Portfolio Insight | 2nd Quarter 2025

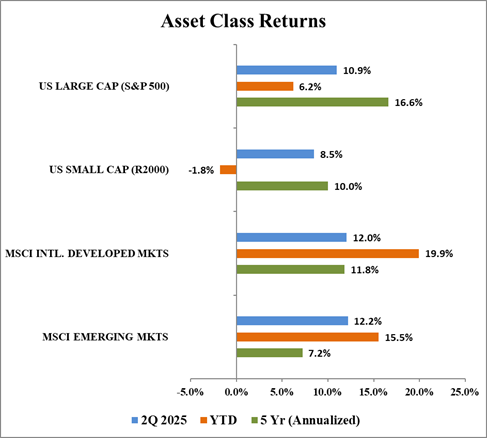

After a steep drop to near bear market levels in April, strong corporate earnings and outlooks, coupled with tariff de-escalation, helped the S&P 500 rebound and close the second quarter at a fresh all-time high of 6,205. The second quarter’s robust 10.9% return erased the first quarter’s negative return and brought total year-to-date index gains to 6.2%.

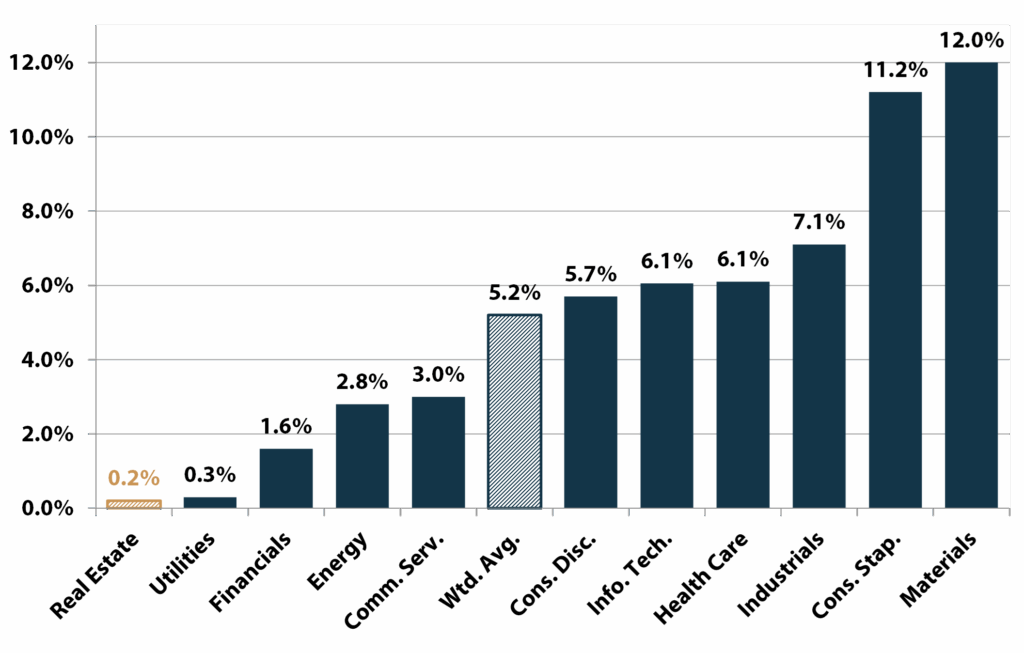

The strongest sectors in the second quarter were Information Technology, Communication Services, and Industrials, while Energy, Health Care, and Real Estate trailed the most. Year to date, Industrials, Communication Services, and Utilities have outperformed the most while Consumer Discretionary, Health Care, and Energy stocks have lagged the most. Large and mega-cap growth stocks bounced back significantly in Q2 and have regained the leadership they had ceded in the first quarter.

Big Beautiful Bounce

Trump’s “Liberation Day” tariff rollout on April 2nd was not the clearing event that many market participants were hoping for. Instead, the selloff that began in the first quarter spilled over and the market cascaded lower in April, with a 19% peak-to-trough move from the February 19th high to the April 8th low stopping just short of bear market territory.

From there, tariff de-escalation and robust earnings drove the market higher by nearly 25% to a new all-time high in late June. Relatively tame inflation readings and a gradually deteriorating labor market that inspired expectations of Fed rate cuts also had a positive effect for the market.

Past Peak Tariffs

Though it was not necessarily evident at the time, President Trump appears to have been employing “Art of the Deal” style negotiation tactics when he announced a shockingly broad and aggressive set of tariffs that lacked, in many cases, clear rationales or specific end goals.

After making many nations uncomfortable in negotiations, Trump has since postponed many of the reciprocal tariff implementation dates or achieved frameworks of deals (China/UK) and has gotten some terms he was seeking. The US is collecting tariff revenues, and Trump has obtained commitments from many companies to invest in the US and has leveled the playing field for many American businesses. Negotiations continue and the ultimate impact of tariff talks has yet to be determined, but tariff de-escalation has been a major driver of the recent market recovery.

American Exceptionalism Lives

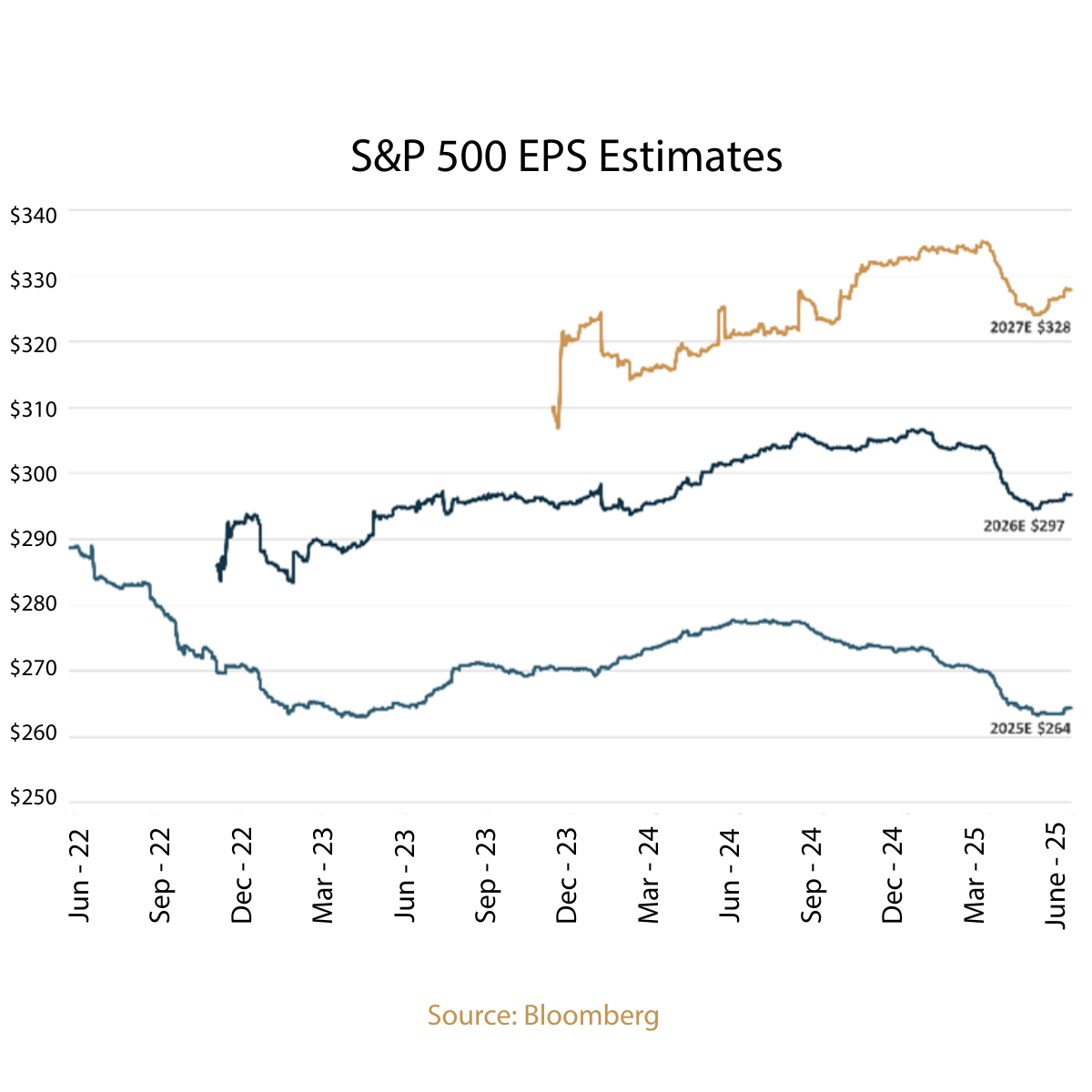

Another boost has been the persistence, despite pundit skepticism, of “American Exceptionalism” in the second quarter. Quarterly earnings reports were better than expected despite very high initially announced tariff rates and a volatile, Trump-tweet-driven market environment. Even accounting for worst case tariff scenarios and conservatively assuming no benefits from a falling US dollar, most companies maintained guidance for 2025, or made only minor reductions. Though the new operating environment is frustrating, there has been little sign that companies are unable to pivot business strategy. Instead, American companies have quickly gotten to work shifting supply chains and looking for optimal tariff avoidance. For example, tech giant Apple was able to shift all of its US-bound iPhone production from China to India. Even smaller companies like specialized industrial equipment maker Dover Corp. see the new environment as an opportunity to gain share vs. competitors that have less US-based production. In addition, secular drivers like AI remain intact despite macro uncertainty, driving strong earnings for many (mostly tech) companies. Growth-boosting deregulation and tax policy are on the come. Rolling everything up, the 2025-2027 S&P 500 earnings outlook dipped temporarily but is now on the upswing, supporting new market highs.

Domestic Equity Outlook

Stocks have seesawed so far in the first half and the market has clearly climbed a steep “wall of worry,” overcoming many actual and perceived challenges. At Chilton, our experience and process dedication allow us to remain calm when navigating through tumultuous periods such as this past April, to filter out the noise and focus on what actually matters for companies and their ultimate stock price performance over the long run. This is a key differentiator and a competitive advantage as we build portfolios.

Given continued tariff uncertainty and the market at an all-time high, it is possible that we have already seen most or all of the index gains for 2025. However, looking ahead to continued earnings growth in 2026 and 2027, and assuming reasonable resolution to tariff negotiations, falling inflation, growth-boosting tailwinds of deregulation and tax policy permanence, as well as potential supportive Fed interest rate cuts, a return to double digit percentage gains for the market is possible next year. As active managers at Chilton, we will continue to seek out the best investment opportunities for our clients, and we are confident plenty of them still exist.

Fixed Income Outlook

The Bloomberg US Aggregate Bond Index, a mix of government and corporate bonds, rose 1.2% during the quarter and is now up 4.0% year-to-date. Client bond allocations have seen similar returns. 10-Year Treasury yields fell during the quarter, moving from 4.36% to 4.24%, having begun the year at 4.58%.

The Federal Reserve has remained on hold thus far in 2025, leaving the Federal Funds rate in the range of 4.25% – 4.50%. However, the Fed is likely to resume cutting rates in the months ahead (the last rate cut took place in December). Markets are pricing in two interest rate cuts this year and another three cuts in 2026. As a reminder, a lower Fed Funds rate is generally stimulative for the US economy since it reduces the cost of borrowing for items such as consumer home equity/automobile loans and corporate borrowings that are tied to a variable rate.

While the majority of economic indicators point to a steadily growing economy, there are signs of economic headwinds on the horizon. The decision for the Fed to cut (or not cut) is always made through the lens of its dual mandate of maintaining stable prices and maximum employment. Both of these measures would suggest cuts need to happen soon. On the one hand, the rate of inflation has steadily moved down from the exceptionally high levels of the immediate post-COVID period toward the Fed’s 2% goal. On the other hand, the unemployment rate has ticked higher over the last several quarters, albeit from uncharacteristically low levels. Certain leading employment indicators, such as continuing jobless claims, would suggest that the unemployment rate is likely to move higher. As a result, the Fed is likely to proactively cut rates to avoid a further significant spike in unemployment. This is especially important for jobs in rate sensitive areas such as housing, which is already seeing multi-year lows in existing home sales and a decline in home prices on a national level. Over the past 40+ years, every rise in the unemployment rate commensurate with what we are experiencing today has been followed by Fed rate cuts.

In our view, bonds remain attractive for those clients with fixed income allocations. The majority of bonds we are buying today are yielding between 4.0% and 4.5% with maturities of 1-6 years. As a reminder, the vast majority of bonds purchased for client accounts are investment-grade quality and are bought with the intent of being held until maturity.

Global Markets Outlook

Global equity markets delivered strong results in the second quarter of 2025, with international equities outperforming their US counterparts thanks to a large slide in the US dollar. The S&P 500 rebounded 10.9% in Q2, driven by resilient corporate earnings and deft supply chain management after the Liberation Day tariff announcements. In contrast, US small-cap stocks continued to lag, reflecting less multinational exposure and more of a tariff burden. Overseas, emerging markets advanced 12.2% on the back of improving sentiment in China. International developed markets nearly matched the performance gaining 12.0%, led by Europe and Japan.

Year-to-date, these trends have reinforced a widening divergence between US and international equities. The S&P 500 is up 6.2%, while the Russell 2000 remains in negative territory, down 1.8%. In contrast, the MSCI EAFE Index is up 19.9% YTD, and the MSCI Emerging Markets Index has gained 15.5%. Reasons for this outperformance include a weaker US dollar, easier monetary policy abroad, and aggressive fiscal stimulus across several major economies.

Source: Bloomberg, Chilton Capital Management

US equities continue to be supported by strong fundamentals. Q2 earnings beat expectations, led by the “Magnificent 7” but with meaningful contributions across sectors including health care and industrials. US corporations benefit from global scale, deep capital markets, and innovation in areas like AI-related applications. However, the policy environment remains in focus, with investors monitoring inflation data and labor market signals for clues on when the Federal Reserve may begin cutting rates.

International markets offer an interesting contrast. Valuations are near historical averages at roughly 14x earnings for developed markets and 12x for emerging markets. Fiscal and monetary policy have also turned significantly more supportive. Germany passed a €1 trillion stimulus program targeting infrastructure and military modernization, NATO members have plans to increase spending to 5% of GDP, and the European Central Bank has already cut rates four times in 2025. Japan has benefited from corporate governance reforms, while emerging markets have rallied on China’s stimulus efforts, including a 3 trillion yuan spending package aimed at domestic consumption and strategic sectors such as semiconductors and electric vehicles.

Perhaps most significantly, rate differentials, concern over the US fiscal path, and a rotation into international assets following the tariff announcements have driven the US dollar nearly 11% lower YTD, magnifying returns for US-based investors holding international assets.

Looking forward, the path of rate cuts, fiscal policy, tariff or trade deal announcements, earnings momentum, and geopolitical developments will be key in shaping relative regional performance. Amid continued divergence, global diversification remains prudent, with attractive opportunities present across both domestic and international equity markets.

REIT Commentary

In the second quarter of 2025, the MSCI US REIT Index (RMZ) produced a total return of +1.1%, which brought the year to date total return to -0.1% as of June 30th. The biggest “new news” in the quarter affecting the market was the announcement, and subsequent delay, of tariffs by the White House. The announcement resulted in reciprocal tariff announcements from US trading partners, bringing new uncertainty into consumer spending, inflation, job growth, and, as a result, asset values. Despite having little to no exposure to imports, public REITs sold off by 8% in the two days following Liberation Day. Following the announcement of a 90 day pause on April 9th, REITs rebounded quickly and have been trading in a tight range as investors speculate on the short term and potential long term effects of tariffs on the economy. The good news for REIT investors is that most REIT management teams maintained or raised guidance in conjunction with Q1 earnings season, and the NAREIT conference we attended in early June confirmed REITs’ defensive nature in a tariff war scenario. Given the 90 day pause expiration date coming on July 9th, we believe it is important to assess the impact (or lack thereof) of tariffs on REITs.

Trade Exposure by Sector to International Sales, Cost of Sales, and Goods Intensity

Source: Alpine Macro

First, any legislation that increases prices (as a tariff would) will increase construction costs. While this is a negative for a real estate developer, this is a positive for current owners. Higher construction costs will dampen new construction, keeping a lid on supply. Furthermore, in general, rents follow replacement cost (another term for the cost of new construction) over time. As a result, we believe a tariff scenario could have positive effects for public REITs over the near and intermediate term.

Second, real estate is a “look-through” to the underlying health of its tenants, both for businesses and personal incomes. As of the writing of this publication, the effects are not known, but uncertainty is usually not a positive. As a result, we have heard anecdotes of companies slowing or pausing their leasing decisions, but we won’t know the full effect of tariffs on leasing decisions for at least another quarter.

So, what can an active manager do? Initially, our assessment that near term REIT earnings would be relatively unscathed by a trade war gave us confidence to invest cash as the market pulled back in early April. The next step was assessing our exposure to each property type. We concluded that industrial, lodging, and malls would have the biggest negative impact, while triple net, manufactured housing, single family rentals, data centers, health care and cell towers would be beneficiaries. We believe multifamily, self storage, life science, office, and shopping centers would not be affected.

We concluded that our portfolio was well-positioned for a trade war, given our underweights to lodging, regional malls, and industrial, and our overweights to cell towers, data centers, single family rentals, and health care. The only outlier was office, which was the third worst performer following the tariff announcements, yet we believed the tariffs would have a neutral effect. We used April’s price action as an opportunity to increase several office names (HIW and BXP) back to model weight for clients.

Given the divergence in performance by property type thus far in 2025, we believe that it will be a good year for active managers, as evidenced by the Chilton REIT Strategy’s +2.73% total return through June 30th (+2.45% net of fees), resulting in 282 basis points of alpha on a gross basis (254 basis points net of fees).

Bradley J. Eixmann, CFA

Brandon J. Frank

Robert J. Greenberg, CFA Matthew R. Werner, CFA

Matthew R. Werner, CFA