Portfolio Insight | 2nd Quarter 2024

After pulling back in April, the S&P 500 continued to surprise market forecasters by moving 4.3% higher in the second quarter, closing just below a record high and bringing its first half gain to a very solid 15.3%. While the labor market began to soften late in the quarter, the overall economy remains decent, inflation continues to trend lower, and corporate earnings growth is improving.

In the second quarter, the strongest sectors were Information Technology, Communication Services, and Utilities while Materials, Industrials, and Energy lagged the most. For the first half of 2024, Information Technology and Communication Services were the only two sectors that outperformed. The worst sectors were Real Estate, Materials, and Consumer Discretionary. Mega-cap growth companies continued to lead the market.

More New Highs

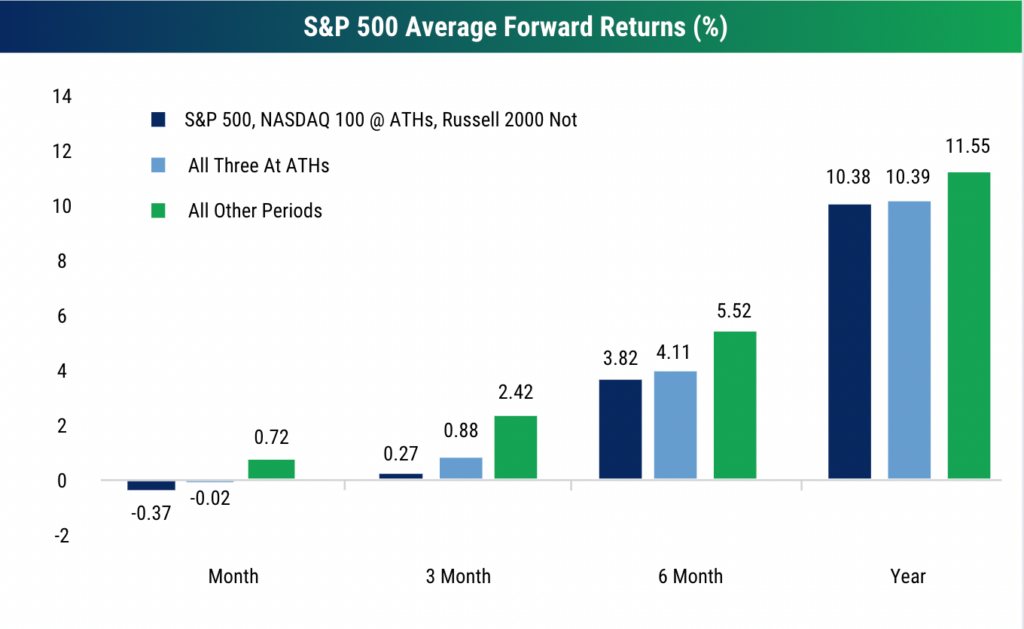

The market’s steady advance to a number of new all-time highs might cause some investors to worry that a major downturn must be near. However, history shows that, usually, new highs lead to more new highs in the ensuing 3, 6, and 12-month periods:

Source: Bespoke Investment Group | As of June 12, 2024

Of course, continued market gains need to be fundamentally driven. The good news is that, due to a number of drivers, forward earnings expectations for companies are improving not only in the US but across the globe, supporting more market gains.

More Mega-cap Dominance

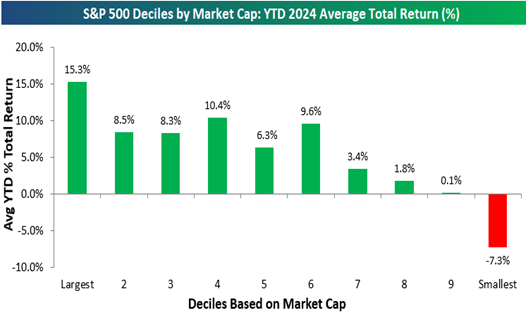

Despite calls for a change of market leadership over the past year, mega-cap growth stocks continue to pace the S&P 500. As a matter of fact, near the end of the quarter, the only market cap decile to have outperformed the overall S&P 500 this year was the largest one:

Source: Bespoke Investment Group | As of June 9, 2024

As rich companies get richer, the market caps of the three largest US companies, Apple, Microsoft, and NVIDIA, have each eclipsed $3 trillion, which is larger than the entire Russell 2000 small cap index. We believe this makes fundamental sense. Mega-cap growth companies like these have the strongest earnings growth, a cost of capital and hiring advantage in a higher interest rate/higher inflation environment, and a greater capacity to benefit from major secular trends such artificial intelligence (AI). However, they warrant close attention in case valuations expand to a point that is no longer justified by fundamentals.

Stock Picker’s Market

A positive recent development for active stock pickers, as evidenced through the wide returns by market cap decile above, is increasing dispersion of returns/lower correlation between the best stocks and worst stocks in the market. When returns of the best stocks and worst stocks diverge widely, active managers have more chances to outperform the market by selecting those names with strong fundamentals or special factors aiding their performance.

It is likely not a coincidence that this widening dispersion is occurring in a higher interest rate environment. Some companies are now dealing with higher costs of capital and higher inflation than they are used to. The “rising tide lifting all boats” phenomenon, in which near-zero interest rates pushed both low and high quality companies higher, has ended.

Domestic Equity Outlook

Following some “hot” inflation reports early in the year, the latest monthly readings have resumed a gradual trend lower. Economic growth remains decent, a tight job market is slowly loosening, and, most importantly, corporate earnings expectations are rising. As a result, the market is justifiably hitting fresh all-time highs.

With the S&P 500’s significant move higher in the first half, it is possible that most or all of this year’s gains have already occurred. However, the market could keep moving higher if a strong consumer continues to support economic growth and inflation continues to move toward 2%, prompting the Fed to begin targeted and gradual interest rate cuts in the coming months. Regardless of the timing of the overall index move, there are numerous attractive opportunities for active portfolio managers with a disciplined and consistent investment process.

Fixed Income Outlook

With interest rates moving modestly higher, fixed income returns were muted during the quarter. The Bloomberg US Aggregate Bond Index, a combination of government and corporate bonds, had a total return of 0.1% in Q2. Year-to-date, the index remains in negative territory at -0.7%. 10-year Treasury yields rose slightly from 4.20% to 4.36% during the quarter, with shorter-term Treasury yields moving similarly. While higher rates were a headwind to returns, interest income more than offset the impact. As has been the case for some time, bond returns in most client accounts have remained in positive territory due to a shorter maturity profile (longer-term bonds are more sensitive to moves in interest rates).

Similar to Q1, market participants continue to reduce their expectations for Federal Reserve rate cuts this year. The bond market is now pricing in just one or two 0.25% rate cuts through year-end, well below the five or six expected at the beginning of the year. Over the next three years, the market expects the short-term Fed Funds rate to come down by approximately 2.0%, and land at around 3.5%. While a 2.0% decline from current levels is noteworthy, just over a year ago, Fed Funds were expected to settle below 3.0%. In other words, short-term interest rates are now expected to “stay higher for longer.”

Declining interest rates have several real-world implications. On the one hand, lower borrowing costs should provide a stimulative boost to the economy. Households benefit from lower costs for everyday obligations such as mortgages, home equity loans, car loans, student loans, etc. This in turn creates a tailwind for businesses such as home improvement retailers and auto dealerships. Individual businesses also benefit as the cost for capital expenditures, workforce expansions, and even acquisitions all move lower. However, for investors currently enjoying around 5.0% money markets, these cash yields will move down in lockstep with future Fed Funds rate cuts.

The timing and magnitude of future rate cuts have been pushed out for several reasons. Due in large part to the resilient US economy, inflation has remained stickier than hoped. While inflation growth has been slowing, we are not yet at the Fed’s preferred 2% level. Likewise, average hourly earnings, the unemployment rate, job openings, and initial jobless claims are all better than historical averages. Only very recently have these measures begun to normalize.

Fortunately, the Fed has signaled that it is likely to act before inflation falls all the way to 2%, and before unemployment moves well above historical norms.

We still believe that bonds remain an attractive asset class for clients with fixed income allocations. The majority of corporate bonds we are buying today, with maturities of 1-5 years, yield between 4.5% – 5.5%. Each bond is investment grade quality and is bought with the intent to hold until maturity.

Global Markets Outlook

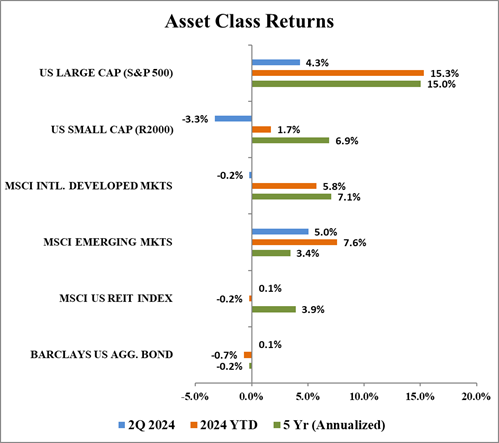

Global markets recorded mixed performance in the second quarter of 2024. US large cap stocks sustained market leadership returning 4.3% while small caps were down 3.3%. International developed markets were nearly flat, and emerging markets improved 5.0%. Year-to-date, US large cap stocks have gained 15.3%, small caps have advanced 1.7%, international developed markets are up 5.8%, and emerging markets have risen 7.6%.

Source: Bloomberg, Chilton Capital Management

The wide divergence in performance is largely attributable to growth stocks outperforming value stocks. US large cap stocks are much more growth-oriented compared to other markets, with a higher weight in outperforming sectors such as Information Technology and Communication Services.

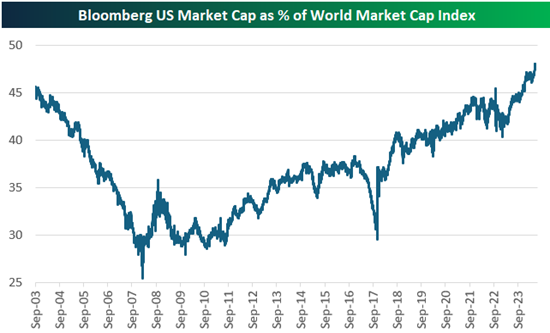

There is a wide dispersion of performance among the S&P 500 sectors so far this year, with Information Technology and Communication Services the only sectors outperforming, and the other nine all underperforming. In fact, over the last five years, Information Technology and Communication Services are the only sectors that have outperformed the S&P 500. Over the last ten years, Information Technology is by far the best performing sector, returning 728% compared to 233% for the overall index. This is a major reason why US large caps have been outperforming other markets, and why, as seen in the following chart, the US share of world market cap has been increasing since the global financial crisis.

Source: Bespoke Investment Group

Another recent headwind for international markets is the stronger dollar. The US Dollar Index (DXY) is up 4.6% year-to-date, making it more expensive for international investments in local currencies to be converted back to US dollars.

Despite a challenging stretch for markets outside of US large caps, global markets may soon benefit from the tailwinds of lower interest rates and lower inflation. The European Central Bank, Bank of Canada, Swiss National Bank, and Sveriges Riksbank (Sweden) have all begun to cut rates. The US Federal Reserve is likely to follow, although it is in less of a hurry, since the US economy is growing faster than peers and inflation is also running somewhat hotter (though moving in the right direction). Conversely, the Bank of Japan recently raised rates for the first time in 17 years (Japan’s interest rate had previously been 0% due to its unique economic challenges).

Looking ahead, the performance of mega-cap growth stocks will be a key area to watch. If companies such as NVIDIA, Meta, Alphabet, and Microsoft keep outperforming due to rising earnings estimates, it will be difficult to unseat US large cap stocks. However, if there is a change in leadership or the mega-cap growth stocks move lower as they did in 2022, it could benefit the relative performance of other markets.

REIT Commentary

In the second quarter of 2024, the MSCI US REIT Index produced a total return of 0.1%. Unfortunately for REIT investors, REIT prices have yet to decouple from movements in long term interest rates. Because real estate typically generates a steady (and growing) yield, there has historically been a playbook that REIT prices should trade down when rates are rising, and vice versa. We have spoken about this numerous times, debunking the theory based on interest rate movements in the 1990’s and 2000’s; however, since 2010, it has clearly worked over short term periods.

The degree to which REITs should move with rates is up for debate, as well as the ideal time to buy REITs while rates are rising. In a perfect world, one could predict the peak for interest rates and buy REITs as rates declined, followed by a timely sale at the trough of interest rates assuming the relationship remains constant. In practice, this is nearly impossible.

Our research suggests that investors that have been brave enough to buy REITs when the rate outlook was at its worst have been handsomely rewarded. In addition, a decline in rates is not needed to achieve double digit annual total returns for REITs – rates merely need to stop rising. Though we cannot predict the peak of interest rates for this cycle, we believe that REITs are on the cusp of a multi-year bull market driven by better-than-expected economic growth, muted new construction, competitive advantages, and the stabilization (and potential decline!) of interest rates.

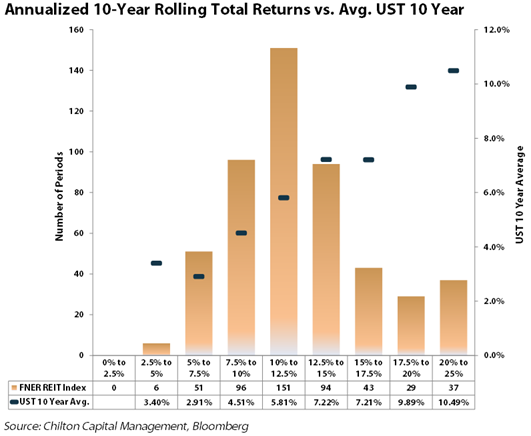

If rates can stabilize, albeit at a higher level, it is not all bad for public REITs. In fact, our research shows that it has led to higher 10-year rolling returns versus periods of low rates. As shown in the chart, the 10-year rolling total returns for REITs were highest when the 10-year Treasury yield averaged the highest rates over the corresponding period.

The reasoning for this is not intuitive, but we would point to the periods between 2007-2017 as an example of why lower rates actually don’t equate to higher returns. The zero-interest policy enacted by the Fed to stimulate the economy gave a cost of capital advantage to high leverage private real estate investors, leaving few opportunities for accretive acquisition or development for the public REITs. In contrast, higher borrowing rates provide public REITs with a significant advantage due to lower blended capital costs, especially when the cost of equity is lower for public REITs. In essence, the business model for public REITs is far superior today. We believe the next 10 years will be a much different world where public REITs’ share of the market will grow dramatically at the expense of private sources. As such, public REITs should not be ignored, but rather embraced for the structural advantages that come from navigating multiple cycles since the modern REIT era began in 1991.

Bradley J. Eixmann, CFA

Brandon J. Frank

Robert J. Greenberg, CFA

Matthew R. Werner, CFA