Equity REITs: Takeaways from REITWeek 2025 | July 2025

We recently attended the annual REITWeek conference, where we conducted 31 meetings with REIT CEOs and CFOs. We also attended two organized dinners, one property tour, and even went for a run through Central Park with a REIT management team to maximize our time in New York City with REIT executives.

–

Similar to last year, we walked away with several actionable takeaways as the industry continues to navigate macro uncertainty, capital markets dislocation, and diverging fundamentals across property types and regions.

–

In general, the lack of new supply should overwhelm the risk of demand diminution across most property types. Furthermore, the secular demand growth occurring in data centers and senior housing is set to continue to the end of the decade. Overall, management teams were optimistic that fundamentals are set to accelerate in 2025 and 2026 in spite of the near-term macro uncertainties, confirming our thesis that REITs should be an attractive investment in the current environment.

–

Multifamily

We met with Camden Property Trust (NYSE: CPT), AvalonBay Communities (NYSE: AVB), Mid-America Apartments (NYSE: MAA), Independence Realty Trust (NYSE: IRT), and Centerspace (NYSE: CSR). A consistent theme across meetings was yet again the performance gap between Coastal and Sun Belt markets. Coastal portfolios continue to benefit from stronger pricing power, limited new supply, and improving job growth, while Sun Belt markets remain under pressure from elevated deliveries and lease-up concessions.

–

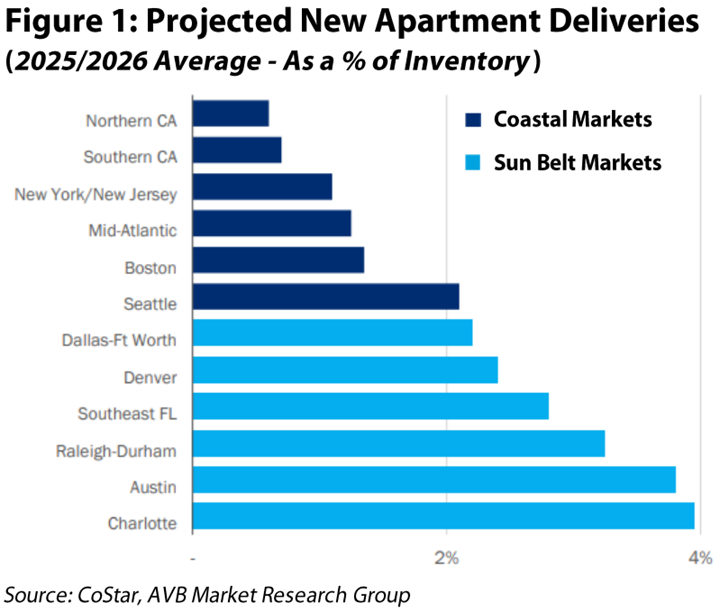

As shown in Figure 1, projected new apartment deliveries are meaningfully higher in Sun Belt markets compared to AVB’s Coastal regions, reinforcing the supply imbalance narrative. Markets such as Austin and Charlotte continue to face downward pressure on new lease rates, forcing landlords to rely more heavily on concessions to preserve occupancy.

–

–

By contrast, D.C. has held up better than anticipated, supported by a rebound in office demand tied to DOGE’s federal return-to-office mandate. Centerspace’s entry into Salt Lake City, funded by capital recycled out of St. Cloud and Minneapolis, reflects an example of a broader theme among REITs: reallocating capital into higher-growth markets and newer properties with lower capex profiles as they position themselves for long-term value creation.

–

Overall, we remain equalweight to the multifamily sector, balancing near-term Sun Belt headwinds against the longer-term upside as new supply peaks. Whether the inflection point for Sun Belt occurs in early 2026 or late 2026, the risk of missing the turn continues to be top of mind as cost pressures ease and fundamentals stabilize.

–

Single Family Rentals

We met with Invitation Homes (NYSE: INVH), the largest owner of single-family rentals with over 90,000 homes. Fundamentals are solid, supported by stable occupancy (~97%), renewal rent growth near 5%, and a wide affordability gap versus home ownership that continues to fuel demand. INVH is also executing on its external growth strategy, including its recently announced developer lending program, which could scale to $1.0 billion over the next few years. The program generates attractive yields while also creating a pipeline of future acquisitions upon stabilization. Despite certain markets such as Phoenix, Dallas, and Tampa seeing pockets of elevated supply, INVH’s geographic diversification, favorable rent-to-income metrics, and long average tenant stays (~38 months) continue to provide meaningful earnings stability and growth for the foreseeable future. Our overweight to single family rentals versus an equalweight to multifamily is based on a higher growth rate, more predictable fundamentals, and an attractive valuation, especially when compared to their private market values.

–

Manufactured Housing / RVs

We met with Sun Communities (NYSE: SUI), a REIT focused on manufactured housing (MH) and RV parks. The core MH business remains healthy with steady +5% rent growth, while the transient RV segment continues to face pressure from shifting Canadian travel patterns and shorter booking windows. The company is in transition following the recent sale of its Safe Harbor marinas business to Blackstone for $5.5 billion (a $1.4 billion gain over a five-year holding period), now prioritizing MH acquisition opportunities to redeploy the remaining capital. After paying investors a $520 million special dividend and likely deploying $1.0 billion into MH, the transient RV business will only be ~7% of pro forma net operating income.

–

We believe the renewed focus on their primary business, coupled with the expected completion of its new CEO search by year-end should result in a re-rating of the shares given the higher predictability of the manufactured home segment and greater leadership clarity.

–

Triple Net

We met with Realty Income (NYSE: O), Getty Realty (NYSE: GTY), NNN REIT (NYSE: NNN), and VICI Properties (NYSE: VICI). Broadly, acquisition activity is improving, though management teams remain disciplined on pricing and underwriting as the cost of capital is still elevated. As such, earnings growth from acquisitions will be muted until the spread between cost of capital and acquisition cap rates improves. On the positive side, the tenant watch list is minimal. At Home, the most recent bankruptcy, will have little to no impact on the REITs, and occupancy should be stable above 97.5%. NNN noted no meaningful deterioration across its tenant base, while Realty Income continues to lean into international markets for incremental growth.

–

VICI is increasingly active, recently investing $510 million in a tribal gaming development partnership with Red Rock Resorts and $300 million into the One Beverly Hills project, further diversifying its portfolio towards experiential real estate. GTY continues to source attractive development projects with yields in the high-7% range while maintaining conservative leverage and no debt maturities until 2028.

–

Despite capital market headwinds, triple net REITs continue to generate predictable cash flows supported by long leases, built-in rent escalators, and high tenant retention. While we view the sector as a stable income generator and a solid ‘risk-off’ play within REITs, we remain underweight to the sector given more compelling opportunities elsewhere.

–

Self-Storage

We met with Public Storage (NYSE: PSA), Extra Space Storage (NYSE: EXR), CubeSmart (NYSE: CUBE), and SmartStop Self Storage (NYSE: SMA). Management teams were generally more constructive, with move-in activity improving, low vacate rates, and encouraging seasonal momentum after a sluggish 2024. Street rates are still down low-single digits year-over-year, but are showing signs of leveling out as demand picks up and comps become easier.

–

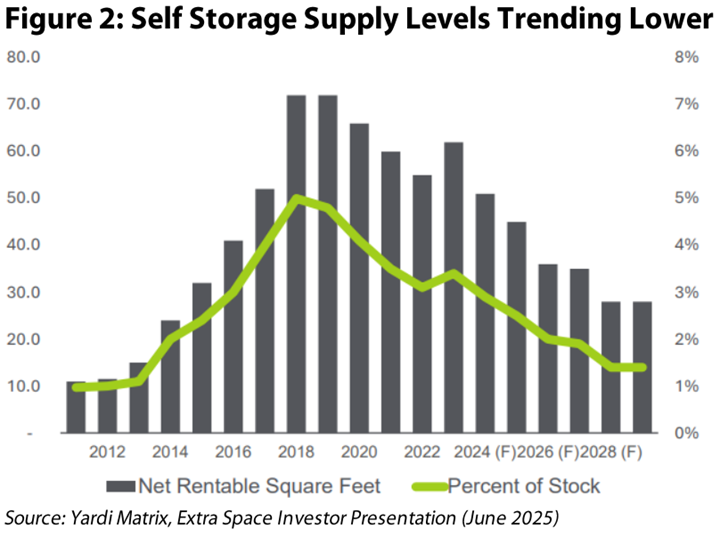

Importantly, new supply continues to decline across most markets, providing a supportive backdrop for pricing power over the next several years as housing activity gradually recovers from current trough levels. As shown in Figure 2, self-storage deliveries peaked in 2018 and have steadily declined since, with new supply expected to remain near 1-2% of existing stock through 2028, well below prior-cycle highs.

–

–

EXR’s integration of Life Storage seems to be fully absorbed, its third-party management (3PM) platform continues to scale, and acquisition activity is selectively resuming through its joint ventures. PSA has ramped investment activity into new developments and acquisitions, despite headwinds in Los Angeles, while SMA is taking advantage of its access to Canadian capital markets, most recently raising CAD $500 million at 3.91%. SMA highlighted its recent five property acquisition in the Houston market, which will have a meaningful effect on future earnings growth given the REIT’s small size in comparison to its peers ($1.4 billion market cap versus a ~$31 billion average). CUBE highlighted rising reservation volume and steady growth in its third-party management pipeline of 869 properties.

–

Overall, storage REITs appear to be transitioning out of the bottoming phase as management teams position themselves for modest revenue acceleration into 2026. We maintain a constructive outlook on the sector, supported by falling supply, sticky customers, and embedded operating leverage as demand normalizes. However, we remain equal weight for now, awaiting greater visibility on home sale recovery and a more convincing turn in street rate growth before shifting off a neutral stance.

–

Data Centers

We met with Digital Realty Trust (NYSE: DLR). Demand fundamentals remain among the strongest in REITland, fueled by the rapid scale-up of AI deployments and continued leasing momentum from hyperscale and enterprise users alike. Power constraints have become the new limiting factor to growth, particularly in high-demand markets such as Northern Virginia and Dallas where land and grid access are increasingly scarce. The result has been meaningful pricing power for those with available capacity and infrastructure already in place.

–

One of the more interesting dynamics discussed in our meeting was the emergence of stronger demand in the <1 MW segment, as smaller deployments from enterprise and AI-linked users begin to scale. While large, multi-MW leases continue to dominate headlines, activity beneath the surface is broadening out. Additionally, DLR is using its hyperscale JV platform to fund development without stressing the balance sheet. The company’s control of land and power in key markets positions it well to capture both large-scale and emerging AI-related demand.

–

We remain constructive on the sector, supported by visible long-term demand drivers, supply constraints in key markets, and increasing evidence that AI leasing is no longer theoretical – it’s here, and accelerating.

–

Shopping Centers

Our team met with InvenTrust Properties (NYSE: IVT), Brixmor (NYSE: BRX), Curbline Properties (NYSE: CURB), and Whitestone Realty (NYSE: WSR). Despite some tariff uncertainty facing retail tenants, leasing velocity continues to impress as retailers compete over well-located space. Conversely, investors remained somewhat cautious about consumers’ stretched finances despite significant releasing success that continues to drive near term cash flow growth. And, coming out of ICSC (International Council of Shopping Centers) major leasing convention in Las Vegas in May, the update was incrementally positive versus what we heard on 1Q earnings calls.

–

Reflecting the best fundamental outlook in years, we are seeing a pickup in interest from private institutional buyers who have been on the sidelines for an extended period. While this is a positive trend for cap rates and property valuations, it is challenging the REITs to be more creative with portfolio growth. Joint ventures with institutional capital have been one avenue of success as well as growing through bolt on redevelopment projects. Following the conference, InvenTrust (NYSE: IVT) closed on their telegraphed California exit (selling 5 of their 6 properties in the state – with the last center expected to close later this year), which we expect to be reinvested in select Sun Belt markets at a 50-75bps (basis point) positive spread and enhancing the pure play aspect of this REIT.

–

Barring any major decline in tenant health, shopping center REITs are set to see accelerating earnings growth in 2026 due to strong renewal spreads and SNO (signed not occupied) pipelines that should turn to revenue-generating. Furthermore, the lack of new construction has made it a landlord’s environment, boosting occupancy to prior highs, and giving us confidence in strong renewal spreads for several years.

–

Healthcare

Within healthcare we expanded our meeting schedule somewhat from recent conferences by placing the primary focus on medical office buildings, also known as Outpatient Medical Facilities. Healthcare Realty (NYSE: HR) owns 648 properties containing almost 40 million sqft of leasable area across 33 states. The recent CEO hiring provided fodder for a timely meeting. While the results from the company’s ‘full review’ will have to wait until at least 2Q earnings, we are encouraged by the top-down focus on leasing and operational efficiency in order to enhance financial flexibility and improve the visibility of earnings growth.

–

Sila Realty (NYSE: SILA), a recent addition to the portfolio, is a company that invests along the continuum of care including outpatient medical, inpatient rehab, a variety of specialized hospitals and behavioral care facilities. The company is being selective with acquisitions, but given its attractive starting leverage position (only 3.5x Net Debt/EBITDA), we believe it can drive ~$200 million of annual acquisitions without requiring new equity.

–

We are more constructive on Senior Housing after our meeting with American Healthcare REIT (NYSE: AHR) as macro uncertainty prolongs the low supply environment and the REIT’s operational advantage accelerates. We discussed the acquisition outlook extensively and, with their pipeline expanding, management is excited to utilize their ATM (At the Market) to raise equity and grow in a leverage neutral manner (a feeling shared by investors in our meeting). Anecdotally from our hallway conversations and presentations released in conjunction with the conference, both WELL and VTR are seeing strong quarter to date move in trends which, in our view, bodes well for the summer leasing season and above trend rental increases.

–

Industrial

Our team kicked off the week touring several cold storage facilities with Lineage Logistics’ (NYSE: LINE) management team in Elizabeth, NJ near the port of Newark. In addition, we also met with Terreno (NYSE: TRNO), Americold (NYSE: COLD), and Vesta (NYSE: VTMX) – a Mexican industrial REIT making inroads with American investors. Consistent with what we heard at 1Q earnings, demand remains choppy nationwide as tariff induced inertia has caused tenants to delay decision making. On the positive side, we have seen industrial construction starts fall at a record pace and, although there remains supply to work through in 2025, the supply-demand balance should flip to a tailwind in the coming years.

–

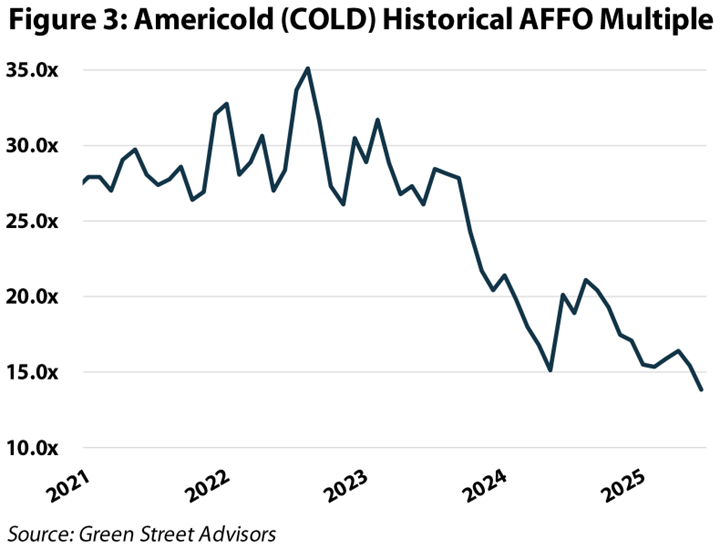

Turning to Cold Storage, both management teams were optimistic that the back half of the year would return to ‘normalized’ seasonal comps after dismal results, year to date. However, while, the property type remains the most difficult to forecast (both internally and for investors) since COVID, we see the current depressed valuation of the stock as very compelling (Figure 3 highlights COLD’s P/AFFO – note LINE only IPO’d summer 2024).

–

–

Based upon our analysis, we see a property type with the lowest multiple (except for lodging) at a time of depressed earnings. Additionally, management has done an excellent job enhancing operating margins with higher tech applications, year to date. While timing is variable, we are confident in the cyclical nature of this property type driving strong future earnings growth. Furthermore, both LINE and COLD tout robust need-driven development pipelines with double-digit stabilized yields, which we expect to support 2026 earnings growth even if operating fundamentals remain challenged.

–

Cell Towers

We met with American Tower (NYSE: AMT), the largest cell tower REIT in the world. Management was positive on a potential acceleration in leasing from the ‘Big 3’ tenants (AT&T, Verizon, and T-Mobile) toward the back half of the year and in 2026. The fourth US tenant, Dish (recently merged into EchoStar (NASDAQ: SATS)) faces significant financial and regulator headwinds as it missed an interest payment, which may result in a bankruptcy. It is important to note that SATS represents 2% of AMT’s total revenue, and in a worst-case scenario (bankruptcy), management expected the spectrum would be auctioned off and split among the Big 3, which would then be deployed to the benefit of AMT, and with a better credit tenant.

–

For a longer-term perspective, AMT clarified that their multiyear domestic tower guide of +5% annualized revenue growth only incudes contractual minimum payments from Dish. Anecdotally, we also discussed the potential for video AI to drive a ramp in 5G (similar to 4Gs trajectory several years ago). While the deployment of 5G has been decidedly disappointing relative to 4G, we believe the current valuation of AMT (and other cell tower REITs) do not factor in any benefit from a ‘killer app’ that would necessitate significant new investment from the carriers in their networks.

–

Office

We met with the management teams of Alexandria (NYSE: ARE), Boston Properties (NYSE: BXP), Highwoods Properties (NYSE: HIW), Cousins Properties (NYSE: CUZ), and Brandywine Realty (NYSE: BDN). As we detailed in last month’s deep dive into the office sector, the accelerating bifurcation within office continues to drive impressive leasing for high quality office buildings despite the prevailing macro uncertainty. The “flight to quality” and “flight to capital” dynamics we have discussed in the past are only increasing, which is widening the gap further between not only well located/amenitized buildings, but also public and private players to the advantage of Equity REITs.

–

Our Sun Belt Office REIT (HIW) reported exceptional quarter to date leasing trends before the conference and, most importantly, reported meaningful progress on its development leasing (weighted average preleasing reached 63% in 1Q and could hit 70% shortly based on our estimates). Relatedly, BXP, the largest publicly traded office REIT, is actively evaluating a major addition to the NYC skyline with a future development start at 343 Madison Avenue with direct access to Grand Central Terminal, a major transportation hub for the city. The project is slated to break ground in July of this year and we are encouraged by the reported interest from several tenants. Overall, we are excited to see pricing power return to landlords in select markets (namely NYC, Boston, and Sun Belt ex Austin) and look for this to accelerate given the anemic supply backdrop.

–

Conversely, life science fundamentals have decelerated faster than anticipated amidst policy uncertainty, though landlords were optimistic that we are nearing a bottom. More specifically, renewal leasing was positive, but new leasing (particularly on development space) remained anemic. In our view, we still don’t have a strong sense when an inflection could arrive, but given the long-term necessity for high quality lab space, we believe current valuations warrant interest. Specifically, highlighted in Figure 4, ARE’s P/AFFO multiple is hovering around 12x today, while the 10-year average is over 27x.

–

–

Conclusion

While uncertainty around rates, capital costs, and transaction activity hasn’t disappeared, most management teams seemed more grounded, and in many cases, more upbeat, than they did six months ago.

–

Across our meetings, one theme stood out: REITs’ earnings growth is set to accelerate in 2026 and 2027, and they are built to weather most economic scenarios, especially relative to other asset classes. If the transaction market opens up, growth could exceed consensus estimates over the next few years.

–

A new real estate cycle is underway, placing investors in some of the most rewarding investment themes we’ve seen in a long time. Namely, infrastructure, with REITs like DLR and EQIX benefitting from AI; longevity, as healthcare REITs stand to gain from favorable demographic trends in the 65+ population; and the housing shortage, where residential REITs remain prime beneficiaries by offering more affordable alternatives. Additionally, REITs are poised to gain market share given their superior access to capital at a competitive rate. Finally, investors can look forward to dividend growth as rents adjust to higher replacement costs.

–

Thomas P. Murphy, CFA

tmurphy@chiltoncapital.com

(713) 243-3211

Isaac A. Shrand, CFA

ishrand@chiltoncapital.com

(713) 243-3219

Matthew R. Werner, CFA

mwerner@chiltoncapital.com

(713) 243- 3234

Bruce G. Garrison, CFA

bgarrison@chiltoncapital.com

(713) 243-3233

–

RMS: 2,964 (6.30.2025) vs. 2,966 (12.31.2024) vs. 3,177 (12.31.2021) vs. 1,433 (3.23.2020)

–

An investment cannot be made directly in an index. The funds consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use.)

The information contained herein should be considered to be current only as of the date indicated, and we do not undertake any obligation to update the information contained herein in light of later circumstances or events. This publication may contain forward looking statements and projections that are based on the current beliefs and assumptions of Chilton Capital Management and on information currently available that we believe to be reasonable, however, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. This communication is provided for informational purposes only and does not constitute an offer or a solicitation to buy, hold, or sell an interest in any Chilton investment or any other security. Past performance does not guarantee future results.

Information contained herein is derived from and based upon data licensed from one or more unaffiliated third parties, such as Bloomberg L.P. The data contained herein is not guaranteed as to its accuracy or completeness and no warranties are made with respect to results obtained from its use. While every effort is made to provide reports free from errors, they are derived from data received from one or more third parties and, as a result, complete accuracy cannot be guaranteed.

Index and ETF performances [MSCI and VNQ and FNER and LBUSTRUU] are presented as a benchmark for reference only and does not imply any portfolio will achieve similar returns, volatility or any characteristics similar to any actual portfolio. The composition of a benchmark index may not reflect the manner in which any is constructed in relation to expected or achieved returns, investment holdings, sectors, correlations, concentrations or tracking error targets, all of which are subject to change over time.