Portfolio Insight | 4th Quarter 2023

The S&P 500 regained its winning ways in the fourth quarter, ripping higher by 11.7% to close at 4,769, just 1% below its all-time closing high reached in January 2022. The S&P 500 advanced a healthy 26.3% in 2023, a welcome reversal of the steep losses in 2022. Inflation growth continued to slow during the quarter, and the Federal Reserve not only remained “on pause” with rate hikes but pivoted towards an outlook of likely rate cuts in 2024. Evidence of an imminent recession is scant, and the resilient economy, fueled by consumers enjoying near full employment and lower inflation, appears to be heading for a “soft landing.”

Market leadership was narrow in 2023 though breadth did improve as the year progressed. The top performing sectors for the full year, by far, were Information Technology, Communication Services, and Consumer Discretionary. Utilities, Energy, and Consumer Staples were the worst. In the fourth quarter, the strongest sectors were Real Estate, Information Technology, and Financials while Energy, Consumer Staples, and Health Care lagged the most. Mega-cap growth stocks, the pariahs of 2022, led the way in 2023 with dramatic gains fueled by confidence in peaking interest rates, a renewed focus on cost controls, and, for many companies, a tangible and material business driver in the form of artificial intelligence (AI).

Current Goldilocks Conditions

Following a three-month period of weakness from the end of July through the end of October, the market made a sustained, sharp move higher into year end. The catalysts for the gains were numerous, most notably a shift in Fed bias from tightening to potentially cutting rates in 2024 as inflation growth slows dramatically.

Positive economic growth persists though it has slowed from the rapid rate seen in the third quarter. Estimates for both GDP and corporate earnings growth are drifting higher. Consumers continue to show resilience as the job market remains tight, and lower inflation gives some relief on everyday purchases.

Gradually Fading Volatility

Coming out of the dismal 2022 market environment, many investors were skittish and worried about the future. A recession was almost universally forecast in 2023, and trust in the Fed’s ability to rein in inflation without crushing the economy was low. In the spring, a regional banking crisis spooked investors but did not become systemic. In late summer, market participants became anxious about a “higher for longer” rate environment. However, the Fed eventually changed its tone on future rate hikes.

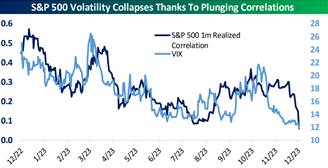

As investors became more comfortable with the outlook, volatility, as measured by the VIX Index, gradually fell into year-end, closing below 12 for the first time since January 2020. S&P 500 correlations, or the degree to which stocks in the index move together, also fell considerably. This type of environment is usually conducive to outperformance by active stock pickers with a proven investment process as opposed to periods when stocks move closely together.

Source: Bespoke Investment Group

Broadening Market Leadership

For much of the year, many investors were concerned by the narrow leadership in the market, though as is usually the case, such narrowness was ultimately followed by a broadening of participation to include other index names. An interesting chart below shows that in 2022, the Magnificent 7 (MSFT, AAPL, GOOG, NVDA, AMZN, META, TSLA) stocks lost $4.9 trillion of combined market value, falling nearly 48%. In 2023, through December 14th, however, they had only regained that same $4.9 trillion of market value, up an average 107%. The fact that they are not all at new all-time highs bodes well for possible further gains.

Source: Bespoke Investment Group

More importantly for the broader market, a record 72% of stocks underperformed the overall index for the whole year. However, from the recent second half 2023 low on October 27th, the S&P Equal Weight Index outperformed the market cap weighted S&P 500 Index +18.0% vs. +15.9%. If inflation and interest rates continue to fall and the economy avoids a recession, this broadening out of leadership could continue.

Domestic Equity Outlook

Assuming current trends in inflation, interest rates, employment, corporate earnings, and economic growth persist, the stock market could see further gains in 2024. Valuations are reasonable given current earnings estimates, which have actually been hooking upwards recently. We believe a +5% to +7% total return for the S&P 500 is attainable in 2024. It would not come as a surprise to see some potential first half weakness since the market enters the new year in a short-term extended condition.

Major risks to further gains include geopolitical issues, the lagged effects of rate hikes potentially tanking economic growth, or a Fed overcorrection in an economy that reaccelerates and drives inflation higher. The forthcoming US Presidential election could cause some investor angst in 2024, but the market historically does not care which political party is in power, and generally registers gains under both.

It is possible that different areas of the market, such as recently lagging sectors like Health Care and Consumer

Staples, as well as smaller large caps and small or mid-caps will fare better after being left behind in the robust but narrow 2023 market rally. Whatever comes our way in 2024, Chilton’s disciplined, consistent, active investment process will continue to adapt to changing market conditions, building on a successful long term track record in its major strategies.

Fixed Income Outlook

With inflation persistently moving lower, investors are now confident that not only has the Federal Reserve finished one of the most aggressive interest rate hiking cycles in history, but also that rate cuts are now on the horizon. This shift led 10-year Treasury yields to fall from 4.59% at the beginning of the quarter to 3.88% at quarter-end. As a result, the Bloomberg US Aggregate Bond Index, a combination of government and corporate bonds, rose 6.8% during the quarter and finished the year up 5.5%. This bond market rebound was a welcome relief after the 13.0% decline in 2022, the worst calendar year performance in the history of the index.

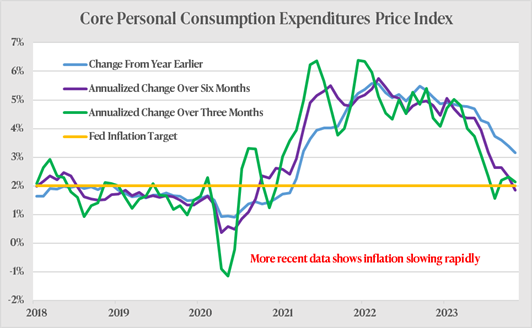

While rates did move lower during the quarter, rate volatility was extreme. Rates actually peaked in late October when lingering inflation, a tight labor market, the possibility of a government shutdown, the dramatic escalation of the Israel and Hamas war, and government deficit/debt concerns briefly pushed the yield of 10-year Treasuries over 5.0%. However, at least on the inflation front, these concerns have subsided somewhat. As shown in the graph below of the Core Personal Consumption Expenditures (PCE) Index, the Fed’s preferred inflation gauge that excludes the volatile food and energy components, the rate of growth continues to slow dramatically, especially looking at more recent monthly annualized data.

Source: Commerce Department

As we head into 2024, the Fed’s committee members currently estimate three 0.25% rate cuts by year-end, quite the “pivot” from recent history. On the other hand, investors are predicting an even more aggressive six rate cuts in 2024. These cuts should act as an economic stimulus by lowering consumer borrowing costs for everyday expenditures such as mortgages, auto loans, and credit cards as well as loans for corporate America.

While bond yields have moved lower over the past couple of months, the asset class remains relatively attractive, especially compared to the miniscule yields seen in recent years. For bonds maturing in the next 1-5 years, yields in the 4.0% – 5.0% range remain common. As such, we continue to buy high-quality corporate and US Treasury bonds for those clients with fixed income allocations. Also, while we are of the opinion that bond yields may move somewhat lower from today’s levels, interest rate risk is mitigated through the use of a laddered bond strategy. In other words, if rates happen to move higher, with bond maturities spread out over a number of years, maturing bonds could be reinvested at higher yields to maturity.

Looking forward to 2024, we feel a reasonable estimate for client fixed income returns is in the +3% to +5% range. While the direction of interest rates will have an impact on total returns, all of our bonds are purchased with the intention of holding to maturity, so any fluctuation in price should prove to be temporary.

Global Markets Outlook

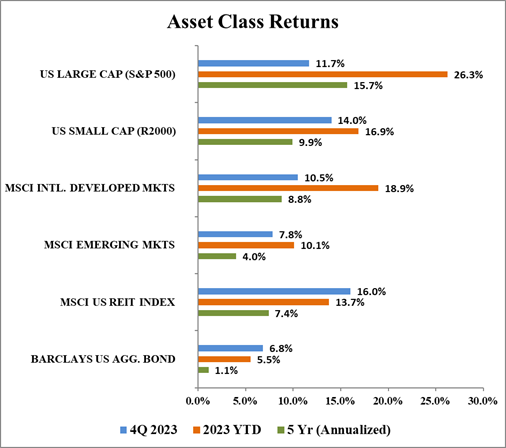

Like US large cap equities (S&P 500), most asset classes rallied sharply in Q4. US REITs led the way followed by US small cap equities. While international developed and emerging markets indices moved higher during the quarter, they lagged the S&P 500. Over the past 1-year and 5-year periods, the S&P 500 has outperformed most asset classes globally. This outperformance can largely be attributed to an oversized weighting towards growth-oriented sectors such as Technology and Communication Services. As such, asset class diversification away from the S&P 500 has been a headwind to relative performance.

Source: Bloomberg

A significant catalyst for non-US stock outperformance could be a shift in sentiment towards value stocks and away from mega-cap growth stocks. S&P 500 returns in recent years, especially in 2023, have in large part been driven by these mega-cap growth stocks. Any reversion in performance could prove to be a headwind for the S&P 500. On the other hand, international indices are much more heavily weighted towards value stocks in sectors such as health care, financials, energy, and utilities, with not as much exposure to the high-flying technology sector. This was a big reason international held up better during the market decline in 2022 as tech-oriented growth stocks pulled back dramatically.

As we turn the page on 2023, the spreads in valuation between growth/value stocks as well as US/international stocks now sit near multi-decade highs. Many of these value names have not participated in the market rally to the extent many of the growth names have. Any sort of mean reversion should favor value over growth which would likely be helpful for relative international performance. In addition, international equities have an average current dividend yield of nearly 3.0%, which is roughly double that of the S&P 500. Lastly, if the US dollar continues to depreciate against foreign currencies, it will act as an additional tailwind for non-US securities.

While there are no guarantees that international stocks will outperform US stocks in 2024, it would not come as a huge surprise if they do. However, many of these same arguments have been made for a number of years only to see the S&P 500 lead the global pack. Taken together, a reasonable estimate for non-US returns in 2024 is similar to those of US returns.

REIT Commentary

The year 2023 proved to be a turbulent ride for public REIT prices, as they closely followed the change in the 10-year Treasury yield. Though it seemed unlikely for most of the year, the MSCI US REIT Index (RMZ) produced a total return of 13.7% in calendar year 2023, which beat our initial forecast of +8% to +12%. However, we would break the year into two parts: first, the RMZ was down 11.3% for the year as of October 27th, almost 36% below the all-time high in December 2021. Factors contributing to this downturn included delayed return-to-office mandates, debt defaults (for non-public players), and higher-than-anticipated interest rates. The Federal Reserve’s deviation from market expectations played a pivotal role, with four interest rate hikes instead of the anticipated two, and a delay in the expected pause from March until September.

However, the market eventually adjusted, and once the Fed paused and commentary changed to rate cuts instead of rate hikes, a rally ensued. The RMZ produced a total return of +24.1% from October 27th to the end of the year while the 10-year Treasury yield declined by over 100bps from its peak on October 18th.

Looking ahead to 2024, while we expect negative headlines to continue for private real estate owners

who took on too much leverage at peak prices, we believe we have passed the bottom of public REIT pricing. As such, we are establishing a 2024 forecast for RMZ total returns in the range of +12% to +16% based on 4-5% dividend and adjusted funds from operations (AFFO) growth and a slight increase in multiples (decline in REIT yield). We believe that the bifurcation between have and have-nots will only get wider, and public REITs have found themselves firmly in the “have” category. Specifically, their cost and availability of capital advantage versus private real estate should be magnified in 2024, driving REITs to trade at a persistent premium to net asset value (NAV). Notably, this has not occurred for 12 consecutive months for public REITS since the early 2000’s. We believe REITs will be able to use this advantage to make accretive acquisitions from distressed (or at least “stressed”) owners facing debt maturities, forcing recapitalizations.

We believe the most attractive REITs are ones that have the ability to generate long term growth in AFFO and dividends, which we balance against our proprietary valuation models to build a portfolio with the best prospective risk-adjusted return. Over 80% of our holdings are in sectors with superb fundamentals characterized with high occupancy rates and rental growth. Looking out beyond 2024, we believe REIT investors can expect total returns to be in the range of +7% to +9%, a slight increase from the +6% to +8% we forecasted a year ago. The stabilization and potential decline in interest rates, along with mid-single digit dividend growth creates an environment that could shift fund flows back into public REITs after a decade of steady outflows.

While we understand that a tactical underweight allocation to REITs has been beneficial relative to equities (as measured by the S&P 500 Index), we believe that the back half of 2023 is a reminder that trends do not continue forever. With REIT prices still 21% off the all-time high from December 31st, 2021, versus the S&P 500 near an all-time high, the Chilton REIT team recommends that investors look to add a tactical allocation to public REITs.

Bradley J. Eixmann, CFA

Brandon J. Frank

Robert J. Greenberg, CFA

Matthew R. Werner, CFA