Portfolio Insight | 2nd Quarter 2022

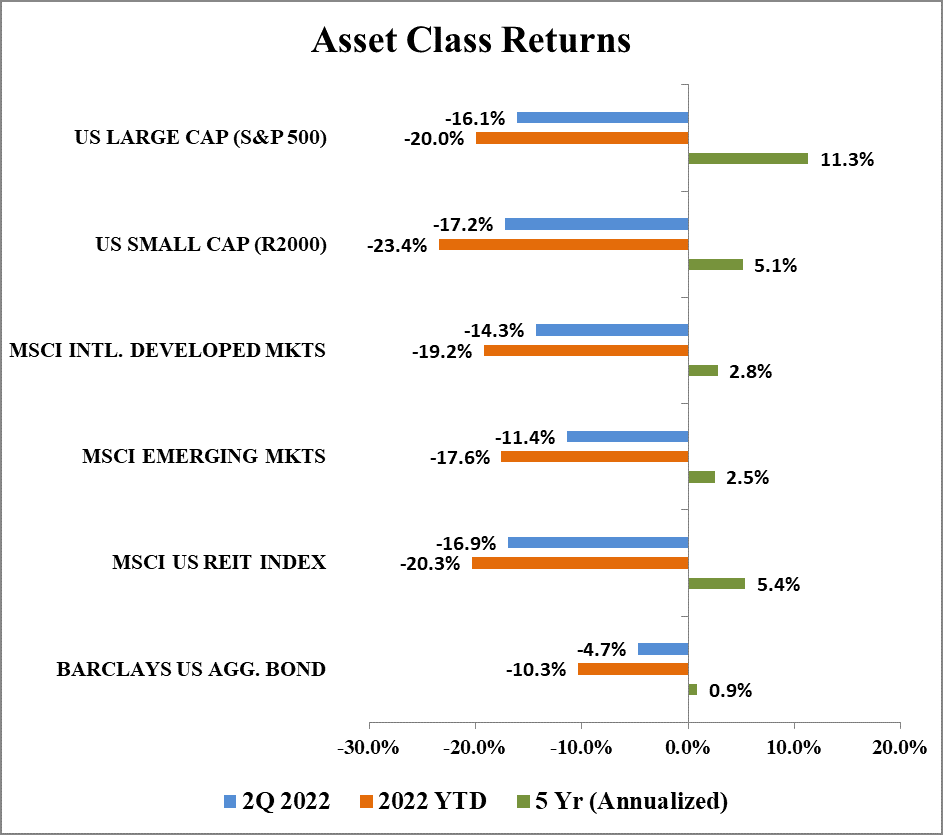

Sustained inflation and supply chain pressures exacerbated by the ongoing war in Ukraine, a fresh set of COVID lockdowns in China, and an aggressive interest rate hiking cycle from the Federal Reserve caused equity markets to plummet in the second quarter. The S&P 500 officially entered bear market territory in June, closing 2Q with a loss of 16.1% amid persistently high volatility. For the first half of 2022, the index was down 20.0%.

Top performing sectors in the second quarter were Consumer Staples, Utilities, and Energy, while Consumer Discretionary, Communication Services, and Information Technology underperformed the most. Winning stocks of recent years, mega cap growth names in particular, continued to materially lag the overall market as rising interest rates and growth fears pressured valuations. Large cap growth names have declined 27.6% so far in 2022 versus large cap value names which have fallen 11.5%. A broad swath of assets, not just stocks, are down sharply this year.

More Market Shocks

Unlike the relatively smooth ride upward for stocks in 2021, higher volatility and more muted market returns that often accompany inflationary periods, slowing economic growth, and Federal Reserve tightening were more likely in 2022. However, additional unanticipated shocks have depressed markets and made the Fed’s job more difficult. In response, portfolio action this year has been tilted towards adding non-cyclical/defensive exposures (healthcare, consumer staples, etc.) with attractive upside.

The prolonged war in Ukraine has put persistent upward pressure on energy and food prices. Further, though the COVID-19 pandemic seems to be abating around the world, China’s ambitious “zero-COVID” policy, and its consequent lockdown of major cities, has perpetuated supply chain issues. At some point, maybe after China’s election later this year, President Xi could permanently ease the restrictions. Until then, we should expect lackluster Chinese growth and disruptions in supply and demand for Chinese goods. These shocks further complicate central bank efforts to slow inflation without tipping economies into recession.

Deteriorating Earnings Picture

The risk of recession is increasing. A number of indicators are confirming pessimism from both consumers and businesses, which portends a weaker-than-expected earnings trajectory.

Despite a strong jobs market and recent wage gains, the University of Michigan Consumer Sentiment index hit its lowest point ever in May. Consumers are worried about higher costs for things that affect them directly, such as gasoline, and a housing market that is already being hurt by spiking mortgage rates.

Likewise, the recent National Federation of Independent Business (NFIB) outlook for the next six months just hit its lowest point ever. Small business leaders are worried about sustained high costs and supply chain issues as well as the changing customer behavior resulting from inflation.

So far this year, consensus earnings estimates for both 2022 and 2023 have actually moved higher. Nonetheless, they now seem destined to move lower as the year progresses, based on current and potential future impacts of inflation and the Fed tightening cycle.

Domestic Equity Outlook

In the near term, at least until late summer, the threat of recession (albeit one of unknown depth and length) will likely keep volatility high. A definitive peak in inflation (with positive surprises) and more realistic earnings forecasts are likely needed before the market can reach a bottom. Once this occurs, the Fed should be able to slow its rate hiking cycle, and the economy can stabilize and reaccelerate.

On the bright side, investor sentiment is highly negative and the market is very oversold, which often foreshadows major gains. The University of Michigan Consumer Sentiment survey noted above is usually a good contrarian indicator. Historically when this index has reached depressed levels, future stock returns tend to be elevated.

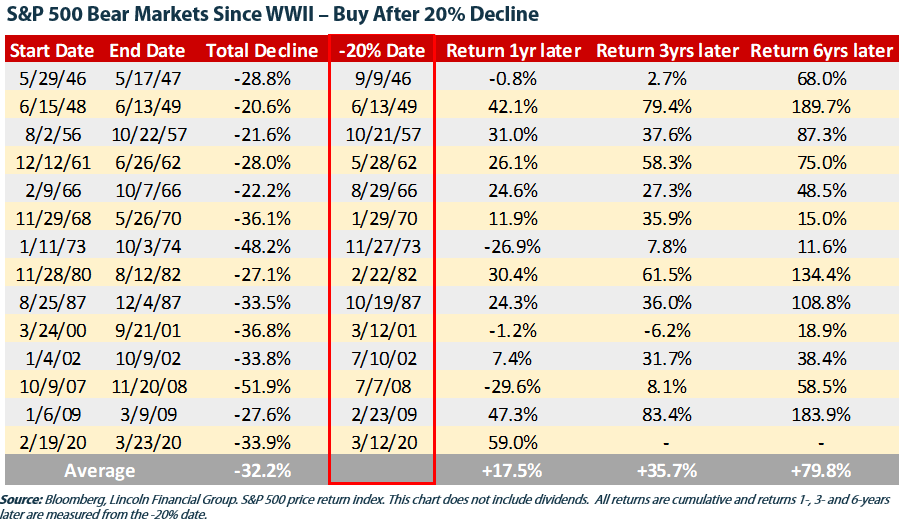

Current valuations suggest the market is already discounting a relatively high likelihood of recession. Though the odds of getting back to even for 2022 by year end are low, the risk/reward for long term equity investors appears attractive today based on expected future earnings growth. With a longer time horizon, the potential for significant future gains is now present. As shown below, following a 20% decline, the S&P 500 has returned an average of +17.5% one year later, +35.7% three years later, and +79.8% six years later.

Fixed Income Outlook

10-year Treasury yields began the year at 1.52% and finished 2Q at 2.98%. This rapid rise in interest rates has led to the worst first half of a year in the history of the Bloomberg US Aggregate Bond Index (a mix of government and corporate bonds that was first constructed in the mid-1970’s). YTD the index has declined 10.4%. Bonds with longer maturities have been hit even harder. For example, the iShares 20+ Year Treasury Bond ETF (ticker: TLT) is down 21.9% YTD. Our holdings have held up meaningfully better due to our shorter maturity positioning.

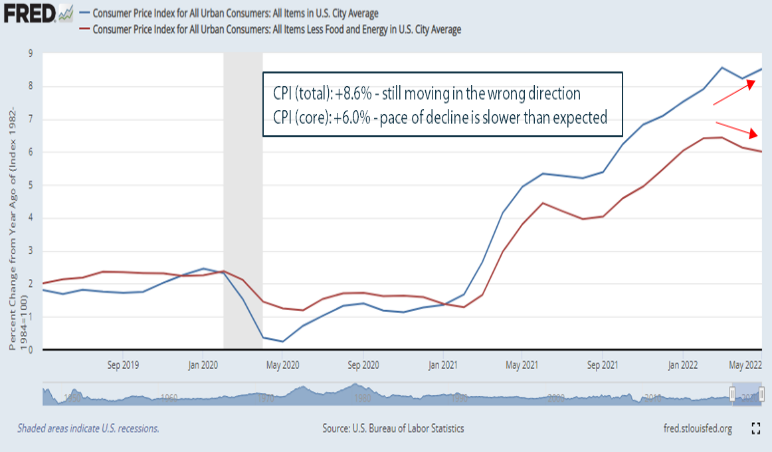

The key culprit in the upward trajectory of rates has been inflation. Too much stimulus, belated Fed rate hikes, supply chain issues, changes in government energy policies, and the war in Ukraine have all resulted in inflation data that is higher and more persistent than most economists and investors had been expecting. As a result, the Federal Reserve has begun to aggressively hike short-term rates, hoping to cool demand. This in turn should push down prices while ideally not pushing the economy into a recession (the proverbial “soft landing”). However, a more aggressive Fed does increase the chances of an eventual recession.

As you can see in the chart below, inflation has been on an upward trajectory for the past year and a half. The most recent Consumer Price Index (CPI) reading reached its highest level in 40+ years at +8.6% y/y. Even the “core” CPI reading that excludes energy and food prices has barely budged lower at +6.0% y/y. Financial markets will likely remain volatile until these measures begin to meaningfully decline.

Oil/gas prices, food prices, rents, airfares, and wages are all likely to remain elevated in the near-term. However, some prices have begun to roll over, including shipping freight rates, used car pricing, and certain commodities such as lumber, cotton, copper, and aluminum. With mortgage rates moving from below 3% to more than 6% in a matter of months, it is likely that housing prices are set to cool. Also, major retailers Wal-Mart and Target both recently reported being caught with too much inventory. These companies plan to aggressively clear this inventory, which usually means deflationary price cuts.

This upheaval in the bond market has brought opportunity. After holding an abnormally high cash position for the past 2 years, we are now deploying that cash into high quality corporate bonds that we plan to hold until maturity. These bonds all have yields in the 3.5% – 4.5% range with maturities of 2 – 4 years. By way of comparison, these same bonds yielded between 0.50% and 0.75% just 18 months ago.

Global Markets Outlook

For the first time in recent memory, large US stocks (S&P 500) underperformed their non-US counterparts as rapidly rising commodity prices more than offset the effects from the war in Ukraine, a challenging energy environment in Europe, repeated lockdowns in China, and a strong US dollar. In 2Q, US stocks were down 16.1% whereas international developed markets were down 14.3% and emerging markets were down 11.4%. YTD, large US stocks have also lagged, returning -20.0% compared to -19.2% for international developed markets and -17.6% for emerging markets.

The US Federal Reserve has neither been the quickest nor slowest to tighten monetary policy. Several emerging markets began hiking rates last year, including Brazil which has hiked rates by more than 10% since early 2021 in order to combat double-digit inflation. Meanwhile, the European Central Bank has yet to raise rates, though it is expected to do so in July. In Japan, interest rates are still negative. The Bank of Japan has not elected to raise rates and has no current plans to do so. At the opposite end of the spectrum, China cut rates earlier this year in attempt to reinvigorate an economy that has been slowed by a cooling property market and continued zero-COVID shutdowns.

Each central bank around the world has its own unique circumstances to consider in developing optimal policy responses. Too much aggression risks sending the economy into a recession. Too much delay risks out of control inflation, currency depreciation, and capital outflows. Precedents can be used as a guide, but no historical situation is exactly alike, and exogenous shocks can throw any plans off course.

Putting aside differing central bank policies, international markets continue to have several advantages over domestic markets. First, despite recent outperformance, international markets remain cheap compared to domestic markets. Second, international markets contain a higher weighting of value oriented companies, which have greater exposure to commodity prices. If commodity prices remain elevated, international markets should benefit. Third, international markets continue to have substantially higher dividend yields compared to domestic markets.

On the other hand, the US dollar may continue to appreciate relative to other currencies, which hurts foreign returns. A stronger dollar makes importing goods more expensive for non-dollar denominated countries and may increase borrowing costs, making it more expensive to pay off dollar denominated debt. Furthermore, the dollar has traditionally been a safe-haven in times of crisis, which has helped US markets outperform international markets in past recessions. A fall in commodity prices would be another headwind. Near the end of the quarter, several commodities had meaningful price corrections that could continue if global growth keeps slowing and supply issues get resolved. Thus, while upping international exposure to increase portfolio diversification could make sense, investors should consider both the advantages and disadvantages of doing so.

REIT Commentary

In the second quarter of 2022, the MSCI US REIT Index produced a total return of -16.9%. In spite of rising earnings estimates and a clear path for strong fundamentals, rising interest rates as a result of high inflation have called into question the proper multiple to apply to current earnings. We believe that the strong “wall of capital” raised by private equity will help public REIT valuations to find a floor, though the price level and timing are difficult to predict.

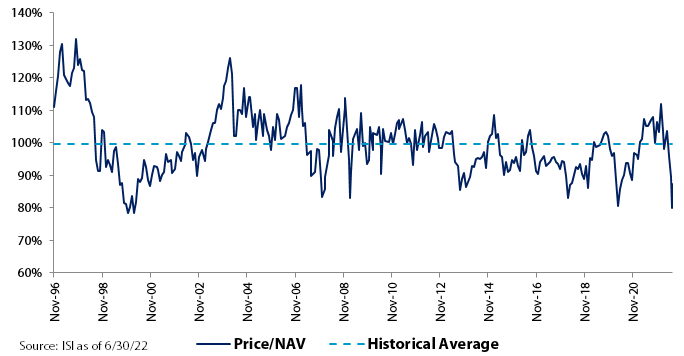

In 2022, there have been announcements of six privatization transactions as of June 30 (we include one deal announced in December 2021 that hasn’t closed yet). What do they have in common? They were trading at a discount to Net Asset Value (or NAV), and did not have any readily identifiable catalysts to close the gap.

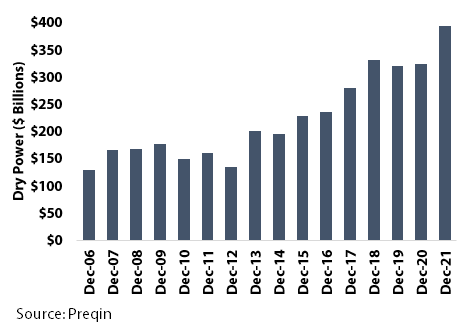

As shown below, the amount of “dry powder”, or cash raised with the purpose of investing in commercial real estate, increased to a new post financial crisis high in 2013, and has increased meaningfully beyond that level since then.

Blackstone, Starwood, and KKR have launched a nuanced version of non-traded REITs, and found unparalleled success in fundraising. For example, as of April 21, Blackstone had raised over $12 billion for its non-traded REIT (BREIT) thus far in 2022, $3 billion+ per month! At the precise moment of bringing in that equity, each vehicle must start the clock on paying dividends. Therefore, any gap in time from the cash being invested in commercial real estate makes it difficult to meet the required payout. Including its other funds, we believe Blackstone needs to acquire about $30 billion of real estate in 2022 (including the use of leverage) just to keep the machine going!

As shown below, the average REIT NAV discount reached nearly 20% in June, before finishing the month at -13%. While not an all-time low, one can see that the index bounced back after hitting a similar level in the late 90’s, 2008, and 2020. We believe the historical private equity “put” has kept public REITs from trading too far below NAV, and the same could occur in 2022 to help public REITs to find a bottom in pricing.

While we can’t be sure as to the timing of a recovery in pricing, we are confident that the supply and demand dynamic will remain strong for at least the next 12-18 months regardless of the direction of the economy (barring a steep recession), thereby driving solid fundamentals, and, as a result, growing dividends.

Bradley J. Eixmann, CFA

Brandon J. Frank

Robert J. Greenberg, CFA

Matthew R. Werner, CFA