2022 Chilton REIT Forecast | January 2022

In 2021, REITs produced one of the best calendar year total returns in history, clocking in at +43.1% through December 31 as measured by the MSCI US REIT Index (Bloomberg: RMZ). Once again, our forecast missed the actual return by more than 1,000 basis points (or bps). However, the top end of our forecast at +19% was the highest we saw among our peers and Wall Street forecasters. The underlying bullish trends that were apparent to us on the publication date of January 4, 2021, ultimately played out. However, our forecast was too conservative on earnings growth and changes in multiples, which was driven by $14+ billion of fund flows into REIT mutual funds and ETFs, the first year of positive net inflows since 2014.

Thankfully, the US was a leader in vaccine distribution in 2021, essentially making it available to anyone who wanted it by mid-year. As a result, many activities were able to resume, including shopping, school, domestic leisure travel, and healthcare procedures. The combination of pent-up demand, incredible fiscal stimulus, and disruptions in the global supply chain caused a mismatch in supply and demand, leading to surging inflation the likes of which we have not seen since the 1980’s. History has demonstrated time and time again that real estate serves as a decent hedge, and we believe most REIT sectors have been beneficiaries of the recent inflation data.

However, other activities such as in-office work and business travel have lagged expectations. Unfortunately, while the vaccine proved effective, the Delta and Omicron variants caused breakthroughs that have pushed back normal in-person business activities. We have confidence that the combination of vaccine, antigens from those that have had COVID, and treatment for those that contract COVID will continue forward progress toward ‘normal’ life.

As such, we believe 2022 will be filled with more good news than bad news about COVID. While REITs are trading near record high multiples of 27x adjusted funds from operations (or AFFO), we believe the continuation of growth due to a return to normal rent paying occupancy rates, higher rents due to demand and inflation, dividend growth of 10%, and a thirst for yield will generate a total return between +5% and +10% in 2022. Looking beyond 2022, we are confident that the environment is ripe for high single digit total returns for several years. Our estimates assume that the 10 yr Treasury yield will move gradually up and end 2022 at 2.0% versus a current rate of 1.5%.

2021 In Review

Many of the assumptions underlying our bullish forecast for REITs played out as expected in 2021, but we did not get everything right. Specifically, we assumed strong job growth due to the positive effects of widespread distribution of a COVID vaccine, no interest rate increases, no sweeping tax overhauls, resumption of normal activities, popularity of work from anywhere, and a sustained rise in e-commerce.

Hiring by companies came raging back due to the economic boom and the need to support consumer spending. We expected job growth to range between +400,000 to +500,000 per month, which compared to the reported January to November 2021 monthly average of +555,000, and the 2020 average of -785,000 per month.

Work from anywhere, and even still the home, has stunted the rebound in coastal office markets. Many of the largest employers have hesitated to bring employees back to the office as the new COVID variants have proven to be more infectious. The necessity for e-commerce in 2020 proved to extend into 2021 as customers enjoyed its convenience even as stores were open. And, so far, there have not been any rate increases or sweeping tax overhauls…yet.

We were somewhat surprised by the surging inflation toward the back half of 2021. While the Fed has not raised rates yet, the notes from the Fed meeting on Wednesday, December 15th indicate three rate increases in 2022 and three more in 2023, which compares to Chair Powell’s comments a year ago that there would not be any rate increases until 2024.

Congress has not passed any significant tax overhaul yet, but they may be able to pass a tax bill in the near future. There are a wide range of outcomes that fluctuate from beneficial to REITs to negative for REITs, so we are prepared for both. On the positive side, a higher corporate tax rate would offer a relatively better tax structure through REITs given that they do not pay any federal income taxes. On the negative side, certain benefits such as 1031 exchanges and a lower tax rate on long term capital gains could go away, which would hurt values, particularly for private investors.

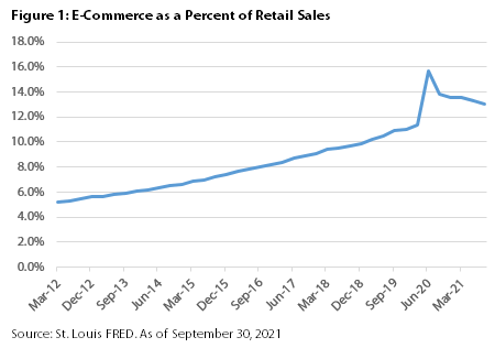

Finally, our prediction about e-commerce booming was correct, but we did not expect that brick-and-mortar retail would also come back so quickly. We simply underestimated the “pent-up” demand that resulted from the various lockdowns in 2020. As shown in Figure 1, e-commerce as a percent of retail sales resumed its linear climb from pre-COVID, albeit on a higher base. As a result, 2021 had record retail sales, which drove leasing in shopping centers and regional malls, which were the two best performing REIT sectors in 2021.

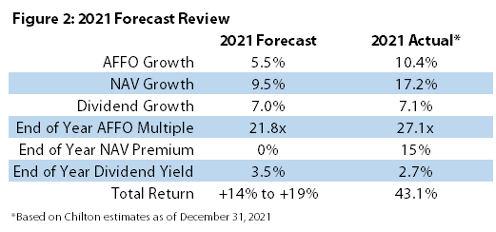

With the backdrop of these themes and assumptions, we had projected total returns for the MSCI US REIT Index the range of +14% to +19%. The underlying assumptions we used for these estimates were: AFFO growth of +5.5%, an AFFO multiple of 21.8x, NAV premium of 0%, NAV growth of +9.5%, dividend growth of +7%, and a dividend yield of 3.5%. Instead, as of December 31, 2021, AFFO grew by an estimated 10.4%, the AFFO multiple was 27.1x, NAVs grew by 17%, the NAV premium was 15%, dividends grew by 7.1%, and the REIT dividend yield was 2.7%.

As summarized in Figure 2, multiples increased (or yields/cap rates decreased) more than we expected, while cash flow growth was higher than anticipated due principally to REITs recouping deferred rent from 2020. Given that we are mindful of risk and would rather make investments based on fundamental research instead of ‘betting’ that multiples would increase (or cap rates decrease), we are not surprised that we undershot 2021’s strong performance along with practically everyone else!

2022 Forecast

Similar to 2021, there are several variables that could have a significant effect on 2022 REIT performance. Namely, interest rates, COVID severity, fiscal and monetary policy, tax code changes, and inflation. We believe that we will achieve herd immunity and be able to effectively treat COVID in 2022. We believe some inflation will go away as supply chains get sorted out, though labor costs are expected to remain elevated given the shortage of workers for the job openings available. The pushback caused by the various vaccine mandates has only exacerbated the situation we face today. We assume individual and corporate tax rates will increase, but real estate is left largely alone. Finally, we believe the Fed will hike interest rates several times in 2022, which should increase the 10 yr Treasury yield by 50 bps to 2.0%, assuming a steady interest rate curve.

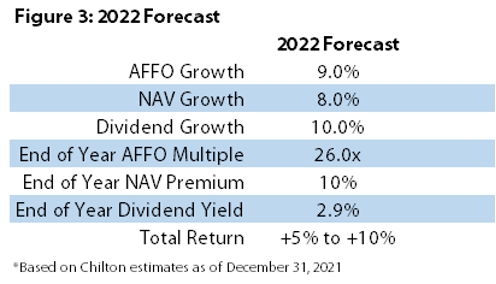

With these assumptions (as summarized in Figure 3), we employ the same three models in forecasting total returns for 2022.

We project AFFO growth of +9% and the AFFO multiple will decline slightly to 26x based on a higher 10 yr Treasury yield and slowing growth in 2023. Thus, using the AFFO growth method, we project appreciation of 5% and an average dividend yield of 3%, resulting in a total return of 8%.

We project NAVs will increase by 8% and the NAV premium will decline from 15% to 10% as cap rates bottom out. Combining these two, we would expect REITs to appreciate by 3% under this model. When added to the average dividend yield of 3%, the resulting total return would be 6%.

Finally, we expect dividends to grow by 10% and the REIT yield will increase by 20 bps to 2.9%, as a result of a rising 10 yr Treasury yield. The result would be appreciation of 2%, which would generate a total return of 5% using the average dividend yield of 3%. Therefore, we forecast REIT total returns to be between 5% and 10% in 2022 using the three methods above.

Risks to the Forecast

Interest rates are a critical determinant of operating cash flow and valuations for commercial real estate, including REITs. As inflation is one of the largest determinants of nominal interest rates, a rapid rise could cause a short term decline in REIT prices. Longer term, higher replacement costs should sustain asset values for investors as rents adjust higher. Notable examples today of well-positioned property sectors for inflation include industrial, residential, and self-storage.

Valuations are another matter and often can respond at odds to the above excellent fundamental outlook. Equity REITs are often considered a bond substitute due to the relatively high dividend yield that they offer to investors. The yield of 2.7% for the RMZ as of December 31, 2021 compares to the 10 year Treasury bond of 1.5%, indicating a spread of 120 bps. When compared to the historical average spread of 120 bps, there is not much of a cushion for the dividend yield to remain at 2.7% if the 10 yr Treasury yield rises rapidly.

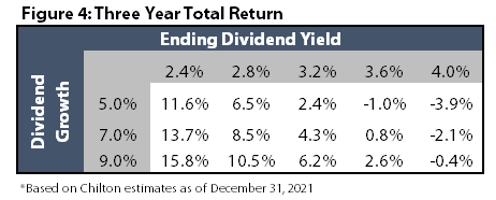

Fortunately, REITs enter 2022 with the lowest dividend payout ratio to cash flow ever at 69%. Thus, above average dividend growth is expected for several years. Our own models suggests over 7% compound growth over the next three years for the benchmark. As shown in Figure 4, if one extrapolates the yield of 2.7% for the expected change in dividends, the yield would increase to 3.3% in 2024, holding all other variables constant. Using the normal spread of 120 basis points, the 10 yr Treasury yield could rise to 2.4% (equivalent to a dividend yield of 3.6%) over this period and investors would still enjoy positive returns. Said differently, it would take a major spike in rates to produce a negative result assuming investors maintained a long term investment horizon.

Equity REITs would certainly do better than bonds in a rising rate environment due to the growth in earnings and dividends. In addition, the spread could compress from current levels as it has in the past when dividends have grown at above-average rates. Helping provide confidence in our outlook is the fact that equity REITs have done a terrific job of extending weighted average maturities of debt and bringing overall debt leverage down to 28% as of September 30, 2021, a record low.

Funds flow into real estate must also be considered, which would provide support in case of short term pullbacks. Private equity real estate firms have accumulated roughly $364 billion as of June 30, 2021 to be invested in real estate. This equity can support $1 trillion in buying power using normal leverage ratios. Equity REITs own some of the best institutional quality real estate on the planet, and the total market cap for the entire industry is only $2.5 trillion. Thus, if REITs were to fall precipitously due to higher interest rates, we see many at risk to being taken over and at valuations in-line with today’s level.

We do not profess to be economists nor are we very good at predicting interest rates and/or the speed of movement. However, the Federal Reserve has a lot at stake in navigating the planned increases in interest rates. Importantly, the Fed’s balance sheet is over $28 trillion as of September 30, 2021. Modest changes in borrowing costs could “wreck” the budget for the US. Worldwide interest rates remain very low, as well, which could cause capital to flow to the US, keeping interest rates low. Accordingly, we are of the opinion that increases in interest rates will fall into the more modest range and REITs are well prepared for the scenario outlined above. While calendar year total return forecasts have proven to be directionally correct at best, we feel much more confident in our analysis that REITs will generate total returns 6-8% annualized over the next several years.

Another Year in the Books!

Once again, we thank all of our clients and readers for trusting us since 2005. The past two years have presented new challenges for everyday life that we could never have anticipated, and we hope our clients can take comfort in the fact that publicly traded REITs tend to own the highest quality properties in the US. And, importantly, despite the strong performance of REITs during this calendar year, the average return using the past several years is in-line with our long term average. Last, even if we miss our 2022 forecast by 1,000 bps or more, we hope we have communicated our enthusiasm for the benefits that REITs provide over a long time horizon.

Matthew R. Werner, CFA

mwerner@chiltoncapital.com

(713) 243- 3234

Bruce G. Garrison, CFA

bgarrison@chiltoncapital.com

(713) 243-3233

Thomas P. Murphy, CFA

tmurphy@chiltoncapital.com

(713) 243-3211

RMS: 3,177 (12.31.2021) vs 2,220 (12.31.2020) vs 1,433

(3.23.2020) and 2,560 (2.21.2020)

An investment cannot be made directly in an index. The funds consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use.)

The information contained herein should be considered to be current only as of the date indicated, and we do not undertake any obligation to update the information contained herein in light of later circumstances or events. This publication may contain forward looking statements and projections that are based on the current beliefs and assumptions of Chilton Capital Management and on information currently available that we believe to be reasonable, however, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. This communication is provided for informational purposes only and does not constitute an offer or a solicitation to buy, hold, or sell an interest in any Chilton investment or any other security. Past performance does not guarantee future results

.