In Case of Inflation, Buy REITs | May 2021

Inflation refers to an economic scenario in which the price of a basket of goods increases, which means the currency is worth less than it was previously. Economic studies have determined that some inflation is necessary to encourage investment, spending, and borrowing. The alternative scenario, called ‘deflation’, is just the opposite; cash and fixed income become the best investments as consumers wait to purchase goods when they become cheaper later. Countries will do everything in their power to avoid deflation, including taking nominal interest rates below zero. In one extreme example, Denmark currently has zero interest rate mortgages and negative rates on savings accounts!

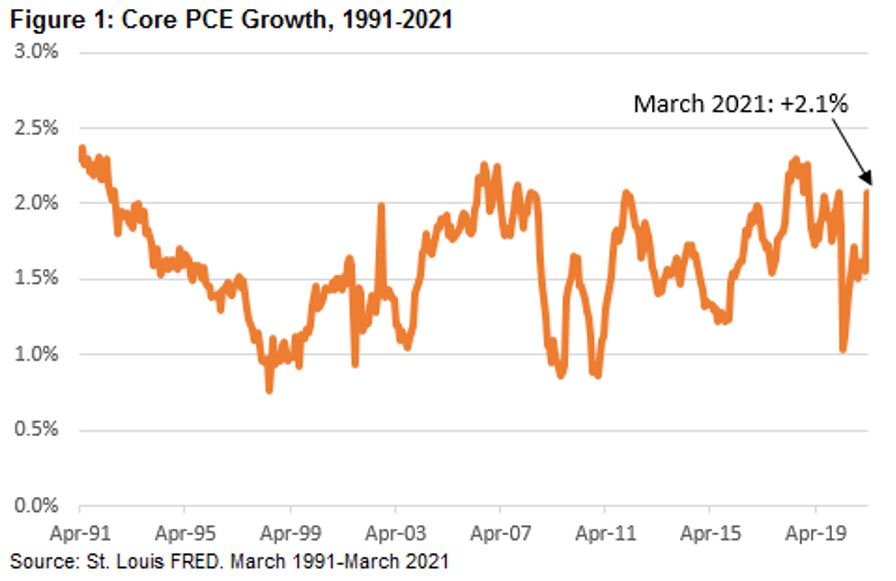

In contrast, a little inflation means that cash loses value each year, so one can only maintain purchasing power if he or she invests in the market, a business, or has an income that will also increase. Too much inflation, however, (called ‘hyperinflation’) is dangerous as it destabilizes currency and leads to high unemployment. Thus, the Federal Reserve has had a formal inflation target of 2% since 2012, though it had previously made statements of optimal inflation being between 1.7% and 2.0%. Interestingly, the US economy has not been able to reach this target very often. Measured by ‘Core PCE’, or Personal Consumption Expenditures, excluding Food and Energy, the country has only exceeded 2% inflation in 32 months from August 1992 through March 2021 (out of 344 months, or 9%!). It has not exceeded 2.5% even once! As a result, anyone born after 1970 may have little experience with investing during inflationary periods.

Recently, inflation has been rising (see Figure 1), which has stimulated a debate that ‘this time is different’ and we may be embarking on the first period of above 2% inflation we have had in a long time. Fed Chair Jerome Powell has stated that the Federal Open Market Committee will allow inflation to go above 2% due to the extraordinary circumstances that he believes will be temporary (i.e. COVID), and to ‘make up for lost time’ when Core PCE languished well below the target.

We think Powell’s analysis is sound, and believe that he will not raise rates in response to above-target inflation through 2023. However, it is important to understand the causes of inflation and how it could surprise to the upside, proving to be more than temporary. In the risk of higher than expected inflation for longer, we believe adding a REIT allocation to defend against inflation is a wise decision for any investor or institution.

Causes of Inflation

Inflation generally occurs when a significant increase in demand for goods and services occurs without a corresponding increase in supply, which usually corresponds to an increase in the money supply. Given the unprecedented monetary stimulus enacted by the US government during the past year coincident with a reopening of the economy, it does not surprise us that inflation is on the forefront for many investors.

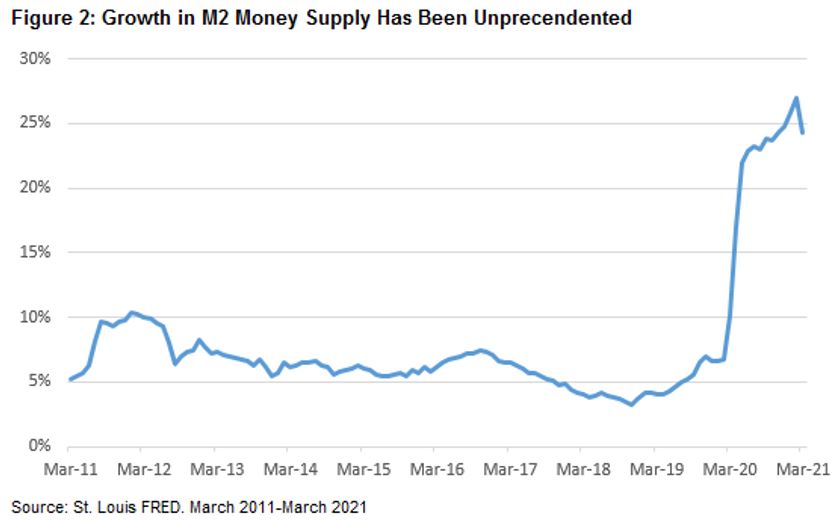

Dovish monetary policy (i.e. low interest rates) and fiscal policy (i.e. stimulus) attempts to encourage investment, borrowing, and spending, which tends to increase the supply of money. As shown in Figure 2, the M2 Money Supply, defined as total amount of cash, deposits, and assets easily convertible to cash (e.g. money market funds), has increased dramatically in the past year due to these conditions. Notably, the most recent growth rate is almost 5 times as fast as it was only two years ago!

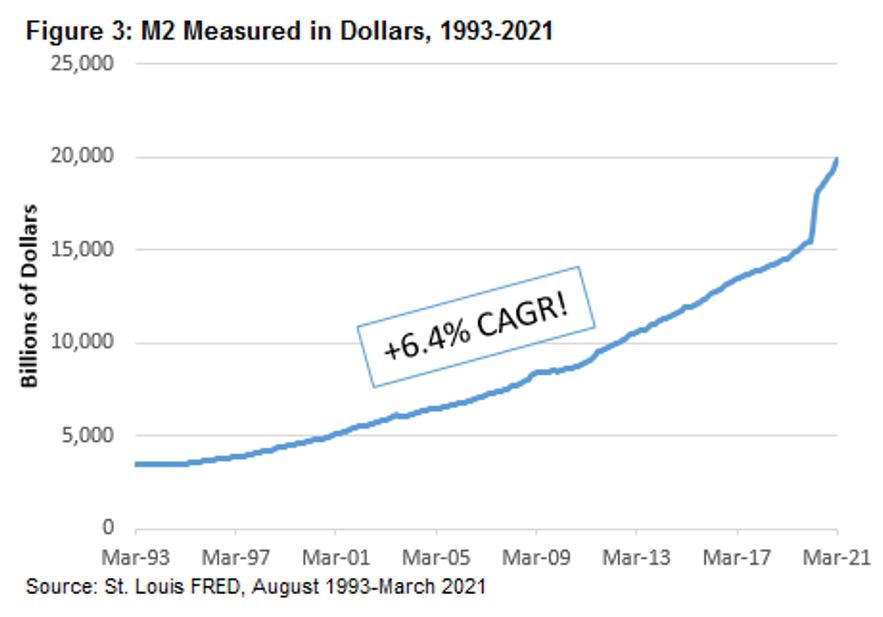

Historically, the growth in M2 has been perceived to have a direct relationship to inflation. However, a study done by Barry Bannister in 2002 actually showed that M2 and inflation had a positive correlation when using a 10 year moving average. As we mentioned previously, Core PCE has rarely exceeded 2% in the past 30 years, yet M2 has grown at a compound annual growth rate (or CAGR) of 6.4%.

As shown in Figure 3, the M2 money supply has been increasing for a long time, and inflation has barely moved. Thus, we are not convinced that the most recent temporary increase will result in a more-than-temporary regime change. As of April 30, 2021, the trailing ten year CAGR has been 8.2%, slightly above the 30 year CAGR. Thus, if the government continues to stimulate the economy at the current pace for an extended period, we would be fearful of higher inflation due to rising M2 money supply.

Other Measures of Inflation

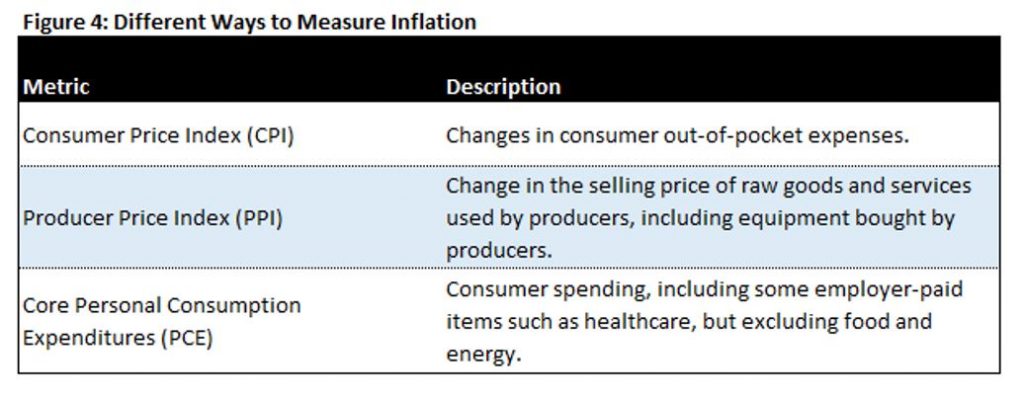

Two other common measures of inflation are the Consumer Price Index (or CPI) and the Producer Price Index (or PPI). PPI serves as a more relevant gauge of real estate replacement costs given the nature of materials used in developing real estate. CPI measures prices paid by consumers for a basket of goods, including imports. In contrast, PPI focuses on prices that producers or corporations pay for goods, which may or may not be passed onto consumers. Core PCE is the primary inflation index used by the US Federal Reserve when making monetary policy decisions because it excludes energy and food costs, which can be volatile and therefore would be difficult to use in making long term monetary decisions. Figure 4 shows the differences between all three measures of inflation.

Because of inflation, interest rates can be quoted in ‘real’ or ‘nominal’ terms, where ‘nominal’ refers to an interest rate that includes inflation, and ‘real’ refers to inflation or growth excluding inflation. Investors that attempt to take away the risk of inflation and achieve a real return can buy Treasury Inflation-Protected Securities, or TIPS. As inflation rises, TIPS adjust in price to maintain its real value, and the interest rate on TIPS can give market observers a view on expected inflation. The difference between the yield on the 10 yr Treasury and TIPS is called the ‘breakeven rate’, and can be used for this purpose. The latest value for breakeven inflation implies what market participants expect inflation to be in the next 10 years, on average, and currently stands at 2.33%, up from a low of 0.50% on March 19, 2020, as shown in Figure 5.

Despite the uptick in inflation expectations, the Federal Reserve has maintained a disciplined and dovish stance in terms of interest rates as it now considers not only inflation expectations, but also unemployment levels. While some market participants may disagree with us, we trust the Federal Reserve and don’t see the Fed raising interest rates as a likely outcome until unemployment reaches pre-pandemic levels, which we think could take until 2023.

Inflation and REITs

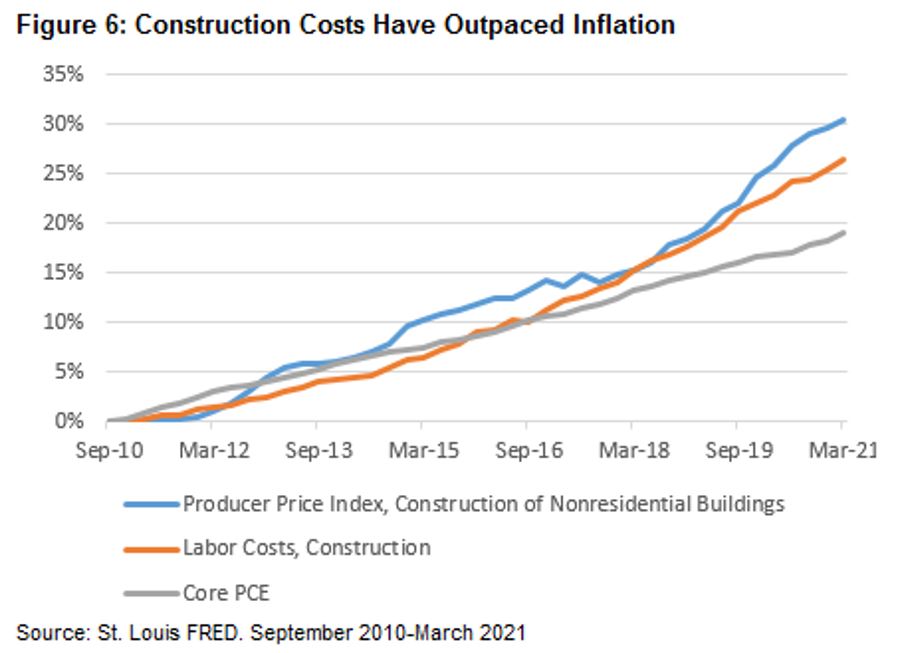

Real estate reacts to inflation in the opposite way from most financial assets. Accordingly, it plays an important hedging role in many investment portfolios. At the heart of this argument is the rate of change in the replacement costs of buildings. In Figure 6 we plot the historical relationship between construction costs (comprised of labor and materials) and inflation. Because construction costs have outpaced inflation, the replacement costs of buildings has increased more the costs of other goods. We believe that rents should follow replacement costs, as buildings would only be built if rents justified construction. History has shown that rents will eventually rise in an inflationary environment assuming markets are at or near equilibrium between supply and demand. Such is the case today for the vast majority of commercial real estate as we expect a rapid recovery as the economy re-opens and government stimulus is recognized.

In addition, aggregate construction levels as a percentage of existing inventory are running slightly below historical averages. Thus, unlike commercial real estate’s poor historical record, we see virtually no overbuilding in core property sectors. The industrial sector stands out as having the most elevated levels of construction activity, but demand has been more than sufficient to allow for above average rent increases as leases expire. The recent negative influences on occupancy in urban apartments and most retail should dissipate as the population gets vaccinated and life returns to a more normal pace. Office seems to be the most troubled given the newfound popularity of “work from home” and “work from anywhere” that many experts believe will result in a 10-20% decline in future demand. The early signs are not encouraging judging by the record amount of sub-lease space on the market currently. We see major urban office markets being most at risk of lagging fundamentals for several years. In contrast, Sunbelt markets should be beneficiaries of robust job growth as more and more companies move away from high tax jurisdictions. Lodging looks to witness a significant rebound from the pent-up leisure demand, but recent surveys suggests that business travel could take years to recover to 2019 levels. Fortunately, in the sectors where demand is low or uncertain, construction is nil or even negative (e.g. retail to industrial conversions).

Most Equity REITs have been major beneficiaries of the debt markets for the past several years and have been very proactive in lowering weighted average borrowing costs and lengthening maturities. We see this setting the stage for better internal growth rates in earnings as higher rents are recognized in the future while the cost of financial leverage stays relatively constant. Equity REITs now have a weighted average cost of debt of 3.2% and average maturity levels run approximately 7 years (using the weighted average of the Chilton REIT Composite). REITs have positioned themselves well for the potential of an inflationary environment by extending their average debt maturities to the longest in history.

Effects on Underlying Property Types

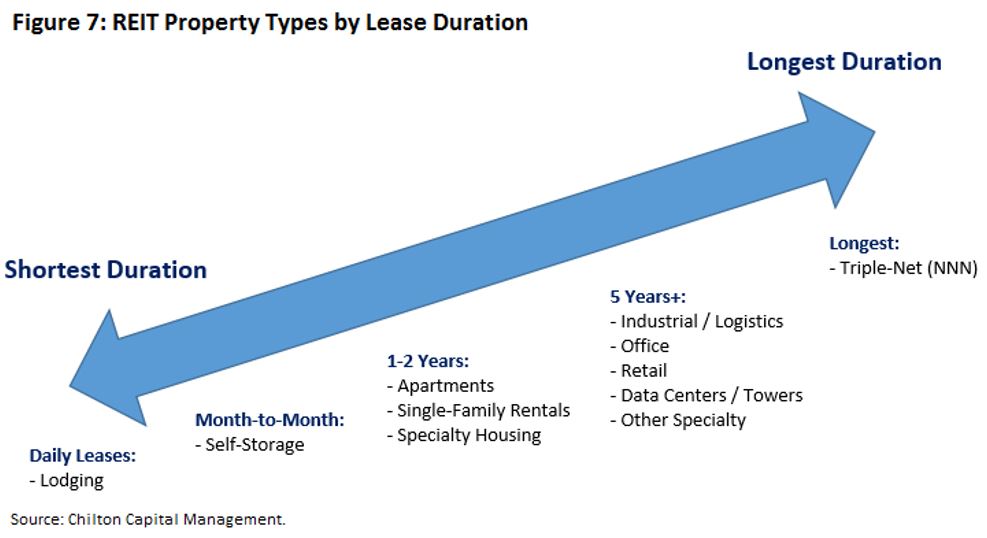

Historically, the best property types to own in an inflationary environment have been ‘short lease’ property types such as lodging, retail, self storage, and residential. Underperformers included the ‘long lease’ property types such as office, healthcare, industrial, and triple net. The reason for the bifurcation of performance between the short lease and long lease sectors relates to the ability to re-lease space at a higher rent when inflation is occurring. A short lease property type can do this much more quickly than a long lease property type, though it eventually should help all real estate.

Current Chilton Portfolio Positioning

The Chilton REIT Strategy has overweight allocations to the residential, cell towers, and industrial sectors. We have underweight allocations to the retail, lodging, triple net, healthcare, and self storage sectors. We believe that the inflation that will occur this year will be mostly ‘transitory’, meaning that it will show up as the country re-opens and massive stimulus is spent due to the pent-up demand from the shut downs. However, once the country reopens and the economy stabilizes, we believe that core PCE will remain close to 2%, which should not necessitate action by the Federal Reserve to raise interest rates and ‘cool’ inflation. We believe that lodging and retail have made a significant move already (many above pre-COVID prices), which reflects the inflation and growth to occur in 2021. Similarly, the pull-back in anticipation of higher inflation in cell towers and industrial has gone too far and these property types should bounce back quickly.

However, there is a risk that the inflation is NOT transitory. In this case, core PCE could stay above 2% for a significant period beyond 2021, which could necessitate the Fed to act. If this occurs and inflation is here to stay, our research shows that REITs should be a beneficiary due to the higher replacement costs, rising rents, and hopefully higher values, offset by higher borrowing costs and potentially higher ‘capitalization rates’.

In conclusion, REITs are well-positioned for both an inflationary and non-inflationary environment. Ideally, inflation will approach 2%, and the Federal Reserve will remain committed to low interest rates. This scenario would maximize real estate values through higher net operating income and low capitalization rates. However, while REITs could temporarily decline from higher inflation causing higher capitalization rates, they should bounce back as landlords pass through rent increases and supply hopefully abates due to higher costs. To reiterate the theme from the February REIT Outlook titled “Why Buy Fixed Income When Your Income Could Grow with REITs?” REITs would especially outperform fixed income in such an environment. Since we published the February REIT Outlook, the Bloomberg Barclays Aggregate Bond Index (Bloomberg: LBUSTRUU) has produced a total return of -2.0%, which compares to a +15.1% total return for the MSCI US REIT Index. As such, we continue to recommend fixed income investors to look to REITs for rising dividends and solid downside protection for an inflationary environment. Furthermore, the optimal scenario of low inflation and interest rates could produce excellent total returns for REIT investors. Even if rates increase, there is a significant buffer between the yield on the 10 year Treasury bond and the REIT dividend such that it could rise 20 basis points before reaching the historical average spread, and still result in a positive return for REIT investors. In contrast, many fixed income investors would suffer losses if rates were to rise. We believe a 10-15% allocation to REITs would be appropriate for investors looking for income but with a hedge against inflation.

Matthew R. Werner, CFA

mwerner@chiltoncapital.com

(713) 243-3234

Bruce G. Garrison, CFA

bgarrison@chiltoncapital.com

(713) 243-3233

Kevin Egan

kegan@chiltoncapital.com

(713) 243-3211

RMS: 2609 (4.30.2021) vs 2220 (12.31.2020) vs 346 (3.6.2009) and 1330 (2.7.2007)

Previous editions of the Chilton Capital REIT Outlook are available at www.chiltoncapital.com/category/library/reit-outlook/.

An investment cannot be made directly in an index. The funds consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use.

The information contained herein should be considered to be current only as of the date indicated, and we do not undertake any obligation to update the information contained herein in light of later circumstances or events. This publication may contain forward looking statements and projections that are based on the current beliefs and assumptions of Chilton Capital Management and on information currently available that we believe to be reasonable, however, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. This communication is provided for informational purposes only and does not constitute an offer or a solicitation to buy, hold, or sell an interest in any Chilton investment or any other security.