Equity REITs: Takeaways from NAREIT REITWeek 2023 | July 2023

The Chilton REIT Team recently embarked on a three-day journey to New York City, braving the haze of Canadian wildfire smoke that engulfed the air in early June. This expedition was fueled by a multitude of management meetings and property tours, all in conjunction with the highly significant REITWeek annual conference, hosted by NAREIT. For our team, this event holds immense importance as it allows us to personally reconnect with the CEOs and CFOs of our portfolio companies, gain valuable insights into potential new ideas, foster connections with industry peers, and explore the diverse landscape of REIT properties in the city. During our time, the Chilton REIT Team actively engaged in 39 meetings. Among these, we had the privilege of 10 exclusive one-on-one sessions with REIT CEOs and CFOs, in addition to participating in 29 other meetings facilitated by sell-side analysts, where we joined a cohort of investors in posing pertinent questions.

–

Amidst the backdrop of the fastest rate hike cycle in the history of the United States, a central theme resonated across all property types: the importance of robust balance sheets. Investor inquiries this year predominantly revolved around the challenges presented by a sluggish debt/transaction market, escalating interest rates, signs of distress in the private market, and the far-reaching implications for the real estate sector. While the Chilton investment process has always prioritized the strength and adaptability of balance sheets, the heightened focus on balance sheet resilience from investors was a notable shift compared to the previous year’s conference.

–

It is worth noting that management teams, as a whole, were pleasantly surprised by the sustained robust demand amidst the looming potential of an economic downturn. Simultaneously, the escalating costs of construction and financing presents a headwind to supply growth, which combined, we expect to sustain landlord pricing power. With this backdrop in mind, our ensuing report aims to provide comprehensive insights into the key findings and observations from our interactions during REIT Week, shedding light on the outlook for different property types and capturing the prevailing sentiment within the industry. Importantly, the business press has mistakenly portrayed all commercial real estate in a very negative light due to the troubles impacting only one sector: Office. And, it only accounts for 5.6% of the MSCI US REIT Index (Bloomberg: RMZ) as of 6/30/23.

–

Data Centers

Within the data center sector, we met with Equinix (NASDAQ: EQIX) and Digital Realty (NYSE: DLR). Both meetings heavily featured discussion about the potential positive effect on demand from artificial intelligence (or AI). While the AI boom has not yet started, some of the lofty projections that have catapulted stocks such as Nvidia (NASDAQ: NVDA) would need to be supported by significant infrastructure upgrades. For example, the chips that NVDA is selling for AI uses are GPUs (Graphics Processing Units) versus CPUs (Central Processing Units). GPUs require approximately twice the amount of power that a CPU requires, and, as data center landlords charge rent based on power, this will flow directly to the bottom line for both EQIX and DLR when the upgrade cycle begins in earnest.

–

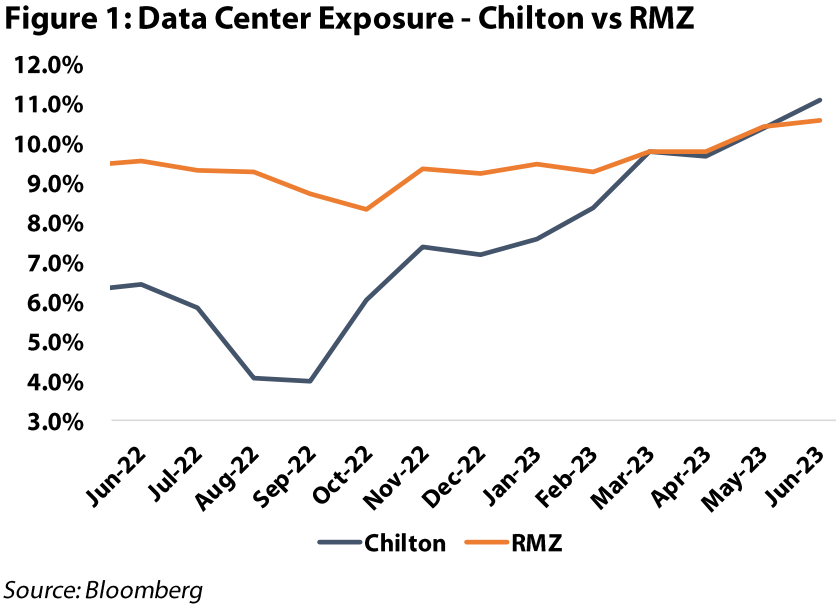

As of now, there are several requirements in the market for which they are bidding, but we are just in the top of the first inning. Both companies are taking advantage of the current mismatch between supply and demand by pushing through significant rent increases on current tenants. For example, EQIX sent out rent increases to over 7,000 tenants this year and has received zero pushback. Specific to DLR, the company used the conference to announce a significant capital raise to fund its accretive development pipeline. DLR announced an 11 million share ‘at the market’ offering to a new investor, bringing in $1.1 billion gross of fees. In addition, the company announced the sale of an asset in Dallas for $150 million, which equates to a 4.4% cap rate, highlighting the disparity between public and private valuations (DLR trades at a 5.6% implied cap rate as of June 30, 2023). The commentary was positive on future aspirations to sell another $3 billion in assets this year, which would shore up funding on the remainder of the development pipeline. As of June 30, 2023, the Chilton REIT Composite has an 11.1% allocation to data centers, which compares to 10.6% in the RMZ. Highlighted below in Figure 1, we have meaningfully increased our exposure to data centers from a low of ~4.0% at the end of 3Q22.

–

–

Multifamily, SFR, and MH/RV

We had the opportunity to meet with the management teams of nine multifamily REITs including AvalonBay (NYSE: AVB), Camden (NYSE: CPT), Equity Residential (NYSE: EQR), Centerspace (NYSE: CSR), Mid-America (NYSE: MAA), Independence Realty (NYSE: IRT), Apartment Income (NYSE: AIRC), UDR (NYSE: UDR), and Essex (NYSE: ESS). Together, they own nearly 500,000 units in most major cities in the US. Three key topics of discussion stood out amongst the rest: elevated supply in the Sun Belt, regional divergence of rent growth, and higher expense growth due to inflation and rising interest rates.

–

Firstly, deliveries of new apartments within the Sun Belt are expected to remain elevated for the remainder of this year and into 2024. Although the influx of supply is expected to negatively affect pricing power for Sun Belt operators, the actual impact might be less significant than anticipated by observers. For example, CPT stated that only 20% of new supply expected in its markets (40,000 of ~200,000 units) are a competitive threat to its assets as new deliveries are heavily sub-market specific, coming online at different price points, and entering into areas that are still relatively under-housed. Additionally, given the sharp decrease in capital availability, development starts should eventually decline, albeit the 50+% declines projected by REIT managers have yet to materialize. Nevertheless, we believe the REITs are particularly well positioned in both ‘25 and ‘26 with improved pricing power as most markets should then be in equilibrium.

–

Furthermore, the regional divergence in near-term rental growth continues to favor Coastal markets over the Sun Belt due to the aforementioned supply pressures affecting pricing power. Within these Coastal markets, the East Coast, particularly New York and Boston, has shown relative strength compared to the West Coast markets like Seattle and San Francisco that have still yet to surpass their pre-pandemic rent levels.

–

Finally, despite headwinds persisting on the expense front such as property taxes, interest expenses, and insurance costs, the apartment REIT group looks well-positioned to weather the storm due to the following: 1) while property tax growth was remarkably high in 2022, general consensus is that this only grows 6%-7% in 2023 and is likely to decelerate in future years as municipalities adjust appraised values to reflect the impact of higher rates; 2) despite interest rates rising at historic levels, apartment REITs balance sheets remain relatively insulated given immaterial floating rate debt exposure and manageable upcoming debt maturities; and 3) although insurance costs are expected to rise anywhere from 20%-35% across portfolios, these costs make up only 4%-7% of total expenses, making them rather negligible.

–

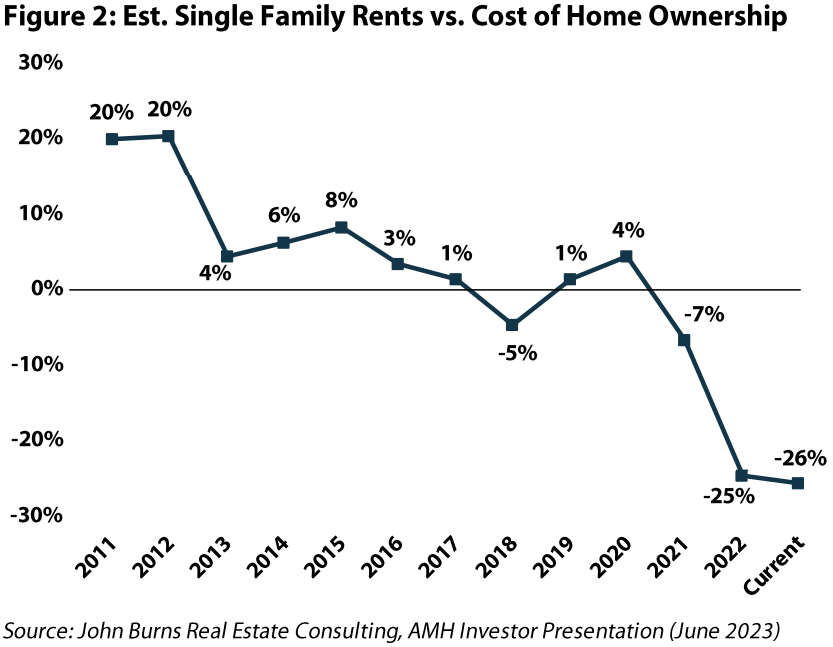

As for the Single Family Rentals (SFR) sector, we were able to meet with both American Homes 4 Rent (NYSE: AMH) and Invitation Homes (NYSE: INVH). All-in-all, demand remains notably strong for SFRs heading into peak leasing season with occupancies hovering around 97%, the national housing market remaining generally under-built, and rising mortgage rates causing rental payments to be ~26% cheaper compared to monthly home ownership costs as seen in Figure 2 across AMH’s top 20 markets.

–

–

Lastly, we had the chance to meet with Sun Communities (NYSE: SUI), a manufactured housing (MH), RV, and marina focused REIT. Pricing power seems to remain strong across all business segments with the exception of its UK operations due to a decline in margins on UK home sales from the low 40% range in 2022 to the high 30% range in 2023, primarily due to a shift towards pre-owned homes. However, while investors remain wary on how this could affect future NOI performance, UK home sales make up only ~5% of SUI’s total NOI, providing us with comfort that this negative sentiment as of recent is likely unwarranted.

–

Self-Storage

We met with Extra Space Storage (NYSE: EXR) and Public Storage (NYSE: PSA). After halcyon conditions brought on by the pandemic, fundamentals appear to be returning to normal including a modest decline from record high occupancy rates and the return of seasonality into ongoing leasing activity. While peak leasing season has been performing relatively in-line with expectations thus far, tough comps continue to weigh on the sector on a year-over-year basis for 2023. On the bright side, existing customer rent increases (ECRIs) remain in the low double-digit range, most self-storage REITs are experiencing record-high levels of average tenant length of stay (meaning more tenants are eligible to receive ECRIs), and supply deliveries are likely to decelerate in the near-term given lower-than-average development starts in recent years. Lastly, despite this return to normalcy brought upon by sluggish home sale activity and lower overall mobility in the US (both key demand drivers to the sector), the storage REITs continue to see solid top of the funnel demand as customers increasingly need more space at home (likely driven by remote work) and digitalization steadily improving customer to tenant conversions day by day.

–

Shopping Centers and Malls

Among the shopping center REITs our team met with management from InvenTrust Properties (NYSE: IVT), Site Centers (NYSE: SITC), CTO Realty (NYSE: CTO), Federal Realty (NYSE: FRT), and Kimco Realty (NYSE: KIM). Additionally, outside of the traditional shopping centers, we also met with mall operator Simon Property Group (NYSE: SPG). The tenor around leasing demand was upbeat as landlords pointed to a large suite of retailers continuing to expand footprints. Investors remained focused on the fallout from Bed Bath & Beyond (NASDAQ: BBBY), but similar to what we heard on the 1Q earnings calls, finding replacements has been faster and less expensive than feared. Specifically to SITC, of their 17 Bed Bath & Beyond locations, they are expecting single tenant backfills at all but one site (expected multifamily redevelopment) with a blended ~30% rent spread.

–

New retail development remains miniscule, which we expect to afford landlords pricing power in the coming years. Specifically, as illustrated in Figure 3, after peaking at nearly 3% of existing supply in 2005, new retail developments have not exceeded 1% of existing supply since 2009. Since 2020, retail supply growth has been even smaller, averaging roughly 0.3% of existing supply. Remember, obsolescence for existing real estate is estimated at up to 1.0% of total space per year, which means net retail square footage is actually declining. Potential M&A was another talking point. Although most management teams agreed the industry is ripe for consolidation, few seemed to have an appetite for large deals due to higher capital costs.

–

–

Finally, we also had the opportunity to sit down with Armada Hoffler (NYSE: AHH). We classify the company as diversified given that management has successfully shifted non-office NOI to being over 75% of the portfolio. Leasing demand was similarly robust at AHH’s properties (Mid-Atlantic and Southeast). However, AHH’s exposure to office properties (although shrinking) remains a headwind to investor sentiment.

–

Healthcare

Before the conference kicked off, a portion of our team toured a mix of independent and assisted senior living facilities with Ventas (NYSE: VTR) and operating partner Atria (Private) across Long Island. Within senior housing, in addition to Ventas, we also met with Welltower (NYSE: WELL). As anticipated, both companies presented strong outlooks underpinned by the rapidly growing 80+ year old demographic and improving near term labor headwinds. Notably, WELL announced another guidance increase in their NAREIT presentation. Finally, a reduction in senior housing starts presents another tailwind. After development grinded to a halt during the pandemic, rising construction and financing costs are continuing to restrict supply during a period of ramping fundamentals. In aggregate we believe these factors position senior housing for a multi-year upcycle with the potential for margin expansion above pre-Covid levels. As a result, as of June 30, 2023, our composite held a 5.7% and 5.3% position in WELL and VTR, versus 4.0% and 1.9% in the RMZ.

–

In addition to senior housing focused healthcare REITs, our team heard from HealthPeak (NYSE: PEAK) and Healthcare Realty (NYSE: HR) in the life science and medical office building (MOB) spaces. After emerging as a darling of the pandemic era, reduced biotech funding (primarily early stage startups) has cast a pall on life science landlords. Further, the March banking crisis supercharged this dynamic driving steeper stock declines in 2023 for the REITs specializing in this property type. While valuations are undeniably more attractive at current levels, we continue to view lab space with caution. For now we still see better risk adjusted returns within our senior housing exposure.

–

Industrial

Anecdotally, industrial appeared to be the most well- attended property type with standing room only during many of the group meetings. Out team was fortunate enough to hear from management at Prologis (NYSE: PLD), EastGroup (NYSE: EGP), Plymouth (NYSE: PLYM), Terreno (NYSE: TRNO), and Americold (NYSE: COLD).

–

First, while evidence suggests market rent growth has decelerated (particularly in hot markets such as Southern California), growth remains strong compared with historical averages. On the supply front, management teams were in agreement that near term completions could present a headwind. But moving forward, new development is grinding to a halt (driven by higher construction and borrowing costs). Further on the topic, EGP highlighted the bifurcated nature of industrial supply, with the majority of new development focused on larger footprint facilities. Overall, we think slowing development today should support pricing power across the entire industrial group. With that said, we view infill, smaller footprint facilities as best positioned, which is expressed through our large overweight position to EGP (3.3% as of June 30, 2023 versus 0.8% in the RMZ).

–

Finally, cold storage, previously an out of favor segment within industrial, witnessed an exceptional increase in investor interest following COLD’s unusually robust 1Q earnings report (roughly doubling 2023 SSNOI growth guidance). Recall, cold storage suffered more from labor shortages and supply chain headwinds (food manufacturing) than traditional industrial facilities. Fortunately, with both dynamics improving simultaneously, we believe COLD is positioned to deliver some of the strongest near term growth amongst all REITs. With that said, the company was also impacted by a recent cyber incursion. Although the sensitive situation would not allow a full update, management appears to have a solid handle on the situation, with the outlined impact from 1Q looking more like a worst case scenario.

–

Office

We met with the CEOs and CFOs of Paramount Realty (NYSE: PGRE), Boston Properties (NYSE: BXP), Highwoods Properties (NYSE: HIW), and Empire State Realty (NYSE: ESRT). Office REITs have been the worst performing sector since the pandemic began due to the impact that WFH (work from home) policies are having on leasing demand both now and into the future. Each of the companies are heeding their cost of capital on new development projects; instead of developing traditional office buildings, they are pursuing either lab space, residential, or entertainment (i.e. Boston observatory at Prudential Center). However, HIW and BXP did start office projects in the past couple years that ultimately could prove to be value-destructive if yields fail to cover the cost of capital or if cap rates remain elevated.

–

There was a noticeable difference in the tone of the HIW meeting versus the other three given the positioning in the Sunbelt having a more robust leasing environment. With that said, debt market activity has been much more impactful to the office stocks recently given the major decline in how office buildings are valued today. Indeed, we have already seen several examples of debt maturities (or floating rate exposure) driving office owners to ‘hand back the keys’ to lenders.

–

HIW is having success finding liquidity in its non-core holdings. In late May, HIW announced the sale of two stabilized, non-core office buildings for ~$40 million located in Raleigh and Tampa. Importantly, we estimate the blended average cap rate for the sale at roughly 6.9%, compared to HIW’s implied cap rate of 9.3% as of June 30, 2023. Management also anticipates completing more non-core land sales in the coming quarters (particularly if debt markets normalize). Of the over $350 million (estimated market value) land bank at HIW, management believes roughly half of the inventory is no longer best suited for office. Management is in active negotiations on several parcels, and, ultimately, the company could sell about $175 million in non-income producing land with the proceeds earmarked for repaying borrowings on the revolving credit facility (e.g., reducing floating rate debt exposure). Earlier in the year, HIW also issued $200 million of 5 year notes secured by the Bank of America Tower in Charlotte with 5.69% fixed rate. Even without further land sales, we believe management has already meaningfully de-risked the remainder of its $518 million development pipeline.

–

ESRT’s earnings are ramping this year as its famed Observatory in midtown Manhattan is expected to eclipse 2019’s net operating income figure thanks to a sharp recovery in attendance post pandemic and better pricing despite heightened competition. BXP has high expectations for its new $150 million observatory at the Prudential Center in Boston, and is still finding strength in lab space leasing in the Boston submarkets of Cambridge and Waltham. As of June 30, 2023, the Chilton REIT Composite has a 2.6% allocation to office, which compares to the RMZ at 5.6%. We do not own any office on the West Coast or East Coast; instead, our exposure is in the Sunbelt.

–

Conclusion

Overall, the Chilton REIT Team’s participation in this year’s REITWeek conference provided us with an improved outlook for most of the 17 property sectors that make up this $1.2 Trillion industry. Despite our ongoing vigilance regarding the potential risks associated with a recession, tenant demand continues to exceed expectations, most notably, industrial, single family rental, data centers, shopping centers, and most healthcare properties. In addition, we view the current environment as very positive for REIT investors who can overlook the negative narrative brought on by the troubles impacting office buildings and focus on all the positive factors that lay ahead for well managed REITs. It is encouraging to note that the performance of the REIT market in 2023 seems to be more influenced by the flexibility of balance sheets and access to capital, as opposed to the indiscriminate selling observed in the latter half of 2022. We are pleased to report that our unwavering focus on balance sheet strength is showing up in favorable performance. As of June 30, 2023, the Chilton REIT Composite has achieved a commendable YTD return of +8.6% net and +8.9% gross, outperforming the RMZ at 5.5% over the same time frame.

–

Matthew R. Werner, CFA

mwerner@chiltoncapital.com

(713) 243- 3234

Thomas P. Murphy, CFA

tmurphy@chiltoncapital.com

(713) 243-3211

Bruce G. Garrison, CFA

bgarrison@chiltoncapital.com

(713) 243-3233

Isaac A. Shrand, CFA

ishrand@chiltoncapital.com

(713) 243-3219

RMS: 2,529 (6.30.2023) vs. 2,398 (12.31.2022) vs. 3,177 (12.31.2021) vs 1,433 (3.23.2020) and 2,560 (2.21.2020)

An investment cannot be made directly in an index. The funds consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use.)

The information contained herein should be considered to be current only as of the date indicated, and we do not undertake any obligation to update the information contained herein in light of later circumstances or events. This publication may contain forward looking statements and projections that are based on the current beliefs and assumptions of Chilton Capital Management and on information currently available that we believe to be reasonable, however, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. This communication is provided for informational purposes only and does not constitute an offer or a solicitation to buy, hold, or sell an interest in any Chilton investment or any other security. Past performance does not guarantee future results.

Information contained herein is derived from and based upon data licensed from one or more unaffiliated third parties, such as Bloomberg L.P. The data contained herein is not guaranteed as to its accuracy or completeness and no warranties are made with respect to results obtained from its use. While every effort is made to provide reports free from errors, they are derived from data received from one or more third parties and, as a result, complete accuracy cannot be guaranteed.

Index performances [MSCI and VNQ] are presented as a benchmark for reference only and does not imply any portfolio will achieve similar returns, volatility or any characteristics similar to any actual portfolio. The composition of a benchmark index may not reflect the manner in which any is constructed in relation to expected or achieved returns, investment holdings, sectors, correlations, concentrations or tracking error targets, all of which are subject to change over time.