Warren Buffett Should Buy the Cell Tower REITs | September 2023

The drumbeat calling for the fall of office real estate has been steady and unrelenting since REITs peaked on December 31, 2021. As we reported in our May 2023 Chilton REIT Outlook titled, “Office REITs: Where is the Bottom?” most people are not surprised to hear that office REITs (as measured by the Bloomberg REIT Office Property Index (Bloomberg: BBREOFPY)) have produced a total return of -40% from December 31, 2021 to August 31, 2023.

–

However, some may be surprised that office has NOT been the worst real estate sector over the past 21 months. That dubious distinction belongs to cell towers, producing a -42% total return over the same period (using a straight average of the total returns for American Tower (NYSE: AMT), Crown Castle International (NYSE: CCI), and SBA Communications (NASDAQ: SBAC)). How can this be? While office utilization has barely reached 50% of 2019 levels, putting pressure on occupancy, rents, and dividends, cell phone data use has been growing at 25% annually over the past three years, and the mobile carriers are in the midst of a historic network upgrade from 4G to 5G.

–

As usual, the answer is nuanced, as some of the underperformance is justified. While the average investor may see a temporary negative change in trend as a reason to sell, legendary investors such as Warren Buffett interpret the negative news and performance as a reason to look more closely at a stock. To quote Mr. Buffett, “Be fearful when others are greedy, and greedy when others are fearful.”

–

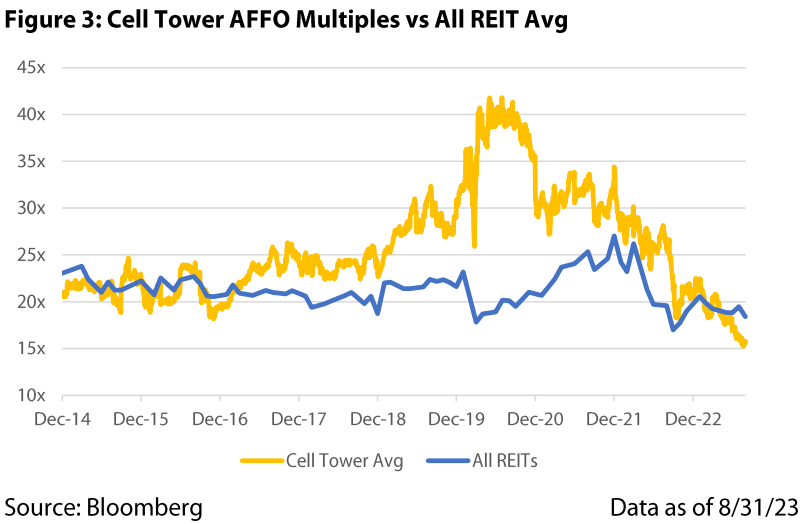

With “Mr. Market” (a Benjamin Graham original) pricing the cell tower REITs at cash flow multiples as of August 31, 2023 that have not been seen in over 15 years (as far back as cell tower companies were reporting AFFO, or adjusted funds from operations), we sincerely believe that Mr. Buffett and team should take a hard look at investing in cell tower REITs.

–

Buffett has stated that he looks for businesses that are trading below intrinsic value, have consistent earnings, and low debt. Each of the cell tower REITs has these attributes to varying degrees. As such, we believe the price declines over the past 21 months are unwarranted, and eventually the positive attributes of the cell tower REITs will garner a premium earnings multiple. To quote Mr. Buffett again (who was paraphrasing Benjamin Graham), “In the short run, the market is a voting machine but in the long run, it is a weighing machine.”

–

Buffett History with REITs

Warren Buffett has shown an adept ability to invest in phenomenal companies at attractive prices across multiple sectors, including consumer staples (Coca-Cola, Heinz, Costco), finance (Geico, American Express, Bank of America), energy (Occidental, Chevron), and technology (Apple), among others. However, he has yet to make a big splash in real estate. In spite of keeping a low profile within the sector, Buffet has a little history with REITs.

–

As far as we know, Buffett’s first foray into REITs was in 1999 when he auctioned off his wallet for charity. Anyone who gave more than $1,000 to Girls, Inc., a charity in Omaha, Nebraska, would receive access to the contents of the wallet: a stock tip. The promotion raised $210,000 and the stock tip was revealed to be First Industrial (NYSE: FR), an out-of-favor industrial REIT. That same year, Buffett disclosed holdings in Tanger Factory Outlets (NYSE: SKT), an outlet center REIT, and Town and Country Trust, an apartment REIT.

–

In 2017, Buffett invested in Store Capital (NYSE: STOR), a net lease REIT. The company was ultimately taken private at a modest premium.

–

Most recently, Buffett personally invested in the equity of Seritage Growth Properties (NYSE: SRG), the real estate spinoff from Sears Holdings. Given the stock’s performance, this is likely one he wants to forget.

–

None of the above were near the size of some of his most well-known investments. With a public investment portfolio of $348 billion, total market cap of $750 billion, and cash on hand of $147 billion as of June 30, 2023, Berkshire Hathaway has considerable capacity to make a new significant investment in one or all three of the cell tower REITs (average equity market cap of $51 billion as of August 31, 2023). Or, similar to Berkshire’s $34 billion purchase of BNSF in 2010, the largest US-based railroad company at the time, Berkshire could take one of them over completely. After all, cell towers are essentially the railroads of data.

–

The “BBE”

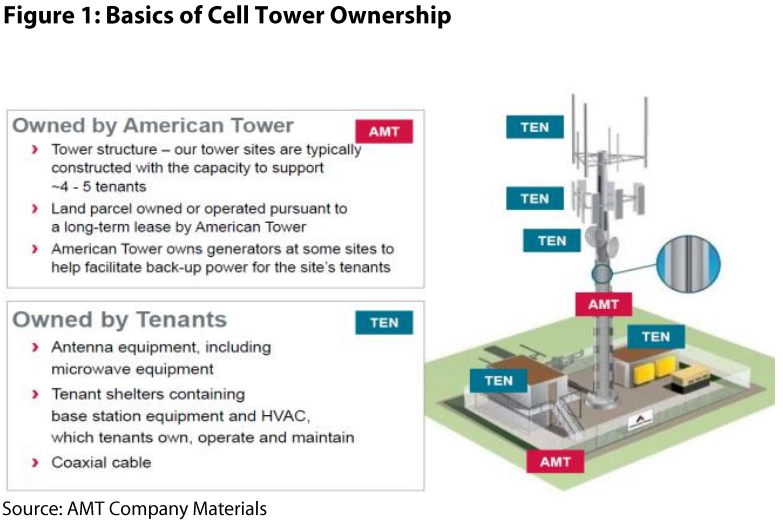

First, a few basics on the cell tower industry. Originally, it was common for a carrier to own its towers, and in those cases, it would be the only tenant. The three cell towers REITs were borne out of the cost savings that come from shared infrastructure: a neutral owner responsible for maintenance of the site that can serve multiple tenants simultaneously at much lower costs than if each had to have its own tower. Furthermore, monetizing cell tower real estate gave the mobile carriers much needed cash to further invest in their networks.

–

In the shared infrastructure model, the cell tower REIT owns the structure itself and either owns or leases the land under it. As shown in Figure 1, the tenant is responsible for antenna equipment and any tenant shelter containing base station equipment. Maintenance costs are minimal (1-2% annually) and every tenant added to the site flows to the bottom line almost 100% due to the low variable costs. Due to these attributes, another legendary investor, Elliott Management, disclosed a $1 billion investment in CCI in July 2020. In its presentation on CCI, Elliott Management stated, “We believe U.S. towers could be the BBE (Best Business Ever)….”

–

–

The combination of all of the above has resulted in an annualized yield (net operating income/invested capital) on US towers of 12.1% for CCI, the only pure-play US cell tower REIT as of June 30, 2023. To show the power of compounding, the annualized yield on US cell towers owned since 2006 for CCI was 20% as of June 30, 2023, an impressive display of value creation. Assuming the company bought them at a 5% yield and could sell them at a 5% yield, the estimated appreciation of towers bought before 2006 would be 300%, plus the annual yield.

–

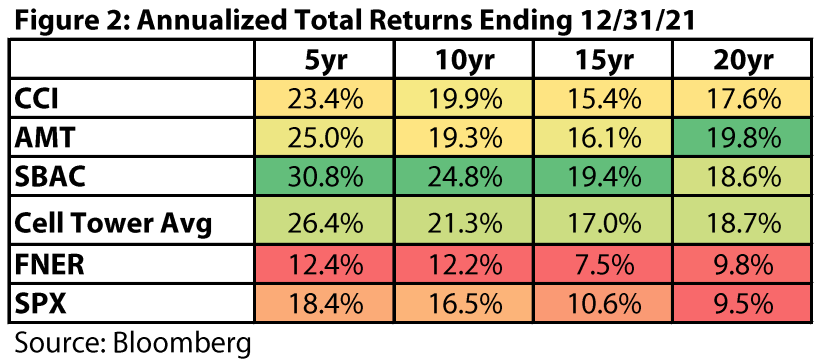

As shown in Figure 2, the three cell tower REITs were incredible investments from 2001 to 2021. As of December 31, 2021, using a straight average of SBAC, CCI, and AMT, the 5, 10, 15, and 20 year annualized total returns were 26.4%., 21.6%, 17.0%, and 18.7%, which compared to the FTSE NAREIT All Equity REITs Index (Bloomberg: FNER) total returns of 12.4%, 12.2%, 7.5%, and 9.8% over the same periods. Similarly, the cell tower REITs also outperformed the S&P 500 (Bloomberg: SPX) total returns of 18.4%, 16.5%, 10.6%, and 9.5% in the same periods.

–

–

Reasons for Recent Underperformance

As a result of the impressive performance, the cell tower REITs entered into 2022 trading at record high valuations, averaging 34.4x 2022 AFFO as of December 31, 2021. This compared to the average REIT multiple of 27.5x at the time, and the trailing five year cell tower average of 28.6x. The elevated multiples were based on investor optimism on the rollout of 5G and an extremely low discount rate being applied to cash flows due to near-record low interest rates. As shown in Figure 3, things can change quickly.

–

–

Starting in March 2022, the Fed underwent the most aggressive rate hike cycle in history. The result was devastating for all asset classes, including equities, fixed income, and REITs. Within REITs, the worst performers were those that were getting the most credit for long-term growth. These ‘growth’ REITs needed high long-term growth and a low discount rate to justify their valuations. As a result of the rate hikes, the 10 year Treasury yield increased from 1.5% on December 31, 2021 to 4.1% on August 31, 2023, thereby increasing the long-term discount rate, and devaluing the growth in cash flows in the outer years.

–

In addition, investors’ expectations for earnings changed for several reasons. First, higher interest rates meant higher debt costs, particularly for companies with significant floating rate debt or near-term maturities. Second, while T-Mobile’s Sprint acquisition was announced in 2018, the ‘non-renewals’ of Sprint sites on towers where there already is a T-Mobile site are mostly concentrated between 2022-2025, causing elevated (though clearly anticipated) churn. Third, the 5G rollout cycle slowed a bit quicker than the 4G cycle, causing some investors to doubt their long-term growth estimates. Finally, though this is not anything new, we believe that the investor base of the cell tower REITs is not as sticky as a typical institutional quality REIT or other S&P 500 non-REIT. They are somewhat caught in the middle where REIT-dedicated investors do not feel they have to own cell towers given their lack of presence in several of the popular REIT benchmarks, and traditional equity fund managers may be comparing valuations and growth to high flying growth stocks such as Nvidia or Meta.

–

Current Valuation and Upside Risks

As a result of the reasons above, the cell tower REITs traded at an average 2024 AFFO multiple of 15.7x as of August 31, 2023, a 54% discount to the multiple applied on December 31, 2021 and the lowest multiple in over 15 years. This compares to the average REIT multiple of 18.4x as of August 31, 2023, a 15% discount. In contrast, cell towers traded at a 7.3x multiple premium to the average REIT multiple for the five years from 2017-2021.

–

While the earnings growth forecasts have come down and it does seem that higher interest rates are here to stay, we believe the selloff in cell tower REITs has gone too far. For example, CCI trades at a 6.3% dividend yield as of August 31, 2023, an all-time high. This compares to the pre-2022 high of 4.4%. The company is committed to long term dividend growth of 7-8%, though it will be in the low single digits for 2024-2025 before resuming the long term trajectory.

–

CCI has committed to 5% annual revenue growth from US cell towers through 2027, while AMT has stuck with its forecast of 7% for its entire portfolio, which includes international towers. In spite of management’s commitment to the organic growth of the business, earnings estimates for 2027 have been revised downward for the cell tower REITs by over 12% since 2021.

–

There are several potential reasons that these earnings estimates could be revised upward.

–

First, they assume that Dish Network (NYSE: DISH) remains a marginal tenant. Currently, DISH is building out the first new cell network in many years from scratch, though only doing the bare minimum to comply with FTC regulations. If DISH were able to partner with a company with a large balance sheet and customer base (Amazon?), a real fourth competitor would increase organic growth estimates.

–

Second, specific to CCI, management is estimating adding about 10,000 new small cell nodes per year. Small cells are used in urban areas where macro towers get overwhelmed by density and a new macro tower is not able to be built. The company has invested $16.1 billion in small cells as of December 31, 2022, and is only getting a yield on invested capital of 7.4%. CCI believes that small cells will become just as essential as towers and eventually garner the same yields. While Verizon and T-Mobile have been dipping their toe in the water for small cells, AT&T has yet to make a commitment to the new infrastructure. Furthermore, the cell carriers have started to compete in the broadband space by offering fixed wireless access (or FWA). In FWA, customers no longer need fiber running to their house to get internet access; instead, a customer can purchase a modem that is able to connect to a nearby cell tower or small cell to get high speed internet access. If FWA gains in popularity, many more small cells will be needed to satisfy demand.

–

Downside Risks

We believe there is little downside risk in earnings or the multiples. However, obsolescence is always a risk when technology is involved. There are several companies, including Starlink and Amazon, launching low orbit satellites to offer internet access to those that do not have fiber or cell towers. There is a perceived risk that cell towers would become obsolete if the data capacity and speed offered by these satellite competitors is able to match cell towers, at a competitive price.

–

We believe this risk is infinitesimal. First, by sheer physics, the data is all trying to get to the same place, a data center. It will always be closer for the data to get to a tower (where there is a tower nearby) than to be transmitted to space and then back down. Second, it’s difficult to imagine the cost being able to match a cell tower network that is already built. Starlink and Amazon have spent an estimated $10 to $20 billion to amass 1.5 million subscribers. If one of these services needed to cover the ~4.5 billion people that are currently using cell towers, the cost would be astronomical and likely not justifiable unless they charged significantly more than what cell carriers charge today. Third, maintenance and upgrades are much more difficult in space than a cell tower. The ongoing costs of keeping the network running with the best technology would again necessitate customers to pay much more than what they are paying today.

–

Chilton Positioning on Cell Towers

Because the RMZ does not have any cell towers in it, the Chilton REIT Composite has had an overweight allocation to cell towers since first buying AMT in 2013. However, cell towers comprise approximately 10.4% of the Vanguard Real Estate ETF (Bloomberg: VNQ) as of August 31, 2023, which compares to the Chilton REIT Composite weighting of 12.5% as of the same date. In January 2023, we sold AMT out of the composite, which decreased the weighting from 17.1% to 13.6%. Thus, as of August 31, 2023, the Chilton REIT Composite held SBAC and CCI only. With AMT trading at a 15.3% discount to where it was sold in January 2023, we are considering buying it back given the potential for near term positive surprises. The catalyst for a re-rating upward could be any of the items mentioned in this publication, and thus Mr. Buffett should consider adding cell towers to Berkshire Hathaway’s portfolio before the market reverts to its historical pricing relationship.

–

In summary, we believe that cell towers provide an asymmetric investment opportunity at current prices. A buyer today is getting in at a trough multiple on trough or near-trough earnings, thus limiting the downside and maximizing the upside. We believe cell towers exemplify many of the qualities that Warren Buffett looks for in a long term investment, and his purchase would certainly be a near term catalyst for the sector to regain its luster.

–

Matthew R. Werner, CFA

mwerner@chiltoncapital.com

(713) 243- 3234

Bruce G. Garrison, CFA

bgarrison@chiltoncapital.com

(713) 243-3233

Isaac A. Shrand, CFA

ishrand@chiltoncapital.com

(713) 243-3219

Thomas P. Murphy, CFA

tmurphy@chiltoncapital.com

(713) 243-3211

–

RMS: 2,521 (8.31.2023) vs. 2,398 (12.31.2022) vs. 3,177 (12.31.2021) vs 1,433 (3.23.2020) and 2,560 (2.21.2020)

–

An investment cannot be made directly in an index. The funds consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use.)

The information contained herein should be considered to be current only as of the date indicated, and we do not undertake any obligation to update the information contained herein in light of later circumstances or events. This publication may contain forward looking statements and projections that are based on the current beliefs and assumptions of Chilton Capital Management and on information currently available that we believe to be reasonable, however, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. This communication is provided for informational purposes only and does not constitute an offer or a solicitation to buy, hold, or sell an interest in any Chilton investment or any other security. Past performance does not guarantee future results.

Information contained herein is derived from and based upon data licensed from one or more unaffiliated third parties, such as Bloomberg L.P. The data contained herein is not guaranteed as to its accuracy or completeness and no warranties are made with respect to results obtained from its use. While every effort is made to provide reports free from errors, they are derived from data received from one or more third parties and, as a result, complete accuracy cannot be guaranteed.

Index and ETF performances [MSCI and VNQ and FNER] are presented as a benchmark for reference only and does not imply any portfolio will achieve similar returns, volatility or any characteristics similar to any actual portfolio. The composition of a benchmark index may not reflect the manner in which any is constructed in relation to expected or achieved returns, investment holdings, sectors, correlations, concentrations or tracking error targets, all of which are subject to change over time.