Portfolio Insight | 4th Quarter 2024

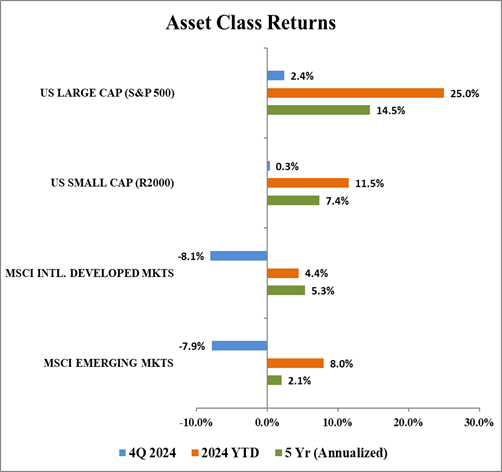

The S&P 500 ended 2024 on a high note, weathering a few periods of high volatility in the fourth quarter to gain 2.4% and close at 5,882, just 3% below the all-time high set in early December. For the year, the market moved 25.0% higher, on top of 2023’s impressive 26.3% move. Inflation growth continued to trend lower, the job market remained solid, and economic and earnings growth trends remained positive.

Mega-cap growth stocks led the pack again in 2024 despite persistent investor concerns regarding market concentration and significant outperformance since 2022. As a result, small and mid-caps as well as value names lagged the overall index significantly. Sector leadership remained narrow as the top performing areas were Communication Services (also top in 2023), Information Technology, and Financials, while Materials, Health Care, and Real Estate lagged the most.

In the fourth quarter, the strongest sectors were Consumer Discretionary, Communication Services, and Financials while Materials, Health Care, and Real Estate were the weakest. A brief shift away from mega-cap leadership in July did not persist into the fourth quarter, and growth names led the way again.

Another Solid Year

A second consecutive year of major S&P 500 gains came as consumer spending held up amidst a favorable job market and a generally improving inflation backdrop. Artificial intelligence remained the hottest topic in corporate America. AI models improved significantly and a number of companies including Salesforce and Meta Platforms realized immediate benefits.

The Federal Reserve, seeing tangible improvement on the inflation front, finally began cutting rates in September, though interestingly, some market rates have since risen. While the market is anticipating potentially decent economic growth, the inflationary implications of President-elect Donald Trump’s threat to implement tariffs on US trading partners, as well as concerns over the US fiscal situation, have moved longer-term rates higher. A favorable liquidity backdrop and solid corporate earnings have also been supportive of new all-time US market highs, despite global instability in Ukraine and the Middle East as well as economic weakness in China.

Election Finally Over

A highly contentious US election concluded with Trump winning the presidency and the Republican party taking control of both the House and the Senate, but by narrow margins. Markets rose after the election, likely on the view that corporate taxes won’t go up and that the new administration will pursue pro-growth policies underpinned by less regulation.

Interestingly, the world’s current richest person, Elon Musk, has become close with Trump after supporting his election campaign, and he and others like Vivek Ramaswamy are being rewarded for their loyalty. These two have been appointed by Trump to head a newly created Department of Government Efficiency (DOGE) which will be tasked with seeking ways to cut federal spending and reduce the size of the government and the federal fiscal deficit. Numerous other business leaders such as Meta’s Mark Zuckerberg and Amazon’s Jeff Bezos have also been getting close to Trump lately in hopes of helping to shape his business policies.

Policy Uncertainty Ahead

There is uncertainty regarding specific actions the administration will take in certain industries, and many of Trump’s choices for Cabinet and other senior leadership positions have sparked controversy and wild market action.

In particular, the DOGE announcements have put a target on areas like defense spending for potential budget cuts, which has harmed defense stocks even though many other appointees are China hawks and Republican administrations are often seen as bullish for defense. Similarly, Trump’s nomination of outspoken junk food, vaccine, and obesity drug critic Robert F. Kennedy Jr. to head the Department of Health and Human Services has hurt processed food and health care stocks. In reality, the sorts of radical budget cuts and policy changes that the incoming administration may want to implement could be highly difficult to enact.

Domestic Equity Outlook

Following a second consecutive year of major market gains, it would be prudent to expect stocks to take a temporary breather early in 2025. Indeed, there was already a minor selloff in December, bucking normally strong seasonal trends.

Key questions entering the new year are whether a rebound of inflation and/or sustained economic strength might delay Federal Reserve rate cuts, and whether the labor market and consumer spending will hold up. Uncertainty about the new Trump administration’s potential tariffs and budget cuts could drive major sector volatility until plans come into focus. Interest-rate sensitive areas like housing are relatively weak and will likely need lower rates to rebound.

Meanwhile, with inflation growth mostly trending lower, the Fed easing its restrictive interest rate policy, the labor market hanging in there, and corporate earnings growth improving, the backdrop for risk assets like equities remains generally favorable. Even assuming some valuation contraction, a +6-8% total return for the overall market is possible due simply to expected earnings growth. Many mega-caps remain attractive due to superior business models and earnings growth, but names/industries/sectors that have lagged the overall market-cap weighted index in recent years might present opportunities for higher returns.

Fixed Income Outlook

After rallying significantly last quarter, the bond market reversed course during 4Q24 due to a post-election rise in longer-term interest rates. The Bloomberg US Aggregate Bond Index, a combination of government and corporate bonds, declined 3.1% during the quarter, which reduced its full-year total return to just 1.3%. The 10-year Treasury yield rose from 3.81% at the beginning of the period to 4.58% at quarter-end, having begun the year at 3.88%. Despite the headwind of higher interest rates in 2024, bond positions in most client accounts saw mid-single-digit returns due to a shorter maturity profile (longer-term bonds are more sensitive to moves in interest rates).

During the quarter, the Federal Reserve implemented two additional 0.25% rate cuts, bringing the Federal Funds rate down to a range of 4.25% – 4.50% from the recent peak range of 5.25% – 5.50%. As a reminder, the Federal Funds rate is the short-term interest rate banks charge each other for overnight loans. The impact of these rate cuts trickles down to individuals, impacting everything from interest paid on money market accounts to interest charged on home equity loans.

If the Fed is cutting rates, why are longer-term rates moving higher? Several factors have had an impact. On the positive front, near-term economic growth projections have moved somewhat higher in recent months. As a result, the number of expected future Fed rate cuts have moved lower, which puts upward pressure on longer-term rates.

On the other hand, concerns over inflation and the US fiscal situation have also put upward pressure on rates. Several recent inflation reports have been “hotter” than hoped and future inflation expectations have moved slightly higher. Since maximum employment and price stability are the Fed’s dual mandate, higher inflation would mean less aggressive future rate cutting. And while many of President-elect Trump’s economic policies are considered pro-growth, the introduction of additional tariffs is seen as inflationary. Similarly, lower taxes may increase the deficit and ultimately, increase the size of the already ballooning US debt load, prompting investors to demand higher yields to compensate for the potential higher credit risk.

Looking ahead to 2025, we still believe that bonds remain an attractive asset class for those clients with fixed income allocations. The majority of bonds that we are buying today, with maturities between 1-6 years, currently yield between 4.5% – 5.0%. As always, each bond is investment-grade quality and is bought with the intent to hold until maturity.

Global Markets Outlook

US markets significantly outperformed their international counterparts in the fourth quarter, with US large caps posting a 2.4% gain and US small caps rising 0.3%, while emerging markets declined by 7.9% and international developed markets fell by 8.1%. For the full year, US large caps returned a remarkable 25.0%, US small caps gained 11.5%, emerging markets advanced 8.0%. and international developed markets rose by a modest 4.4%.

Source: Bloomberg, Chilton Capital Management

Two key reasons for the disparity in returns have been the ongoing outperformance of growth compared to value and the strengthening of the US dollar. The US (large caps in particular) has much greater exposure to growth stocks compared to international markets, and growth has now outperformed value in 7 of the past 8 quarters. In Q4, the Russell 1000 Growth Index rose by 7.1% compared to -2.0% for the Russell 1000 Value Index. For 2024, the Russell 1000 Growth Index rocketed 33.4% compared to 14.3% for the Russell 1000 Value Index. Large US companies are disproportionally benefitting from a strong economy and innovation in areas like artificial intelligence. Exceptionally strong returns from the so-called “Magnificent 7”—a group of leading U.S. large cap technology and consumer growth companies—had a substantial influence on the broader benchmarks this quarter, underscoring the potent combination of strong earnings growth, considerable market share, and economic moats. International markets, in contrast, operate in a weaker macro environment with higher concentrations in value-oriented sectors such as financials, energy, and materials, which have not produced a similar cohort of high-growth innovators.

Secondly, the US Dollar was a severe headwind to international performance in Q4 as shifting political expectations in the United States, including the potential for tax cuts and tariff adjustments following a Republican sweep, as well as the Federal Reserve’s more hawkish monetary stance, drove the US Dollar Index 7.6% higher in Q4. Even as the US central bank turned more cautious on rate cuts, other major central banks, including the European Central Bank and the Bank of Canada, cut rates sharply in response to unexpectedly weak economic data. These divergent policy paths propelled the US dollar higher and put significant pressure on non-US equity returns when translated back into dollars.

Despite recent challenges, there are positives for international markets. The US Dollar Index is unlikely to continue the recent pace of its ascent. Additionally, international equities continue to trade at a historically wide valuation discount relative to US equities, currently at a forward PE of 13.4x compared to 22.2x for the S&P 500.

However, this spread has been wide for years, and has not been a good short-term predictor of outperformance. International markets will likely need a catalyst such as a broadening out of market leadership or disappointing performance from the Magnificent 7 in order to have a better relative 2025.

REIT Commentary

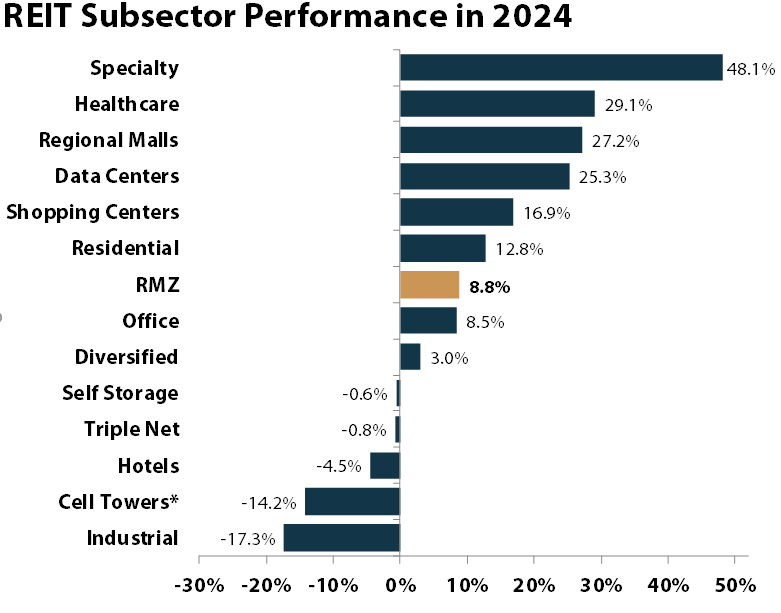

In the fourth quarter of 2024, the MSCI US REIT Index (RMZ) produced a total return of -6.1%, though it was flat in the first two months. What followed in December was one of the worst months for REIT performance in years due to fears over a political regime that could struggle to tame inflation and lead to higher interest rates for longer. While the Federal Open Market Committee cut rates by a total of 100 basis points (bps) over three cuts in 2024, this still fell short of the market expectation of 150 bps over six cuts at the beginning of 2024. In spite of a cut on December 18th, the 10-year Treasury yield rose to 4.58% by year end and resulted in a total return of -7.4% for the month.

For the full year of 2024, the RMZ produced a total return of +8.8%, below our forecast of +12-16%. However, the index was up 17.4% on a total return basis through November 30th, above our forecast for the year. Through November 30th, the themes played out largely as we had hoped in our bullish forecast, as most REITs traded at NAV premiums and the acquisition market was beginning to thaw. We believe that the December pullback makes the setup incrementally more attractive for 2025.

For 2025, we are forecasting a total return for the RMZ between +10% and +15% using our three-pronged method of cash flow, NAV, and dividend growth. While a higher 10-year Treasury yield remains a risk, we believe that REITs can perform well in a flat yield environment thanks to accelerating cash flow and dividend growth, with the potential “X factor” of a resurgence of accretive acquisitions.

As always, we believe active management will be key in 2025. As shown in the chart, there were significant deviations between sector performance in 2024, a trend we expect to continue. We believe that REITs with NAV premiums, accelerating cash flow growth, and a flexible balance sheet for acquisitions will be in the best position to outperform in 2025. As such, the largest over-weights going into 2025 are healthcare, shopping centers, single family rentals, and cell towers (versus the RMZ, underweight to VNQ). Underweights include lodging, regional malls, industrial, multifamily, office, and triple net. We are equal weight to self-storage and data centers.

While December was a disappointing ending to an otherwise impressive year for REITs, we believe it is important to “zoom out” and be thankful for the returns that have been provided by REITs. As of December 31st, the trailing 10-year total return for the RMZ was +5.7%, just short of our long-term forecast of +6-8%. Given the recent pullback, we believe that the next 10 years could be slightly higher at +7-9%, even if interest rates remain elevated. While the S&P 500 bested REITs over the past 10 years by a hefty margin, we remind our readers that “envy is the thief of happiness”; in financial terms, REITs did their job of providing income and growth to a diversified portfolio. Going forward, we believe that the asset class will continue to gain acceptance as a key allocation that benefits from economic growth but can also provide downside protection as growth slows and interest rates decline.

Bradley J. Eixmann, CFA

Brandon J. Frank

Robert J. Greenberg, CFA

Matthew R. Werner, CFA