The Ten Commandments of REIT Investing | February 2025

In December 2024, the Chilton REIT Strategy celebrated its 20th year since being founded by Bruce Garrison in January 2005. Over this period, the strategy produced an annualized total return of +9.3% gross of fees (+8.5% net of fees), which compared to the MSCI US REIT Index (Bloomberg: RMZ) at +7.0% and the Vanguard Real Estate ETF (Bloomberg: VNQ) at +6.6%. This period covers bull markets, bear markets, the birth of new property types, and multiple economic regime changes. While the price target methodology has evolved over the 20 years, the basic tenets underlying what makes a great REIT investment remain the same.

–

Mr. Garrison’s background spanning over 50 years in the industry on both the buy side and sell side have created the foundation upon which the Chilton research process resides. The REIT landscape has undergone a profound transformation since he started his REIT journey in 1972. Today’s successful equity REITs bear little resemblance to their predecessors, evolving into sophisticated and diverse enterprises involved in property types that were unimaginable when REIT legislation was first passed in 1960 – and even at the dawn of the modern REIT era in 1991. While the period between 1972 and 1991 is often overlooked, the hard lessons learned during those years laid the groundwork for the more resilient and innovative REITs that emerged in the 1990’s. Subsequent economic cycles, particularly the 2008-09 financial crisis, solidified REITs as a durable asset class prepared to thrive in the decades ahead.

–

Today’s REITs are no longer passive investment vehicles; instead, they operate as dynamic companies with multiple levers for sustained dividend growth. Despite significant evolution, the core principles of success have remained remarkably consistent. Below, we outline ‘The Ten Commandments of REIT Investing’ – a set of guiding principles for REIT management teams, bankers, boards of directors, and investors to ensure long-term success, premium valuation, and steady dividend growth.

–

–

The Ten Commandments of REIT Investing

- Management is Number One. To re-write the old real estate maxim of “location, location, location,” the three most critical tenets for a successful REIT are “management, management, management.” Continuity of strategy, exceptional people skills, and a proven track record of value creation define great management teams. Simon Property Group (NYSE: SPG) is a prime example of all of these attributes. Celebrating its 31st anniversary as a public company in 2024, SPG has continually refined its core competencies to become the world’s preeminent owner and operator of retail real estate. Over this period, it has distributed over $45 billion in dividends (approximately $120 per share) to its shareholders. As of January 31, 2025, SPG closed at $173.86 per share.

–

- Strong Track Record. A REIT’s ability to navigate economic cycles and outperform its peers is a hallmark of strong leadership. Federal Realty (NYSE: FRT) has a sterling track record in retail real estate that goes back to the 1970’s. It has an unblemished record of dividend growth spanning 56 consecutive years despite all the upheaval that has occurred historically with retailers that come and go and, more recently, how brick and mortar stores have demonstrated staying power in an era of e-commerce. This consistency underscores the value of a long-term strategy and disciplined execution.

–

- A Fully Integrated Organization. Creating franchise value that exceeds the sum of a REIT’s real estate holdings cannot be understated. Achieving a premium to net asset value (NAV) enables REITs to raise equity without diluting shareholders, creating a virtuous cycle that drives long-term earnings growth. EastGroup Properties (NYSE: EGP) provides a textbook example. EGP began its journey as a diversified REIT involved in multiple property types, but, fortunately for investors, it learned that the best formula for success was a straight-forward strategy focused 100% on multi-tenant logistics parks oriented to “last mile” end users. Having development, leasing, and financial professionals under one roof with aligned incentives enabled the company to properly allocate capital, heeding signals from the financial and real estate markets. The result has been 32 consecutive years in which EGP has either increased or maintained its dividend, including 13 straight years of growth.

–

- Sharpshooter Focus. In the early days, REITs often adopted diversified models, spanning multiple property types and geographies. Over time, this strategy fell out of favor as investors recognized the advantages of specialization. In a REIT focused on one property type, management is more readily able to recognize and take advantage of opportunities at all stages of the real estate cycle, as well as foresee or react to adverse situations. We saw many examples of this following the Great Financial Crisis (GFC) of 2008-2009 where REITs were able to purchase top-notch properties at prices lower than replacement costs and accretive to earnings. For example, BXP Inc (NYSE: BXP) demonstrated strategic agility by acquiring the GM Building in New York during the GFC, securing a high-quality asset at a discounted price.

–

- High Insider Ownership. Alignment between management and shareholders is critical. Minimum stock ownership requirements for executives and directors have significantly improved alignment since the modern REIT era began in 1991. High insider ownership reassures investors that management’s interests are closely tied to shareholder outcomes.

–

- Avoid Conflicts of Interest. Transparency and ethical governance are essential. While related-party transactions and self-dealing were common in the 1990’s, today’s REITs largely avoid these pitfalls. For instance, in the 1990’s the REIT market was flooded with initial public offerings that often-held real estate out of the REIT’s portfolios for a variety of reasons, including not producing sufficient cash flow. Early missteps have given way to a strong culture of accountability, ensuring investor trust going forward.

–

- Avoid Mezzanine Lending. There is a reason that equity REITs have dramatically outpaced mortgage REITs over the past 50 years: the durability of earnings from equity ownership is far more desirable and deserving of a higher multiple. Today, we still see equity REITs that are tempted to use mezzanine lending to boost near term earnings, especially if cap rates on property ownership do not allow for accretive acquisitions. However, while near term earnings from such activities may be accretive, this is merely a temporary boost that has to be either a) replaced by a similar or higher coupon loan at maturity to sustain the earnings, or b) the property is bought at the low cap rate anyway, thus losing the earnings boost. We have seen too many of these deals go sideways, and the risk of this happening even one time is not worth the reputational damage that could occur. Investors typically place a much lower multiple on interest income, so the earnings boost rarely leads to any sustained stock outperformance. Furthermore, NAV focused investors carry these investments at book value, making it an NAV-neutral transaction. Finally, disclosures around the capital stack are scant, if disclosed at all, making it difficult to assess the risk.

–

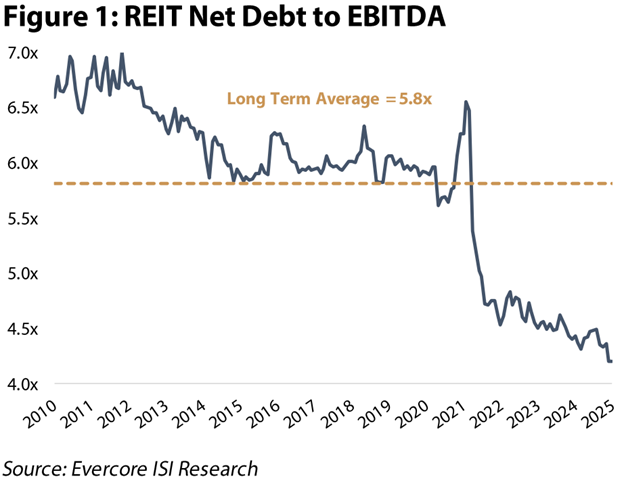

- Financial Strength and Flexibility. The contrast between the ‘haves’ and ‘have-nots’ was stark in the GFC. Though painful for many, it became a watershed event, and the actions taken subsequently account for why REIT debt ratios (Figure 1) and dividend payout ratios are at or near historic lows. Due to the collapse of Lehman Brothers and the capital markets, a majority of REITs were forced to cut dividends and raise dilutive equity in order to satisfy lenders and have enough cash to run their businesses. Following the GFC, aside from a pandemic that severely impacted cash flow, public REITs have not had to worry about a capital market event destroying their companies. Low dividend payout ratios give REITs free cash flow that serves as both a buffer for any such interruptions as well as internally-generated ‘equity’ that can be deployed without going to the capital markets. Today, public REITs maintain net debt ratios near 30% of gross assets, less than half of a typical private equity investment. In addition, well-laddered maturity schedules minimize exposure to interest rate volatility and capital market disruptions, should they occur.

–

–

- The Simpler, the Better. Financial reporting is complicated enough for the typical investor not acquainted with the arcane terminology used by real estate investors. For example, wholly owned portfolios are preferable to complex joint ventures (JVs). JVs create the need for additional pages in SEC filings and supplemental reports to inform the investor of the true economic earnings and assets/liabilities of the company, thus preventing easy side-by-side comparisons. Generally accepted accounting principles (GAAP) have always been inadequate in presenting financial statements that investors can understand. In addition, it is already difficult for a layperson to go from a world looking at net income and book value to FFO (Funds from Operations), AFFO (Adjusted Funds from Operations), and NAV. REITs with simple business models and easy to follow filings / supplementals deserve a higher multiple. Chilton has been proactive in rewarding such REITs by serving on the committee for the NAREIT CARE Awards over the past 10 years, an annual contest for Communication and Reporting Excellence.

–

- “Quality” of Reported Earnings. GAAP accounting allows too many opportunities to disguise reality. When helping structure the IPO of AvalonBay Properties (NYSE: AVB) in 1993, Mr. Garrison encouraged management to be a leader in adopting conservative accounting principles such as including clear disclosures of capital expenditures necessary to maintain a real estate portfolio. AVB’s conservative accounting practices during its 1993 IPO set a benchmark for the industry, earning it the highest multiple of all apartment REITs that went public that year. This translated into a lower cost of capital, a goal that every REIT should pursue as a part of a winning strategy. An example we see today that lowers the quality of earnings is the use of interest rate swaps and caps. Under GAAP accounting, a REIT can spend millions of dollars fixing interest rates on a variable loan, but such sums are not subtracted from reported FFO/AFFO, the primary earnings metrics for REITs. Instead, an asset is created on the balance sheet and then amortized as a non-cash expense on the income statement over the life of the interest rate cap. Because the amortization is a non-cash charge to income, it can be added back to a REIT’s AFFO or ‘Core FFO’. Furthermore, disclosures around the expiration of the cap or swap may be difficult to find (or nonexistent), leading to potential surprises when they adjust. Thus, we believe it is a perfect example of a REIT trying to “have its cake and eat it too!”

–

Conclusion: Lessons for the Future

Today, public REITs are facing stiff competition for investor’s money from private equity alternatives. It is safe to assume that few, if any, follow some of the Ten Commandments of REIT Investing. Investors in these private alternatives have demonstrated short term memory loss as to what happened in the GFC for such investments. Those that bought from 2010-2020 have likely enjoyed excellent returns, goosed by declining interest rates, high leverage, and falling cap rates. However, we believe public REITs will be on a more level playing field with their private counterparts going forward, and many will have a clear advantage.

–

With superior balance sheets, we believe public REITs are in the perfect position to illustrate superior total returns going forward. Though some private participants have proactively marked down their portfolios (and some forced to do so due to debt maturities), there is still a reckoning to come from investments made in the peak years of 2021 and 2022. Lenders have been willing to work with these borrowers, but it has certainly dampened their flexibility. In contrast, public REITs are sporting a record low net debt/EBITDA, and have options for borrowing secured or unsecured – usually at lower rates. As such, we believe public REITs’ superior access to capital will be a differentiator in this higher interest rate environment. Examples include acquisitions and development, but also include maintaining properties and attracting/retaining tenants.

–

In summary, the lessons of the past 50 years have prepared REITs to navigate the next 50. Their disciplined approach to financial management, focus on sustainable growth, and commitment to transparency provide a solid foundation for enduring success. By following the Ten Commandments of REIT Investing, REIT management teams can build REITs that will endure the economic and real estate cycles to come over the next 50 years, and REIT investors using such principles can construct a portfolio that outperform a passive ETF that is forced to own an index that may include REITs following a different path.

–

Bruce G. Garrison, CFA

bgarrison@chiltoncapital.com

(713) 243-3233

Matthew R. Werner, CFA

mwerner@chiltoncapital.com

(713) 243- 3234

Thomas P. Murphy, CFA

tmurphy@chiltoncapital.com

(713) 243-3211

Isaac A. Shrand, CFA

ishrand@chiltoncapital.com

(713) 243-3219

–

RMS: 2,997 (1.31.2025) vs. 2,966 (12.31.2024) vs. 3,177 (12.31.2021) vs. 1,433 (3.23.2020)

–

An investment cannot be made directly in an index. The funds consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use.)

The information contained herein should be considered to be current only as of the date indicated, and we do not undertake any obligation to update the information contained herein in light of later circumstances or events. This publication may contain forward looking statements and projections that are based on the current beliefs and assumptions of Chilton Capital Management and on information currently available that we believe to be reasonable, however, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. This communication is provided for informational purposes only and does not constitute an offer or a solicitation to buy, hold, or sell an interest in any Chilton investment or any other security. Past performance does not guarantee future results.

Information contained herein is derived from and based upon data licensed from one or more unaffiliated third parties, such as Bloomberg L.P. The data contained herein is not guaranteed as to its accuracy or completeness and no warranties are made with respect to results obtained from its use. While every effort is made to provide reports free from errors, they are derived from data received from one or more third parties and, as a result, complete accuracy cannot be guaranteed.

Index and ETF performances [MSCI and VNQ and FNER and LBUSTRUU] are presented as a benchmark for reference only and does not imply any portfolio will achieve similar returns, volatility or any characteristics similar to any actual portfolio. The composition of a benchmark index may not reflect the manner in which any is constructed in relation to expected or achieved returns, investment holdings, sectors, correlations, concentrations or tracking error targets, all of which are subject to change over time.