Demographic Trends Shaping REIT Portfolio Construction | March 2025

Demographic shifts have long influenced REIT performance, often acting as early indicators of real estate demand. In 2025, key demographic trends – including an aging population, migration shifts, affordability constraints, and income disparities – are shaping sector allocations and investment strategies as they have for years. However, while demographics provide valuable context, we recognize that they are just one piece of the puzzle. Our bottom-up analysis focuses on property fundamentals and market dynamics, allowing us to capitalize on potential value discrepancies. This approach ensures that we strategically position our investments to benefit from demographic-driven trends, while remaining adaptable to evolving market conditions.

–

Chilton’s strategy remains focused on benefitting from the demographic-driven trends we have identified, with overweight allocations in single-family rental (SFR) and healthcare REITs, as well as targeted exposure to multifamily REITs in both coastal and Sun Belt markets.

–

The Aging Population & Healthcare REITs

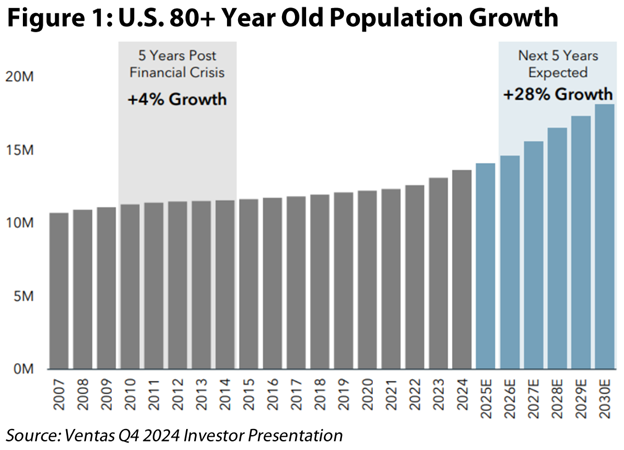

The aging population, often referred to as the “Silver Tsunami,” is reshaping real estate demand, particularly in senior housing. According to Oxford Economics, the 80+ population is projected to surge by nearly 30% over the next five years (Figure 1), driving an increased need for senior-focused housing, assisted living, and medical services. This demographic shift presents a structural tailwind for REITs focused on healthcare and age-restricted housing, with strong occupancy and rent growth expected in these sectors. Previous REIT outlooks, such as our November 2024 publication (MOBs: Office but No Need for Life Support) and October 2023 report (Senior Housing REITs: The Cure for Rising Rates) provide deeper insight into these trends.

–

–

According to the NIC MAP Data Service, our country needs to add 560,000 new senior housing units to meet demand by 2030. However, based on current development rates, the industry is pacing to only add 191,000 units. The wide gap between growing demand and waning supply point to above average rental rate and occupancy increases over the coming years. Additionally, unlike apartment rents that are typically paid through wages, senior housing stays are overwhelmingly funded through asset dispositions (typically home sales). Given the impressive housing price gains in recent years, we see more room for senior housing operators to continue to push rent even if wage growth were to stagnate.

–

With the impressive fundamental outlook detailed above, incremental development certainly could increase in the coming years and eat into the favorable supply / demand balance. However, constraints – including labor shortages and the high cost of new development – continue to limit new inventory, with existing facilities currently trading hands meaningfully below replacement costs.

–

These trends are particularly beneficial for Welltower (NYSE: WELL), Ventas (NYSE: VTR), and American Healthcare REIT (NYSE: AHR), which remain well-positioned to capitalize on the rising demand for senior living options. Longevity, or people living longer, presents another potential risk for senior housing. In our view, while this could push out the ‘move-in’ date for some seniors, they will also remain in the facilities into later ages.

–

Beyond senior housing, the aging population is also fueling demand for medical outpatient buildings (MOBs), life sciences facilities, and post-acute care centers. As healthcare services increasingly shift to outpatient settings (which are substantially more affordable than inpatient or hospital settings), MOBs and specialized healthcare REITs stand to benefit from increasing tenant demand and limited new supply given the extraordinary increase in replacement costs that has occurred in the past five years. This trend underscores the importance of well-located, modern medical facilities, particularly as technological advancements drive a greater emphasis on outpatient procedures and telehealth-enabled care models.

–

Migration Trends Favor the Sun Belt

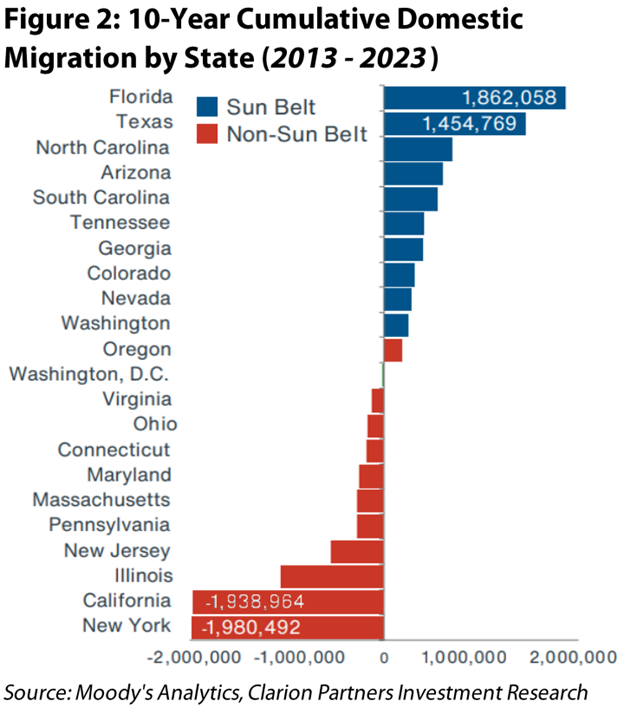

The Sun Belt continues to dominate domestic migration, solidifying its status as the nation’s fastest-growing region. Favorable economic conditions, strong job creation, less crime, and a lower cost of living have fueled a sustained outflow from high-cost coastal markets – such as New York, California, and Illinois – toward business-friendly states such as Florida, Texas, and North Carolina, as shown in Figure 2.

–

–

This shift is not just residential – corporate relocations and expansions have accelerated the trend. Major employers across technology (Oracle), manufacturing (Tesla), energy (Chevron), and financial services (CBRE) have expanded their footprints in the Sun Belt to capitalize on lower taxes, reduced regulatory burdens, and a more affordable workforce. This corporate migration fuels a reinforcing cycle – job creation attracts workers, driving housing demand and commercial expansion, which benefits residential, industrial, and retail REITs. Chilton stands to benefit from this cycle through overweight positions in both InvenTrust (NYSE: IVT) and Highwoods (NYSE: HIW), a shopping center and office REIT, respectively, both predominantly focused within top Sun Belt markets.

–

While migration to the Sun Belt has been a recurring trend over the past few decades, today’s shift is more pronounced due to a combination of structural and economic factors. Unlike the post-2008 financial crisis, where migration was largely driven by job losses in coastal cities, today’s movement is fueled by corporate relocations, remote work flexibility, and high-income earners seeking lower-cost living. Additionally, state-level tax incentives, infrastructure investments, and business-friendly policies are reinforcing long-term population shifts, making this trend more sustainable than previous migration waves.

–

Beyond economic factors, demographic shifts further support the Sun Belt’s growth trajectory. According to U.S. Census data, from 2020 to 2024, Texas, Florida, and Arizona each saw annual population growth rates exceeding 1.5%, far outpacing national averages. This migration surge has translated into robust job creation with Texas and Florida accounting for nearly 30% of all new jobs added in the U.S. over the past two years. In contrast, New York’s population shrank by ~2% and California lost over 800,000 residents driven by affordability challenges, rising tax burdens, and shifting workforce preferences.

–

Managing Multifamily Supply in the Sun Belt

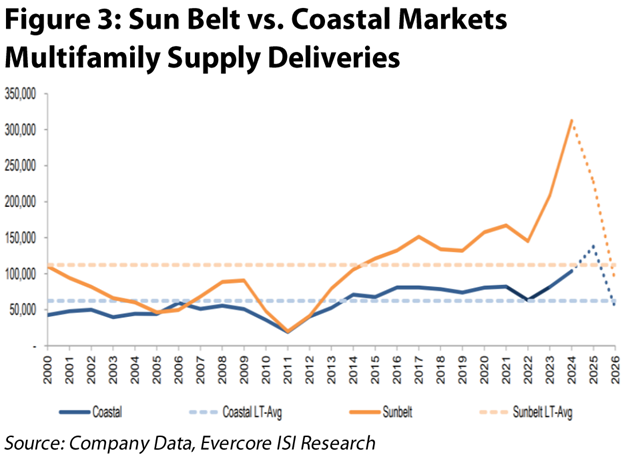

One of the most pressing concerns for Sun Belt multifamily REITs is the substantial pipeline of new deliveries, particularly in Austin, Phoenix, and Charlotte, as shown in Figure 3. In 2024, national apartment supply deliveries hit a 50-year high, raising fears of potential oversupply in select markets. However, demand is proving more resilient than expected reinforcing the reality that the housing shortage is a big issue.

–

–

Apartment absorption, a metric of rental demand that measures the change in how many units are leased, was higher last quarter than in any other fourth quarter since at least 1985, per CBRE. This record-setting absorption marks a critical inflection point, with demand finally catching up to supply for the first time since 2021. Moreover, with multifamily starts at their lowest level since 2011, the delivery pipeline will slow considerably into 2025 and 2026, easing current pressure on fundamentals as we discussed in our February 2024 outlook, “Multifamily REITs: Navigating the Sun Belt Amid Record Supply.”

–

Recognizing this shift, even historically coastal-focused multifamily REITs are increasing their Sun Belt exposure. AvalonBay Communities (NYSE: AVB), long concentrated in gateway markets such as New York and San Francisco, has actively expanded into high-growth metros such as Austin, Dallas, and Miami to capture strong demographic and employment trends. For instance, AVB recently acquired eight communities located in both Austin and Dallas for ~$620 million from BSR REIT, further reinforcing confidence in the region’s long-term demand. As supply moderates, multifamily REITs are well-positioned for a multi-year tailwind, particularly those strategically positioned in high-demand, demographically advantaged markets.

–

Housing Affordability – Renting for Longer

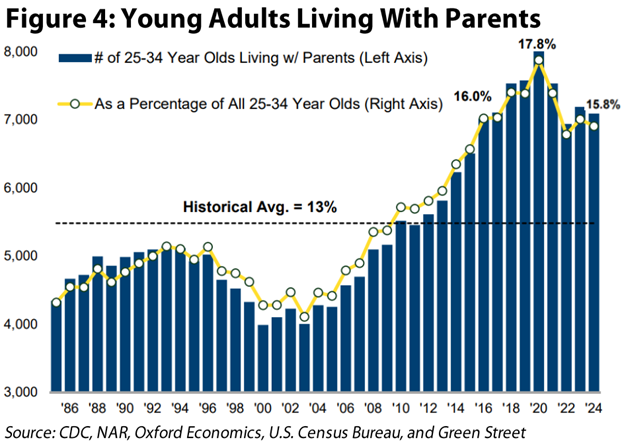

The gap between homeownership and renting affordability continues to widen. Elevated mortgage rates, record-high home prices, and constrained inventory have made buying a home increasingly unattainable for many households. More 25–34-year-olds are living with their parents due to affordability challenges (15.8% as of December 31, 2024) as shown in Figure 4. As this cohort ages, the share should gradually decline from pandemic highs, contributing to an expanding renter base. At the same time, a rising preference for one-person households continues to strengthen long-term demand for well-located multifamily and SFR properties.

–

–

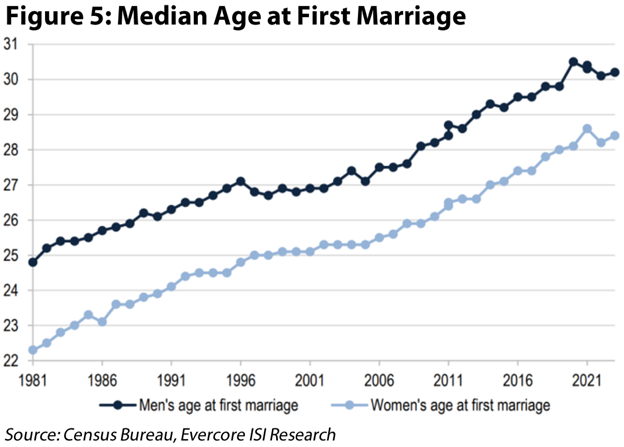

According to the National Association of Realtors (NAR), the median age of first-time homebuyers has risen to 36 years old, up from 29 in 1981, reflecting the growing difficulty of transitioning from renting to ownership. Similarly, the median age at first marriage has climbed to 30 for men and 28 for women, delaying traditional household formations and prolonging rental demand, as illustrated in Figure 5.

–

–

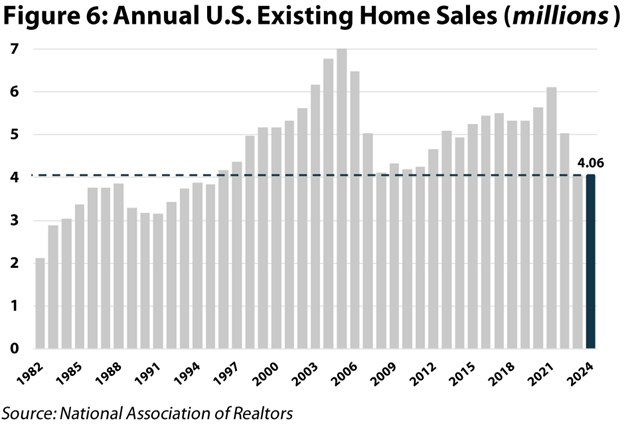

Adding further pressure, the “lock-in effect” – where existing homeowners are disincentivized from selling due to low fixed mortgage rates – is exacerbating supply shortages. As of December 2024, approximately 75% of outstanding mortgages carry rates below 5%, 200 bps below prevailing rates, discouraging sellers and reducing overall housing turnover. This dynamic has pushed existing home sales down to just 4.06 million units in 2024 – marking the lowest level since 1995 (Figure 6). For a deeper dive into how these trends shape residential REITs, refer to our October 2024 publication, “Assessing the Impact of Mortgage Rates on REITs.“

–

–

Unlike the post-2008 housing downturn, where falling home prices and lower interest rates made ownership more accessible, today’s market remains structurally constrained by record-low inventory and persistently high borrowing costs. As a result, homeownership remains out of reach for many, reinforcing the need for rental housing as the default option.

–

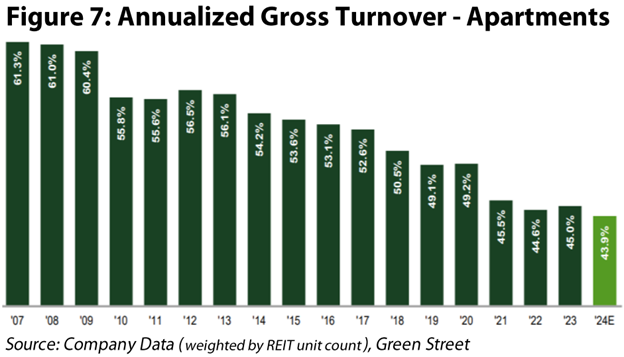

With homeownership increasingly out of reach, multifamily and SFR REITs continue to benefit from record-low annualized turnover rates as highlighted in Figure 7. While both multifamily and SFR REITs benefit from prolonged rental tenures, they serve different renter profiles. SFRs appeal to families seeking more space to raise a family, have a yard, a garage, and better school district access, whereas multifamily REITs, particularly in urban markets, capture demand from younger renters delaying marriage and children. As affordability pressures persist, both segments remain positioned for sustained growth as rental housing will remain the primary solution for millions of Americans, sustaining long-term demand for SFR and multifamily REITs for many years to come.

–

–

Conclusion

Demographic shifts remain a foundational driver of REIT performance, influencing investment strategies and sector allocations. However, Chilton emphasizes a bottom-up approach, focusing on property-level fundamentals and market-specific dynamics. This allows us to identify undervalued opportunities and make strategic investments based on intrinsic value and growth potential, rather than relying solely on demographic patterns.

–

While the aging population continues to fuel demand for senior housing and MOBs, and migration trends favor Sun Belt markets, we recognize that demographics are just one piece of the puzzle. Our strategic positioning capitalizes on these long-term tailwinds through targeted investments in SFR and healthcare REITs, alongside Sun Belt multifamily REITs expected to experience high-growth in 2026 and 2027 as supply deliveries subside and demographic tailwinds shine through.

–

Isaac A. Shrand, CFA

ishrand@chiltoncapital.com

(713) 243-3219

Matthew R. Werner, CFA

mwerner@chiltoncapital.com

(713) 243- 3234

Bruce G. Garrison, CFA

bgarrison@chiltoncapital.com

(713) 243-3233

Thomas P. Murphy, CFA

tmurphy@chiltoncapital.com

(713) 243-3211

–

RMS: 3,108 (2.28.2025) vs. 2,966 (12.31.2024) vs. 3,177 (12.31.2021) vs. 1,433 (3.23.2020)

–

An investment cannot be made directly in an index. The funds consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use.)

The information contained herein should be considered to be current only as of the date indicated, and we do not undertake any obligation to update the information contained herein in light of later circumstances or events. This publication may contain forward looking statements and projections that are based on the current beliefs and assumptions of Chilton Capital Management and on information currently available that we believe to be reasonable, however, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. This communication is provided for informational purposes only and does not constitute an offer or a solicitation to buy, hold, or sell an interest in any Chilton investment or any other security. Past performance does not guarantee future results.

Information contained herein is derived from and based upon data licensed from one or more unaffiliated third parties, such as Bloomberg L.P. The data contained herein is not guaranteed as to its accuracy or completeness and no warranties are made with respect to results obtained from its use. While every effort is made to provide reports free from errors, they are derived from data received from one or more third parties and, as a result, complete accuracy cannot be guaranteed.

Index and ETF performances [MSCI and VNQ and FNER and LBUSTRUU] are presented as a benchmark for reference only and does not imply any portfolio will achieve similar returns, volatility or any characteristics similar to any actual portfolio. The composition of a benchmark index may not reflect the manner in which any is constructed in relation to expected or achieved returns, investment holdings, sectors, correlations, concentrations or tracking error targets, all of which are subject to change over time.