Property Type Round-Up from REIT World | December 2021

In November, we participated in the annual REIT World conference where we had the opportunity to speak with 31 REIT management teams. While we hope it will be the last 100% virtual conference sponsored by NAREIT, we did find it productive to speak to current portfolio companies as well as connect with several new companies that we may add in the near term. These conversations with industry leaders are instrumental in helping us to form our outlook for the next twelve months and beyond.

Overall, the sentiment of most management teams was upbeat, although lodging and office are still lagging. Inflation was a popular topic in each meeting as companies position themselves for potentially higher interest rates and rising costs. We believe REITs should be extending out maturities as long as possible, and potentially exploring preferred equity to lock in low rates in case inflation causes rates to increase substantially from current low levels. Supply chain issues do not seem to be affecting REIT property development yet because most companies have ‘bought-out’ the hard costs of construction. However, going forward new projects will certainly bear significant increases in costs. Finally, the environment of plentiful capital and some willing sellers is creating opportunities for mergers and acquisitions (or M&A). On the Monday following the conference, two $10+ billion deals were announced, both in the data center space. We would not be surprised if 2022 contains more deals than 2021.

The upbeat takeaways from the conference gave us more confidence to increase our exposure to ‘reopening’ or ‘vaccine’ REITs in the coming months, particularly those with a tail of above-average same store net operating income (or SSNOI) growth beyond 2022. The recent pullback due to fears of the Omicron COVID variant provides an attractive entry point to such investments, in our opinion.

Diversified

As we have mentioned in the past, we believe the market has undervalued the ‘vaccine’ exposure in the diversified sector, as our holdings boast multifamily, retail, office, student housing, and lodging properties. Within the diversified sector, we met with American Assets Trust (NYSE: AAT), Armada Hoffler (NYSE: AHH), CTO Realty Growth (NYSE: CTO), and Alexander Baldwin (NYSE: ALEX). Each company was glad to not be pigeonholed into one property type given the competitive acquisition environment for many of the underlying property types. They believe their respective geographic concentrations will allow them to source accretive acquisitions and development opportunities. In addition, they can use capital from selling into the competitive transaction market to source these deals, which could minimize having to raise equity on the public market. The REITs with Hawaii exposure (ALEX and AAT) expect tourism to return to normal by 3Q2022 as international destinations ease their regulations on returning from trips to the island.

Industrial

We met with Prologis (NYSE: PLD) and Americold (NYSE: COLD) within the industrial sector. The meeting with PLD emphasized the reason that the sector has been one of the top performers going into and coming out of the pandemic. There is almost no vacancy, which has made it a landlord’s market for increasing rent. While construction has ticked up in the past year, it still does not seem to be enough to absorb the insatiable demand. Interestingly, PLD’s CEO said that there would be more demand if there were more supply, a phenomenon that does not occur often in commercial real estate. We also believe there is further potential for demand growth as the supply chain issues will only encourage tenants to manufacture domestically and increase inventories by 5-10%.

In contrast, cold storage is suffering from the labor shortage, which has increased costs, and supply chain issues, which has decreased demand. In our meeting, the company detailed its ability to pass-through expenses to its tenants starting in 1Q2022 that should help to offset a significant portion of these expenses. Approximately half of its top 100 customers have contractual obligations to cover any increase in COLD’s expenses, while the other half are up for negotiation. COLD says that it has been successful thus far in getting rent increases of mid-single digits without much pushback. They recently pushed back their expectations for a stabilization of the supply chain to the back half of 2022.

Residential

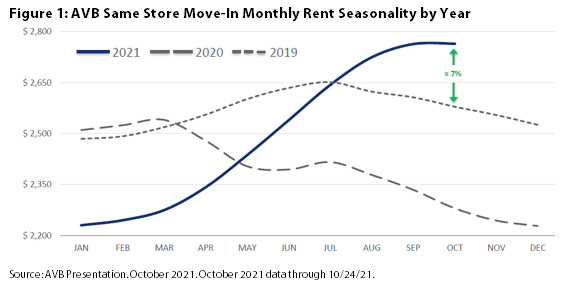

Turning to residential, while there is still some unevenness amidst the recovery, the broad group is starting to see extremely attractive rental increases. This was certainly evident coming out of 3Q2021 earnings season, but we also had the chance to catch up with management teams at Sun Communities (NYSE: SUI), American Campus Communities (NYSE: ACC), AvalonBay (NYSE: AVB), American Homes 4 Rent (NYSE: AMH), and Invitation Homes (NYSE: INVH). One of the primary points of discussion was bifurcation among markets (e.g., Sunbelt versus Coastal). Without question, the strongest markets today for multifamily and single family rental are located in the Sunbelt (Nashville, Austin, Phoenix, etc.), and most seemed to expect that to continue in 2022, but one interesting takeaway from our meetings was the potential for growth rates to converge in 2023. The caveat to that point remains the future of work from home policies, which could hamper downtown cores that are meaningfully tied to a return to office (e.g., San Francisco). As shown in Figure 1, AVB’s rents are well above 2019 and will have very easy comps in the first half of 2022. Finally, turning to supply, rising construction costs (and delays) remain a headwind. However, overall management teams expect moderate supply additions in the coming year in part due to capitalization rates continuing to fall allowing merchant builders to produce gains that have overcome such persistent headwinds.

Net Lease

We met with Getty Realty (NYSE: GTY), a nationwide owner of convenience stores with gas and auto service, and VICI Properties (NYSE: VICI), one of the largest owners of casinos in Las Vegas and other regional markets. While net lease normally is not considered a sector with high organic growth, we did discuss how leases linked to the consumer price index (or CPI) could give a significant bump to organic rents in 2022. For example, about half of VICI’s rent is linked to CPI without a cap, while others in the industry may have caps at 3%. The active transaction market has lowered cap rates on acquisitions, both for GTY and VICI, which appears to make acquisitions going forward less accretive. Both believe they can source accretive deals in size, and the stock price will follow upward, especially as their stocks appear undervalued with dividend yields of 5.4% and 5.3%, respectively, as of November 30, 2021.

Lodging

We met with Pebblebrook Hotel Trust (NYSE: PEB), our only meeting in the lodging sector. While stock prices have bounced significantly off of the bottom from 2020, much of that steam has been lost in 2021 as business travel has not resumed in earnest. Leisure has helped to offset much of the decline, but not in urban settings. In addition, labor shortages are hurting lodging disproportionately to other REIT sectors with much less operational intensity. PEB has been combating these trends by passing through costs to hotel guests on food and beverage and increasing resort fees, along with other amenities such as parking, golf, and recreational activities.

Self Storage

Within the self storage sector, we met with Public Storage (NYSE: PSA), Life Storage (NYSE: LSI), and SmartStop (Private). The self storage industry continues to surprise to the upside due to record occupancy rates and rental increases at historical levels. Not surprisingly, valuations have responded with recent transactions occurring at cap rates in the 3.5% range. However, the near term growth offsets the low ‘headline’ cap rate in many cases, as communicated by PSA. Their announced cap rate of 2.8% on the $1.5 billion AllStorage transaction will actually stabilize with a yield in the 6% range as the portfolio leases up and PSA is able to implement best practices centered on the digital revolution that has increased margins for the REITs. Increasingly, the gains achieved from technological enhancements have helped to consolidate this fragmented industry, a trend we expect to continue.

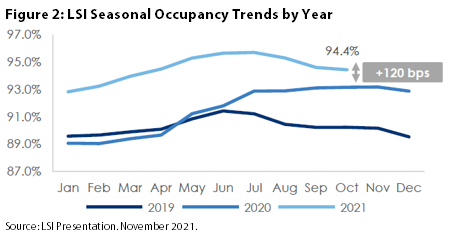

All-time high occupancy in the third quarter (as shown in Figure 2) should lead to seasonal strength in the fourth quarter which is normally a seasonally weak quarter. Management teams appear ready to push rents more aggressively in 1Q2022 than they did in 1Q2021, which should lead to strong growth in the first half of 2022. PSA also introduced the fifth ‘D’ of demand this year: Decluttering. In addition to Dislocation, Divorce, Death, and Downsizing, PSA believes the trend of decluttering to make (and maintain) room to work from home – if even for one day per week – is here to stay.

Shopping Centers

While we’d encourage readers to look to last month’s outlook for a deeper dive into our thoughts surrounding retail REITs, the retail space is another property type that presented a lightning rod for discussion at NAREIT. Looking back, the pandemic obviously weighed hard on retail in 2020, but as we’ve seen this year, the strength of the American Consumer has surprised to the upside and the group is looking to turn the corner due to robust leasing demand. We had the opportunity to meet with the management teams of Kimco Realty (NSYE: KIM), Urban Edge Properties (NYSE: UE), Acadia Realty Trust (NYSE: AKR), Brixmor Property Group (NYSE: BRX), Retail Opportunity Investments (NASDAQ: ROIC), Phillips Edison & Company (NASDAQ: PECO), Federal Realty Trust (NYSE: FRT), and Regency Centers (NASDAQ: REG).

The role of e-commerce, solving last mile distribution, occupancy rebounds, and regional distinctions were the most salient topics. On e-commerce, COVID certainly sped up the shift that was already well underway. However, COVID also highlighted how much of a role brick and mortar will play in the future of e-commerce, specifically fulfilling last mile delivery. Managements noted that one key benefit from 2020 has been the overall upgrade in the credit quality of the tenant mix due to the replacement of weaker tenants. Occupancy has continued to improve from the depths of COVID, but as we’ve been saying, the rebound is not being felt evenly. Currently, Sun Belt and grocery-anchored centers are in favor, though enthusiasm for retail assets has lowered cap rates for shopping centers across the board. On the flip side, Coastal and particularly street retail continue to lag. We are cautiously optimistic on the rebound in retail, and thus are only adding to selective shopping center names with reasonable valuations in geographies with positive demographic trends.

Healthcare

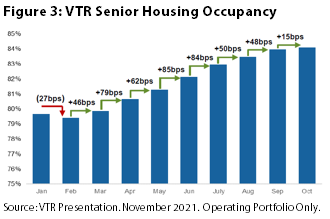

Healthcare presents an interesting space that was disrupted in the pandemic but that also sports attractive underlying demographic drivers going forward. Fortunately at NAREIT we had the opportunity to interact with management at Ventas Inc. (NYSE: VTR), one of the leading REITs in senior housing, medical office, and life science. Within senior housing, VTR highlighted moderating discounts and stabilizing re-leasing spreads as evidence demand was beginning to return. This ‘pent-up’ demand source combined with a moderation in new supply points to a compelling supply/demand outlook for the next few years. Figure 3 shows that occupancy has improved with each month after bottoming in February 2021. With that said, new COVID variants remain a potential headwind to occupancy improvements and has added risk to the short term outlook. Additionally, rising labor availability concerns and costs are expected to pressure operating expenses, though management teams mostly expected to pass those through to tenants.

Cell Towers and Data Centers

We met with cell tower REITs American Tower (NYSE: AMT) and Crown Castle (NYSE: CCI), and data center REIT Equinix (NASDAQ: EQIX). Our theme of ‘Essential’ real estate is applicable to this sector due to increasing data consumption and mobile traffic that is requiring networks to be denser and supportive of the multi-year rollout of 5G technology. The three major players, AMT, CCI, and SBA Communications (NASDAQ: SBAC) are beneficiaries of the billions of investment ahead by the carriers, including Verizon, AT&T, and T-Mobile. Additionally, Dish is underway with a build-out of its nationwide mobile network that should also prove very beneficial to the cell tower REITs, the first such build-out of a new tenant in a long time.

Impressively, we are only in the initial stages of 5G that will take years to fully implement. US total mobile traffic is expected to grow at 28% per year through at least 2026 according to AMT. While most of the attention is focused on the US since the above three REITs own about 60% of all macro towers nationwide, the worldwide demand for mobile communications is staggering. By 2023, mobile carriers are expected to have 5.7 billion subscribers using 13.1 billion devices but only 1.4 billion 5G capable phones.

CCI stated that the best use of spectrum today is on macro towers, and thus that is where the carriers are investing first. However, small cells will be needed in dense populations, starting with the top 30 cities. CCI pointed out however, that the massive increase in data means that cities 31-60 should also need small cells in five years, and cities smaller than that in the following five years.

Equinix spoke about its new joint venture to build hyperscale data centers around the world, which it believes will generate significant value for the company in fees. The company did concede however that these data centers carry lower multiples than its network-dense centers, which continue to sport low single-digit organic growth. However, the announcements of M&A for CyrusOne (NASDAQ: CONE) and CoreSite (NYSE: COR) following the conference indicate that investor interest remains high for all data centers.

Office

Within the office sector, we met with Kilroy Realty (NYSE: KRC), Boston Properties (NYSE: BXP), and Douglas Emmett (NYSE: DEI). KRC and DEI own primarily office in West Coast cities including Hawaii (DEI only). Additionally, KRC recently bought its first office tower in Austin, Texas and is planning on making this a key market for the company due to the strong demand by technology companies migrating to lower cost environments. While leasing has accelerated for all three companies, the leasing spread between expiring and new/renewal rent has yet to gain significant traction. Notably, KRC has been able to maintain positive leasing spreads in 2021, which it attributes to its relatively new portfolio (average age of ~11 years, vs peer average of 30 years) and focus on technology and life science tenants, which have been leasing throughout the pandemic. DEI believes the next positive catalyst will be the announcements by large companies of mandatory going back into the office, but the dates seem to be pushed back into 2022. DEI and BXP are at cyclical low occupancy, which means that merely leasing up space to pre-COVID levels will more than offset any decline in rent per square foot. All three companies have active development pipelines which they believe will create significant value. Projects are principally aimed at life science tenancy in the key clusters of San Francisco and San Diego for KRC and Cambridge for BXP. Notably, BXP has quoted development yields over 8% for its life science developments, which would imply profit margins of almost 100% when compared to cap rates around 4% today.

Matthew R. Werner, CFA

mwerner@chiltoncapital.com

(713) 243- 3234

Bruce G. Garrison, CFA

bgarrison@chiltoncapital.com

(713) 243-3233

Thomas P. Murphy, CFA

tmurphy@chiltoncapital.com

(713) 243-3211

RMS: 2,921 (11.30.2021) vs 2,220 (12.31.2020) vs 1,433

(3.23.2020) and 2,560 (2.21.2020)

An investment cannot be made directly in an index. The funds consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use.)

The information contained herein should be considered to be current only as of the date indicated, and we do not undertake any obligation to update the information contained herein in light of later circumstances or events. This publication may contain forward looking statements and projections that are based on the current beliefs and assumptions of Chilton Capital Management and on information currently available that we believe to be reasonable, however, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. This communication is provided for informational purposes only and does not constitute an offer or a solicitation to buy, hold, or sell an interest in any Chilton investment or any other security. Past performance does not guarantee future results.