2023 Chilton REIT Forecast | January 2023

Although the change in public REIT equity prices over the past 12 months would not suggest it, 2022 actually saw earnings growth arrive above our initial expectations. Specifically, occupancy continued its positive trajectory, leading to further upward pressure on rents across nearly every property type. Additionally, the inflationary pressures helped to slow new construction, creating a further positive outlook on REIT fundamentals for the next several years. Still, in 2022, the MSCI US REIT Index (Bloomberg: RMZ) produced a total return of -24.5%, which along with nearly all asset classes, was one of the worst on record. What was the culprit? Interest rates, and specifically their effects on the applied multiple to earnings.

The change in the earnings multiple is what makes forecasting so difficult over the short term, specifically for companies that are subject to speculation on the public market. Therefore, while we will take an objective view of our 2022 forecast versus actual, and make another educated and informed 2023 forecast, we encourage our readers to focus on the long term outlook for publicly traded real estate.

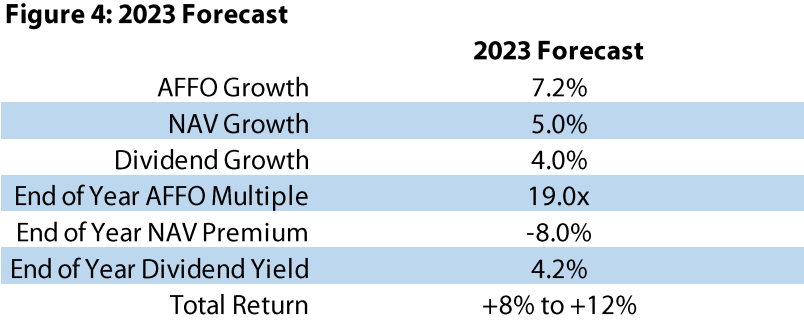

Using an estimated adjusted fund from operations (or AFFO) growth rate of 7.2%, a year end multiple of 19x, dividend growth of 4.0%, and a dividend yield of 4.2% as of December 31, 2022, we forecast total returns for REITs in 2023 to be between +8% to +12%. Longer term, we maintain our outlook of +6% to +8% total returns based on a long term dividend yield of 4% and long term dividend growth of +2% to +4%. Importantly, we are increasingly confident that the Chilton process will produce total returns above and beyond the index as passive investors will find themselves exposed to companies that could struggle in a higher interest rate environment.

2022 In Review

First and foremost, REITs had a tough year. In fact, as measured by the FTSE NAREIT All Equity REITs (Bloomberg: FNER), which goes back to 1971, the REIT sector recorded its second worst year ever on a total return basis, after only 2008. Other asset classes were not spared either, as the traditional 60/40 portfolio of stocks and bonds, represented by a 60% weighting to the S&P 500 and a 40% weighting to the Barclays Aggregate Bond Index, had its worst year since 1937 – even underperforming 2008.

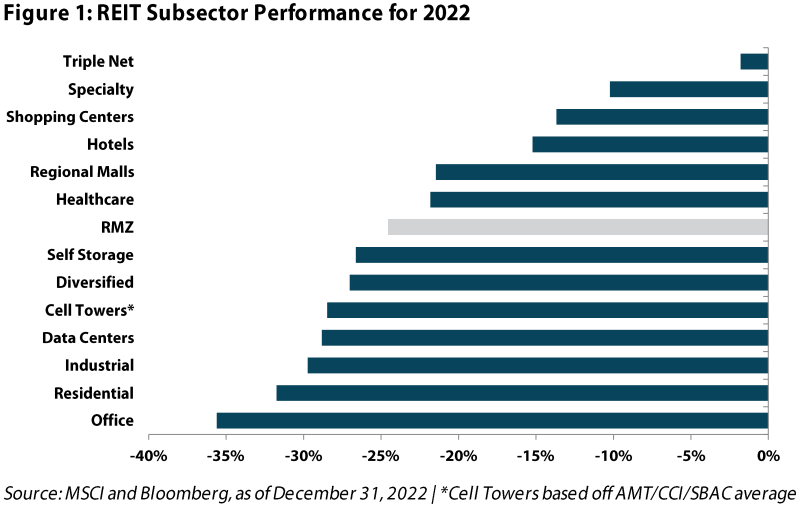

Within the REIT sector, there was significant dispersion among the top and bottom REIT subsectors, as shown in Figure 1. Triple Net (-1.8%), Specialty (-10.2%), and Shopping Centers (-13.7%) led the way, while Office (-35.6%), Residential (-31.8%), and Industrial (-29.7%) lagged. However, the middle eight sectors were surprisingly bunched together, and those at the top and bottom were a surprise to us given the rising rate environment. For example, triple net has historically been the worst-performing sector in times of rising interest rates, while residential has been among the best.

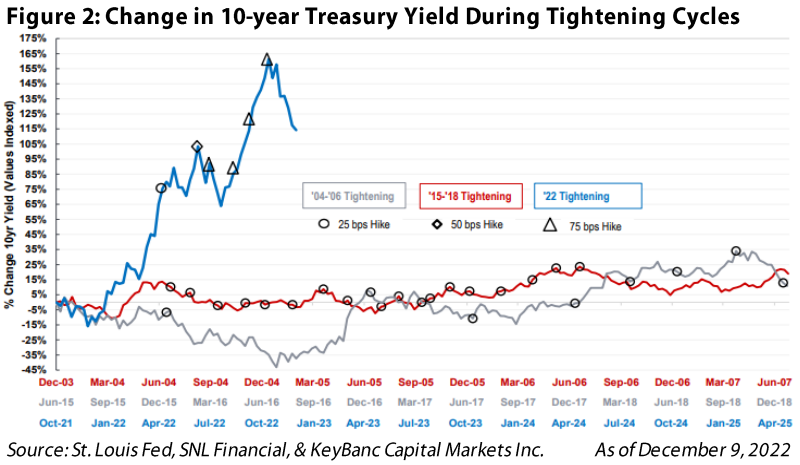

Looking back at our 2022 Chilton REIT Forecast, the one variable that is predominantly guilty for the wide dispersion in our total return projections vs. actuals would undoubtedly be interest rates. While we did believe that the Fed would hike interest rates in 2022, the swiftness and severity of these rate hikes was anything but expected, as seen in the following chart in Figure 2.

The Federal Reserve’s cumulative rate hikes of 425 bps in 2022 led to the 10-year Treasury yield jumping from 1.5% at December 31, 2021 to 3.8% as of December 30, 2022, a whopping +230 bps increase and notably higher than our 2022 year-end estimate for the 10-year Treasury yield to end at 2.0%. These unprecedented rate hikes by the Fed contrasted notes from the Fed meeting in December 2021 where Chair Powell indicated that there would only be three rate increases in 2022… not the seven that took place.

With regards to these seven interest rate hikes in 2022, they have all been focused on fighting one thing – red hot inflation. While we believed that some inflation, measured as the 12-month percentage change in the consumer price index (or CPI), would go away as supply chains got sorted out, it instead accelerated and ultimately peaked in June 2022 at +9.1%, the highest level in over 40 years! The Fed’s goal to reduce this “non-transient” inflation is what drove the historical rate hikes that dragged REITs (and most other asset classes) across the floor all year long. On a more promising note, the rate hikes seem to be working, as year over year inflation has decelerated each month following the June 2022 report. The most recent CPI report showed year over year inflation currently sitting at +7.1% for November 2022, the lowest mark since December 2021.

Overall, we had projected total returns for the MSCI US REIT Index in the range of +5% to +10% for 2022. The underlying assumptions we used for these estimates, along with the actual results, can be seen in Figure 3. Despite what was arguably one of the most impressive years with regards to REIT fundamentals and AFFO growth, the constant uncertainty driven by the Fed’s rate hikes and the increased likelihood of a recession have sent both AFFO multiples and net asset value (or NAV) premiums notably down from the start of the year.

2023 Economic Outlook

Looking into 2023, the market now expects the Fed to hike another 50 basis points in 2023, thereby ending the rate cycle in either February or March. The Fed has claimed to be ‘data-dependent’ and thus the actions will depend on the January CPI report, jobs data, and GDP growth, among other items. While it may seem like the country is still far away from the Fed’s target inflation of +2%, we think it’s also important to look at the month over month change in CPI to see the real time effects of the swift rate hikes over the past year. Importantly, the average of the most recent five month over month CPI reports is only 0.2% (2.4% annualized), which we believe will give the Fed the ability to pause rate hikes in February or March 2023. By ending the rate hike cycle, the Fed would be signaling that the economy is in a decline, CPI is under control, and unemployment is rising.

However, economists project 2.3 million new jobs in 2023, CPI of 3.4%, and nominal GDP growth of 4.3%. We are more cautious on the economy, which we believe will result in lower long term interest rates. The ‘inverted’ yield curve in which the 10 year Treasury yield is lower than the 2 year Treasury yield, indicates that the Fed will not be able to engineer a ‘soft landing’ and a recession will ultimately cause the Fed to begin cutting rates. Using this as a signal, we see the 10 year Treasury stabilizing around where it is today at 3.5%. We believe job growth will be muted as companies face declining earnings, but, the amalgamation of less jobs and lower consumer spending will bring down CPI and enable the Fed to stop the rate hike cycle in early 2023. This will also result in less new construction of commercial real estate, enabling supply/demand fundamentals to remain positive.

2023 Forecast

While the financial environment has changed markedly from the end of 2021, the primary variables for next year’s performance are mostly unchanged – namely inflation, fed policy, and interest rates. Inflation has started to decelerate over the past few months and we expect some incremental relief as the market laps the start of the energy price increases in a few months.

Based off of these assumptions (as summarized in Figure 4), we employ several models in forecasting total returns for 2023. However, this year, compared to others, we place a higher weighting on our AFFO growth model and dividend model. As we detail further below, NAVs are highly dependent on cap rates. Due to the lack of transaction volume in 2022’s rising interest rate environment, cap rates have not had enough price discovery to give us conviction in current reported private market cap rates (e.g., the cap rates implied by today’s stock prices are much higher than what the private market is still reflecting).

One of the key positive fundamentals underpinning REITs is continued AFFO growth – we are projecting another +7.2% in 2023. Additionally, AFFO growth visibility is one of the primary attributes we look for to select stocks today; thus, we see average AFFO growth across our portfolio a few hundred basis points above the REIT average. Turning to the multiple piece of the equation, although we expect short term interest rates to rise early in 2023, we also expect meaningfully more clarity on interest rates by the end of 2023. We think this added clarity could be enough to expand multiples by the end of 2023, but conservatively, we are assuming the AFFO multiple remains effectively unchanged at ~19x. Overall, using the AFFO growth method, we project appreciation of 6.6% plus an average dividend yield of 4.2%, resulting in a total return of 10.8%.

Next, we expect dividends to grow by 4% and the REIT yield to remain unchanged at 4.2%. This results in price appreciation of 4.0%, which generates a total return of 8.2% using the average dividend yield of 4.2%.

Our final method, based off of NAV, is a somewhat circuitous exercise in today’s environment. Recall, NAV’s are a function of net operating income (or NOI) divided by a market cap rate. However, given the interest rate volatility experienced in recent quarters and the lack of private real estate transaction price discovery, there is a wide range of potential cap rates. Given this uncertainty in cap rates, we find it much more informative to look at implied cap rates – which can be thought of as the cap rate investors are applying to public REITs today (e.g., what do you current equity prices imply). Currently, REITs are trading just above a 6% implied cap rate which is much higher than recent years. Applying this implied cap rate, alongside modest NOI growth and a reduction in the NAV discount achieves a similar total return prospect. However, given the uncertainty in cap rates, we are only using the first two methodologies this year. Overall, we forecast REIT total returns to be between 8% and 12% in 2023.

Risks to 2023 Forecast

Normally, investors place too much emphasis on short term events and today the situation has been exacerbated by the aggressive moves by the Federal Reserve to use high interest rates to tamp down record high inflation. “When will the Fed pivot away from its policies?” is the $64,000 question, referencing the TV Game Show from the 1960’s. All we know is that uncertainty in the markets will reign until such time investors know for sure that inflation rates are back at or near the Fed target of 2%. Fortunately, investors with a longer term investment horizon, the outlook remains favorable for Equity REITs given the attractive valuations that exist today.

The upside risks are numerous. For virtually all property sectors, except office, fundamentals such as occupancy and rental growth rates are above historical averages that will support heathy dividend growth in the foreseeable future. Equity REITs enter 2023 with balance sheets characterized by low leverage and long weighted average maturities of predominately fixed rate debt. Accordingly, disruptions in the credit market will freeze out most traditional players and create opportunities for the REITs with various external growth initiatives. Additionally, the decline in future supply is underappreciated by investors and supports our longer term view that Equity REITs have a bright extended outlook.

After the 24.5% decline in Equity REITs in 2022, the downside risks of rising interest rates are well known and appears to be discounted at current REIT prices. Both the Price to FFO multiple of 16.2x and the implied cap rate of above 6% are at 15 year averages. However, the narrative about investing in commercial real estate could be hurt by what we believe will be forthcoming troubles with private players, which are notorious for using high leverage and floating rate debt. In 2022, net outflows from REIT mutual funds and ETFs totaled over almost $20 billion, which compares to 2021’s net inflows of approximately $16 billion. Depending upon how long it takes for conditions in the economy to exhibit some degree of normalcy (including extended mild recession), fund flows away from public REITs would remain a risk for 2023. Operating expenses, particularly real estate taxes and payroll expenses, could temporarily rise above our estimates. Higher expenses would compress margins, putting pressure on 2023 net operating income growth estimates. Furthermore, while same store revenue growth is setup well for 2023, a potential recession in the next 12 months could cause occupancy to dip and rents to fall, which could lead to negative revenue growth in some sectors in 2024. We are comforted by the fact that REITs have record low payout ratios and would likely still be increasing dividends even if that were the case.

To 2023 and Beyond!

Historically, the Chilton REIT Strategy has produced some of its best outperformance in years when the RMZ produced a negative total return. In 2022, we believe elevated levels of outflows came from generalists that sold REITs for reasons other than fundamentals. This was evidenced by balance sheets and cash flow (and dividend) growth having nearly zero correlation with total returns in 2022. While our composite performed roughly in line with the index, our strategy of allocating to high growth and fortress balance sheets didn’t produce the outperformance that we thought it would. However, we expect 2023 to be a year when the ‘chickens come to roost’ and strong fundamentals to outperform. In addition to our calendar year forecasts, the outperformance has not been linear and we believe 2022 was an outlier. We point to our since inception track record of 257 bps of outperformance, and more recently, the 3 year track record of 113 bps of outperformance versus the benchmark. Going back to inception, the strategy has outperformed the benchmark in 100% of the trailing 5 year periods, on a gross and net basis, and 90% of the 3 year periods (80% on a net basis). We look forward to another year serving our clients, and thank you all for your confidence.

Matthew R. Werner, CFA

mwerner@chiltoncapital.com

(713) 243- 3234

Bruce G. Garrison, CFA

bgarrison@chiltoncapital.com

(713) 243-3233

Thomas P. Murphy, CFA

tmurphy@chiltoncapital.com

(713) 243-3211

Isaac A. Shrand

ishrand@chiltoncapital.com

(713) 243-3219

RMS: 2,398 (12.31.2022) vs. 3,177 (12.31.2021) vs 1,433 (3.23.2020) and 2,560 (2.21.2020)

An investment cannot be made directly in an index. The funds consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use.)

The information contained herein should be considered to be current only as of the date indicated, and we do not undertake any obligation to update the information contained herein in light of later circumstances or events. This publication may contain forward looking statements and projections that are based on the current beliefs and assumptions of Chilton Capital Management and on information currently available that we believe to be reasonable, however, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. This communication is provided for informational purposes only and does not constitute an offer or a solicitation to buy, hold, or sell an interest in any Chilton investment or any other security. Past performance does not guarantee future results.