REIT Commentary | Third Quarter 2025

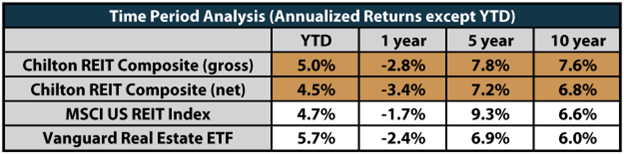

In the third quarter, the Chilton REIT Composite underperformed the RMZ by producing a total return of +2.3% gross of fees and +2.1% net of fees, which compares to the RMZ’s total return of +4.8%. Year to date, the Chilton REIT Composite has performed in line with the RMZ by producing a total return of +5.0% gross of fees and +4.5% net of fees, which compares to the RMZ’s total return of +4.7%. Additionally, the Chilton REIT Composite underperformed the Vanguard Real Estate Index (VNQ), our secondary benchmark, that produced a YTD total return of +5.7%.

–

Third Quarter 2025 Attribution

Positive contributors to relative performance for the third quarter of 2025 included stock selection within the self storage sector, an overweight to the healthcare sector, and an underweight to the specialty sector. Conversely, an overweight allocation to the cell tower sector, an underweight to the regional mall sector, and an overweight to the residential sector detracted from relative performance.

–

Year-to-Date 2025 Attribution

Positive contributors to relative performance for 2025 included stock selection within the office sector, an overweight to the healthcare sector, and an underweight to the lodging sector. Conversely, an underweight allocation to the triple net sector, stock selection within the industrial sector, and an underweight allocation to the regional malls sector detracted from relative performance.

–

2025 Contributors Summary

- Stock selection within the office sector positively contributed to relative performance. Most notably, our strategy held overweight positions in Highwoods Properties (NYSE: HIW) and BXP Properties (NYSE: BXP), both of which outperformed the group average.

–

- An overweight allocation to the healthcare sector also contributed to relative performance. In particular, our overweight position to senior housing continues to benefit from accelerating fundamentals. We remain attracted to the long term demand fundamentals driven by an aging population.

–

- An underweight allocation to the lodging sector also contributed to relative performance. In particular, fears around waning consumer health have weighed on the lodging REITs in 2025 and contributed to Composite relative performance.

–

2025 Detractors Summary

- An underweight allocation to the triple net sector detracted from the Composite’s relative performance. Given the long lease terms typical in triple net, the group has benefited from the specter of falling rates this year.

–

- Stock selection within the industrial sector also detracted from relative performance. In particular, we have an overweight to cold storage, which has underperformed due to continued pressure on food volumes and weighed on Composite relative performance.

–

- An underweight allocation in the regional malls sector also detracted from relative performance. While our Composite has retail exposure through shopping center REITs, we currently have no exposure to regional malls. The group’s outperformance continues to be driven by Simon Property Group (NYSE: SPG).

–

Market Commentary

Data Center REITs: Own the Real Estate Behind AI | August 2025

Shopping Center REITs: Undervalued Despite Growth Ramp | September 2025

Tipping Point: The New Diversified Portfolio Needs REITs | October 2025

–

–

Additional Disclosures

The information contained herein should be considered to be current only as of the date indicated, and we do not undertake any obligation to update the information contained herein in light of later circumstances or events. This publication may contain forward looking statements and projections that are based on the current beliefs and assumptions of Chilton Capital Management and on information currently available that we believe to be reasonable, however, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. This communication is provided for informational purposes only and does not constitute an offer or a solicitation to buy, hold, or sell an interest in any Chilton Capital Management investment or any other security.

Past performance is not indicative of future results. Investment returns and principal value will fluctuate so that an investor account, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. MSCI US REIT Index and Vanguard Real Estate ETF performance is presented as a benchmark for reference only and does not imply any portfolio will achieve similar returns, volatility or any characteristics similar to any actual portfolio. The composition of a benchmark index may not reflect the manner in which any is constructed in relation to expected or achieved returns, investment holdings, sectors, correlations, concentrations or tracking error targets, all of which are subject to change over time.