Portfolio Insight | 4th Quarter 2021

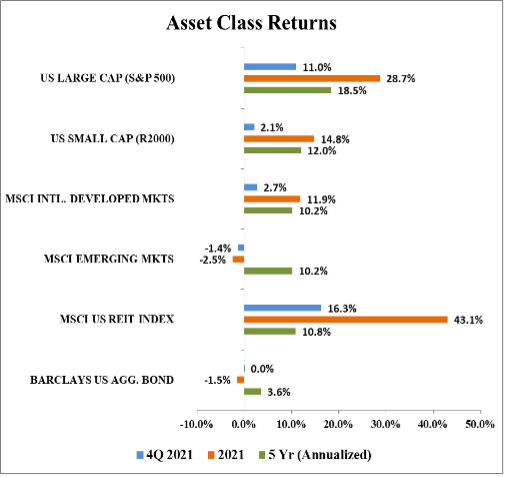

The S&P 500 Index continued its remarkable run in the fourth quarter, climbing the proverbial wall of worry to close the year on a very high note. Amid concerns about inflation and supply chains, Federal Reserve tapering, and COVID-19 variants, the index gained 11.0% in the quarter and hit a new all-time high on December 29th. For the full year it registered a heady 28.7% gain. All four quarters saw positive returns, and 4Q was the best of the lot.

The top performing sectors for 2021 were Energy, Real Estate, and Financials, while Communication Services, Consumer Staples, and Utilities underperformed the most. In the fourth quarter, the best areas were Real Estate, Information Technology, and Materials, while Communication Services, Financials, and Energy lagged. Steady gains and low volatility were the norm for most of the year, though at times there was significant churning under the surface of the market. As they have for many years, large cap growth stocks continued to lead the market.

A Resilient Economy

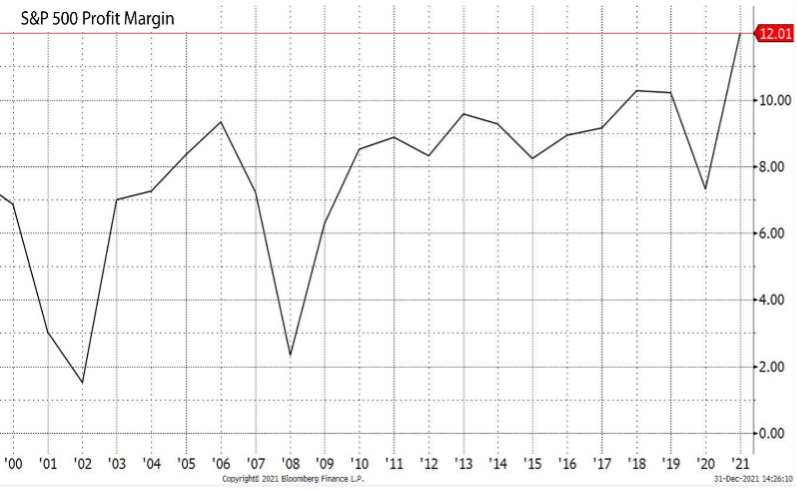

Despite some ongoing challenges, global economies generally recovered from 2020’s COVID-19 induced lockdowns. Early in the year, government support sustained the strong economic momentum that began in late 2020, and widespread vaccine/therapeutic proliferation efforts enabled further reopening. The job market improved consistently, leading to lower unemployment and higher wages that benefitted consumers. Due partially to exceptional consumer demand, resilient companies were able to adapt to rising costs with price increases and other measures. In fact, despite the headwinds, corporate profit margins hit new all-time highs in 2021.

In the long run, earnings drive markets. A persistent theme this year was the relentless upward revision of earnings estimates for large US companies. The S&P 500 tracked these estimates quite closely, and the good news is that estimates for the next two years keep rising.

An Ongoing Pandemic

Somewhat less encouragingly, COVID-19 has exhibited staying power. The Delta variant that appeared in late August gave way to the Omicron variant in mid-November, sparking a quick market drop, new travel restrictions, and fear. Often as viruses mutate, they become more transmissible but less deadly. Luckily, this has so far been the case with Omicron as hospitalizations and deaths have not spiked proportionally with cases in December.

It appears that global economies can handle this round of virus spread without aggressive lockdowns. The Center for Disease Control (CDC) even took the step of recommending shorter COVID-19 isolation and quarantine time, which should help alleviate the acute staffing shortages in a number of industries.

A Transition Year

In 2021, the Federal Reserve kept borrowing costs low and lent monetary support to the economy. However, the Fed has now begun gradually stepping down this support by tapering its bond purchases, and should soon begin increasing interest rates to combat inflationary pressures. Fiscal stimulus will fade if the economy continues to stand on its own, and political infighting over issues like the Build Back Better framework is likely as the 2022 US midterm elections approach.

Following the strongest year for GDP growth since 1984, economic growth will likely slow in 2022. However, considering that some cyclical areas have yet to snap back from 2020, and that pent up consumer demand remains, growth should still be above average. Wild cards include the future stickiness of certain inflation pressures and whether or not supply chain bottlenecks continue to abate. We expect more COVID-19 flare-ups in 2022 but hope the world has moved past the most acute phase of the pandemic.

Domestic Equity Outlook

As the current economic cycle progresses, and as the Fed embarks on its first rate hiking cycle in years amidst a continuing pandemic, we believe markets will be more volatile in 2022. Earnings continue to grow, and, following a strong move higher at year-end, the market is poised for further, though smaller, gains in 2022. Assuming some minor valuation contraction due to higher expected interest rates and positive though decelerating earnings growth in the high-single-digit range, we believe the S&P 500 will deliver mid-single-digit total returns for the full year.

Returns could be lower than expected if there is outsized impact from well-known risk factors such as slowing growth, withdrawal of monetary and fiscal stimulus, COVID-related impacts, and any lingering supply chain and inflation issues. Conversely, returns could be higher if the Fed engineers a “soft landing” by taming inflation and perpetuating the current economic cycle and if successful pandemic mitigation efforts allow for a full reopening of economies. On a relative basis, stocks continue to look much more attractive than bonds and cash, particularly in this inflationary environment.

Active management can be particularly helpful in mid or late cycle market environments when volatility increases and market leadership can change markedly. Our finely tuned, fundamental, bottom-up research process can unearth material trend changes and quickly adjust portfolios as needed. Currently, we do not anticipate significant moves in portfolios, though we could begin adding some defensive non-cyclical exposure as the year progresses.

Fixed Income Outlook

The Bloomberg Barclays Aggregate Index, a mix of government and corporate bonds, moved 0.01% higher in 4Q, bringing its total 2021 return to -1.54%. Since this index contains a substantial number of long-term bond holdings, the rise in interest rates this year put downward pressure on bond prices. 10-year Treasury yields began the year at 0.93% and finished at 1.52%, still exceptionally low in historical terms. Fortunately, the vast majority of our individual corporate bond positions showed positive returns due to our decision to own relatively short maturity securities.

A steadily improving labor market and persistent inflationary pressures have pushed the Fed into a more hawkish stance. As a result, the Fed has already accelerated its tapering of bond purchases and, more importantly, moved up its timeline for eventual rate hikes. Since early 2020, the Fed had been buying $120 billion of Treasury and mortgage-backed securities every month. These incremental purchases helped push up the value of these bonds, which, in turn, pushed interest rates lower. Since November, the Fed has been reducing (“tapering”) this bond buying by $15 billion each month. Starting in January, the Fed will reduce the buying by $30 billion per month, meaning the Fed’s bond buying will conclude in March and its balance sheet will begin to shrink as bonds mature.

On the rate front, Fed officials now expect three 0.25% increases in 2022, starting as early as March. Fed projections show three additional rate hikes in 2023, and two more by the end of 2024. This would mean that short-term rates will have moved from near zero since March 2020 to near 2% by year-end 2024. That will almost certainly translate into higher yields, even for high-quality shorter-term corporate bonds, many of which yield less than 0.50% today. We still are of the opinion that any sort of economic turbulence would cause the Fed to slow or reverse its rate hikes.

While our team continues to search for new fixed income ideas, we generally have not purchased new fixed income positions in recent months. Prices remain elevated (and yields extraordinarily low), for short, medium, and longer-term bonds. Our plan is still in place: use any substantial volatility-related price dislocations to deploy cash from client fixed income allocations. We continue to own mostly short-term, investment-grade corporate bonds with the intention to hold until maturity. While the forward potential total return for these bonds is limited, fixed income continues to play an important role of providing both income and stability within a larger diversified portfolio.

Global Markets Outlook

Large US stocks (S&P 500) once again led the way in 4Q and in 2021 relative to their smaller and non-US counterparts. International equity markets continued to underperform domestic indices for a number of reasons, which include a lower weighting of growth oriented companies versus the US, the strengthening US dollar, more COVID-related slowdowns/shutdowns across much of Europe and Asia, and a significantly tighter regulatory environment in China. As in the US, the medium-term outlook for international equities remains solid given the positive outlook for earnings growth globally, though this is somewhat offset by less accommodative monetary policy from global central banks.

Source: Bloomberg

As discussed previously, non-US equities have materially underperformed US stocks for a number of years. Lower valuations and higher dividend yields remain the two major tailwinds for potential future outperformance. However, it is important to understand a couple of key potential headwinds for international equities. First, changes in the value of the US dollar relative to foreign currencies can have a big impact on returns. For example, when a US investor buys a foreign security denominated in another currency, a strengthening US dollar will hurt returns (and vice-versa). Since the buyer of that security holds an instrument denominated in a currency that has lost value versus the US dollar, the value of that security goes down in dollar terms. With that in mind, a key input that can have an outsized impact on currency values is the direction of individual country interest rates. Therefore, to the extent that the Federal Reserve is more aggressive in raising rates relative to the rest of the world, the value of the dollar could continue to move higher as more capital flows to the US.

A second factor to consider is the composition of foreign markets. Looking back over the past decade-plus in the US, growth stocks (AAPL, AMZN, TSLA, etc.) have materially outperformed value stocks (JPM, AXP, COP, etc.). Not surprisingly, since foreign markets tend to have a lower proportion of these types of growth companies compared to the US, foreign performance has been more muted. This is important, given that we are likely no longer at the beginning of the current economic cycle. Value stocks tend to perform better at the beginning of economic cycles, while growth stocks tend to perform better towards the end. So, while moving abroad to increase portfolio diversification could make sense, investors should consider both the advantages and disadvantages of doing so.

REIT Commentary

In 2021, REITs produced one of the best calendar year total returns in history, clocking in at 43.1% through December 31st as measured by the MSCI US REIT Index (Bloomberg: RMZ). Once again, our forecast missed the actual return by more than 1,000 basis points (or bps). However, the top end of our forecast at 19% was the highest we saw among our peers and Wall Street forecasters. Our forecast was too conservative on earnings growth and changes in multiples, which was driven by more than $14 billion of fund flows into REIT mutual funds and ETFs, the first year of positive net inflows since 2014.

Thankfully, the US was a leader in vaccine distribution in 2021, essentially making it available to anyone who wanted it by mid-year. As a result, many activities were able to resume, including shopping, school, domestic leisure travel, and healthcare procedures. The combination of pent-up demand, incredible fiscal stimulus, and global supply chain issues led to surging inflation the likes of which we have not seen since the 1980’s. History has demonstrated time and time again that real estate serves as a decent hedge, and we believe most REIT sectors have been beneficiaries of the recent inflation data.

However, other activities such as in-office work and business travel have lagged expectations. Unfortunately, the Delta and Omicron variants have pushed back normal in-person business activities. We are confident that we will continue forward progress toward “normal” life, though the path may not be linear.

As such, we believe 2022 will be filled with more good news than bad news about COVID. While REITs are trading near record high multiples of 27x adjusted funds from operations (or AFFO) as of December 31st, we believe the continuation of growth due to a return to normal rent paying tenancy, higher rents due to demand and inflation, dividend growth of 10%, and a thirst for yield will generate a total return between 5% and 10% in 2022. Looking beyond 2022, we are confident that the environment is ripe for high-single-digit total returns for several years.

Rising interest rates pose the largest threat to near-term REIT valuations. Equity REITs are often considered a bond substitute due to the relatively high dividend yield. The yield of 2.7% for the RMZ at year-end compares to the 10-year Treasury yield of 1.5%, indicating a spread of 120 bps. When compared to the historical average spread of 120 bps, there is not much of a cushion for the dividend yield to remain at 2.7% if the 10-year Treasury yield rises rapidly.

Fortunately, REITs enter 2022 with the lowest dividend payout ratio to cash flow ever at 69%. Thus, above average dividend growth is expected for several years. Our own models suggest a 7% three year compound growth rate for the benchmark. If one extrapolates the yield of 2.7% for the expected change in dividends, the yield would increase to 3.3% in 2024, holding all other variables constant. Using the normal spread of 120 basis points, the 10-year Treasury yield could rise to 2.4% over this period and investors would still enjoy positive returns. Longer term, if rates are rising due to inflation and economic growth, REITs would benefit due to higher rent growth and rising replacement costs.

Bradley J. Eixmann, CFA

Brandon J. Frank

Robert J. Greenberg, CFA

Matthew R. Werner, CFA