Positive Data for Data Centers | February 2023

Though the elevator pitch for data centers due to their vital role as the backbone of the internet seems like ‘easy money’, investing in this sector has many more elements to consider other than ‘data creation is growing exponentially’. Yes, the demand for data storage has been a major growth story for ten years, but supply and obsolescence are extremely important for data centers, even more so than in other real estate sectors.

–

However, early investors in data center REITs have been rewarded handsomely, in spite of the fits and starts of the past ten years. We first invested in a data center REIT in 2010 by adding a recent data center REIT IPO to client accounts. The company, CoreSite (now part of American Tower (NYSE: AMT)), had only 10 properties, including One Wilshire, one of the most highly ‘connected’ data centers in the world. Again, looking back, the thesis was simple: COR was able to develop data centers at yields close to 20% at a time when traditional property types, such as office or multifamily, were developing at yields in the 7% range. With market cap rates below 10%, this was a slam dunk value-creation story that no other property type could match (20% yield sold at a 10% cap rate = 100% development profit margin). From our initial investment into COR in September 2010 at $16 per share until it was acquired by AMT in 2021 for $170 per share, COR generated an annualized total return of 28%, which compared to the MSCI US REIT Index (Bloomberg: RMZ) annualized total return of 11%.

–

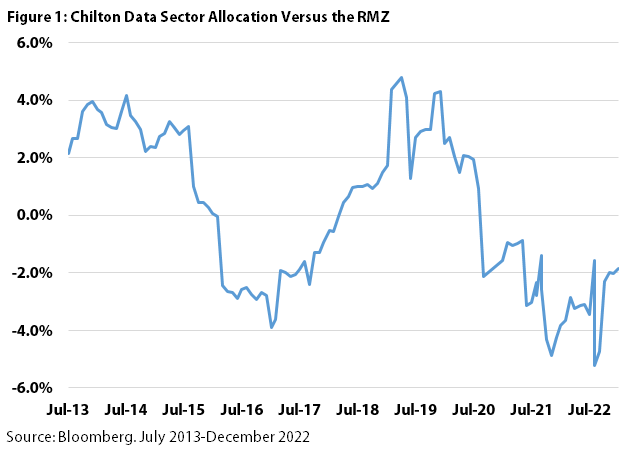

It was not a linear ride to the top as low barriers to entry made organic rent growth difficult to come by for certain types of data centers in certain periods. Though we did not hold COR through its acquisition by AMT, we did have an overweight allocation to data centers as recently as August 2020, seen in Figure 1. We subsequently had an underweight position until recently due to high valuation, high capital expenditures, and a lack of organic growth.

–

However, we believe the fundamentals are beginning to shift toward the landlord due to the record year of demand in 2022 that witnessed 2,500 megawatts (or MW) of absorption worldwide. Well-capitalized developers, for the first time in years, can look forward to better times ahead. The cause for excitement is primarily due to surging power costs and lower power availability, which has created a favorable supply/demand environment that should last for several years. At the same time, valuations have come down from sky-high to ‘reasonable’, setting the stage for a period of outperformance, in our opinion. While we are still slightly underweight the data center REIT sector, this is the highest allocation we’ve had since September 2021.

–

Data Centers 101

Data centers serve as the physical backbone for processing, storing, and exchanging data. Without data centers, the internet would not exist; essentially, the data center is the ‘meeting point’ for the source of the data and the end-user’s request. Whether the end user is on a Wi-Fi network, hard-wired fiber connection, or a smart phone via a cell tower, all data must travel over a fiber connection to a data center where it can be processed and sent back. Storing and processing data requires servers, which require power and cooling. Thus, the basic prototype of any data center is a reliable power source, several backup generators, connectivity via fiber, and raised floor for optimized cooling. While it sounds essential today, data centers were not exactly always considered essential.

–

Chilton History with Data Centers

Back when data centers were a nascent sector on the fringe between technology and real estate, we became comfortable with the fact that data center leases were mostly measured in dollars per watt of power (usually kw or MW, ‘kilowatt’ or ‘megawatt’). This mitigated the most common opposition to data center investing at the time, which was that servers would be able to store more data in a smaller physical area; however, though the size of the servers declined, the servers drew more power to store that data, thus protecting the data centers’ revenue stream. Ultimately, the amount of data grew so quickly that development was needed to keep up, regardless of the capabilities of servers.

–

Initially, we were excited with the supply side of the sector given the high development cost (>$1000 per square foot versus multifamily at $200-500 per square foot, for example) and specialized nature; at the time, there was a thesis that only a few companies had the expertise and capital to develop data centers. In real estate however, 20% development yields will attract capital and ‘experts’ like a bug to a light. Larger and larger players found capital to develop larger data centers, mostly on speculation, which had a tendency to keep market rents down. Furthermore, newer technology and leasing incentives at the speculative data centers gave little pricing power to the current landlords.

–

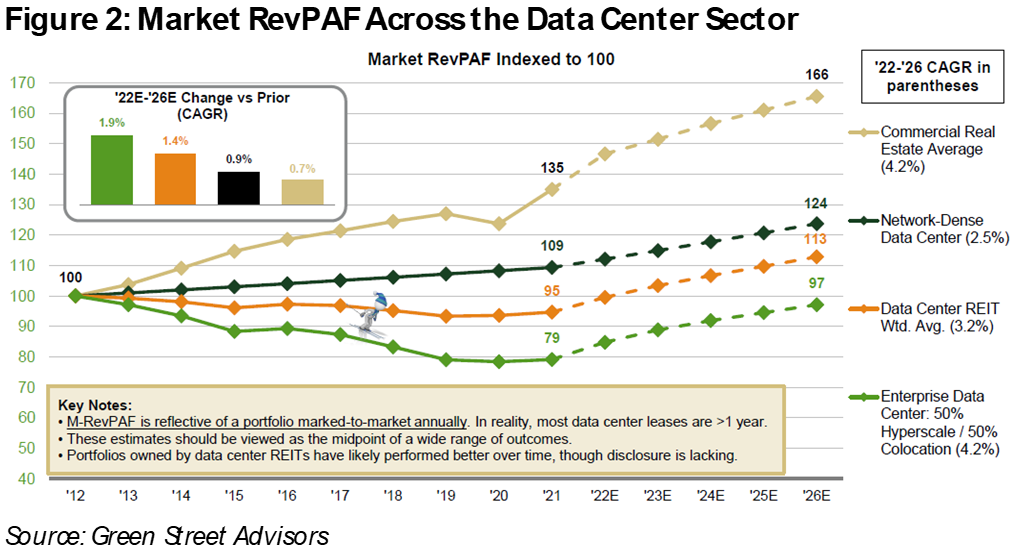

We also had to understand the difference between ‘Enterprise’ and ‘Network-Dense’ data centers; ‘Enterprise’ data centers could be located anywhere that was near cheap power and at least a few internet service providers (implying at least a minimal amount of fiber for connectivity), while ‘Network Dense’ data centers (particularly IXPs, or ‘internet exchanges’) were in only a few key locations across the world, boasting a myriad of internet service providers. By nature, all of the new supply was in the enterprise space, while new network-dense data centers have been few and far between since they are virtually impossible to replicate. As shown in Figure 2, this had a significant effect on organic rent growth, or market revenue per available foot (MRevPAF, per Green Street Advisors). Due to the differences in new supply, network-dense data centers have been able to slowly push rents higher over the past 10 years, while enterprise data centers have seen rents slowly decay.

–

In the public market, COR and Equinix (NASDAQ: EQIX) were the two network-dense data center REITs, while Digital Realty (NYSE: DLR), QTS (privatized by Blackstone), Switch (privatized by DigitalBridge), and CyrusOne (privatized by KKR) were the enterprise data center REITs. Thus, within client portfolios, we employed a strategic long term allocation to network-dense data centers through EQIX or COR, and shorter term tactical allocations to DLR, CyrusOne, or QTS when we believed valuation and the supply/demand environment were attractive.

–

Following QTS’s acquisition by Blackstone in 2021 and our sale of DLR in October 2021 at over $140 per share (30% above current levels, we had only EQIX in the portfolio as of December 31, 2021. We had sold DLR in October 2021 due to high valuation, its large development pipeline, lack of organic growth, and presence in markets that tend to get oversupplied.

–

However, the environment dramatically changed in 2022 as power costs, building costs, and borrowing costs all soared. These conditions have put a damper on new supply that could last for years and with it, the stage is now set for organic growth, in favor of current landlords of enterprise data centers for the first time in years. Furthermore, DLR made some key acquisitions in the past few years to go from almost no exposure to network-dense data centers to about 35% as of September 30, 2022, which compares to EQIX at approximately 60% as of the same date. We believe this has not been adequately factored into DLR’s valuation. As a result, we added a new position in DLR in October 2022 at prices close to $95 per share, or more than 32% below where we had sold it only a year earlier.

–

DLR Summary

As of September 30, 2022, DLR produced a total return of -42.3% versus -28.3% for the RMZ over the calendar year to date period. Its earnings were disappointing for the first two quarters due to negative foreign exchange effects, higher operating expenses (power costs, for example), and some near-term dilution from M&A.

–

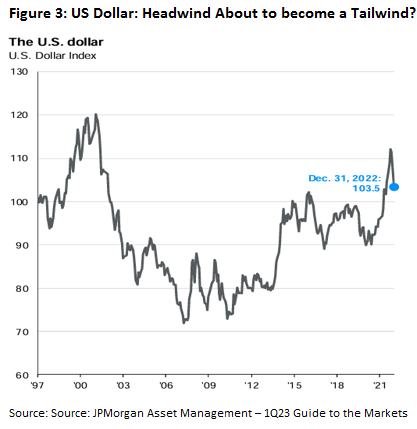

However, the 3Q22 earnings report caught our eye: the company reported positive constant currency same store revenue growth for the first time in several years. In addition, the company was trading at its lowest cash flow (or AFFO) multiple since 2019, highest dividend yield since 2015, and lowest price/NAV in the company’s history. In addition, in July 2022, Dominion Energy announced that it had overpromised power to data center developers in Loudoun County Virginia, one of the largest data center markets in the world. This effectively halted all data center development in the county through 2026. While higher power costs temporarily hurt DLR, it also caused markets such as Singapore, one of the largest, to put a moratorium on all data center development. Meanwhile, these higher costs are eventually passed through to the DLR tenants. Finally, the US dollar peaked against a basket of foreign currencies in September 2022, and has traded down ever since. As a result, foreign exchange effects could be a tailwind for the first time since 2019 (see Figure 3).

–

The “Gift”

The data center sector’s position somewhere between technology and real estate does lead to some muddy understanding of the business by technology experts and real estate experts alike. In 2013, a hedge fund called Highfields issued a ‘short thesis’ on DLR, calling it a ‘melting ice cube’ and sending shares down by 40%. Its main criticism of the stock was that the company was not covering its dividend after all capital expenditures. Unfortunately, Highfields did not fully understand the nuances of GAAP accounting that make it difficult to ascertain the differences between maintenance capital and investments into new, revenue-generating development. As we were well-versed in this and double checked each item with our data center contacts, we significantly increased our position in DLR at what we thought were bargain prices! The stock recovered all of its losses within 13 months.

–

Similarly, a CNBC regular named Jim Chanos issued a short thesis in June 2022 that data center owners such as DLR and EQIX would not be needed anymore because cloud companies such as Alphabet (NASDAQ: GOOGL), Microsoft (NASDAQ: MSFT), Meta (NASDAQ: META), Apple (NASDAQ: AAPL), and Amazon (NASDAQ: AMZN) would build all of their own data centers. He unfortunately did not provide any data to prove his claim. Our research showed quite the opposite; all five companies were leasing more space than they ever had before! Furthermore, with the large selloff in ‘Big Tech’ over the past year, it makes even less financial sense for tech companies to get into the real estate business.

–

Essential Infrastructure for the Future

Data centers have proven they are an ‘essential’ cog in the world wide internet and are indispensable to all businesses. We believe that the durability of this income stream is being undervalued in the current market due to several unique circumstances, including short-sellers with incomplete knowledge of the industry and headwinds (high power costs, negative foreign exchange effects) turning into tailwinds (less new construction, positive foreign exchange effects). Furthermore, we believe that future earnings growth may be underestimated as the business is only just now beginning to turn. As shown in Figure 2, Green Street Advisors believes we are about to embark on the first period of market rent growth that the data center market has had in 10 years!

–

Matthew R. Werner, CFA

mwerner@chiltoncapital.com

(713) 243- 3234

Bruce G. Garrison, CFA

bgarrison@chiltoncapital.com

(713) 243-3233

Thomas P. Murphy, CFA

tmurphy@chiltoncapital.com

(713) 243-3211

Isaac A. Shrand

ishrand@chiltoncapital.com

(713) 243-3219

RMS: 2,652 (1.31.2023) vs. 2,398 (12.31.2022) vs. 1,433 (3.23.2020) vs. 3,177 (12.31.2021)

An investment cannot be made directly in an index. The funds consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use.)

The information contained herein should be considered to be current only as of the date indicated, and we do not undertake any obligation to update the information contained herein in light of later circumstances or events. This publication may contain forward looking statements and projections that are based on the current beliefs and assumptions of Chilton Capital Management and on information currently available that we believe to be reasonable, however, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. This communication is provided for informational purposes only and does not constitute an offer or a solicitation to buy, hold, or sell an interest in any Chilton investment or any other security. Past performance does not guarantee future results.