Portfolio Insight | 4th Quarter 2022

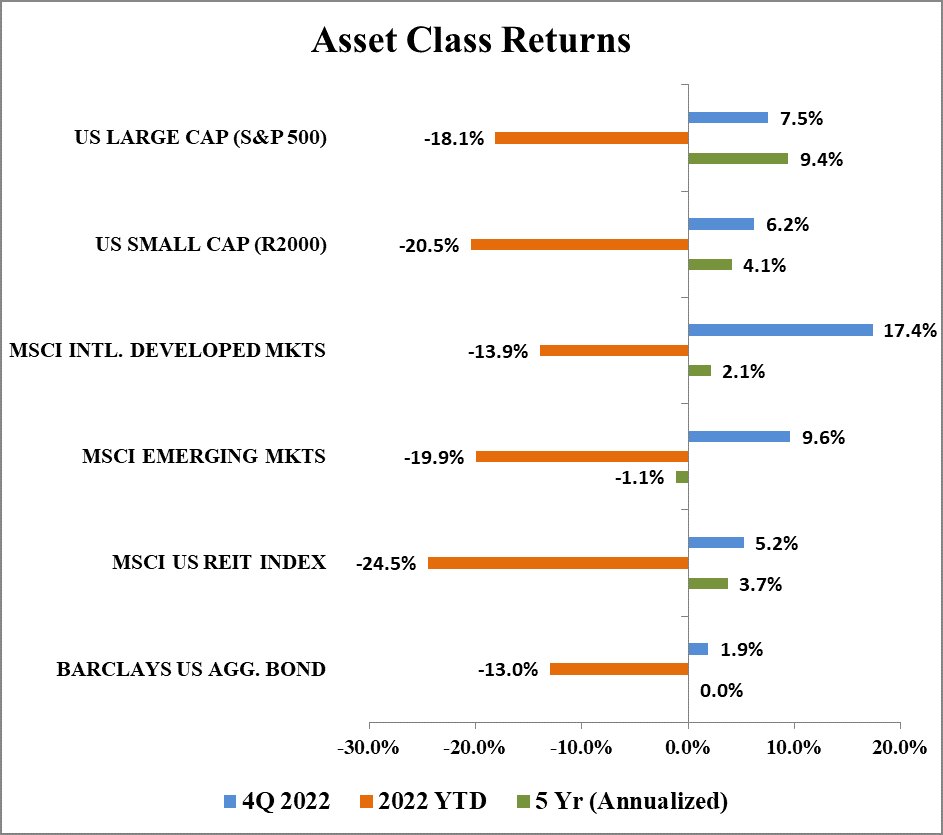

The S&P 500 Index had three extraordinarily strong years from 2019-2021, generating a 100.3% total return which culminated in an all-time high on January 3rd, 2022. Then, the S&P 500 stair-stepped lower throughout a volatile year, officially entering bear market territory in June. Though the market staged a 7.5% fourth quarter advance, including a multi-year low made in October, a total 2022 return of -18.1% marked the worst year for large US stocks since the financial crisis in 2008. Surging inflation, Russia’s invasion of Ukraine, and one of the most aggressive Federal Reserve rate hiking cycles in history put persistent downward pressure on stocks and led to major losses in popular index names. As a matter of fact, the top 5 largest stocks by market cap were all down over 25% for the year. And, out of all 500 index constituents, 357 were negative in 2022, and 242 were down over 15%.

The top performing sectors in 2022 were Energy, Utilities, and Consumer Staples, while Communication Services, Consumer Discretionary, and Information Technology underperformed. In the fourth quarter, the strongest sectors were Energy, Industrials, and Materials, while Consumer Discretionary, Communication Services, and Real Estate lagged. Notably, spiking interest rates decimated growth names that had led the market for many years, with large cap growth stocks down 29.5%, while large cap value stocks were down only 5.4%.

Difficult Market Year

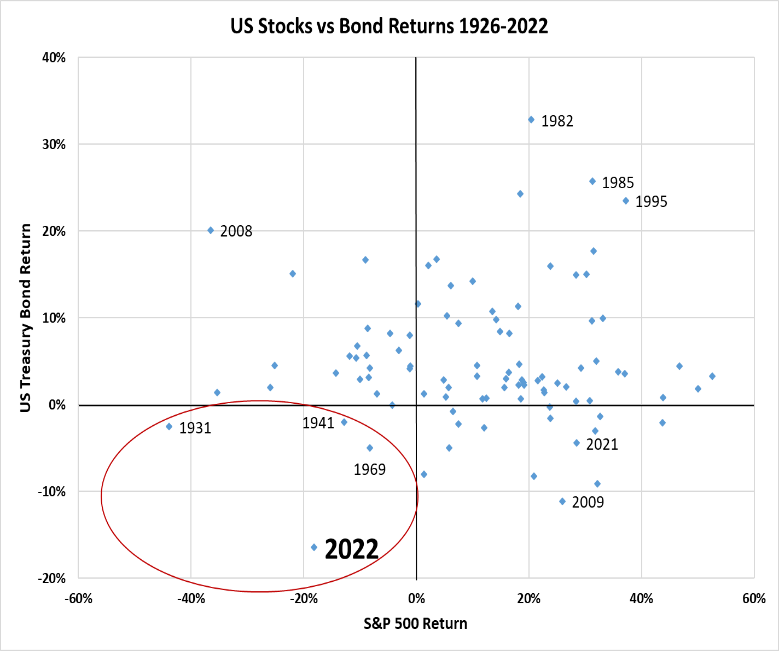

Though stocks are a tremendous creator of wealth over the long run, stock investors will endure downdrafts from time to time. However, it’s rare to see bonds perform as poorly as they did in 2022. In fact, 2022 proved to be the worst year for US bonds on record. Since 1926, there have been only three other years in which US stocks (S&P 500) and US bonds (10-year Treasuries) both had negative returns. 2022 felt terrible for many investors, and for good reason.

Decelerating Inflation Growth

On the bright side, investors who had been looking for signs of slowing inflation can take heart from the last two Consumer Price Index (CPI) data points for October and November. Though still too high, both reports were better than expected, suggesting that Fed actions are having the desired impact and that inflation has likely peaked.

These lower inflation readings are an important step in establishing a definitive market bottom and new bull market. Many companies including Caterpillar and Dollar General are telegraphing that 2022 cost headwinds such as freight, raw materials, etc. will become tailwinds in 2023.

Fed In Focus

So far, the Fed has had less impact on the labor market, where unemployment remains extraordinarily low and wages have not yet materially softened. However, major companies like Goldman Sachs and Amazon are beginning to lay off significant numbers of employees, and unemployment is likely to rise in 2023, which could cool wage and service inflation.

The key question entering 2023, given that inflation is now growing at a slower pace, is whether or not the Fed can engineer a “soft landing” and avoid a severe downturn. Several indicators including the inverted Treasury yield curve are pointing to a high likelihood of recession, and it has become a consensus view that one will occur. However, a very resilient consumer makes it less than a foregone conclusion.

Domestic Equity Outlook

While markets proved to be volatile in 2022, the persistence of high inflation, Fed aggressiveness, and much higher interest rates had a worse-than-expected impact on valuation multiples and, recently, on corporate earnings. If, as noted previously, inflation growth has peaked and begins to slow down more quickly than expected, it could mean that interest rates have also crested, and that the valuation multiple on the market has bottomed and could even expand.

The decline in stocks during 2022 was mostly valuation driven rather than by a decline in earnings. We think earnings estimates for 2023 may still need to come down, but valuation levels for the market, especially looking out over the next several years, appear attractive. We believe the total return for the S&P 500 could approach 10% in 2023, albeit in what will likely be another volatile year.

If the Fed overdoes its rate hiking, unemployment spikes too far, consumers are severely pressured, and earnings move much lower, returns could be negative to flat again, though a drop as severe as 2022’s would be surprising. Unforeseen geopolitical events, could obviously impact this return outlook, both positively and negatively.

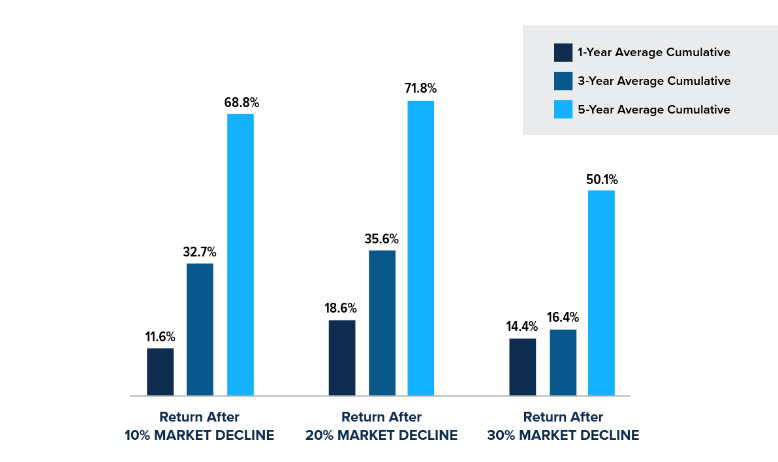

Stocks of many high quality companies are currently trading at very attractive valuation levels, presenting outstanding opportunities for investors with multi-year time horizons. In fact, since 1926, stocks have tended to rise significantly in the 1, 3 and 5-year periods following major down years.

Active portfolio managers with a time-tested, disciplined stock picking process often thrive in such volatile late cycle environments. In recent years, the persistent decline in interest rates accompanied by fiscal stimulus was a “rising tide that lifted all boats,” including a number of risky assets. With the tide having ebbed, market leadership has changed. Less liquidity has made it more difficult for companies to operate and lowered investor risk appetite. This regime change and wider dispersion of returns between the best stocks and worst stocks was an opportunity rich environment for our consistent stock-picking process in 2022 as our composite outperformed its benchmark.

Fixed Income Outlook

While bond prices did rebound modestly in 4Q as interest rates nudged lower, 2022 was an exceedingly challenging year for fixed income. The Bloomberg US Aggregate Bond Index, a mix of government and corporate bonds, declined 13.0%. The rise in interest rates was mostly to blame as 10-year Treasury yields moved from 1.52% at the beginning of the year to 3.88% at year-end. The majority of our bond holdings held up meaningfully better than the index due to our shorter maturity positioning.

The rise in rates can be directly attributed to persistently high inflation. It is no coincidence that the 10-year Treasury yield peaked at 4.25% just weeks after the mid-October “core” Consumer Price Index report showed its highest reading in nearly 40 years.

Fortunately, subsequent inflation data points have begun to move lower, including core CPI, which excludes the volatile food and energy components.

While there has been some welcome relief in certain categories (lower gasoline prices, lumber, rents, shipping costs, etc.), inflation remains stubbornly high in many other areas such as wages, food prices, and energy bills. Therefore, the current inflationary environment can be classified in aggregate as disinflationary (inflation growing less quickly), rather than outright deflationary (inflation moving lower).

Throughout 2022 the Federal Reserve rapidly increased short-term rates with the hope of cooling demand and ultimately lowering inflation. These rates have moved from effectively zero at the beginning of the year to a current range of 4.25% – 4.50%, representing one of the most aggressive Fed tightening cycles ever.

As inflation continues to slow, the Fed is likely nearing the end of this rate hiking cycle. The futures market currently predicts two more 0.25% hikes in early 2023 with a pause for several months thereafter. Investors nonetheless continue to grapple with the possibility that, even if the Fed is successful in pulling down inflation, the US may not be able to avoid a recession, given the economic fallout from aggressive rate hikes. However, given the relatively low unemployment, high wages, and solid balance sheets of the US consumer, any potential slowdown may not resemble other recent substantial recessions, such as those following the global financial crisis or dot-com crash.

We continue to buy high-quality corporate and US Treasury bonds for those clients with fixed income allocations. These bonds currently have yields in the 4.0% – 5.5% range with maturities of 1 – 4 years. Given the recent rise in rates (and subsequent decline in bond prices), the near-term outlook for buy-and-hold fixed income investors is the best we’ve seen in many years.

Global Markets Outlook

After strongly appreciating for most of 2022, the US dollar reversed course in 4Q, causing large US stocks (S&P 500) to underperform their non-US counterparts. For the quarter, US stocks were up 7.5% whereas international developed markets gained 17.4% and emerging markets rose 9.6%. For 2022, large US stocks were in the middle of the pack, returning -18.1% compared to -13.9% for international developed markets and -19.9% for emerging markets.

China is coming off a tough year during which its property market slumped and severe COVID-19 restrictions hampered its economy. Having eased these restrictions entering 2023, China’s economy may rebound, or it may again suffer from COVID-19 spikes.

Another major factor to watch is the energy situation in Europe following Russia’s invasion of Ukraine. With a lack of natural gas flowing from Russia, several countries have been scrambling to find alternative energy supplies and dampen energy usage. Winter has been warmer than expected in Europe thus far, but a cold spell could challenge much of the continent.

From a valuation standpoint, international stocks continue to trade at a wide discount to US stocks. If value stocks keep outperforming and the US dollar depreciates against other currencies, international developed stocks may once again outperform.

REIT Commentary

In the fourth quarter of 2022 , the MSCI US REIT Index (Bloomberg: RMZ) produced a total return of +5.2%. In 2022, the MSCI US REIT Index produced a total return of -24.5%, one of the worst on record. In fact, using the FTSE NAREIT All Equity REITs Index (Bloomberg: FNER), which goes back to 1971, it was the second worst year on record!

The main culprit? Interest rates, and specifically their effects on the applied multiple to earnings. In fact, earnings came in better than we expected, as occupancy continued its positive trajectory, putting further upward pressure on rents for almost all property types. Furthermore, the inflationary pressures helped to slow new construction, creating a further positive outlook on REIT fundamentals for the next several years.

The change in the earnings multiple is what makes forecasting so difficult over the short term. We believe our strategy of focusing on rigorous fundamental analysis by employing proprietary financial models to identify undervalued high dividend growth companies remains the best for this uncertain environment. We are confident that our adjusted funds from operations (or AFFO) growth forecasts combined with the record low dividend payout ratio of only 64% of AFFO will lead to dividend growth beyond most investors’ expectations, proving that REITs can have positive results during inflationary periods.

Using an estimated AFFO growth rate of 7.2%, a year end multiple of 19.0x (which compares to a 2022 year end multiple of 18.9x, dividend growth of 4.0%, and a dividend yield of 4.2% as of December 31st, 2022, we forecast total returns for REITs in 2023 to be +8% to +12%.

The upside risks are numerous. For virtually all property sectors, except office, fundamentals such as occupancy and rental growth rates are above historical averages that will support heathy dividend growth in the foreseeable future. Equity REITs enter 2023 with balance sheets characterized by low leverage and long weighted average maturities of predominately fixed rate debt. Accordingly, disruptions in the credit market will freeze out most traditional players and create opportunities for the REITs with various external growth initiatives. Additionally, the decline in future supply is underappreciated by investors and supports our longer-term view that Equity REITs have a bright extended outlook.

However, the narrative about investing in commercial real estate could be hurt by what we believe will be forthcoming troubles with highly leveraged players such as private equity that typically uses high leverage and floating rate debt. In 2022, negative funds flows from REIT mutual funds and ETFs totaled over $20 billion, which compares to 2021’s positive fund flows of nearly $16 billion. Depending upon how long it takes for conditions in the economy to exhibit some degree of normalcy (including a potential extended mild recession), fund flows away from public REITs would remain a risk for 2023.

Longer term, we maintain our outlook of +6% to +8% total returns based on a dividend yield of 4% and long- term dividend growth of +2% to +4%. Importantly, we are increasingly confident that the Chilton process will produce total returns above and beyond the index as passive investors will find themselves exposed to companies that could struggle in a higher interest rate environment.

Bradley J. Eixmann, CFA

Brandon J. Frank

Robert J. Greenberg, CFA

Matthew R. Werner, CFA