutting today because its policy may be too “tight” for the forward path of growth and employment. In his post announcement news conference, Federal Reserve Chairman Jerome Powell described this recent move as an “insurance cut,” signaling caution rather than the start of more aggressive easing. Also, while Chairman Powell acknowledges that inflation remains above its desired level today, he and the committee point toward future inflation expectations as a sign that inflation is likely to move closer to its 2% target level. While many areas of the economy are experiencing solid levels of growth (retail sales, AI-driven spend, durable goods, etc.), others would welcome lower rates. The depressed housing industry would be a prime beneficiary as lower rates would not only reduce mortgage payments, but also the borrowing rate for variable home equity loans that consumers could use to finance large, previously delayed home improvement projects. And while the employment picture can currently be described as stable, indicators such as initial jobless claims and a rising unemployment rate are a cause for concern.

While yields are off recent highs, we still believe bonds remain relatively attractive for those clients with fixed income allocations. The majority of corporate bonds we are buying today are yielding between 4.00% and 4.25% with maturities of 1-6 years. As always, bonds purchased for the majority of client accounts are investment-grade quality and are bought with the intention of being held until maturity.

Global Markets Outlook

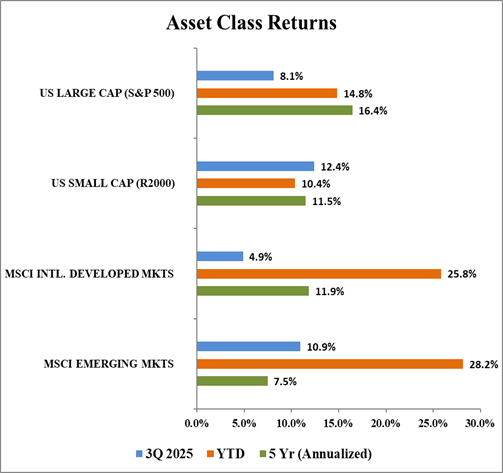

Global equity markets continued their ascent in the third quarter of 2025 with a few interesting shifts in leadership. US small-cap stocks returned 12.4%, finally surpassing their 2021 highs and outperforming US large caps for the first time in a year. Large caps rose a solid 8.1%, while international developed markets gained 4.9% and emerging markets surged 10.9%.

Due to a combination of currency tailwinds, earlier stimulus measures, and lower starting valuations, international equities continue to lead US markets year-to-date. Through the third quarter, international developed markets are up 25.8% and emerging markets are up 28.2%, compared to US large caps at 14.8%, and US small caps at 10.4%.

Source: Bloomberg, Chilton Capital Management

Although dollar weakness has been the key factor in relative US underperformance this year, the US Dollar Index was effectively flat in the third quarter. Instead,

in addition to AI-driven enthusiasm, domestic performance was driven by solid earnings growth and optimism over the Federal Reserve’s first rate cut of the year, which boosted rate-sensitive sectors as well as small caps that carry heavier debt loads.

Emerging market performance was supported not only by enthusiasm around Chinese AI and semiconductor developments, but also by improving domestic demand and ongoing fiscal support. Korea and Taiwan benefited from solid semiconductor demand, while Latin America also participated in the rally. Ongoing trade talks between the US and China will bear watching after the extension of a tariff truce to November 10th.

Europe, meanwhile, lagged both the US and China. Weak economic growth and a rate cutting cycle that is likely complete weighed on sentiment. On the positive side, the European Central Bank has dropped short-term rates to 2.0%, inflation is near target, employment is strong, and structural investment continues. Major technology players in the UK announced more than $40 billion in AI-related projects, and Germany and France rolled out fiscal programs aimed at supporting industrial competitiveness. Furthermore, the US and EU reached a trade deal framework that brings more certainty and reduces auto tariffs from their prior highs.

In the coming quarters, markets will continue to be guided by the interplay of monetary easing, fiscal initiatives, shifting trade policies, and the durability of corporate earnings. Geopolitical events and the pace of technological innovation, particularly in AI, add further complexity to the outlook. In this environment of evolving risks and opportunities, diversified exposure across regions and sectors remains prudent for many clients.

REIT Commentary

In the third quarter of 2025, the MSCI US REIT Index (RMZ) produced a total return of +4.8%, which brought the year-to-date total return to +4.7% as of September 30th. The Fed’s first rate cut since December 2024 was a welcome sign to the market, pushing down long-term yields leading into the announcement in September. With construction continuing to slow and the market on solid footing, REITs are poised for an acceleration of earnings growth in 2026 and 2027.

One of the mainstays of wealth management for individuals for the past 50 years has been the 60% equities / 40% fixed income portfolio. However, underperformance in fixed income and the growth in alternatives have challenged this thesis – and may have won. Notably, today’s market seems to be focused on returns much more than risk, and we believe that public REITs need to be able to produce high single digits or even low double-digit returns to gain investor’s attention.

While one would think that the decline of interest rates in the 2010-2020 decade would make fixed income a winner, the actual winners were private assets, including private equity, real estate, and private credit. Low interest rates fueled high leverage speculation that produced fantastic returns, and risk was all but forgotten. Public equities also enjoyed a historic run that continues in 2025. In contrast, public REITs, which produced returns in-line with our +6 – 8% assumptions, suffered net outflows from ETFs and active mutual funds for the past 11 years, except for 2021. We believe these trends will reverse at some point in the future, and investors will once again focus on risk-adjusted returns, bringing public REITs back into an essential part of a diversified portfolio.

The shift in the Fed’s interest rate policy in 2022 has had a sweeping effect on all asset classes. Fixed income, as measured by the Barclays Aggregate Bond Index, experienced its worst drawdown in history. In its place, private credit has soared, boasting mostly variable rate debt that increased yields as the Fed pursued its aggressive rate hikes to fight inflation. Private equity and private real estate have seen fundraising pull back over 50% from its 2021 highs as higher rates make it more difficult for deals to pencil.

Fast forward to 2025, and the Fed has finally resumed cutting rates. With another four to five rate cuts baked into the Fed’s dot plots, returns on cash (money market) and private credit should come down. While this may push flows back into private real estate and private equity, there is over $1.3 trillion in uncalled capital that is still looking for deals.

As a result of the net outflows, public REITs have been struggling to trade at or near their net asset values (or NAVs). We believe the setup is similar to 1999. At the time, public REITs were trading near a 20% discount to NAV. Furthermore, REITs were out of favor given the impressive tech-driven performance of the S&P 500 in the previous 2-3 years. When technology stocks sold off in 2000-2001 and the Fed began their rate-cutting cycle, REITs were the best-performing asset class for three of the next seven years, and the top-performing asset class of 2000-2009. We believe that the yield, safety, and hard assets will come back into favor at some point, and the favorable supply/demand dynamics that will play out for the next 3-5 years could drive REIT prices back above NAV at a time when NAVs are increasing due to growth in net operating income, creating a positive feedback loop. As such, we believe that, even without adjusting for risk, public REITs can produce total returns that are at or above private real estate, and should be competitive with private credit and debt.

Bradley J. Eixmann, CFA

Brandon J. Frank

Robert J. Greenberg, CFA

Matthew R. Werner, CFA