Portfolio Insight | 2nd Quarter 2023

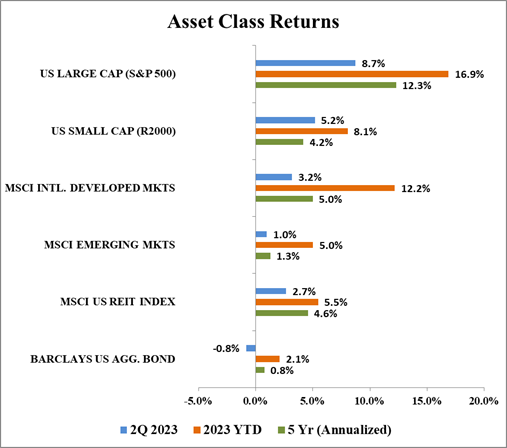

The stock market delivered a third consecutive quarter of gains, building on the rally that started in October 2022. The S&P 500 finished the quarter up 8.7% and advanced 16.9% for the first half of 2023.

The top performing sectors for the period were once again Information Technology, Communication Services, and Consumer Discretionary, while those that underperformed the most were Utilities, Energy, and Consumer Staples. Mega-cap growth stocks continued to lead the market, with the Nasdaq producing its best first half in 40 years.

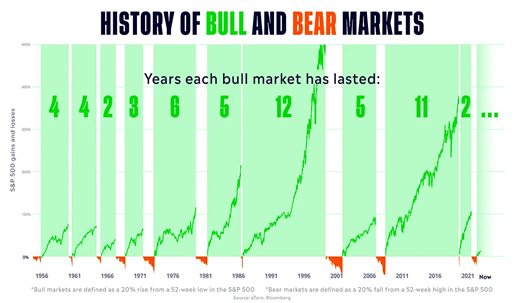

New Bull Market

Having vaulted more than 20% off of its October 2022 low, the S&P 500 has entered a new bull market despite prevailing negative sentiment in the media and many investor circles. This is a reminder that markets spend far more time going up than going down. It remains to be seen how long the current bull market will last, but catalysts for sustaining the run are certainly present, in particular steadily falling inflation growth, a Federal Reserve that may be near the end of its rate hiking cycle, lack of a recession (which consensus has been wrongly predicting for a while now), a resilient consumer, and an improving earnings outlook.

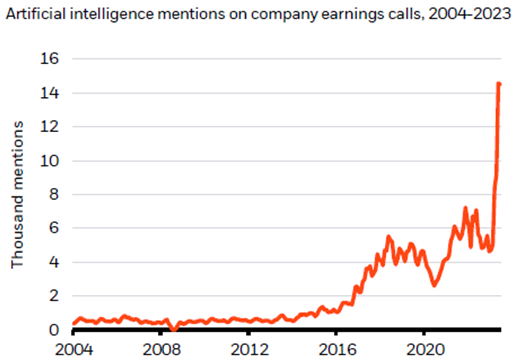

A(I) Major Driver

Artificial Intelligence (AI), the simulation or approximation of human intelligence in machines, continued to garner significant investor attention during the quarter. A growing appreciation for the current and future implications of the technology pushed many large cap beneficiaries including NVIDIA (NVDA), Broadcom (AVGO), and Microsoft (MSFT) to new heights. However, companies from a wide range of industries were eager to highlight AI’s long term growth opportunities on earnings calls.

Last November, ChatGPT, a natural language processing tool, launched and became by far the fastest growing consumer application ever, amassing 1 million users within 5 days and 100 million users within 60 days of launch. By comparison, Twitter, launched in 2006, took 2 years to reach 1 million users, and Instagram, launched in 2010, took 2.5 months to get to 1 million. NVIDIA CEO Jensen Huang called this the “iPhone moment” for AI, and enterprises are now rushing to adopt AI-related applications that can improve efficiency, consumer engagement, product development, and myriad other facets of their businesses. While there are some concerns about potential job losses and privacy issues (and even the Terminator scenario in which robots become self-aware and destroy humanity!), AI could be a major growth catalyst for the overall economy. Goldman Sachs estimates it could add 7% to global GDP and 4% to S&P 500 net margins over the next decade.

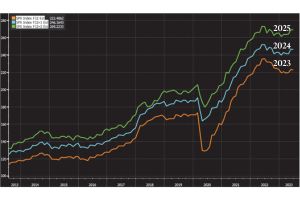

Broadening Market Leadership

Narrow market leadership has been a concern of many investors in 2023, with technology stocks driving the market higher and broader improvement slow to develop. However, it should be noted that this is the same group of stocks that led the market lower in 2022 and the issue is not overly worrying. Most often when market “breadth” is weak, leadership tends to broaden out eventually and many laggards catch up with the leaders. This may already be happening in cyclical, non-technology areas such as the homebuilding stocks, where housing prices and starts have begun to rise again following a short period of weakness.

Earnings drive the stock market in the long run, and AI, company cost-cutting, lower inflation, easing supply chains, and resilient consumer spending are all positive drivers of earnings. After stabilizing over the last quarter, forward 12-month earnings estimates for 2023, 2024, and 2025 are now hooking upwards.

Domestic Equity Outlook

Overall conditions have improved for the economy and stocks since last quarter, lending confidence to the idea that the market will end the year with gains. One key remaining risk is the potential for the Fed to over-tighten in its efforts to bring down “sticky” inflation. If unemployment was to spike and consumers reduced spending meaningfully, it could lead to a deep recession.

Normal seasonality and current valuation levels may put a cap on major market gains from current levels in the near-term. However, earnings drive markets, and prospects are brightening for a possible return to the previous all-time S&P 500 high near 4,800 by year-end 2024, which would represent a further double digit percentage gain for stocks.

Fixed Income Outlook

The 10-year Treasury yield rose from 3.48% at the beginning of the quarter to 3.81% by quarter-end, closing just below where it began the year. Accordingly, the Bloomberg US Aggregate Bond Index, a mix of government and corporate bonds, fell 0.8% during the quarter, though its YTD total return remains positive at 2.1%. Rates moved higher during the quarter due in large part to the increasing likelihood the Federal Reserve will hike short-term rates further than previously anticipated. Despite the most aggressive hiking cycle in decades, many areas of the economy, including employment, consumer spending, business investment, and even the housing market, have proven to be incredibly resilient. Moreover, while inflation growth is undoubtedly slowing in aggregate, certain components of inflation, namely services, have remained “stickier” than hoped. As a result, further rate hikes are likely needed to cool off the economy and inflation. An obvious concern for investors is quantifying the negative impacts these rate hikes will have on the economy. In some cases, the repercussions have already been felt. The regional banking mini-crisis that arose earlier in the year was due almost entirely to higher interest rates (and ultimately, poor internal risk management). However, there has been more of a lagged effect with inflation and employment. Again, inflation in aggregate continues to rise less quickly (disinflation), but is still above historical norms. Similarly, the growth in average hourly earnings has begun to slow but remains elevated. Only recently have labor market indicators like the unemployment rate and initial jobless claims begun to tick up from historically low levels. Taken together, the Fed is likely near the end of this hiking cycle and the odds of a “soft landing” (in which rates move higher to curb inflation but don’t cause a recession) continue to move upwards.

The upshot for investors is that the yields on high quality corporate bonds and US Treasuries are the most attractive we’ve seen in years. For bonds maturing in the next 1-5 years, yields in the 4.5% – 5.5% range are common. Many money market funds yield in the 4.75% – 5.00% range, although those rates are variable. While interest rates may climb higher in the short-term, the current market expectation is that rates will materially decrease over the next several years. Longer-term Treasury bonds (longer than 5 years) yield <4.0% today. As such, locking in 4.5% – 5.5% yields on high quality corporate bonds today may be an attractive proposition, considering that money market rates may move lower in the future.

Global Markets Outlook

Global markets maintained their positive momentum in the second quarter of 2023, led by a strong performance in US large cap stocks (S&P 500), which saw an increase of 8.7%. In comparison, international developed markets returned 3.2%, while emerging markets gained 1.0%. For the first half of 2023, the S&P 500 continues to lead the pack with growth of 16.9%, followed by international developed markets at 12.2% and emerging markets at 5.0%.

The outperformance of the S&P 500 can be attributed to the dominance of mega-cap growth companies within the index. The US has a much greater technology presence than the rest of the world, with the information technology sector comprising 28.3% of the S&P 500, compared to only 8.2% for the MSCI EAFE Index. The US exposure to technology is even more substantial when considering that technology-related companies such as Amazon and Alphabet are not classified as tech by GICS standards.

The sensational performance of mega-cap growth companies has pushed the relative valuation of US versus international stocks to near the widest level in decades. However, it must be acknowledged that the spread has been wide for close to 15 years. The primary reason behind the elevated gap is the substantial rise in earnings in the US, again thanks to innovations in the information technology sector such as cloud computing and artificial intelligence, while international markets have a greater exposure to the slower growing financial and energy sectors. Several international markets have still not fully recovered from the devastating effects of the global financial crisis of 2008-09. The extent to which this valuation gap can still expand remains uncertain, but the US continues to lead the way in innovation, including in the exploding AI field.

A few factors could potentially narrow the valuation gap, the first being inflation, which has receded more quickly in the US than in developed international markets. Higher inflation puts pressure on consumers and businesses, so any reversal could be a catalyst for international markets. Another factor to consider is the US dollar, which has declined somewhat after rising sharply last year. Since investments made overseas are denominated in other currencies, any strengthening of the foreign currency relative to the dollar will increase the value of the holding when translated back to US dollars. While there are no guarantees that international markets will outperform in the near term, maintaining a diversified allocation within a portfolio may be a prudent strategy.

REIT Commentary

In the second quarter of 2023, the MSCI US REIT Index (Bloomberg: RMZ) produced a total return of +2.7%. The commentary from the Fed, while promising, continues to push up long term interest rates as data from the economy remains hot. Ultimately, REITs should benefit from the economic strength, but the interest rate uncertainty has caused investors to speculate on where cash flow multiples should be for public REITs. Words such as “distress,” “crisis,” and “crash” have headlined many news articles recently, and some clarification is needed to understand the differences between property types, cities, and property owners.

First, the commercial real estate market as a whole is currently facing significant challenges reminiscent of the early 1990s. The tightening of the capital window has made it difficult for all but the most creditworthy borrowers to secure financing. Property owners who relied on floating-rate debt are experiencing reduced cash flows, with many even facing negative cash flow due to rising interest expenses and operating costs. The assumption of robust rent and occupancy growth made during property acquisitions in the past few years is not materializing as expected, leading to pressure on valuations and an increased risk of property foreclosures.

In particular, the office sector has been grabbing headlines due to declining occupancy rates resulting from remote work policies. However, it is important to note that the office sector represents only a small portion of our primary and secondary benchmark indices for public REITs (less than 6%). Furthermore, office sector valuations already reflect significant distress, with a decline of almost 50% (price only) from December 2021 through June 2023 as measured by the Bloomberg REIT Office Index (Bloomberg: BBREOFPY).

Despite the current negative sentiment surrounding commercial real estate, public REITs hold a distinct advantage over private market participants. Unlike previous crises when REITs raised dilutive equity to stabilize operations, comply with debt covenants, and satisfy banks, public REITs today possess stronger balance sheets and the ability to provide capital to make accretive acquisitions from undercapitalized properties and companies. Additionally, constrained liquidity for construction financing creates a favorable supply environment in the intermediate term.

Furthermore, public REITs trade at a 10% discount compared to the private markets as of June 30, offering an attractive investment opportunity. Price-to-cash-flow ratios indicate that public equity REITs are below their historical averages, presenting potential for capital appreciation. Moreover, the emergence of vehicles such as Blackstone’s $30 billion closed-end private equity real estate fund suggests a floor to public REIT prices and the potential for outsized alpha opportunities for active REIT managers and investors who can identify attractive targets in advance.

In particular, active REIT managers can avoid companies that have more exposure to upcoming debt maturities, companies with tech tenants on the West Coast, or high payout ratio companies that will not be able to raise dividends. While a decline in private valuations may seem like a negative, this would be a huge positive, especially for the public REITs that have balance sheet strength to pursue acquisitions. Again, as active managers, we can identify such opportunities and avoid others that may not have the same ability.

Despite recent price fluctuations, public REITs offer an average yield of 4.5% and have low dividend payout ratios, supporting potential growth in the coming years. With manageable debt maturities and positive free cash flow after dividends, public REITs are well-positioned to generate double-digit returns coming off of the market sell-offs, similar to past cycles. What is unique to this cycle is the little downside risk we see, which should get investors of all kinds excited.

Bradley J. Eixmann, CFA

Brandon J. Frank

Robert J. Greenberg, CFA

Matthew R. Werner, CFA