Arbitrage Opportunity Available in Public REITs | April 2023

In June, 2022, we published ‘The Private Equity Put’, essentially urging all public REIT teams to consider going private at valuations that now most companies would only dream of getting. Unfortunately, soon after that piece was published, the financing environment changed dramatically for private real estate players.

–

While the tombstones may have different names on them than in 2008-2009, the reasons for the demise of private equity real estate players are going to rhyme, and possibly mirror those from the Global Financial Crisis (or GFC). While public REITs fell 77% from peak to trough in the GFC (as measured by the MSCI US REIT Index (Bloomberg: RMZ)), a similar decline seems unlikely for public REITs this time around due to all the lessons learned: stronger balance sheets and laddered debt maturities to prevent dilutive equity issuances, and lower dividend payout ratios to allow for dividend increases rather than cuts. While private real estate investors couldn’t help themselves from buying a record amount of property at peak prices in 2021-2022, the public REITs were actually net sellers, mirroring the environment leading up to the GFC. Instead of financing purchases with short term floating rate debt like many private players, public REITs took advantage of the low interest rate environment to bring their floating rate debt to a minimum and lock in fixed rate debt into long dated maturities.

–

However, as of March 31, 2023 public REITs trade at a discount to private real estate, a phenomenon that is able to occur thanks to both the appraisal lag and the system that has been built with massive conflicts of interest and unfortunate ignorance by investors. We believe that the market will correct this arbitrage opportunity over the next 12 months as the reduced liquidity in the capital markets results in private real estate owners that are no longer able to afford interest payments and hedging costs, thereby causing a decline in real estate prices. In contrast, the public REITs will be able to use their fortress balance sheets to acquire high quality properties at attractive prices. As such, we strongly believe that public REITs will outperform private real estate over the next 12-24 months.

–

History Doesn’t Repeat Itself – But It Does Rhyme

The GFC is synonymous with the housing crisis and sub-prime lending, which has been blamed on corporate greed in the banking/finance sector. However, the commercial and residential real estate market just needed a little crack to lead to the ultimate downfall as the high prices and exorbitant leverage prefacing the GFC were unsustainable. While public REIT management teams were not perfect, many did see it coming and decided to sell into the irrational private market strength. In fact, 2006-2007 saw the most public to private REIT transactions in history.

–

In the GFC, private real estate owners were generally much more exposed to an economic downturn than their public peers due to higher leverage, shorter debt maturities, and higher floating rate debt, combined with a portfolio that was purchased mostly at peak prices (when most of their investor money was raised and HAD to be put to work). As such, they were at the mercy of their lenders. Readers may remember the massive bailouts for the banks, which essentially were done to prevent them from having to foreclose and thus write down their loan portfolios. Some of the common phrases used at the time included ‘Extend and Pretend’ and ‘Delay and Pray’.

–

The bailouts changed the private market fallout from what would have been a ‘bloodbath’ to more of a ‘slow bleed’. It also encouraged developers, owners, and investors to once again take on risk as they now knew there was a parachute in case of emergency. Therefore, while there were new banking restrictions, a ‘shadow banking’ economy formed to cater to private owners. Private credit, insurance companies, and mezzanine lenders proliferated from 2010-2022. They were also extremely profitable, capitalizing on their ability to borrow from the government at near-zero rates. This zero interest rate pricing (or ZIRP) environment was like a drug, and everyone was hooked. As a result of all the money floating around on the private side, similar to 2006-2007, public REITs were net sellers to the private market in 2021-2022, highlighted by Blackstone’s (NYSE: BX) privatization of four public REITs in 2022 for a total of over $30 billion!

–

The Return of Non-Traded REIT

While private owners had a short term and selective memory of the GFC, investors didn’t fare much better. Non-traded REITs (or ‘NTRs’) were one of the biggest losers of the GFC. Thanks to subpar returns, gated redemptions, high brokerage fees (among other fees), and several large fines from FINRA to NTR sponsors, NTR fundraising dropped to almost zero for the years from 2007 to 2009. While institutional real estate private equity was able to enjoy magnificent returns in the investment period of 2010-2022 as a result of the declining interest rates, individual investors were mostly on the sidelines for real estate private equity. Like a bug to a light, retail investors forgot all the lessons learned and once again started to show interest in these ‘steady’, ‘high yield’ investments in a zero interest environment, and sponsors were more than happy to accommodate.

–

What happened next was unprecedented. Blackstone, Starwood, KKR, and Ares (due to its purchase of Black Creek) raised ~$67 billion from 2021 to 2022 in NTRs, dwarfing the totals from 2006-2007!

–

“Mark to Magic”

Because these REITs are raising money from broker-dealers, they must file financial statements with the SEC. While the disclosures are nowhere near those of public REITs and there aren’t institutional analysts, activist buyers, short sellers, and earnings calls to look out for shareholders, the 10-K and 10-Q filings spell out explicitly how risky these investments could be to the astute reader. Below, we use the BREIT 2022 10K filing to compare and contrast to public REITs.

–

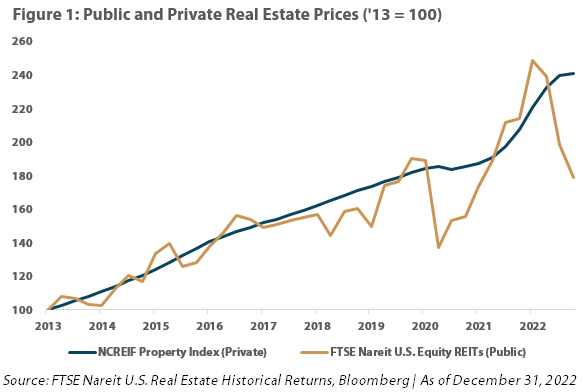

Instead of being marked to market daily (or by the millisecond like public REITs) by thousands of market participants, the NTR mark-to-market process is done by a third party on a monthly, quarterly, or annual basis. In the case of BREIT, the Adviser (Blackstone) values the properties for the monthly NAV, and an independent third party appraisal is done annually. These appraisals use cap rates from recent transactions, most of which have occurred within the past 12 months. As shown in Figure 1, the private market (as represented by the NCREIF National Property Index) has yet to mark down its assets, while the public market (as represented by the FTSE NAREIT All Equity REITs Index (Bloomberg: FNER)) has already re-rated. While we don’t claim to have a better way to do this, it inherently is a flawed process when prices are changing quickly. In particular, the transaction market can slow down when property prices change quickly, which further exacerbates the appraisals from reality. Per the BREIT 2022 10K, “accurate valuations are more difficult to obtain in times of low transaction volume because there are fewer market transactions that can be considered in the context of the appraisal”. For reference, commercial real estate transaction volume declined by 60% year-over-year from 4Q21 to 4Q22.

–

We refer to this imperfect appraisal process as ‘mark to magic’. Mark to magic is most feasible when there are NOT many transactions giving a consensus for valuation of assets, and, in spite of the independent valuation advisor (which of course is paid by Blackstone), the 2022 BREIT 10K simply states, “…the Adviser [Blackstone] is ultimately and solely responsible for the determination of our [BREIT] NAV.”

–

These valuation conflicts are relevant today because BREIT is facing unprecedented redemption requests. Starting in November 2022, BREIT reached its stated limit of redemption requests for the month, and fulfilled the entire quarter’s limit in December (5% of capital). In December, BREIT was only able to fulfill 4% of redemption requests, implying that redemption requests were almost $3.8 billion. Already in January and February 2023, BREIT has fulfilled redemptions of ~$1.4 billion each month (only representing ~35% of redemptions requested) again reaching the quarterly limit. This will likely continue for an extended period.

–

To meet these redemptions while maintaining the ‘magic’ NAV, BREIT first decided to sell properties in December 2022 that it knew would sell for more than the value at which it was carrying the assets: the MGM Grand and Mandalay Bay. BREIT was able to raise $1.3 billion in net cash from this transaction without having to mark down its industrial or residential assets (combined 78% of the portfolio by value as of 12/31/22). These properties sold at an attractive cap rate because the buyer (VICI Properties (NYSE: VICI)) was trading at a premium to its asset value and could assume the long term fixed rate debt on the property.

–

Next, Blackstone secured a $4.5 billion investment into BREIT from UC Investments, the pension fund for the University of California system. To entice an investment into BREIT, Blackstone had to contribute $1.25 billion of BREIT stock which could be transferred to UC Investments in the case that BREIT’s returns don’t meet an 11.25% hurdle rate. While Blackstone touted this as a strong endorsement in BREIT from a sophisticated investor, this transaction sent two huge signals that we believe have not been appropriately heard by the market: 1) UC Investments believes that BREIT’s NAV is overstated by 25% ($1.125b/$4.5b = 25%), and 2) Blackstone was willing to give up $1.125 billion in order have enough cash to fund redemptions. In effect, this move allowed them to avoid selling assets at a loss versus the original purchase prices that would have had a major negative impact on future fund raising efforts.

–

BREIT Valuation vs Public REITs

At Chilton, we use a valuation model that is able to capture not only the value of the properties, or NAV, but also the specific company attributes that, in our opinion, can cause a REIT to trade at a premium or discount to NAV. In the case of BREIT, we recently applied our blended property sector cap rate (6.5% for rental housing and 4.5% for industrial) to arrive at an NAV that is approximately 55% lower than BREIT’s stated NAV as of December 31, 2022. However, if it were a public REIT, we would also have to account for the specific attributes, though unfortunately, BREIT is actually off the chart on many of the metrics we use as is illustrated below.

–

Leverage

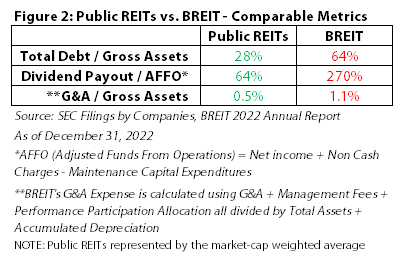

First, we apply a premium or discount based on leverage. We use a range of factors, but we can use debt/gross assets as a simple comparison. With average debt/gross assets of 30%, we reward public REITs that have a ratio below 30%, and start to penalize them if the ratio goes above 40%. Though we don’t own any public REIT with a leverage ratio above 50%, we further penalize companies with leverage above 50%. As of December 31, 2022, BREIT had a debt/gross assets ratio of 64%, before counting any debt on unconsolidated joint ventures (undisclosed), which more than garners the biggest discount of any REIT we’ve ever analyzed.

–

Dividend Payout

We also reward companies that are able to generate free cash flow after paying dividends, maintenance capital expenditures, normal building improvements and leasing commissions. This gives them flexibility from not having to tap the capital markets, security in the current dividend, and room for future dividend increases. As of December 31, 2022, the average REIT dividend/adjusted funds from operations (AFFO) payout ratio was 64%, meaning 36% of every dollar earned is retained. We reward companies with a payout ratio below 70%, and start to penalize them if the ratio is above 80%. We calculate BREIT’s AFFO by using their ‘FAD’ and subtracting the management fees (BREIT adds back management fees because they are paid in BREIT stock). Using this formula, BREIT’s payout ratio in 2022 was a whopping 270%! A quick way to identify the shortfall is that the company classified 94% of its 2022 dividend as ‘return of capital’, meaning it was not funded by the operations of the company – instead it was funded 94% by the capital that investors contributed to the fund.

–

Fees

All public REITs in our portfolio have ‘internal’ management teams, meaning that the companies do not pay any fees to outside firms to manage the company. Thus, similar to most C-corps, the cost of corporate functions are in the ‘General and Administrative’ (or ‘G&A’) line item. On average, the public REIT G&A/gross assets was approximately 0.5%. The multifamily and industrial REITs in the Chilton REIT portfolio (most similar to BREIT) had an average G&A/gross assets of 0.2%. In contrast, BREIT has no employees and instead pays the Adviser (Blackstone) management fees for corporate functions. In 2022, BREIT paid Blackstone $838 million in management fees, $743 million in ‘performance participation allocation’, and had direct costs of $53 million in G&A, and, which equates to 1.1% of gross assets, more than double the average REIT. Again we penalize companies when their G&A is over 0.4% and furthermore when it’s above 0.5%. These are summarized in Figure 2 below.

–

In summary, before even factoring in subjective items such as corporate governance (no shareholder rights at BREIT!) and liquidity (liquidity to buy, but not to sell BREIT), we believe that BREIT would be trading at 65% to 75% less than its current price if it were public today.

–

Real Estate in a Rate Hike Cycle

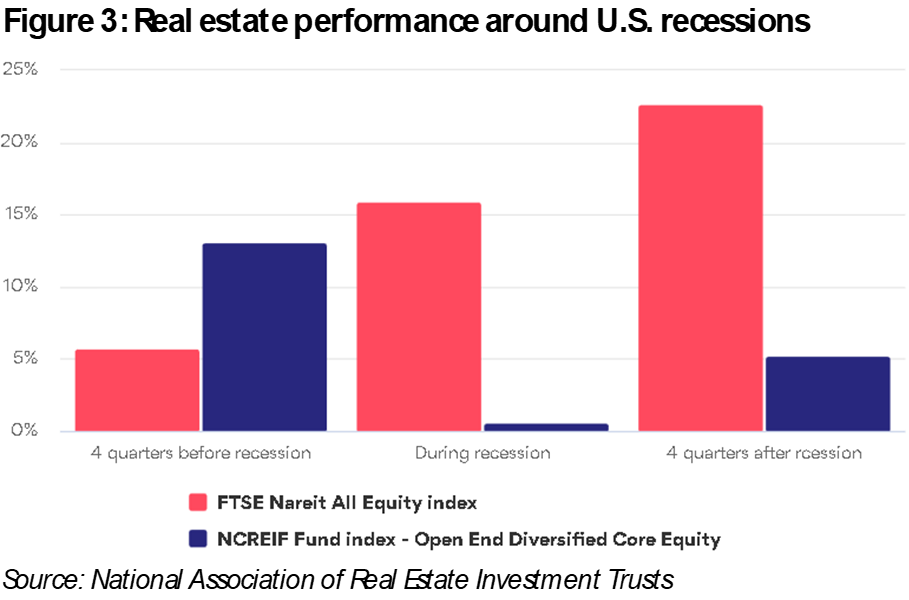

Though it came at the expense of shareholders in several regional banks (thankfully the depositors seem to be able to keep their deposits above $250,000), the recent bank malaise may have brought us closer to the end of the rate hike cycle. While this should help real estate, as we’ve shown, private REIT valuations do not yet reflect the changes that occurred in the interest rate environment even a year ago. The Fed’s quest to tame inflation is now putting the economy on the precipice of a recession, which the market believes would result in rate cuts. As shown in Figure 3, public REITs massively outperformed their private counterparts during and coming out of recession, but underperformed leading up to the recession. The current situation is setting up to be no different, as public REITs are currently 26% off their peak prices while private real estate still has yet to mark down their assets in a significant way. In summary, investors can purchase real estate in the public market for approx. 10-12% less than the private market, take on less leverage, earn a growing dividend (funded from cash flow), pay less fees, and maintain liquidity.

–

To be clear, higher interest rates punish most real estate owners, and issues with private owners will at a minimum carry headline risk for public REITs. The upcoming marking down of private property prices could affect the banks’ ability to fund other businesses, which will certainly slow the activity of many REIT tenants, including individuals. However, we believe that public REIT prices already reflect this scenario, and anything less than a moderate recession will be a near-term positive for public REITs.

——————————————————————————————————————–

Matthew R. Werner, CFA

mwerner@chiltoncapital.com

(713) 243- 3234

Bruce G. Garrison, CFA

bgarrison@chiltoncapital.com

(713) 243-3233

Isaac A. Shrand

ishrand@chiltoncapital.com

(713) 243-3219

Thomas P. Murphy, CFA

tmurphy@chiltoncapital.com

(713) 243-3211

–

RMS: 2,463 (3.31.2023) vs. 2,398 (12.31.2022) vs. 3,177 (12.31.2021) vs. 1,433 (3.23.2020) and 2,560 (2.21.2020)

An investment cannot be made directly in an index. The funds consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use.)

The information contained herein should be considered to be current only as of the date indicated, and we do not undertake any obligation to update the information contained herein in light of later circumstances or events. This publication may contain forward looking statements and projections that are based on the current beliefs and assumptions of Chilton Capital Management and on information currently available that we believe to be reasonable, however, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. This communication is provided for informational purposes only and does not constitute an offer or a solicitation to buy, hold, or sell an interest in any Chilton investment or any other security. Past performance does not guarantee future results.