Portfolio Insight | 1st Quarter 2022

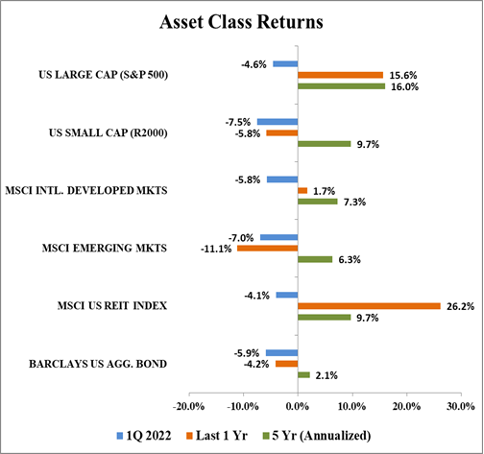

Following a mostly calm ride in 2021, the stock market experienced serious turbulence due to both expected and unexpected factors in the first quarter of 2022. Persistent inflation, a new Federal Reserve interest rate hiking cycle, and a violent incursion by Russia into Ukraine generated volatility not seen in a year. The S&P 500 underwent a full -10% intra-quarter correction (and many growth stocks pulled back much further) before rebounding strongly to close the quarter down only 4.6%.

The top performing sectors in the first quarter were Energy, Utilities, and Financials while those that underperformed the most were Communication Services, Consumer Discretionary, and Information Technology. In a reversal of often sustained leadership of recent years, value stocks significantly outperformed growth stocks in the period as rising interest rates pressured valuations. Rising commodity prices and an inflationary environment boosted some cyclical areas such as Energy.

A Geopolitical Shock

Following a prolonged Russian military buildup and the formal recognition of two pro-Russian breakaway regions in eastern Ukraine, Russia launched an invasion of its neighbor on February 24th. The ruthlessness of the campaign as well as the resolve of the 44 million Ukrainian people to defend their democracy have galvanized Western sentiment against Russian president Vladimir Putin, who is seeking to overrun Ukraine, depose its government, and end its ambition to join NATO.

In response, the Western world imposed aggressive sanctions on Russia and its oligarchs, with a broad swath of companies ceasing operations and cutting off funding. NATO members have coalesced to aid Ukraine with money and supplies, though not with direct military operations against the Russians. This conflict has thrown commodity markets into a tizzy as Russia is a major exporter of oil and gas, metals, wheat, and fertilizers. Another major consequence is that Europe has drawn up an ambitious plan to reduce energy dependence on Russia, which should be beneficial in the long run.

Return of Volatility

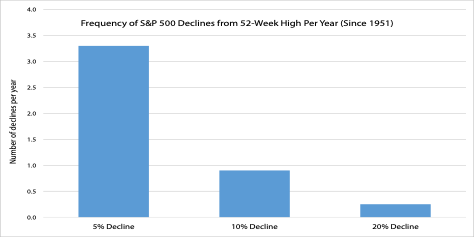

Confronted with the largest ground war in Europe since World War II, and with the potential unwinding of the extreme fiscal and monetary stimulus that juiced the economy after the COVID lockdowns of 2020, it is no surprise that anxious market sentiment and large index swings dominated action in the first quarter. As a reminder though, market corrections, especially of the 5-10% variety, are healthy and occur almost every year.

Source: Bloomberg

Fortunately, there were signs of possible progress in Ukraine-Russia negotiations near the end of the quarter, which fueled a market rebound and calming of nerves.

Rising Recession Risk

As higher-for-longer inflation forces the Federal Reserve towards substantial rate increases, the risk of a recession is rising as well. This does not guarantee that a recession will occur any time soon, but it does increase the degree of difficulty that Chairman Powell and the Federal Open Market Committee (FOMC) face with regards to engineering a “soft landing.”

Market bears seem to think such a downturn is a forgone conclusion, but most intermediate-term indicators have not yet signaled that recession is likely any time soon. These still-robust indicators include housing permits, jobless claims, retail sales, and ISM new orders. On the last day of the quarter, a reliable intermediate-term recession indicator, the 2-10 Treasury yield curve, did invert as the 2-year Treasury rate moved above the 10-year Treasury rate. After this has occurred in the past, however, the stock market typically has continued to move higher for another 1-2 years.

Consumers are generally in solid shape due to a very strong job market, wage increases, and relatively low floating-rate debt exposure. The pandemic is fading, so global demand for services should improve, especially in industries that have been depressed since 2020, such as travel and entertainment. On the industrial side, true end market demand for goods remains healthy and inventories are relatively low and will need to be replenished due to the sharp rebound in demand and recent supply chain issues.

Most companies are navigating the current environment quite well, with strong demand and pricing power more than offsetting supply chain issues and cost increases. As a result, positive aggregate earnings revisions and the expectation for continued profit growth are intact for now.

Domestic Equity Outlook

As expected, markets in 2022 have been much more volatile than they were last year. Investors are reacting not only to a new Fed rate hiking cycle, but to a Ukraine-Russia conflict that has exacerbated inflation concerns. Uncertainty surrounding the war in Europe, the pace and degree of interest rate increases, and their ultimate impact on a robust, inflationary economy have widened the range of possible outcomes and increased the likelihood of an eventual recession.

However, we know that markets ultimately follow earnings, and that they typically recover well and generate positive returns within a year of geopolitical shocks. And, despite perceived and actual challenges, the earnings outlook for both 2022 and 2023 is positive. Gains from current levels and a close above last year are still on the table, as long as this trajectory remains intact.

Fixed Income Outlook

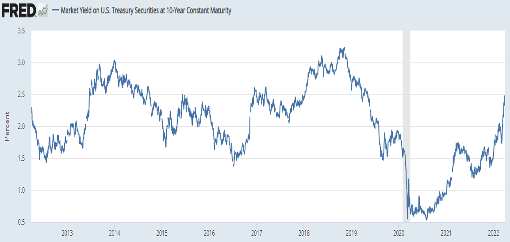

Bond returns have been dismal over the past several quarters. Following a total return of -1.54% in 2021, the Bloomberg Barclays Aggregate Index, a mix of government and corporate bonds, posted a -5.93% return in 1Q. Rising interest rates, driven by inflation and anticipated future Federal Reserve actions, have been the primary headwind so far in 2022, as exemplified by 10-year Treasury yields that began the year at 1.52% and finished 1Q at 2.32%. Widening credit spreads (the incremental yield of a corporate bond over an equivalent-term risk free, i.e. Treasury, investment) were also a minor headwind. Since the majority of our bond holdings have shorter maturities than the Barclays Agg, the price impact of rising rates has been much less meaningful to our portfolios.

Source: St. Louis Federal Reserve

As a result of the significantly higher inflation readings and the steadily improving labor market, the Fed raised its short-term benchmark rate by 0.25% in mid-March (from effectively zero), and is likely to continue to raise rates through 2023 and perhaps into 2024. It would not be a surprise if the next 2-3 rate hikes were 0.50% each. In fact, the futures markets, which can be extremely volatile day-to-day, are currently predicting an additional 2.25% of hikes just this year. Looking ahead to 2023, these same futures markets expect rates to top-out around 3.00%-3.25%, a still historically low level. The Fed will also soon begin to shrink the size of its nearly $9 trillion balance sheet. As a reminder, since early 2020, the Fed has been buying Treasury and mortgage-backed securities each month. These incremental purchases have helped push up the value of these bonds and, in turn, moved interest rates lower. By letting these bonds mature and not reinvesting the proceeds, the Fed’s balance sheet will get smaller, which should put modest upward pressure on interest rates.

Our lack of bond buying over the past several quarters was largely due to our concern over rising interest rates. With the substantial recent move in rates and subsequent decline in fixed income prices, our appetite for purchasing has increased. During the quarter, we began to buy a handful of preferred stocks that have been especially hit hard from the increase in interest rates. Our expectation is that we will now begin to deploy cash from fixed income allocations to buy investment grade corporate bonds, which we intend to hold until maturity. While the potential total return for these bonds remains limited, fixed income continues to play an important role of providing both income and stability within a larger diversified portfolio.

Global Markets Outlook

Non-US equities have materially underperformed US stocks for a number of years, and the trend continued in 1Q as international developed markets finished 120 bps behind the S&P 500 and emerging markets finished 240 bps behind. War in Ukraine, the strengthening US dollar, more COVID-related slowdowns/shutdowns across Asia, and a tighter regulatory environment in China all contributed to international underperformance.

Source: Bloomberg

The importance of diversification was on full display in 1Q as commodity sensitive economies benefited. The Brazilian stock market (IBOVESPA) was up 34.5%, Australia (S&P/ASX 200) was up 5.3%, and Canada (S&P/TSX) was up 5.2%. On the opposite end of the scale, war caused Russian equities (MOEX) to fall 34.0%, and Chinese equities (CSI 300) fell 14.3% on growth concerns.

As usual, there were plenty of frightening storylines. Investors in Chinese markets, which account for around 32% of the MSCI Emerging Markets Index and about 3% of the global index, grew concerned due to a slowing property market, consequences from the war in Ukraine, and large shutdowns due to COVID-19. Next door in Russia, we saw Russian stocks being removed from emerging markets indices and investors unable to transact as a result of the invasion. Prior to their expulsion, Russian equities accounted for roughly 3% of MSCI’s Emerging Markets Index and only 0.3% of the global index.

The ramifications of the war could last for years to come. Multinational companies will have to think about the effect of sanctions, public backlash, and asset seizures. Furthermore, additional thought must be given to ensure redundancy in supply chains. Such difficulties lend further credence to the notion that we are past peak globalization. All of this comes at a time when inflation is at its highest point in decades.

Despite the scary headlines, there are reasons to be optimistic. Russia and Ukraine continue to hold peace talks, China may keep cutting rates to bolster growth, earnings are still strong, and valuations remain undemanding.

As in the US, the medium-term outlook for international equities remains moderately bullish given the positive outlook for earnings growth globally, though this is somewhat offset by less accommodative monetary policy from global central banks. Lower valuations and higher dividend yields remain the two major tailwinds for potential future international outperformance.

REIT Commentary

In the first quarter of 2022, the MSCI US REIT Index produced a total return of -4.1%. The market was especially volatile due to high inflation prints, the Russia/Ukraine war, and the first interest rate hike since 2018. REITs were down (along with many other sectors) as the 10-year Treasury yield moved from 1.52% to 2.32%, a swift move in anticipation of a rate hiking cycle. The recent volatility, rising interest rates, and unpredictable exogenous events are a reminder about how important it is to be flexible.

It is a common misconception that Equity REITs must pay out all the cash they generate. The actual mandate is to distribute 90% of taxable net income. The major difference is that the depreciation expense lowers taxable income but is a non-cash charge. This distinction is extremely important because it allows REITs to retain cash to be reinvested in the business. This reinvestment process translates into an average internal growth rate of 1-2%. We calculate REITs’ dividend payout ratio based on Adjusted Funds from Operations (AFFO = normalized FFO after deducting spending on capital improvements), and this measure is currently at its lowest level in history! REITs historically paid out ~79% but are only paying out a record low 69% of AFFO as of 3Q21. Said a different way, 31% of every dollar generated remains on the balance sheet to fund future growth projects, retire debt, or grow dividends.

Furthermore, REITs have used attractive debt costs and robust business models to meaningfully improve balance sheets over the past two years. Specifically, net debt to EBITDA declined tremendously in recent quarters, falling below 5.0x as of year-end (vs the long term average of 6.2x). At the same time, the weighted average maturity of REIT debt has increased from ~5 years to closer to 9 years!

The flexibility of strong balance sheets and low payout ratios should benefit REITs during periods of inflation. Real estate is a beneficiary of inflation because owners are able to pass on higher costs in the form of increased rent. Additionally, the cost structure for the typical REIT is far less exposed to inflation (no cost of goods sold, less employees, etc.). Further, REITs with relatively short lease terms (self-storage, hotels, apartments, etc.) or contracts with inflation-linked escalators should be able to keep increasing rents in line with inflation.

One theme over the past eleven years has been the decline in capitalization rates (or “cap rates”). Cap rates are calculated by dividing the market value of a property by the net operating income, or NOI. Lower cap rates result in higher values, keeping all else equal. Cap rates have decreased from nearly 10% in 2010 down to a record low of 5.75% as of year-end 2021. As a result, commercial real estate investors of almost all types and risk profiles have been able to generate positive returns regardless of respective skill sets, and some fantastically so. We believe the next eleven years will not look the same. Although we are not predicting that cap rates will return to 10%, we believe that commercial real estate investors need to be especially selective in what they own (or don’t own) for the intermediate term. Specifically, operating performance of one’s portfolio will increasingly be the primary determinant of achieving target rates of returns. Most equity REITs are focused on one property type and have navigated numerous cycles with great success. Similarly, as we have seen recently, exogenous events can change things quickly, meaning investors need to be able to change with the markets quickly. As such, we believe an actively managed REIT strategy with high active share has the best chance of producing outperformance.

Bradley J. Eixmann, CFA

Brandon J. Frank

Robert J. Greenberg, CFA Matthew R. Werner, CFA